SUBSCRIPTION BILLING SOFTWARE

Boost revenue 14% by automating billing

- Billing. Collect payments. Manage subscriptions. Handle signups, trials, and upgrades. Automate collections and dunning.

- Usage and Metering. Connect product usage to billing and support any pricing model. Bill by time used, units sold & prepaid usage.

- Reporting. One-click reports for ARR, MRR, churn, renewals, and more. Advanced cohort, revenue waterfalls, and drill-down reports.

SUBSCRIPTION BILLING SOFTWARE

Boost revenue 14% by automating billing

How it works

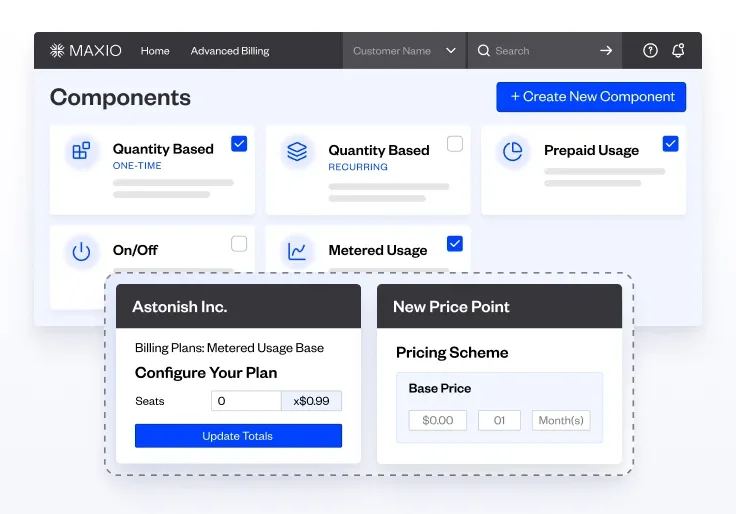

1 Define subscriptions

Input products & services. Select subscription and pricing options. Enable one-time payments, usage-based billing, etc. 1-click custom pricing.

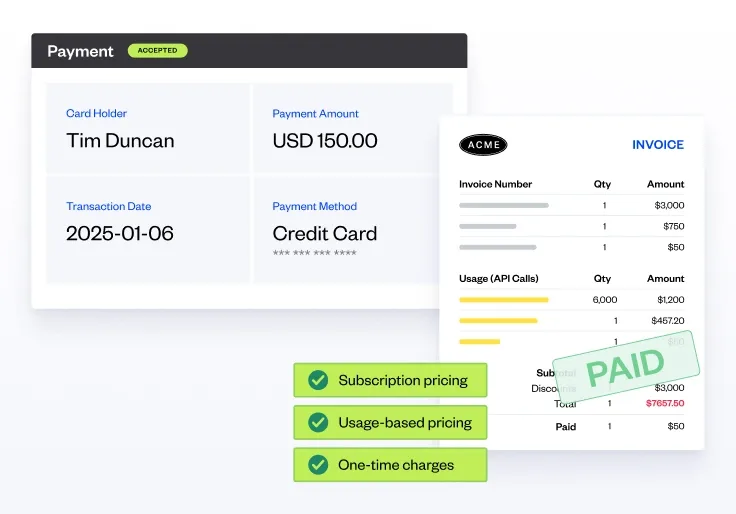

2 Collect payments

Auto-bill customers. Generate & send invoices. Follow up and retry late payments. Set rules for dunning notifications. Supports 150+ currencies.

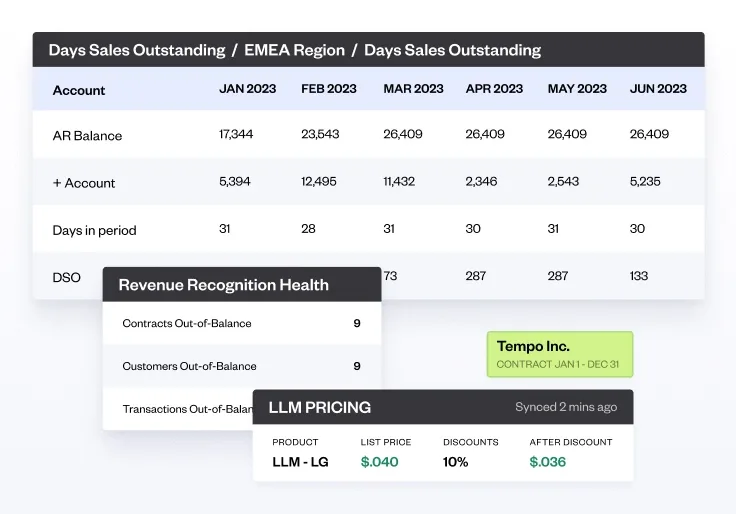

3 Report revenue

Close books in minutes, not days. Automate revenue recognition for FASB standards. 1-click audit reports. ARR, roll forwards, and more.

Features

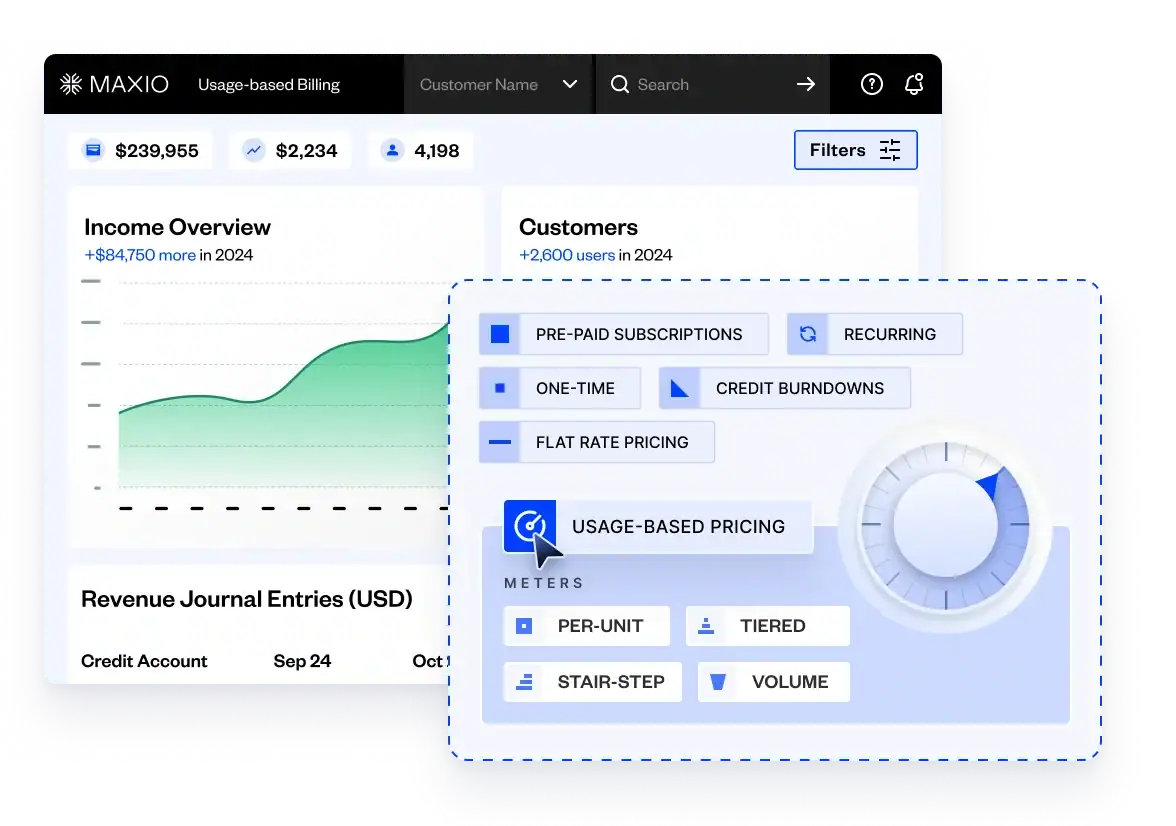

Usage-based billing

Sync product usage with billing for accurate invoicing. No more spreadsheets and manual reconciliation.

Charge based on license quantity, usage beyond prepaid capacity, or run a meter. Supports per unit, volume-based, tiered, and stairstep pricing schemes. No code.

Subscription management

Create subscription plans and individual contracts in minutes. Set prices. Enable setup fees, coupons, add-ons, and upsells.

Let users get custom pricing by filling out a PCI-compliant form. Auto-generate invoices for self-service billing. Sync customer data with Salesforce, HubSpot, and other CRMs.

Revenue recognition

& reporting

Create revenue recognition rules based on your ASC 606/IFRS 15 policies. Or use premade recognition methods for fast results.

Automate schedules, run calculations, and identify deviations. Visualize data with unlimited custom dashboards. Drill down. Generate 1-click reports. ARR summary, DSO, and 30+ others.

Subscription billing software FAQs

Subscription billing software allows businesses to manage their subscription-based business models with automatic invoicing, recurring payment processing, late payment notifications, revenue recognition and management, and more.

By integrating subscription billing software into their operations, SaaS businesses can enhance their revenue management, reduce administrative overhead, and provide a smoother, more reliable billing experience for their customers.

Recurring billing software and subscription billing software both automate the process of charging customers at regular intervals, but they cater to different business needs. Recurring billing software is designed for any type of business that needs to charge customers periodically (e.g., monthly utility bills), focusing on the automation of repeat payments for ongoing services or products.

On the other hand, subscription billing platforms are specifically tailored for businesses, often in the SaaS realm, that utilize a subscription-based business model. These platforms are able to support various subscription models and pricing plans, manage customer subscriptions, handle upgrades, downgrades, and cancellations, and often integrate with other business tools. While both systems ensure timely payments, subscription billing platforms offer more functionalities to manage the complexities of subscription-based models, including customer lifecycle, subscription metrics, and tailored pricing strategies.

Maxio’s subscription billing software offers unmatched visibility into the financial operations of your SaaS company.

More than 600 reviewers on G2 call Maxio a “very powerful product,” a “great tool for our finance department,” and an “integral part of our business.” If you’re looking to streamline subscription management, it’s worth scheduling a demo for a personalized walkthrough of the tools Maxio provides.

Our subscription billing software addresses failed payments through a comprehensive revenue management platform that can implement several revenue management strategies, such as sending automated notifications to customers about payment issues, and working with major payment gateways like Stripe, PayPal, Braintree, and more to facilitate retries. This proactive approach ensures businesses maintain a steady cash flow while keeping customer relationships intact, offering multiple pathways to resolve payment failures and keep subscriptions active.