If you ask a SaaS founder or CEO what their top priority is, nine times out of 10, you’ll get a one-word reply: “growth.” It’s easy to see why. Everyone loves to talk about how fast their SaaS business is growing, and in recent years investors have rewarded companies that can deliver massive revenue growth.

But according to Battery’s latest Cloud Quarterly report, times are changing. Of course, growth still matters. But it isn’t the only thing that matters. Increasingly, investors seek not “growth at any cost” but rather a more measured and sustainable approach. Yes, they want to see growth, but during these turbulent times, they want growth to be accompanied by responsible leadership and a clearly articulated path to profitability.

That’s why today’s smartest SaaS leaders aren’t obsessed with growth—they’re obsessed with the Rule of 40.

Why are the best SaaS Leaders obsessed with the Rule of 40?

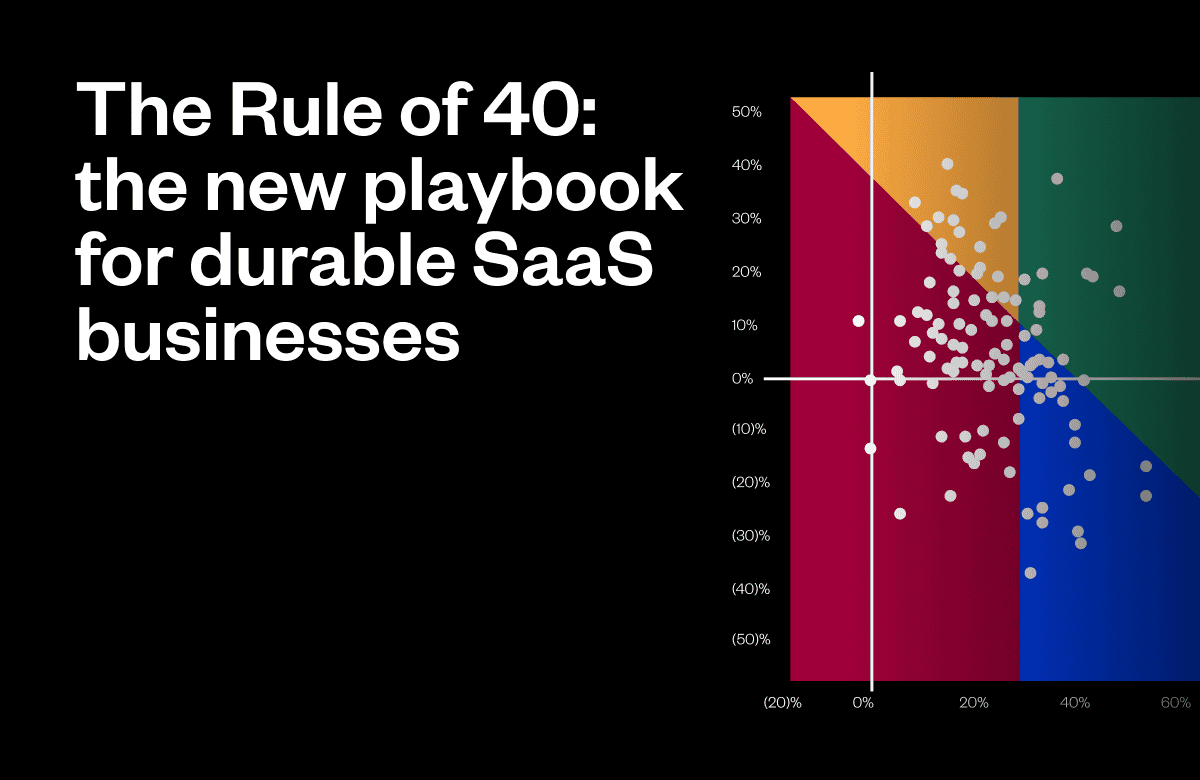

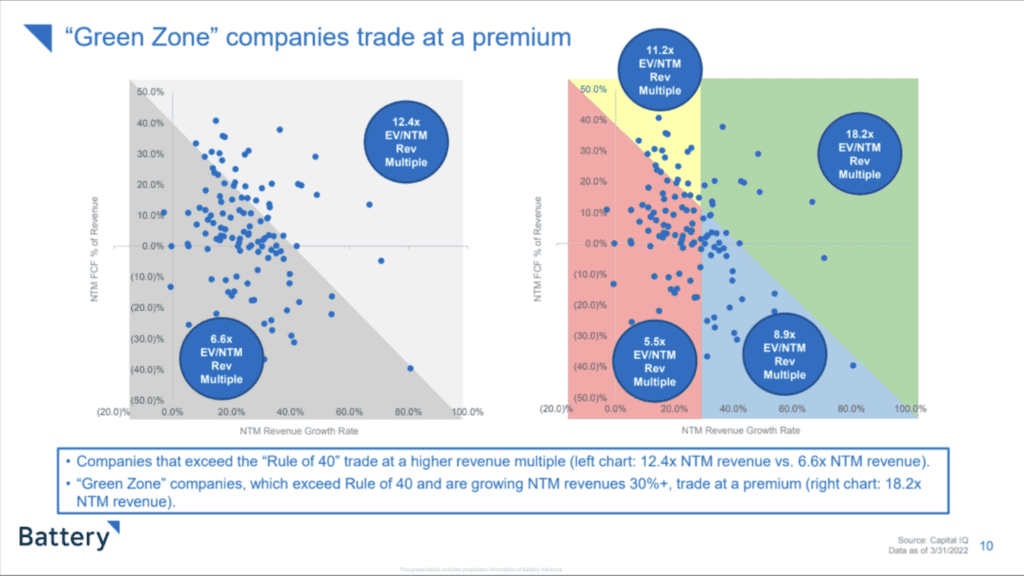

It is all about creating more economic value (EV) over time. To that end, many VCs and growth equity firms (like Battery, which is the majority owner of Maxio) have published articles on the Rule of 40, showing the difference in economic value (a.k.a. valuation) between companies depending on where they sit on the Rule of 40 graph.

One I like a lot is Volition Capital’s POV, which you can find here. In Battery’s recent report, they reviewed and plotted many public companies on a Rule of 40 Graph, which clearly shows the increase in EV for those in the green zone (high growth and higher EBITDA).

Understanding the Rule of 40

The Rule of 40 helps you understand whether you’re focusing too much on revenue growth at the expense of profitability. It works by adding your current 12-month growth rate (in percentage terms) to your profit margin. If the result is 40 or more, you’re golden; if it isn’t, you’re doing something wrong.

In other words, if you’re growing at 80% per year, you can afford up to a negative 40% profit margin. If you’re growing at 40% per year, you can afford to operate at no worse than breakeven. And if you’re growing at just 20% per year, you’re doing fine as long as your profit margin is 20% or higher.

That’s a significant break with the conventional wisdom. Many SaaS businesses have long assumed that if they’re posting 80% or 100% or 120% annual revenue growth, nobody’s going to ask questions about their path to profitability, and if their growth is down around 20% or 30%, nobody’s going to care how profitable they are.

What are the benefits of tracking the Rule of 40?

Between new bookings, revenue growth, churn, and more, there are countless SaaS metrics that require constant attention to keep your business healthy and on track. So what makes the Rule of 40 special, exactly?

1. Aligning Growth and Profitability

The first and most immediate benefit of monitoring the Rule of 40 is its ability to spotlight the balance, or imbalance, between your company’s growth and profitability. For a SaaS business, keeping an eye on this metric can offer insights into how to manage the company’s resources more efficiently. It encourages an optimal allocation of resources between driving sales growth and maintaining a healthy bottom line, facilitating a sustainable trajectory of future growth.

2. Future Growth

The Rule of 40 isn’t just about today’s performance — it’s about tomorrow’s prospects. This rule is a forward-looking indicator, presenting a trajectory of where the business is heading based on current performance metrics. It offers a reality check for businesses, enabling them to adapt their strategies for future growth. This could mean reinvesting profits for more aggressive growth or managing costs to enhance profitability.

3. Increased Profitability

Closely tied to future growth is increased profitability and high margins. A SaaS business that meets or exceeds the Rule of 40 demonstrates a healthy balance between growth and profit. Such a balance often indicates that the company is efficiently converting its revenue into profits, which can result in increased profitability over time.

4. Higher Revenue Multiples

In the eyes of private equity investors, a company following the Rule of 40 is often deemed more valuable and stable, leading to higher revenue multiples. The ability to balance growth with profit margins is seen as a strong indicator of an effectively managed business. This aspect makes such companies more appealing to investors and could potentially lead to higher valuations in the investment market.

Measuring growth rate and profitability

Once you understand the benefits of the Rule of 40, you need to learn how to calculate it in your own business. Deciphering the Rule of 40 ultimately boils down to how you measure your revenue growth against profitability.

Here’s how these two variables factor in:

Revenue Growth Rate

The primary element of the Rule of 40 is the revenue growth rate, a measure of how a company’s revenue grows from one period to the next. For SaaS businesses, this is typically determined by analyzing changes in Annual Recurring Revenue (ARR) from year to year on the income statement.

Calculating your revenue growth rate should be fairly straightforward as long as your SaaS company has been operating for at least a year. Generally Accepted Accounting Principles (GAAP) establish clear definitions for what constitutes revenue, and these definitions tend to remain consistent year over year.

To find your revenue growth rate, subtract last year’s ARR from this year’s ARR, divide that by last year’s ARR, and then multiply by 100 to yield a percentage.

Profitability Margin

Profitability margin, the other essential piece of the Rule of 40 puzzle, can be a bit more complex due to its broad interpretation. This metric represents the proportion of revenue that a company retains as profit after covering all costs, thus depicting its efficiency in generating profits.

A profitability margin can be calculated from various items on your income statement or balance sheet, such as free cash flow, total operating income, and earnings before interest, taxes, depreciation, and amortization (EBITDA).

If you decide to use EBITDA, you can calculate the profitability margin by dividing EBITDA by total operating revenue, and then multiplying by 100 for the percentage.

How to calculate the Rule of 40

The formula for the Rule of 40 can be represented as follows:

Rule of 40 = Company’s Revenue Growth Rate (%) Company’s Profit Margin (%)

This equation means that for a software company to meet the Rule of 40, the sum of its revenue growth rate (a measure of its total revenue growth) and its profit margin (a measure of its profitability per dollar of revenue) should be 40% or more.

Here’s how you can calculate these variables:

- Company’s Revenue Growth Rate (%): (Current Year Revenue – Previous Year Revenue) / Previous Year Revenue x 100

- Company’s Profit Margin (%): (Net Income / Total Revenue) x 100

How many SaaS companies meet the Rule of 40?

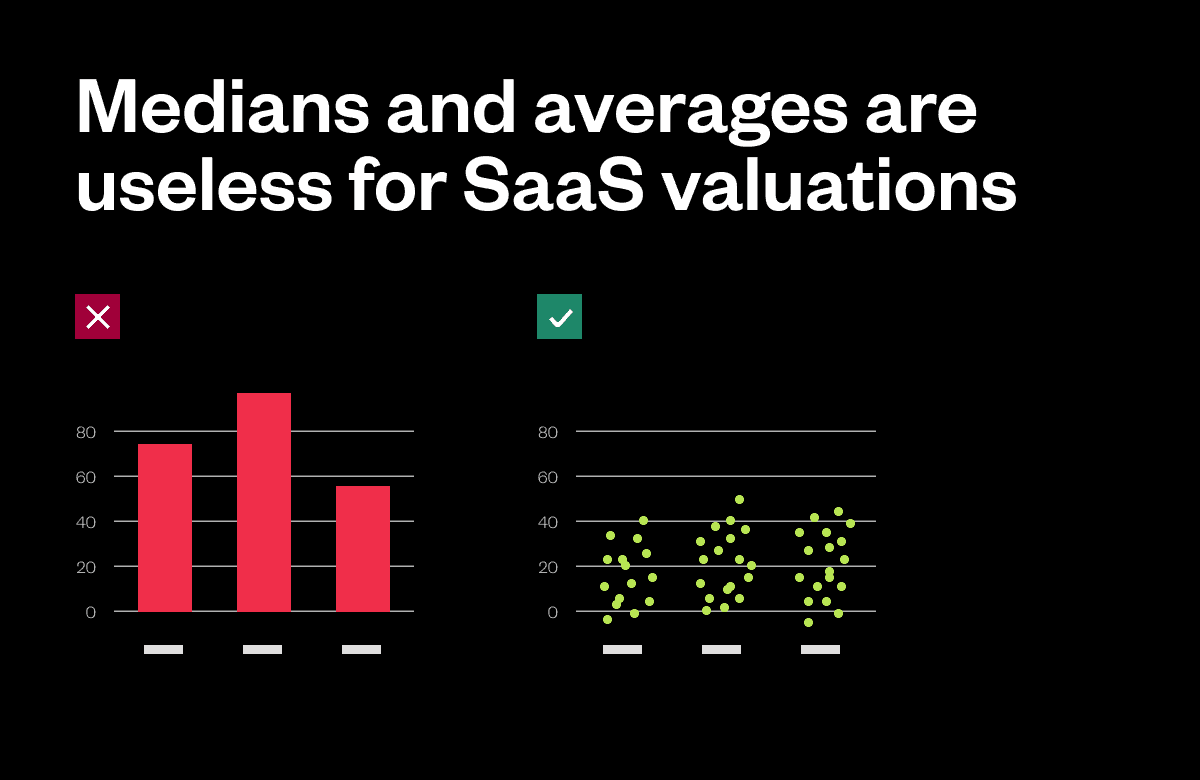

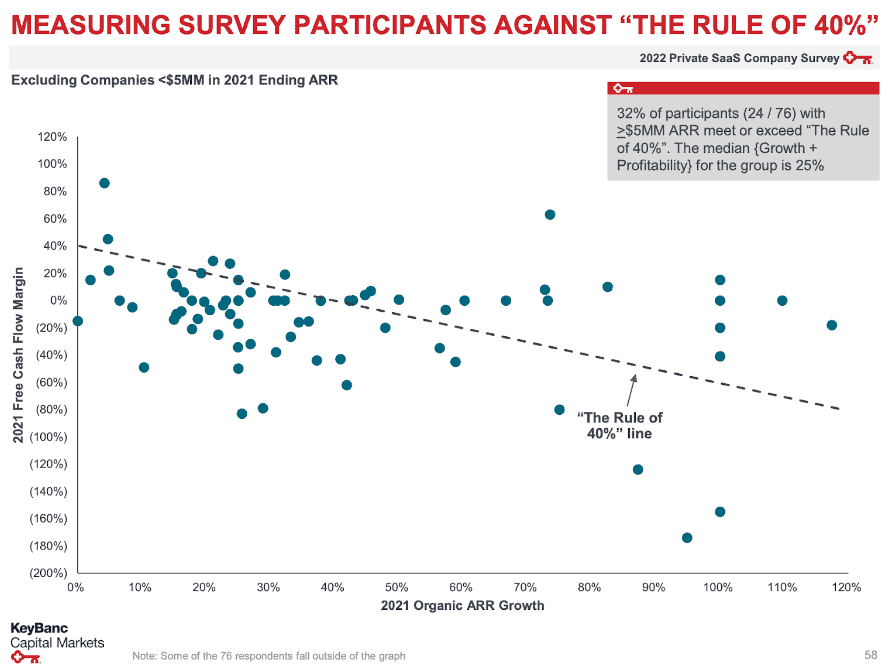

According to the 2022 KeyBanc’s Capital Markets Private SaaS Company Survey, only 32% of participants with ≥$5MM ARR meet or exceed Rule of 40. The median {Growth Profitability} for the group is 25%.

Why aren’t more SaaS companies achieving the golden Rule of 40?

When compared head-to-head, SaaS companies with a lower Customer Acquisition Cost (CAC) perform significantly better than their peers. Ultimately, CAC stands out as a differentiator between companies that achieve Rule of 40 status and those that don’t.

The Rule of 40 in public SaaS companies vs. private SaaS companies

Within SaaS, the application of the Rule of 40 tends to vary between public and private software companies, reflecting their differing stages of growth and maturity.

Public SaaS companies, with an established market presence and proven track record, are often in a position to balance growth and profitability more effectively. These companies frequently exhibit higher revenue growth rates and profit margins, allowing them to easily meet or even exceed the Rule of 40. This alignment is a key indicator of a healthy SaaS company and is essential to maintaining market position and investor satisfaction.

On the flip side, private SaaS companies, often in their expansion stage, typically emphasize rapid market growth over immediate profitability. Such companies may heavily invest in sales and marketing initiatives for customer acquisition and market share capture. While this approach often results in robust revenue growth rates, it can also lead to low or even negative profit margins. Consequently, these companies may find the Rule of 40 more challenging to meet as they prioritize scaling their operations.

However, as a company matures, balancing growth and profitability becomes increasingly critical, making the Rule of 40 a valuable benchmark in the SaaS landscape. It’s vital to remember, though, that it’s not a one-size-fits-all metric. When assessing a SaaS company’s health and sustainability, the Rule of 40 should be used in conjunction with other key metrics and considerations, such as market dynamics, the competitive landscape, and customer acquisition costs. In this way, a more comprehensive and nuanced evaluation of a company’s performance can be achieved.

Not all Rule of 40 companies are equal

While the math says you can have an 80% growth profile and -40% EBITDA, it is probably not a great profile given the recent uncertainty in the market. According to Battery, the downturn has made the Rule of 40 more important than ever. Relying on hypergrowth to carry you to a big exit is no longer the best strategy. With VC money flagging, founders are having to conserve capital and extend their runway. That’s making measured and sustainable expansion, accompanied by an appropriate level of profitability, more critical than breakneck growth at any cost.

What this means for your SaaS business

The Rule of 40 requires different things from different stakeholders:

- Investors need to make sure they’re doing due diligence and investing in companies that have staying power. Growth without a pathway to profitability is worthless; so are slash-and-burn spending reductions that come at the cost of existing or future revenue streams. Steady and sustainable growth driven by smart spending and monetization strategies is vital.

- Founders need to ensure they have the right financial metrics at their fingertips. Burn rate is important, of course, but don’t neglect the money coming in. To get a handle on your Rule of 40 compliance, you need to manage growth and outlay in parallel and ensure you have data-driven insights into metrics such as recurring revenue growth, customer churn, etc.

- Employees need to understand that disciplined growth is now the name of the game, and that reduced or more measured spending, or new kinds of spending, might be necessary. That doesn’t mean the company is panicking or running out of money, it means it’s maturing and battening down the hatches for the long haul.

What’s the common thread here? It’s an obsessive commitment to the nuts and bolts of your growing business—the financials and KPIs that enable you to achieve not just growth, but durable growth at a sustainable pace. Only with meaningful and continuous visibility into and control over these core metrics can you simultaneously unlock both growth and profitability in today’s fast-changing SaaS environment.

A new playbook

Bottom line: the Rule of 40 is the new playbook for durable SaaS businesses. Investors, founders, and employees all need to focus on making intelligent, data-driven decisions that will give their companies real staying power. That means building out the financial toolkit you need to unlock the next stage of growth while also building a rock-solid path to profitability.

Want to find out more? The Maxio team is here to help. Get in touch today to learn how you can leverage the Rule of 40 to drive enduring success for your business.

Ready to achieve sustainable growth in today’s market? Get a demo