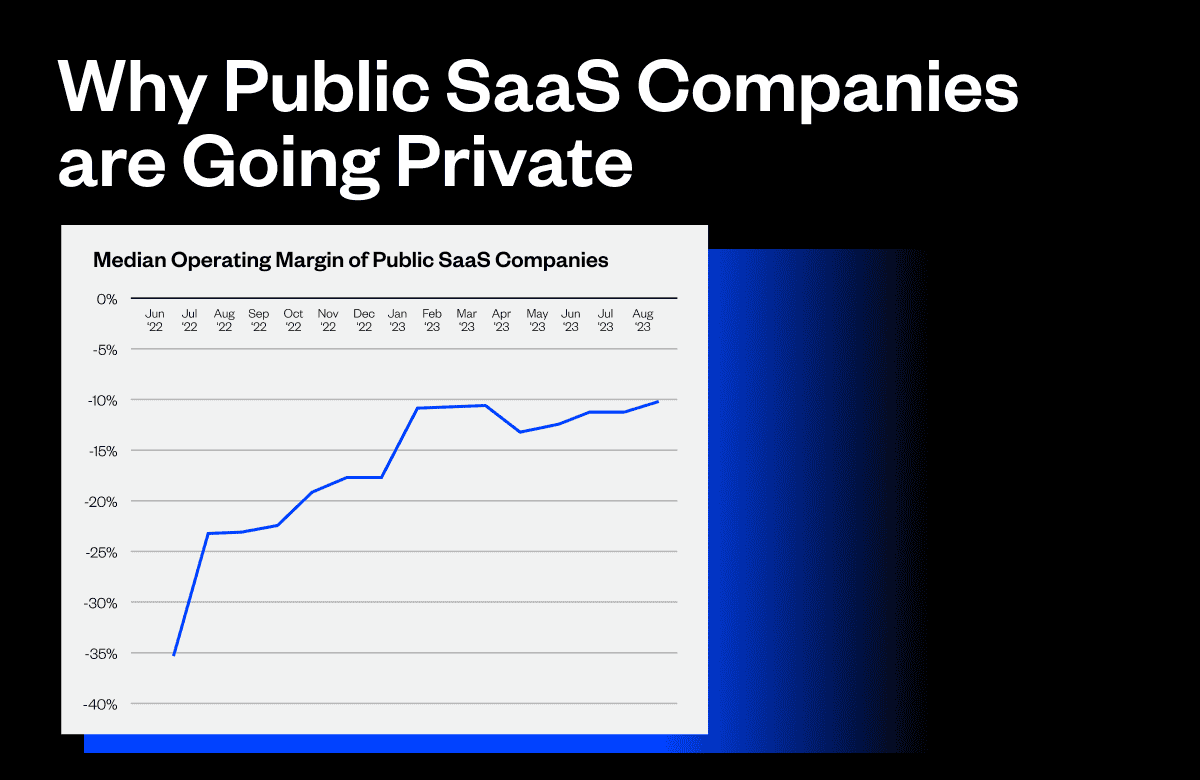

Remember SaaS before the Rule of 40? Life was simpler then. Grow fast with good retention, and capital will find its way to your door. You can create value that way, but it’s reliant on cheap capital, which no longer exists.

Given the current cost of capital, should CEOs press the accelerator, drive growth, and raise another round? Or should they pull back to break even with more moderate growth and forgo additional dilution?

I’ve built a financial model to answer these questions. It looks at the outcomes for existing shareholders based on the following four assumptions: burn ratio*, growth rate, cost of capital, and exit multiples.

The model provides insight into this fundamental question: based on how efficient your business is at turning cash into ARR, and given the dilution needed to support that growth, should you jump on the accelerator or not? Alternatively, how much of a slowdown can you absorb in transitioning to breakeven without destroying value?

The assumptions graphed compare a 50% growth business with a 1.1 burn ratio to a 33% growth business with a .2 burn ratio. The higher growth business raises capital at five times ARR and sells at six times ARR, and the efficient business raises money at four times ARR and exits at five times. Feel free to adjust as you see fit. Fundamentally, the burn ratio in the model drives the need for capital, which dilutes the current shareholders.

In this example, the current shareholders clear $229 million in the High Growth scenario vs. $146 million in the Efficient scenario. That’s the math. The model, however, does not include a risk adjustment. The High Growth plan requires $127 million to be raised in five rounds over ten years. A lot can go wrong with that plan, including droughts in the VC market like we see today.

In addition, the existing shareholders’ ownership in the High Growth scenario is only 33% at exit. That might be fine, but founders need to take into account of the lack of control that implies.

*Burn ratio is defined as Cash Consumed/New ARR. For this model, profit and loss are equivalent to cash flow.

About the author

Todd Gardner is the Managing Director of SaaS Advisors and the founder and former CEO of SaaS Capital. Todd was also a partner in the venture capital firm Blue Chip Venture Company and was a management consultant with Deloitte. Todd has worked with hundreds of SaaS companies across various engagements, including pricing, capital formation, M&A, metrics, valuations, and content marketing. Todd is a graduate of DePauw University and Indiana University.