Over the last 26 months, sixteen public SaaS companies have been taken private. Sixteen!

What can we learn from the PE firms? Let’s look at the data.

My first observation is that while the PE firms were undoubtedly looking for value, that did not necessarily mean “cheap.” They paid, on average, 7.7 times ARR when acquiring a company, which was only about 1.7 times below the average ARR of public SaaS companies at the time of the acquisition. These data are consistent with the “flight to quality” that we have seen private market investors adopt. Private buyers are looking for undervalued SaaS companies, not low-value ones.

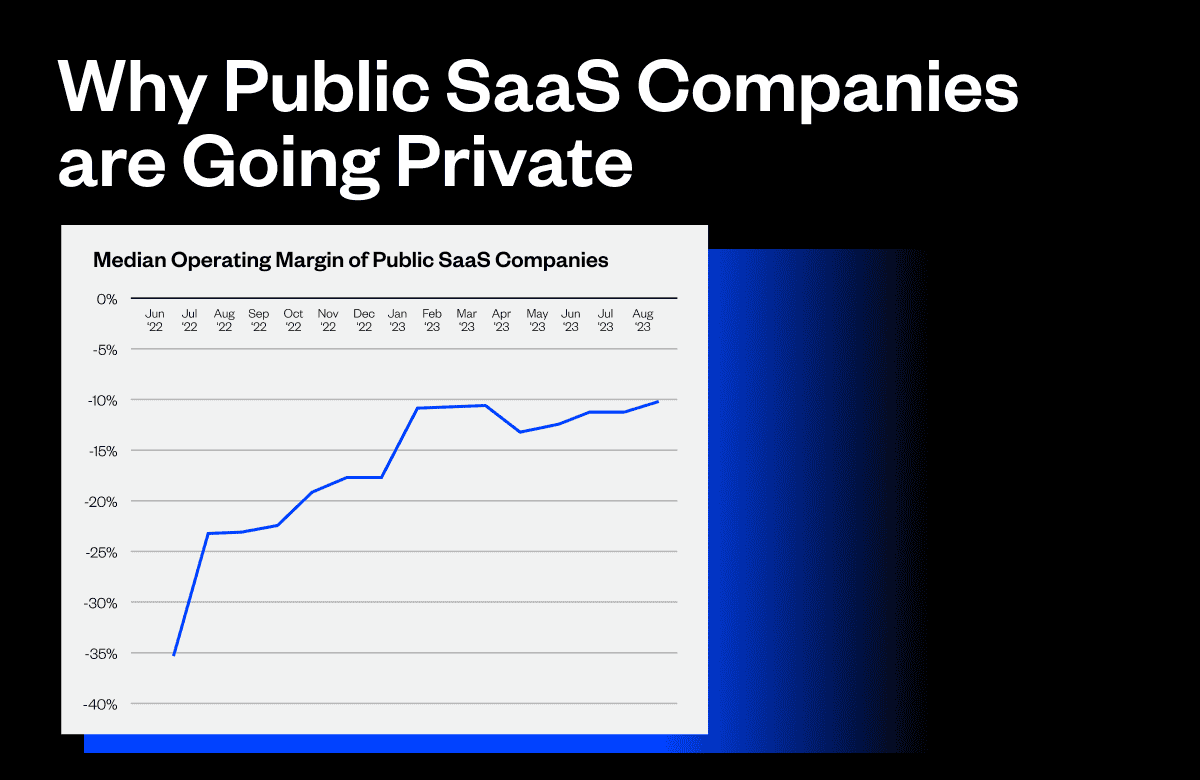

The growth profile of the companies taken private was about the same as the universe of public SaaS companies at 22%. Profits, however, are a different story. As a group, the companies targeted by PE firms were very unprofitable. Half of the companies had operating losses above 30%, with several running into the 60% loss range. Thoma Bravo, the most active buyer, acquired seven companies with an average operating loss of 36%. (This was substantially worse than the other public SaaS companies, which averaged losses of 20% over the same period and are now only losing 10%.)

The Growth State for B2B SaaS Businesses

We’ve analyzed the billing data of over 2,100 B2B SaaS companies between 2022 and 2023—download the report to learn what we found.

Referring back to my post a few weeks ago, Growth or Profit: It’s Time to Pick a Lane, all but one of the companies acquired by the PE firms were in the Dead Zone or Grey Zone. That means they were underperforming on the Rule of 40 and, generally speaking, the profit side of that equation.

The point I made in the Pick a Lane post was that management teams running companies with a low Rule of 40 need to be intentional about pursuing growth or profit and stop trying to do both, at least initially. I lay out some objective measures to determine if growth is a viable strategy, and if not, driving profits must be the imperative. If you don’t do one or the other, someone will do it for you, and that’s what happened to these companies.

The SaaS businesses that were not gobbled up have received the message. The chart shows public SaaS companies’ substantial operating margin improvement over the last fourteen months. (To some degree helped by the underperformers being acquired.)

It’s likely the go-private wave is largely behind us. The remaining public SaaS companies are picked over at this point; debt is more expensive, and many of these companies cleaned up their profitability picture independently.

The takeaway is that all SaaS companies, even large public ones, must either grow quickly or make money. The relentlessly efficient capital markets will solve that equation if the current owners and management team cannot.

About the Author

Todd Gardner is the Managing Director of SaaS Advisors and the founder and former CEO of SaaS Capital. Todd was also a partner in the venture capital firm Blue Chip Venture Company and was a management consultant with Deloitte. Todd has worked with hundreds of SaaS companies across various engagements, including pricing, capital formation, M&A, metrics, valuations, and content marketing. Todd is a graduate of DePauw University and Indiana University.