Revenue Recognition Software

Revenue recognition software built for SaaS

Integrates with:

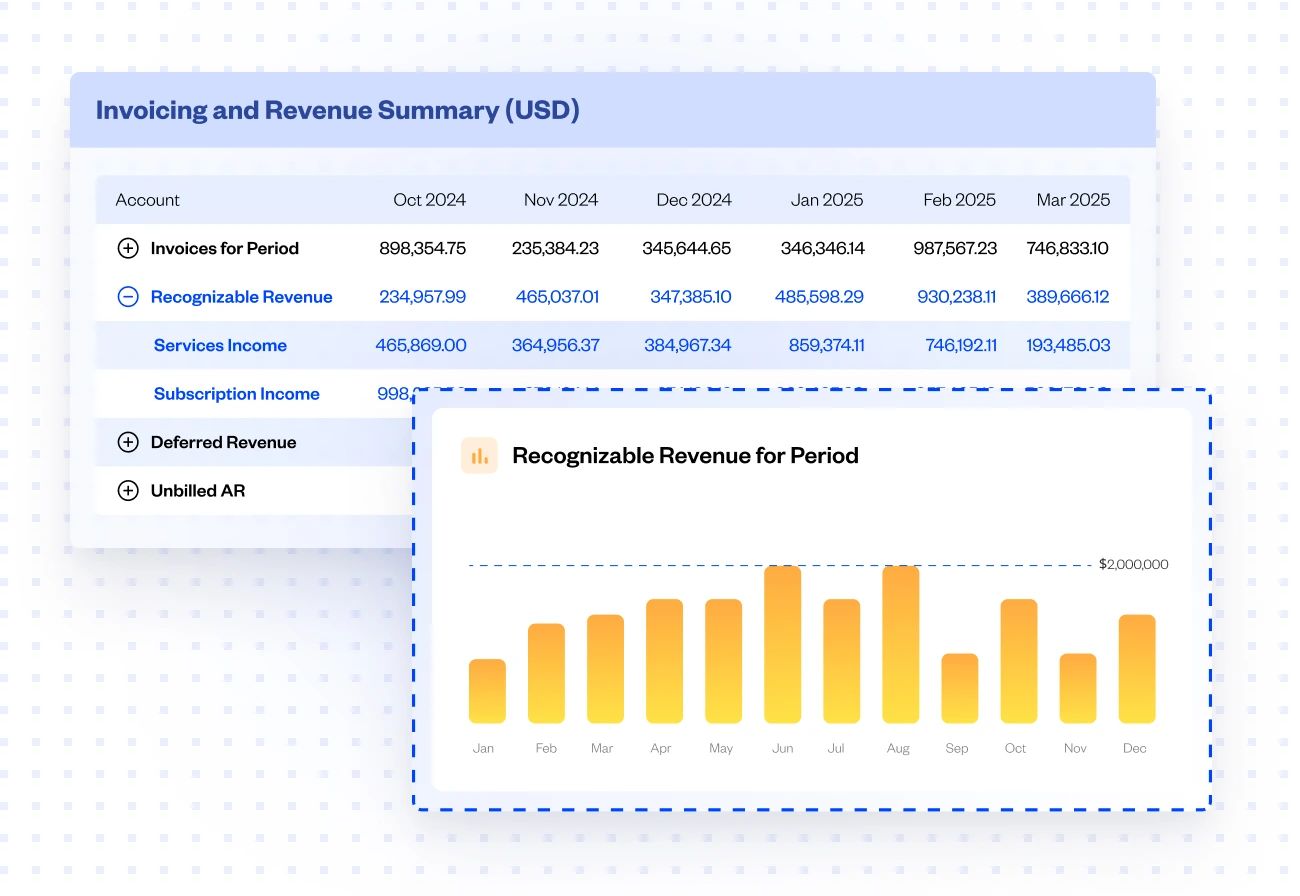

Automate SaaS revenue recognition for accurate reporting

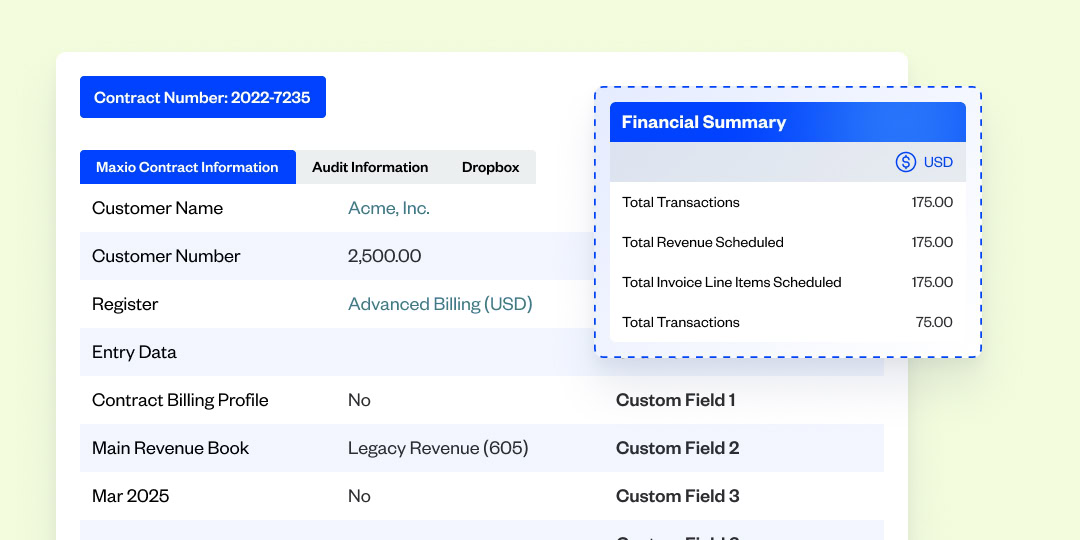

Recognize revenue & track changes

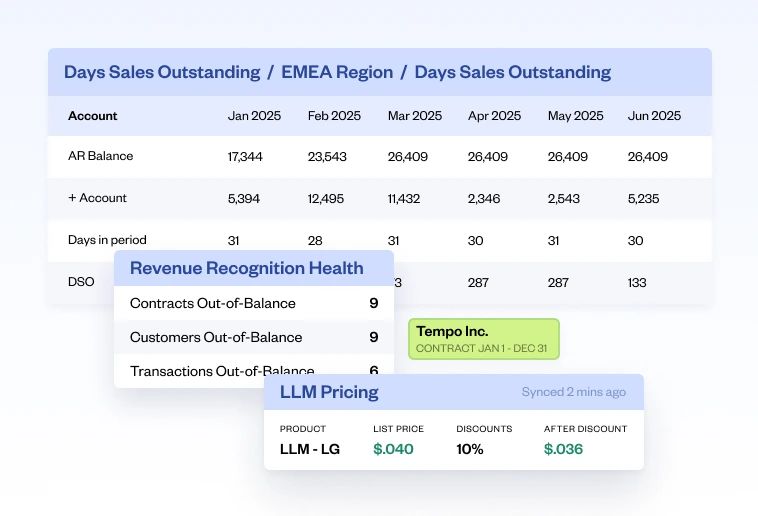

Easily adjust recognition schedules by customer, contract, or transaction without overwriting original data. Reflect real-world changes and preserve financial accuracy.

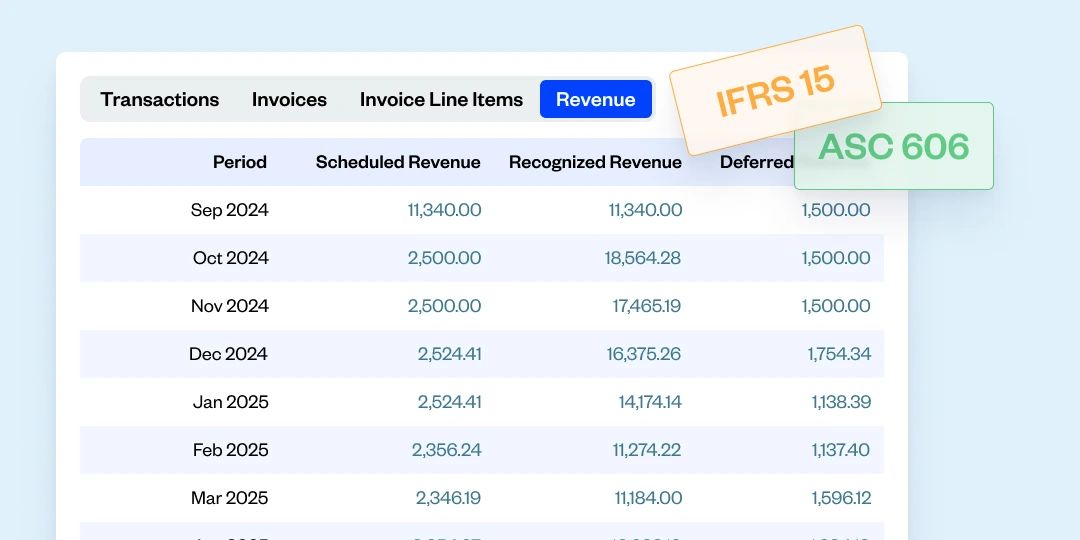

Stay compliant with ASC 606 and IFRS 15

Apply tailored recognition rules across your entire contract base. Align with ASC 606, IFRS 15, and internal policies.

Sync invoices with your GL

Sync invoices and SaaS payments to NetSuite, Sage, QuickBooks, etc. Reduce manual entry and errors. Close faster.

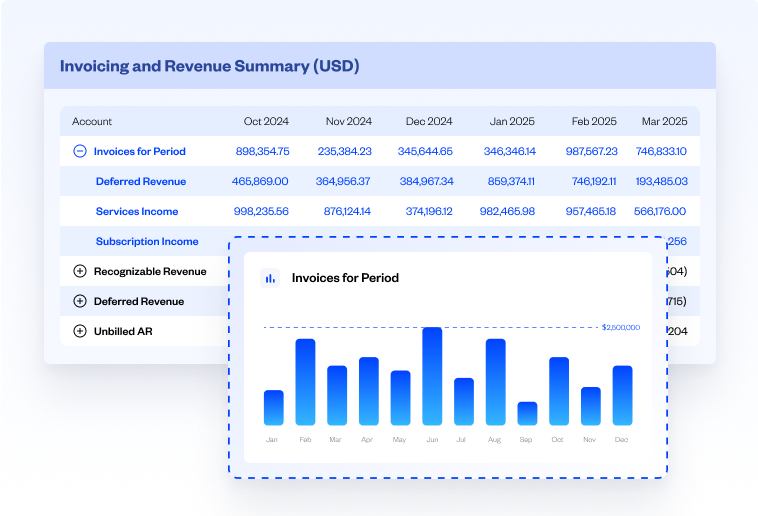

Consolidate journal entries

Get a unified view of your deferred revenue and journal entries across specific time periods. Streamline reconciliation, ensure transparency, and prevent reporting errors.

Revenue recognition for SaaS companies

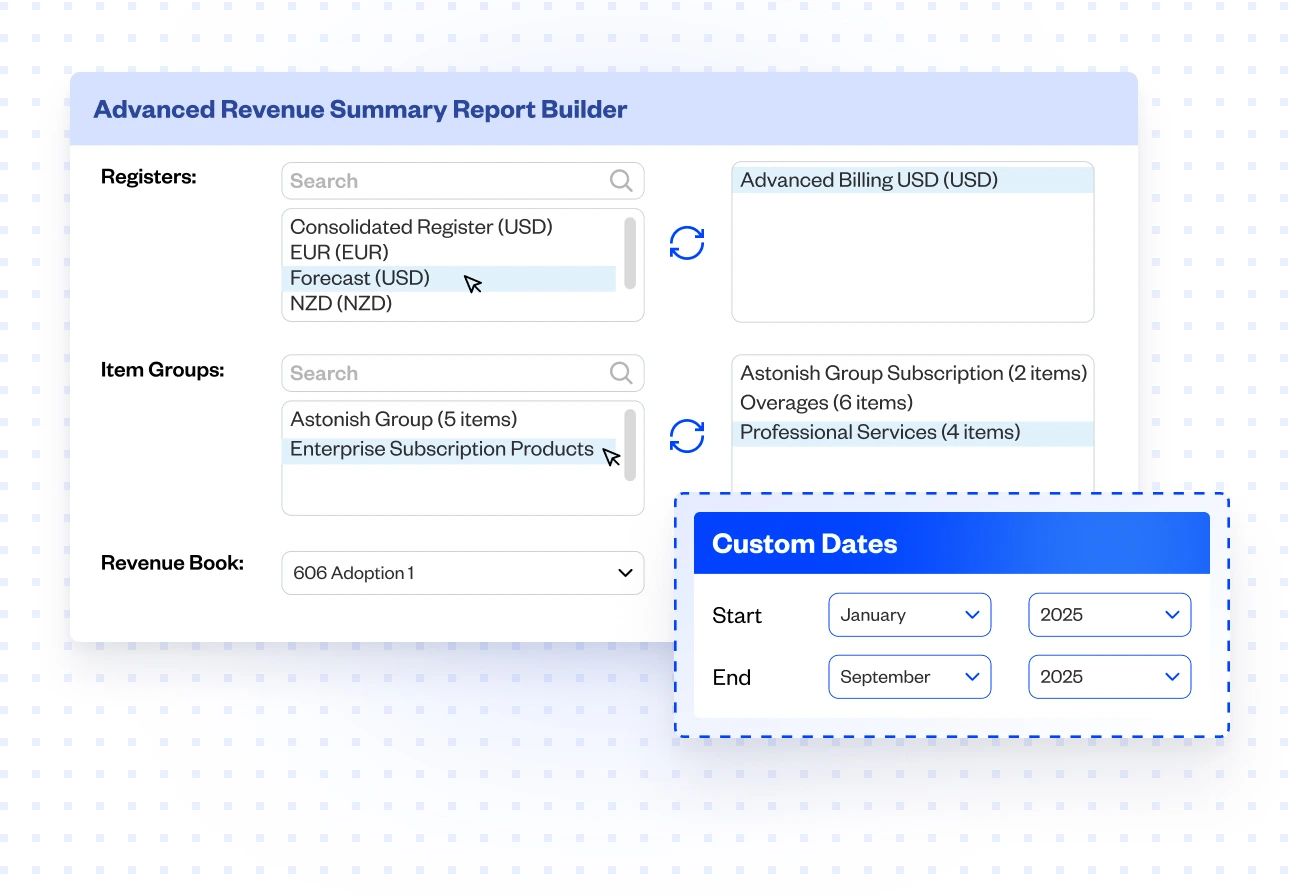

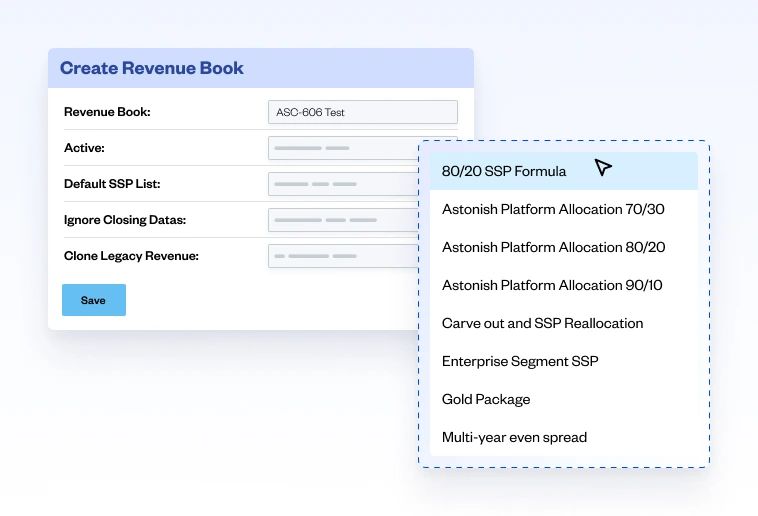

Streamline compliance

Create revenue recognition rules matching your accounting policies. Auto-apply across contracts so your reporting stays consistent and compliant.

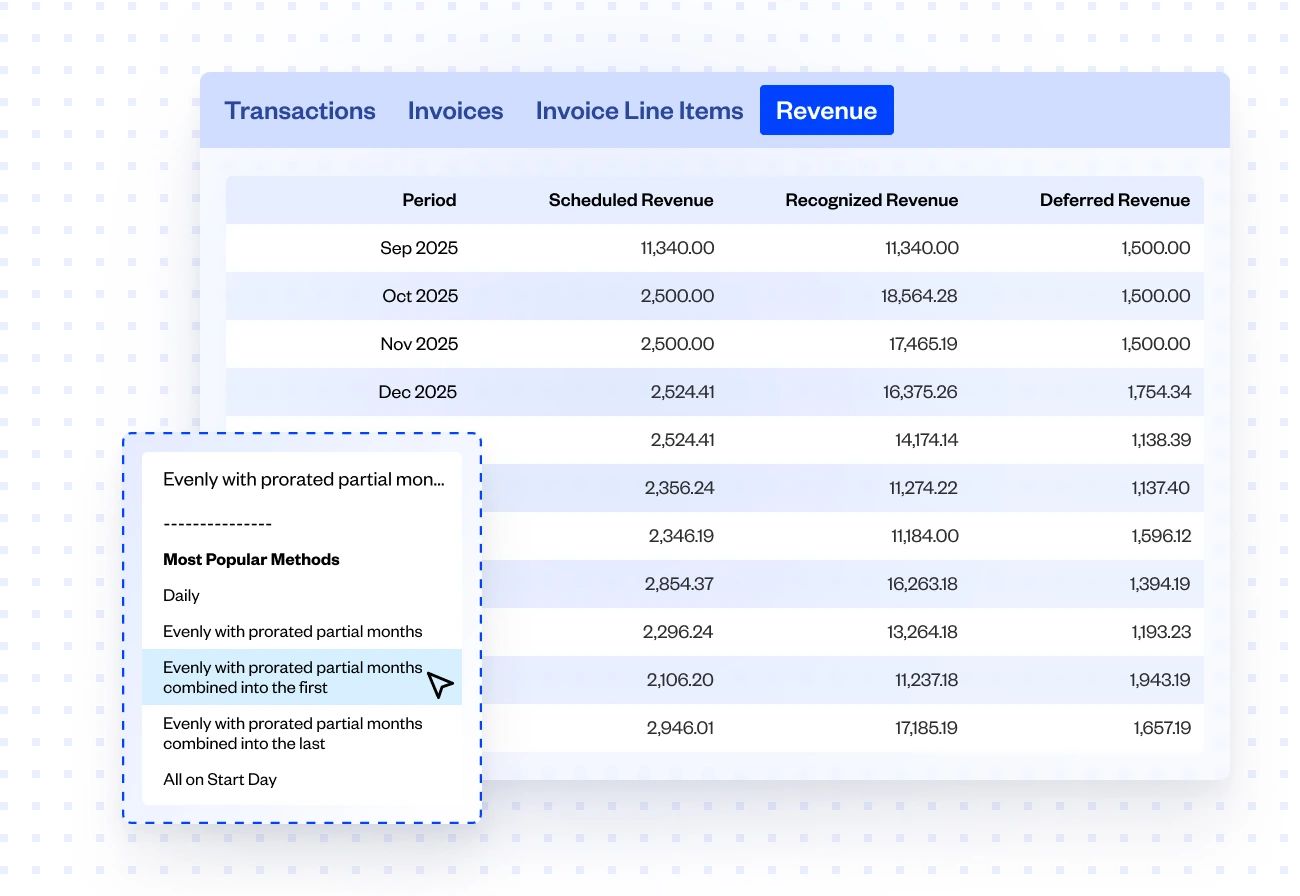

Automate accounting processes

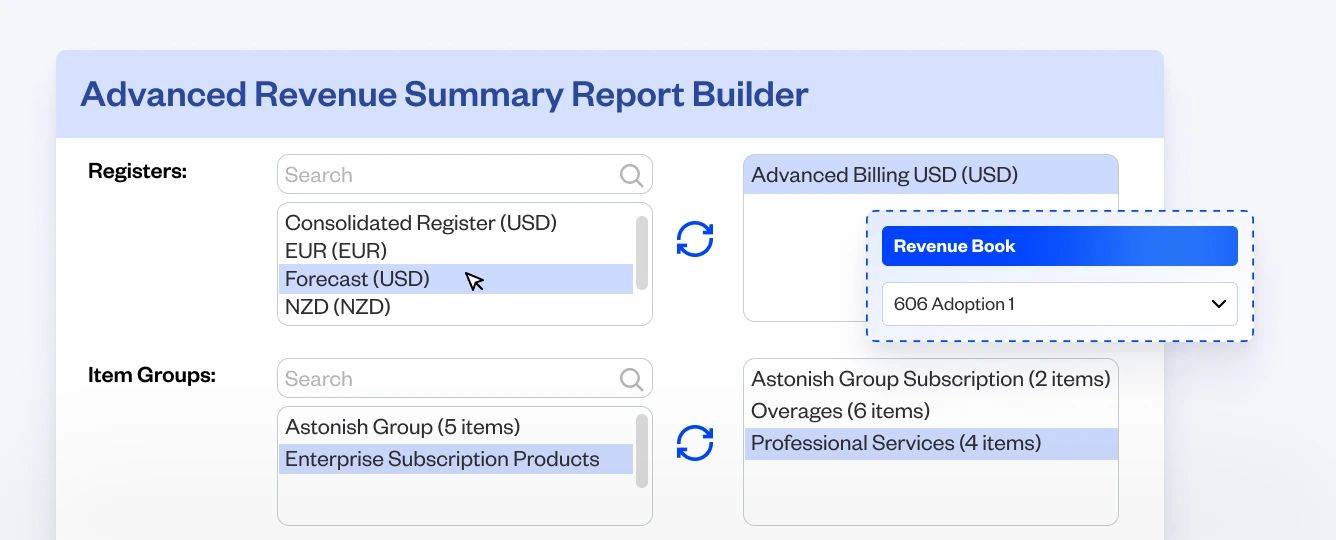

Replace time-consuming manual calculations. Generate automated revenue schedules and waterfall reports aligned to your accounting policies.

Generate detailed audit trails

Quickly create detailed reports with revenue broken down by customer, contract, transaction, or item over any time period.

Customer reviews

Integrations for your finance team

Revenue recognition software FAQs

Revenue recognition software automates revenue recognition process while meeting Financial Accounting Standards Board (FASB) requirements. SaaS companies typically use it alongside subscription billing software or subscription management software.

It manages recurring and nonrecurring revenue streams by handling standalone selling prices (SSP) and negotiated transaction prices.

For example: A SaaS company sells an annual contract but delivers services monthly. The software recognizes revenue each month rather than yearly, keeping financial statements accurate.

In this case, the automation ensures revenue is recognized at the right time, supporting clear financial reporting and better strategic decisions.

Revenue recognition software helps ensure GAAP compliance by streamlining the revenue reporting process for your business model. Revenue recognition automation features ensure consistent and compliant revenue accounting within the requirements of IFRS 15, ASC606, and other GAAP principles. This keeps your finances in order and streamlines annual financial audits.

Yes. Our automated revenue recognition software can handle complex pricing and revenue scenarios by reducing manual work.

Our cloud-based revenue management solution can recognize multiple revenue streams, handle carve-outs, and reallocate revenue. These help simplify financial reporting and reduce risks tied to spreadsheet-based processes.

It’s especially effective for revenue recognition in SaaS use cases, where subscription models, usage-based billing software, and contract modifications require flexible, automated recognition logic.

Revenue recognition software improves reporting accuracy by eliminating manual processes and applying standardized recognition rules to every contract. This reduces inconsistencies, accelerates month-end close, and ensures your revenue data reflects real business activity.

For finance teams, it means fewer errors, fewer audit adjustments, and greater confidence in the numbers shared with leadership and the board.

Yes, a revenue recognition platform can integrate with other systems. These include customer relationship management (CRM) platforms like Salesforce; enterprise resource planning (ERP) systems like Oracle NetSuite; and a range of project management and general ledgers/accounting software.

These integrations streamline workflows and allows for real-time data sync, ensuring that all revenue-related activities, such as sales, renewals, and cancellations, are accounted for.

Because Maxio includes its own accounts receivable software, you can manage billing and collections without relying on external systems.