Enable Sales-Led Growth

The most efficient sales-to-finance handoff in B2B SaaS

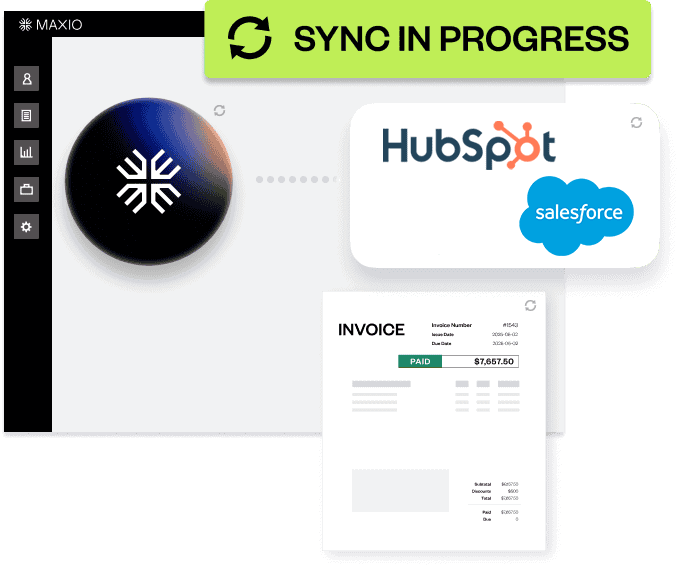

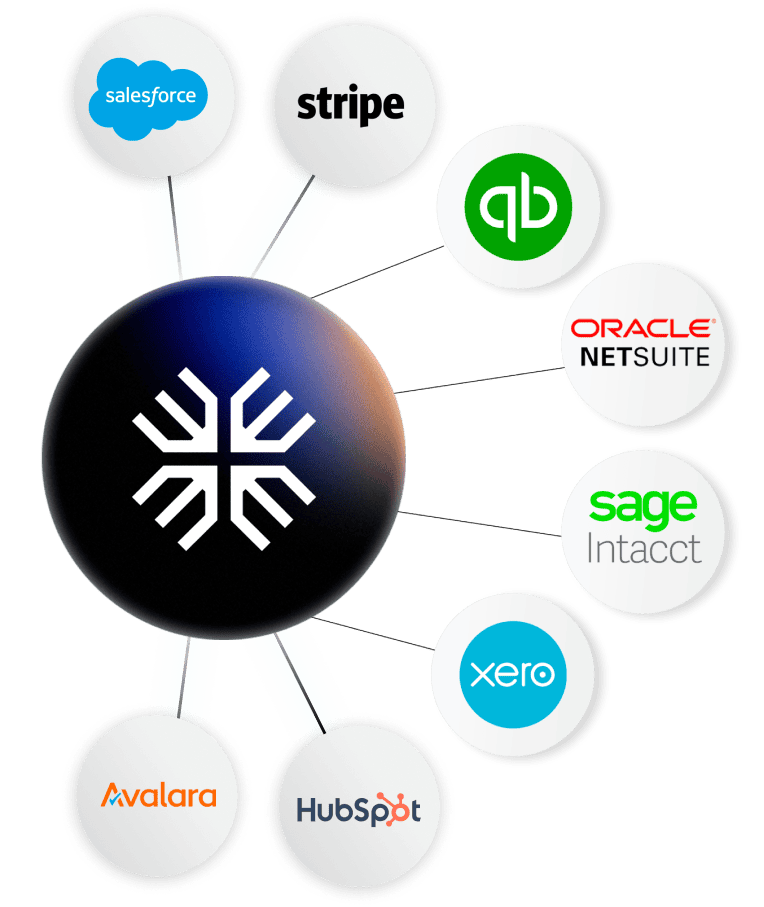

- Two way integrations with your CRM and GL

- Automate sales order processing

- Automate invoice creation and revenue recognition

- Reduce manual workload for your finance team

How it works

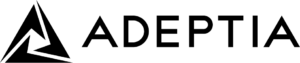

1. Set up your product catalog

- Determine if the product is recurring and set its billing frequency

- Map your product catalog between your CRM, general ledger, and Maxio

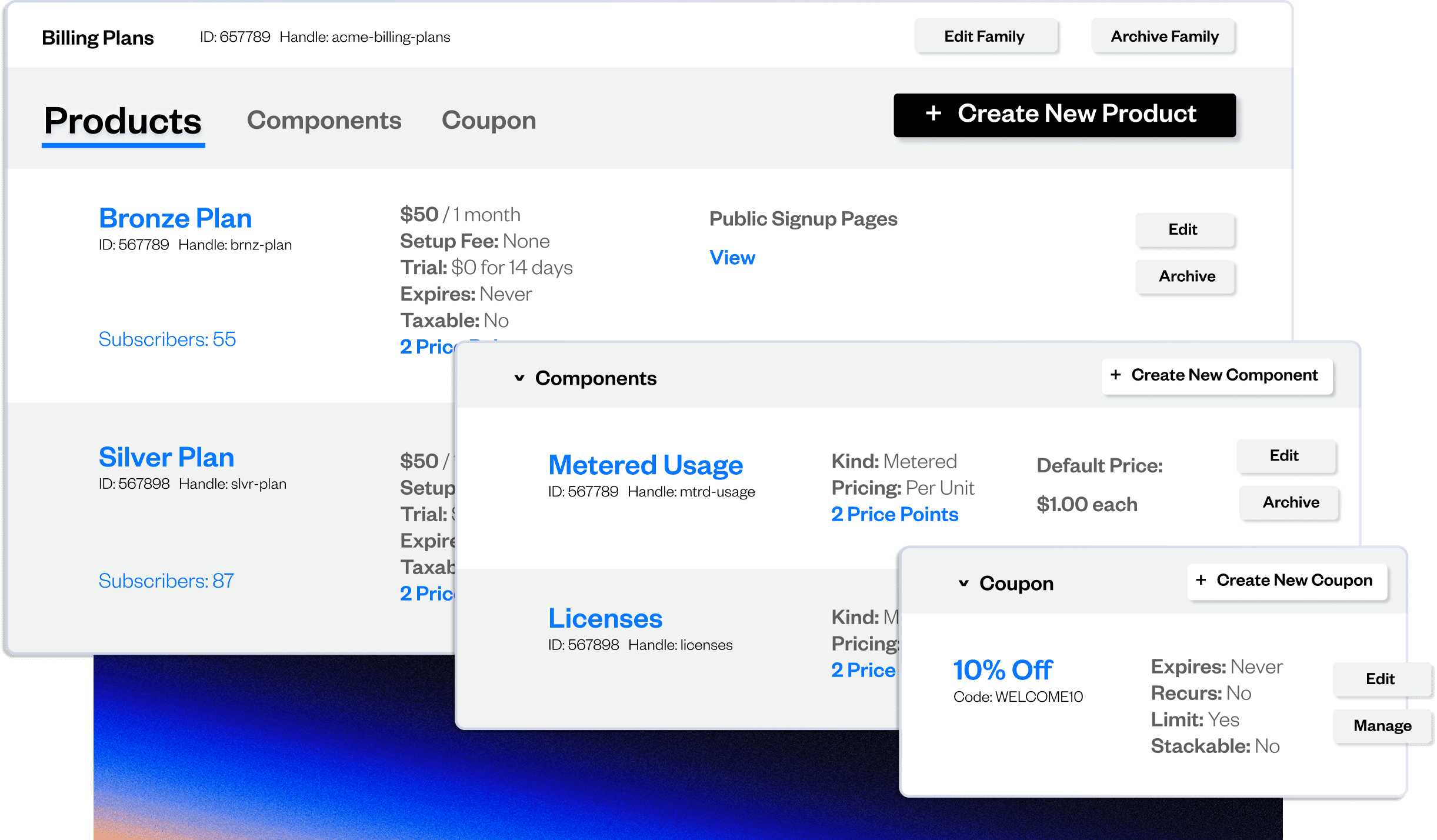

2. Process new deals directly in Maxio

- Bi-directional CRM integrations make the sales-to-finance hand off frictionless

- Pull in default and custom CRM fields to enrich your financial data

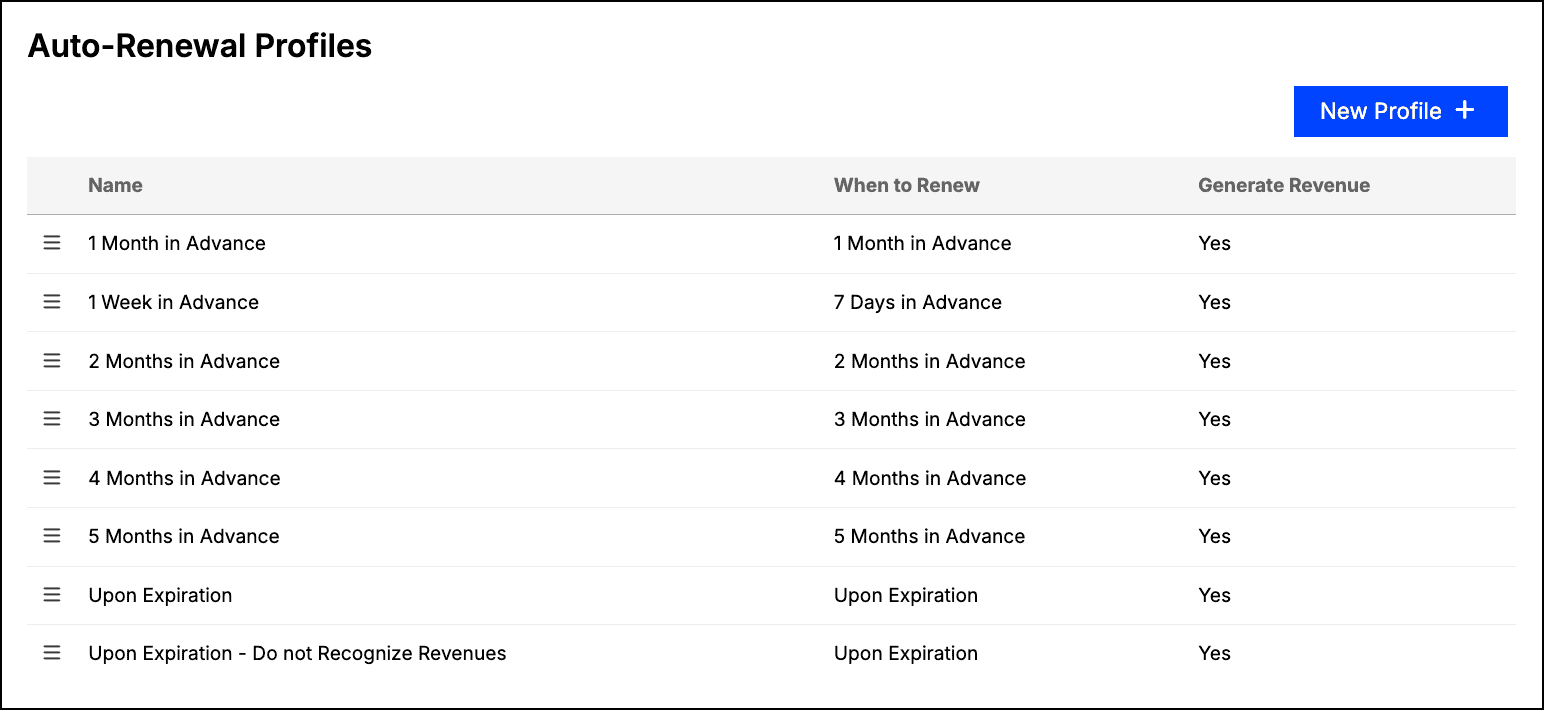

- Create auto-renewal rules for each customer

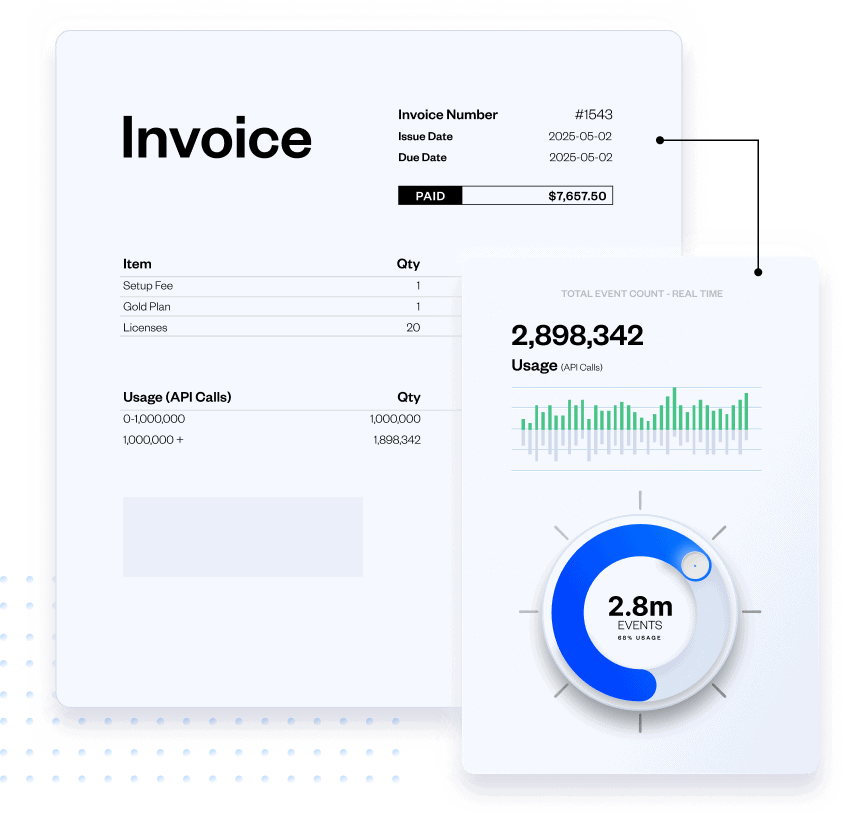

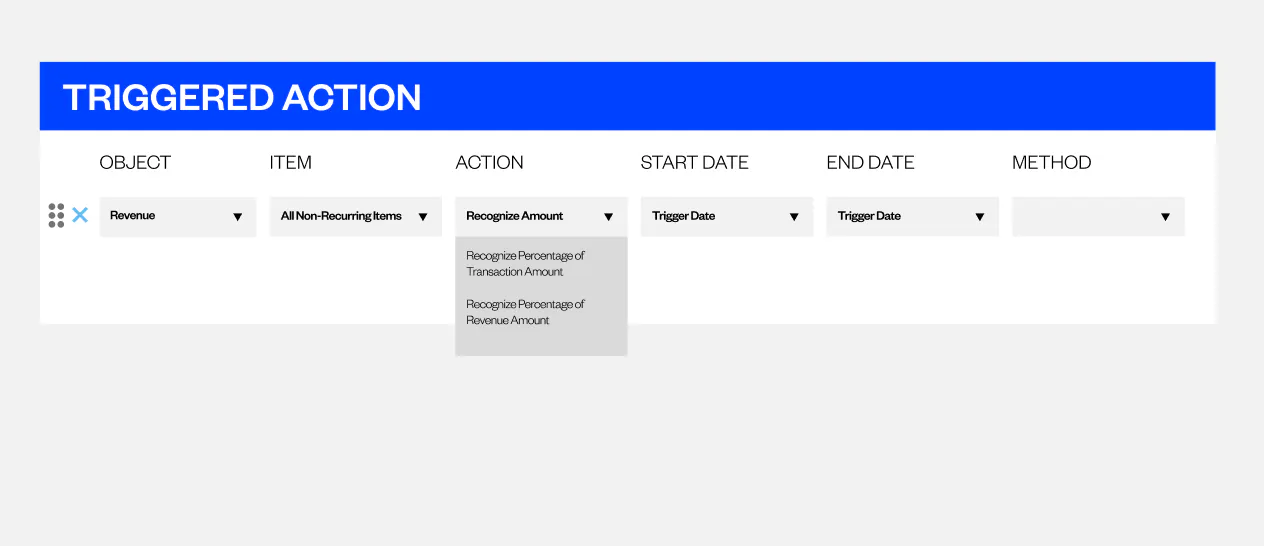

3. Maxio automates invoice creation and revenue schedules

- Automate revenue schedules based on pre-determined rev rec methods

- Invoices are created instantly

- MRR and ARR is adjusted for each recurring item

Built to scale with you

Enable your sales team to sell complex deals

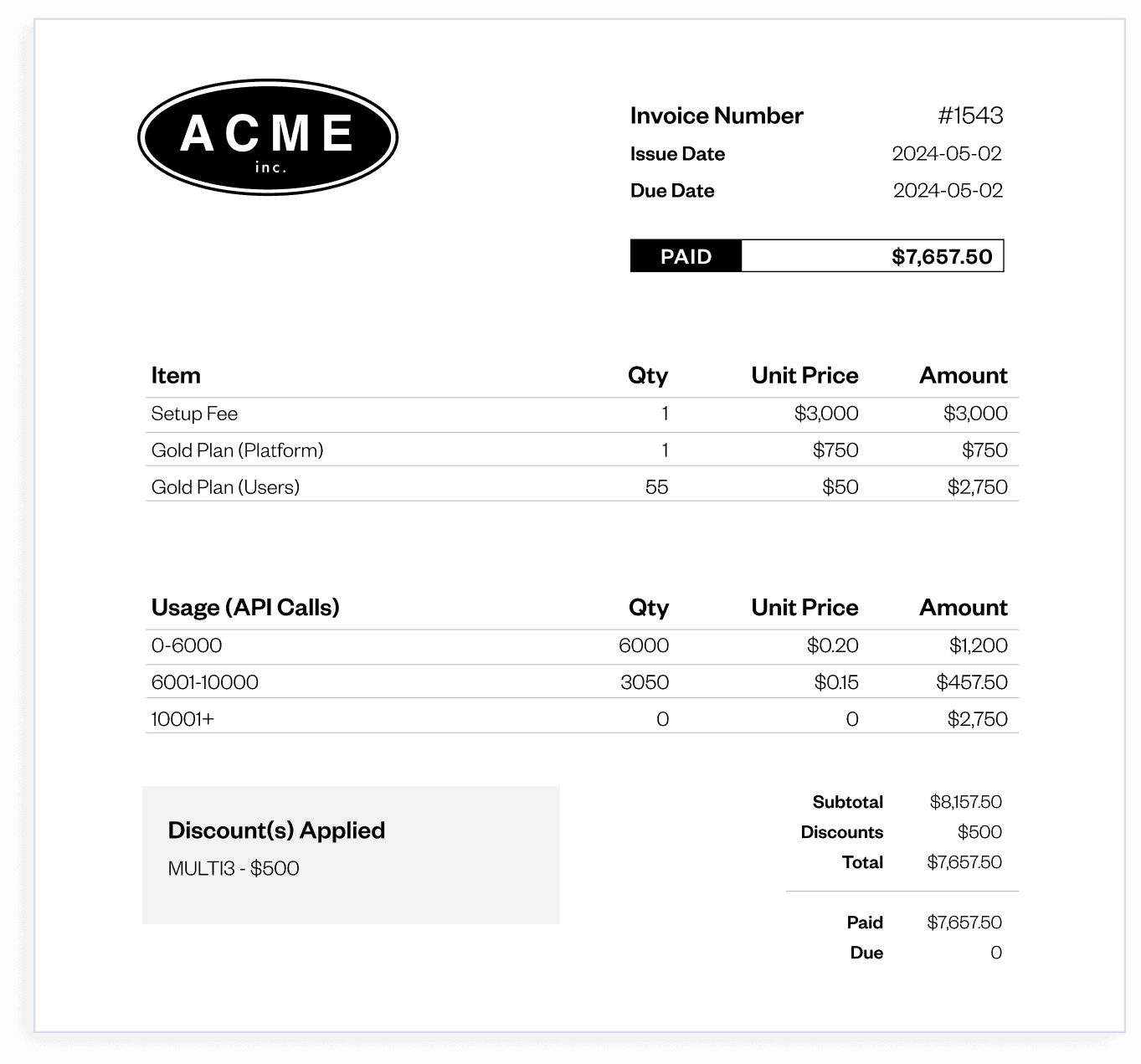

- Support hybrid contracts with term contracts with usage components

- Sell multiple subscriptions with different invoicing frequencies under the same contract

Support complex parent-child billing requirments

- Flexible invoicing capabilities without sacrificing accurate sales tax calculations or reporting visibility

- Report revenue and create metrics on the parent or child level.

- Create consolidated invoices with total flexibilty on payment options

Manage workflows dependent on contract requirements

- Dynamic project tracking – Build contracts that adapt over time, letting you update revenue, invoicing, and subscription terms as milestones are completed. Flexible invoicing capabilities without sacrificing accurate sales tax calculations or reporting visibility.

- Reduce risk & manual errors – Automate key financial actions, preventing lost revenue or missed invoices due to unclear contract terms.

- Works across business models – Supports variable pricing, professional services, and contracts with undetermined start dates.

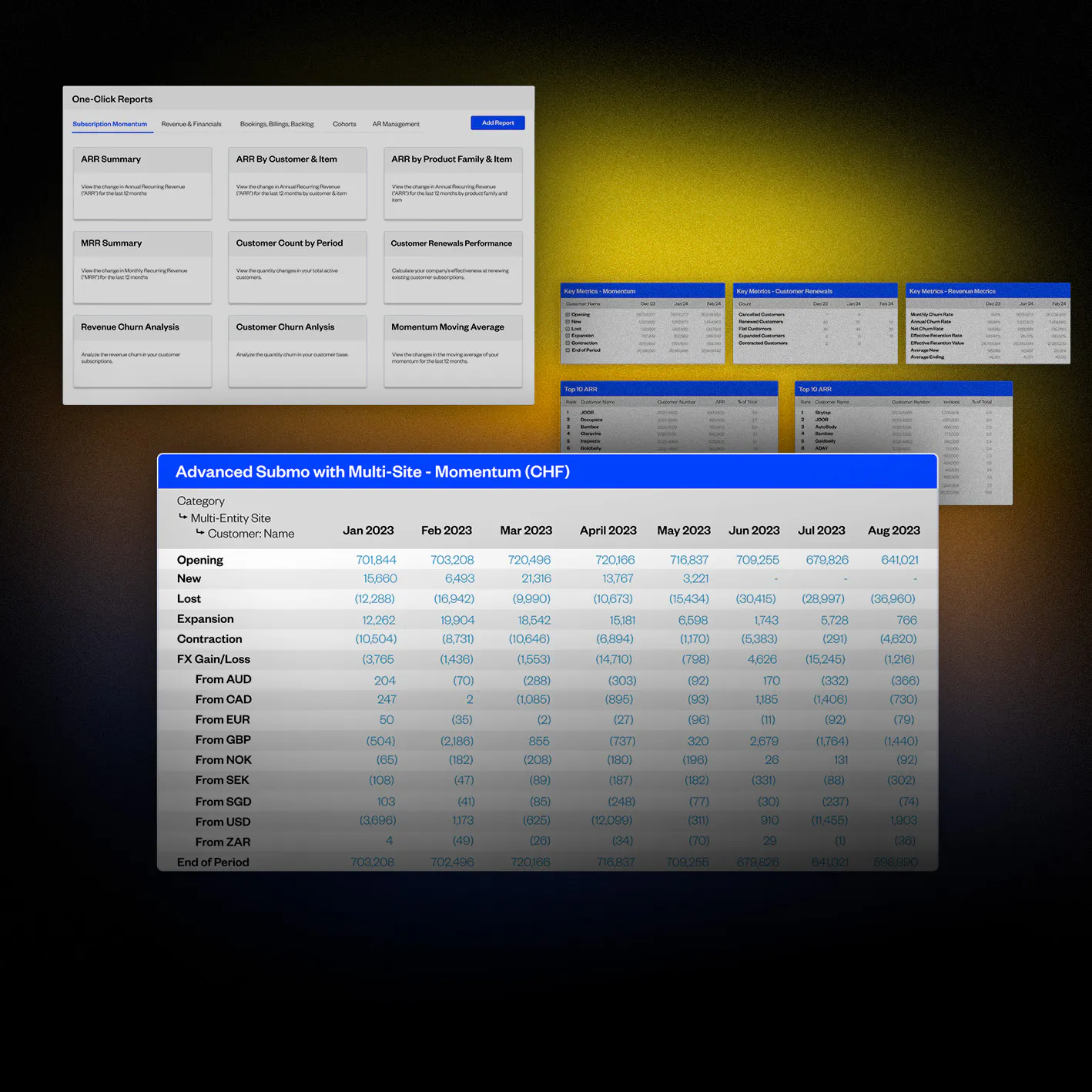

Generate SaaS metrics in a single click

- From ARR momentum reporting to deferred revenue waterfalls, Maxio provides investor grade metrics in a single click

- Gain visibility into the health of your business without wrangling with data

- Build custom dashboards and see your most important metrics in one place

Never miss another renewal

- Create auto-renewal rules to stay on top of recurring subscriptions

- Automatically create CRM opportunities for your customer-facing teams prior to the renewal expiration to proactively win work renewals

- Build in automatic price increases for renewals

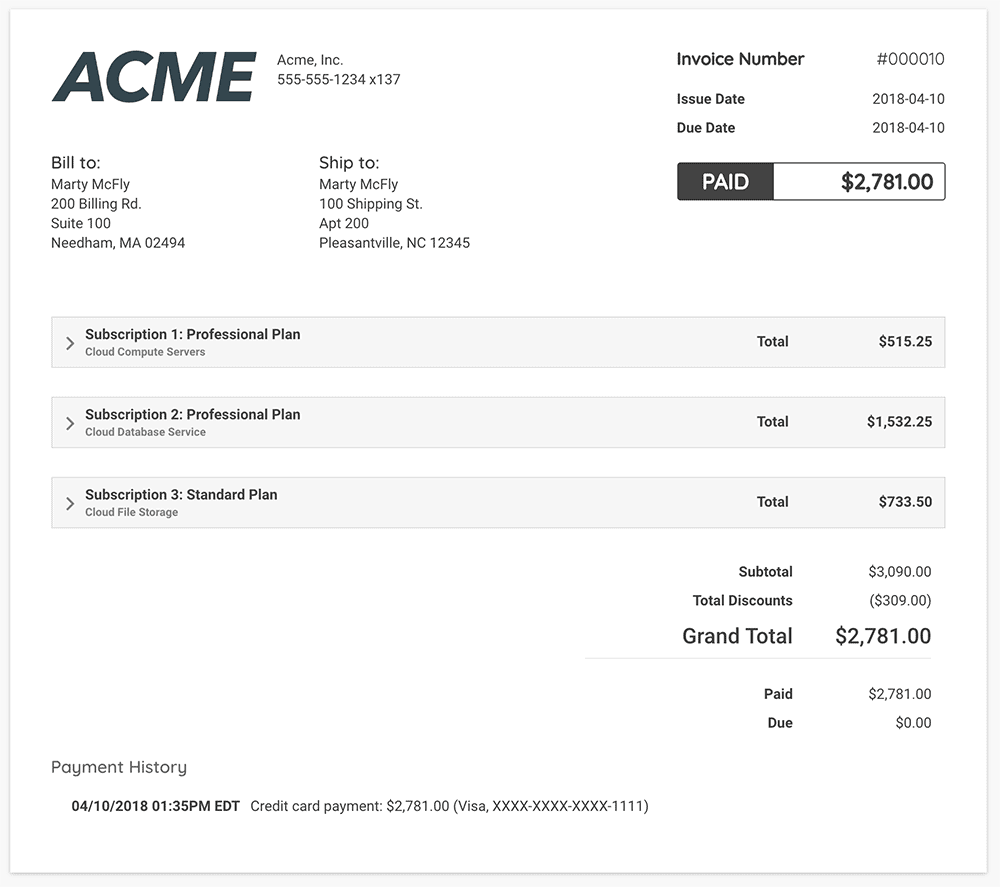

Invoice management at scale

Generate invoices for thousands of customers, and charge accurately and on time with the click of a button.

Toggle Maxio’s built-in invoice fields, or create your own custom fields, to include as much detail as necessary for your clients.

Invoices can be automatically created:

- On subscription signup

- At subscription renewal

- For prorated upgrades

- For ad hoc charges

If you choose not to automate invoice sends, you can still save time by selecting and sending multiple invoices at one time.

Maxio helps you keep track of each invoice’s status, so you can quickly see what’s been paid and what hasn’t.

If a customer has a credit balance at the time of subscription renewal, the available balance will automatically apply to their renewal invoice.

Improve cashflow and drive down DSO

Creating, sending, and tracking invoices is just the beginning. Automate your collections process to create a more efficient accounts receivable process.

Create a custom collections cadence

Manually or automatically send reminders for over due invoices via email directly from Maxio.

Establish pre-determined escalation paths

Escalate overdue invoices with escalation paths to loop in your customer’s key stakeholders.

Report on your collections efforts

Use data to drive your collections strategy. Access reports like DSO monitoring and AR aging trends to see if your efforts are trending in the right direction.

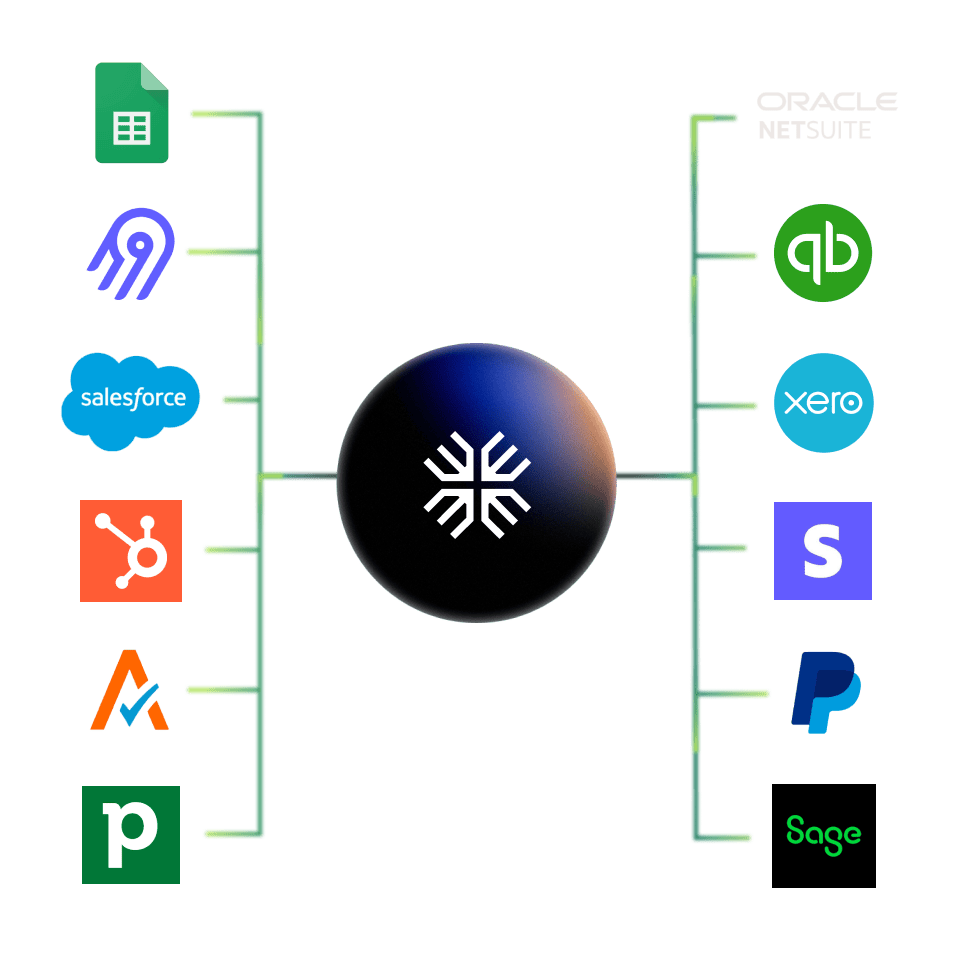

Integrate your financial tech stack with 60+ integrations

From CRMs to payment gateways and general ledgers, make sure data flows between your critical systems with out-of-the-box integrations.

Resources from Maxio’s blog

November 08, 2024

Pricing strategy

Ultimate Guide to Software Pricing Models: Strategies for SaaS Success

“In this guide, I’ll be walking you through the different pricing models I’ve seen prove successful for SaaS businesses across different verticals, growth stages, and everything in between.”

January 27, 2025

Financial Reporting

Top Red Flags in SaaS Financial Reporting

“I have reviewed the financial statements of over a thousand SaaS companies, and certain red flags consistently stand out.”

February 21, 2025

Billing & payments, Pricing strategy

The Smart Approach to Usage-Based Pricing: Aligning Billing, Metrics & Growth

“Learn why UBP is lucrative for SaaS companies, how to select the right value metric, key billing and pricing considerations, how to efficiently ingest usage data, and the downstream reporting impacts. ”

Maxio FAQs

Maxio makes the sales-to-finance handoff frictionless. Finance teams can either completely automate order processing, which includes inputting customer data, creating invoices, and automating revenue schedueles, or they can make the process more efficient than ever with easy to use processes.

Plus,your sales teams will be enabled to sell complex deals like pairing term contracts with usage billing line items without burning out your finance team.

Recurring billing software and subscription billing software both automate the process of charging customers at regular intervals, but they cater to different business needs. Recurring billing software is designed for any type of business that needs to charge customers periodically (e.g., monthly utility bills), focusing on the automation of repeat payments for ongoing services or products.

On the other hand, subscription billing platforms are specifically tailored for businesses, often in the SaaS realm, that utilize a subscription-based business model. These platforms are able to support various subscription models and pricing plans, manage customer subscriptions, handle upgrades, downgrades, and cancellations, and often integrate with other business tools. While both systems ensure timely payments, subscription billing platforms offer more functionalities to manage the complexities of subscription-based models, including customer lifecycle, subscription metrics, and tailored pricing strategies.

Maxio’s advanced accounts receivable software streamlines accounts receivable management by automating customer payments and collections management. It allows users to customize invoicing, implement automated dunning processes to recover past due payments, and manage customer accounts efficiently. These features help businesses reduce the time and effort spent on manual collections and improve cash flow.

Yes, Maxio supports parent-child relationships. Create invoices and even report on SaaS metrics that fall under parent-child relationships.

Explore the #1 billing and finance platform for B2B SaaS

Get a customized demo to see how Maxio will help you:

- Streamline your order-to-cash process

- Reduce churn and stop revenue leakage

- Get cash in the door faster

- Drive strategic decisions with real-time SaaS metrics and analytics

“With Maxio, we are able to test different pricing models just by talking to customers and proposing different plans. We could see what made sense, what was too high, what was too cheap, and what really resonated with our customers.”

– Bethany Stachenfeld, Co-founder and CEO of Sendspark

See what Maxio can do

Revenue recognition

Help your finance team sleep at night with revenue recognition built for the complexity of B2B SaaS.

SaaS reporting tools

Never lose sight of your business performance with accurate, reportable SaaS metrics.

Subscription management

Streamline every step of your customer’s lifecycle, from onboarding to renewal and beyond.

Subscription billing

Manage complex billing scenarios without cluttering your product catalog.