Setting up a seamless front-end and back-end billing system for your SaaS business is crucial. Your billing engine sets the tone for your company’s future and can mean the difference between profit or failure. However, as software as a service (Saas) continues to mature, we have seen a rise in SaaS subscription billing mistakes.

These recurring problems are tempting pitfalls that SaaS businesses can fall into and are often due to a lack of research or understanding of the billing process.

To ensure you are setting yourself up for SaaS subscription billing success, avoid these 6 mistakes.

[content_upgrade cu_id=”7026″]Think you may have outgrown your current billing system? Subscribe for our free Checklist: How to Tell if You Have Outgrown Your Billing Solution[content_upgrade_button]Click Here[/content_upgrade_button][/content_upgrade]

Mistake #1: DIY Billing Engine

Building a homegrown billing engine seems like an attractive option at surface level for some. After all, you have the talented development resources in-house and the opportunity to forgo the cost of any third-party platforms.

However, this is one of the foremost traps that SaaS businesses fall into. While your development team might have time now to craft the best billing engine for your current needs, what about the future?

Building an in-house billing solution can be a slippery slope that ends up consuming a ton of time and resources in the long run — time and resources that you could have used to grow and evolve your business. Instead of building a custom billing engine, you should instead focus your time on optimizing your business and its processes. Maybe even implement some version of revenue operations to more efficiently generate revenue.

Think about it: Will your development team have time down the road to work new features and processes into your DIY billing engine? What about when your company is experiencing wild amounts of success and all teams are operating at capacity on business-critical initiatives? Or, what about when you add new products and features that change when and how you bill customers?

This is why it’s critical to have a billing solution that scales with you. Rapid success often brings rapid change, and a DIY billing engine will only slow you down. Your billing engine will have to take its place in line on the dev team’s backlog — and it’s unlikely that it will have the amount of prioritization it requires.

Alternatively, if you instead invest in an already vetted, robust billing solution, you can do away with scaling problems and burdening your dev team. Instead, you can focus on optimizing your business to run at its best.

Working with a billing and revenue management provider like Maxio takes this burden off of your company. Our fully stacked team is constantly working to ensure our platform is up to date and addressing the most current needs of B2B SaaS companies. Not to mention, you don’t have to worry about compliance. If you’re on your own, all of the burdens fall on you, and a home-grown billing system can seriously impact your revenue and growth.

Mistake #2: Not Pricing Based on Value

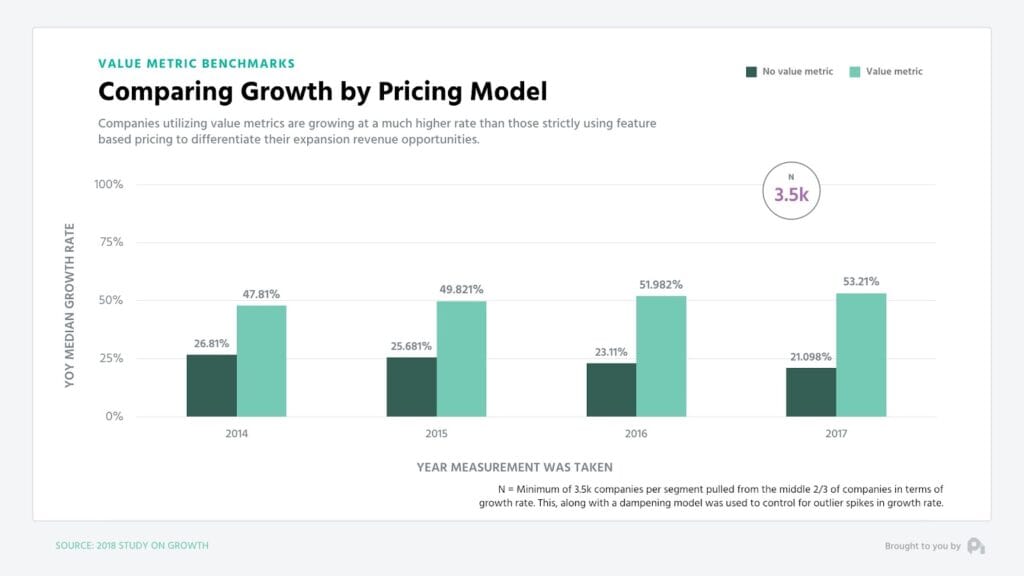

It is no surprise that researching and understanding the true value of your product offering is invaluable, yet many businesses fail to do it because it’s complicated and ever-changing.

However, the value metric of a product is a crucial aspect to consider when discussing billing. After all, your value metric defines how you will present and bill your product.

A value metric is how a product is measured and subsequently billed. For example, take a look at Slack’s billing packages. They charge per user per month. This makes Slack’s value metric the users that benefit from their functionality each day.

Pretty simple, right? Well, there is a lot that goes into figuring out what value metric your SaaS product should use. A common knee-jerk reaction is to just choose the per-user value metric, but many SaaS businesses make this mistake. Instead, a value metric should be a result of in-depth research to ensure that the correct value metric is chosen. Perhaps the per-user value metric does work well for your company. However, it could also be something else – like bandwidth, number of messages, or more.

Your value metric will determine how you set your pricing. You wouldn’t charge the same amount per user as you would per bandwidth amount. If you don’t take into account your product’s value metric, it can create a disconnect between your product and billing that can hinder growth.

For an in-depth look at the value metric, see our recent blog post: How to Find Your SaaS Product’s Best Value Metric

Mistake #3: Not Customizing the Experience

The SaaS economy is relationship-driven, making it imperative that your customers feel some connection to your company. Gone are the days of cookie-cutter invoices and notices. If you send out the same billing materials to everyone, you’ll be just another interchangeable SaaS company they’ll ditch when a cheaper or more relevant product comes along.

Customization is key in SaaS businesses. When you send a customized billing notice, it helps build a relationship between you and your customer. When this approach is coupled with great customer service and in-person or phone interactions with customers to build rapport, customers notice — it can go a long way to inspire brand loyalty.

Billing materials, like invoices or dunning emails, are great places to begin implementing customizations. If you have a good billing solution, this type of customization should be easy.

Mistake #4: Trying to use a Payment Gateway to Manage Billing

We love payment gateways. In fact, we integrate with 20 of them. However, they are not designed to be a full billing and subscription management solution. Many companies make the mistake of trying to manage their subscriptions on top of these gateways without any additional framework.

Because payment gateways aren’t optimized for this level of business management, it can create a truly painful process for both a company and its customers.

That’s why we recommend that companies look for a billing and subscription management platform to work on top of their gateway(s). That way, they have a pre-built framework designed to work seamlessly with a gateway and add functionality that the gateway does not offer out-of-the-box. This additional functionality includes things like subscription management, analytics and reporting.

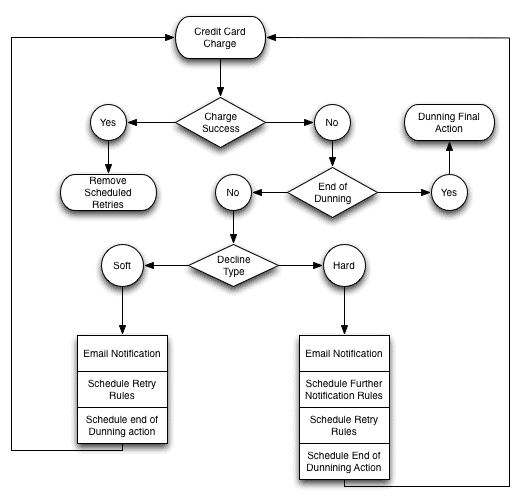

Mistake #5: Not Having a Dunning Strategy

A SaaS dunning strategy can save you thousands upon thousands of dollars in lost revenue as a result of failed customer payments.

When the payment fails to go through, you send a reminder email (or two, or three) notifying them of the failed payment and prompting them to make the necessary changes so that payment can be made.

Dunning seems deceptively simple. It’s just to remind your customers to make their payments, right?

(Source)

But it’s much more than that. Many companies don’t think about dunning as a strategy until it’s too late and they have already lost a ton of revenue to churn.

This mistake is easy to avoid with the right tools in place. We mentioned earlier the importance of building relationships and customizing your customers’ experience. This approach also applies to dunning. Convince customers that they are important to you by customizing your dunning communications.

A good billing solution will make dunning customization easy. Building dunning strategies shouldn’t be complex or hard work. It should be a series of emails that include customized reminders and prompts. If you want to be on top of your dunning game, start your strategy before a customer reaches the dunning process. Some billing solutions offer features to help you prevent failed transactions altogether, like end-of-trial and credit card expiration emails.

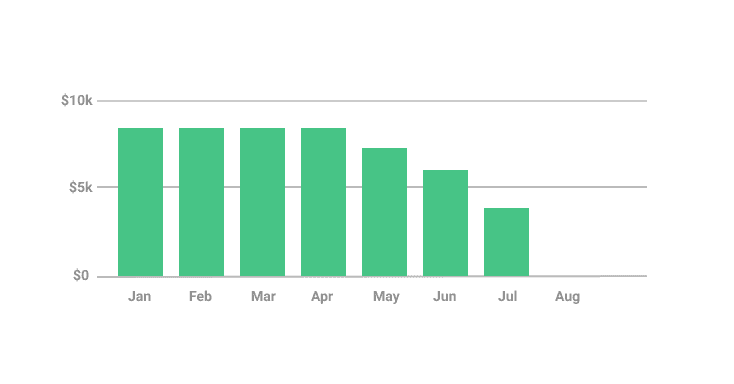

Mistake #6: Not Having the Right Reporting

Reporting gives you insights and insights lead to meaningful decisions. Not having a billing solution that can supply you with meaningful insights about how your customers consume your product can cause complications for your business in the future.

(Source)

There is so much information to be gathered from the billing and subscription management process – not only the obvious metrics, like MRR and churn, but less obvious insights like billing forecasts to show your company’s performance outlook.

The more insights you have, the more context you have to inform your decisions. Make sure you choose a billing solution that illuminates the path ahead, instead of keeping you in the dark.

Billing is never stagnant — it needs to be consistently updated and improved. By investing in your reporting tools, you can stay up-to-date on any billing, pricing or operational shifts or improvements that should be made.

Learn From Our Experiences

As a billing and revenue management solution for B2B SaaS companies, we have seen our fair share of mistakes at Maxio, and we have worked solutions into our platform as a result. We offer strong insight reporting (and easy-to-understand charts), robust dunning capabilities and so many other features that can help take your billing to the next level.