2023 was supposed to bring long-awaited stability. Instead, it surfaced hidden risks.

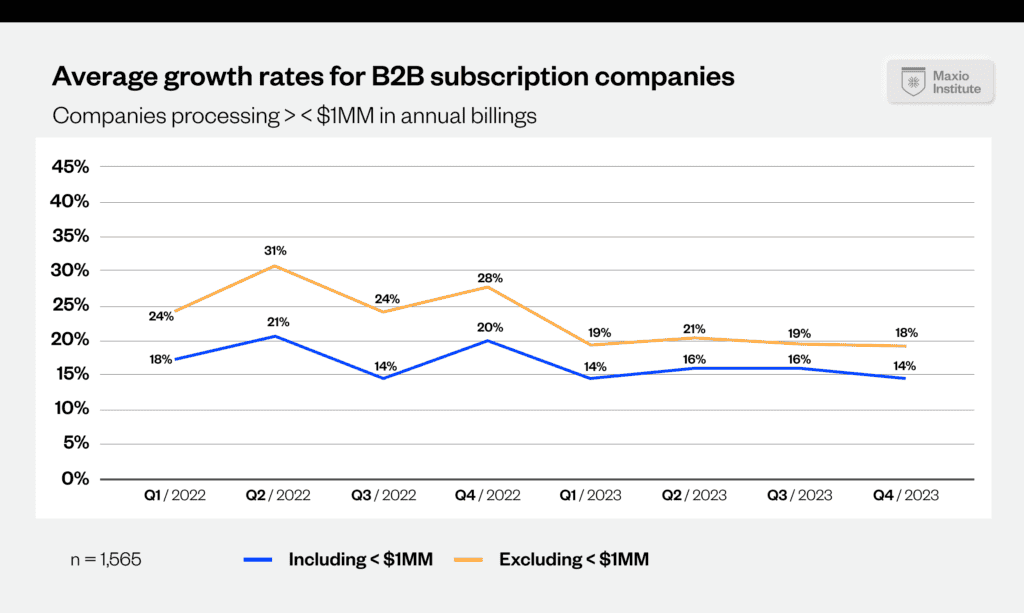

According to our January 2024 Growth Index report, after an uptick in Q2/Q3, overall subscription growth leveled off in Q4 2023. Rates settled around the 14% mark for sub-$100MM companies—a notable 6% decline from Q4 2022 figures.

In other words, the market has undoubtedly normalized again—but “normal” looks very different depending on your business sector and situation. Businesses seeking to rebound or accelerate their growth need to update their go-to-market playbook.

As we’ll explore in this article, the future favors those flexible enough to adapt to these new market conditions rather than banking on the return of predictable growth trends.

Get the Maxio Institute Growth Index Report

Complete the form below to gain access to the 2024 growth report from the Maxio Institute

Benchmarking your business: Growth rate comparisons

Wondering how your business stacks up against wider subscription industry growth rates? With so much fluctuation happening in the market, you need the right context to set your business goals in 2024.

Based on our analysis of the billing data from our own customers (over 2,000 B2B SaaS companies), our report revealed that, while broader subscription growth settled around 14% for sub-$100MM businesses in Q4 2023, plenty still outperformed the pack.

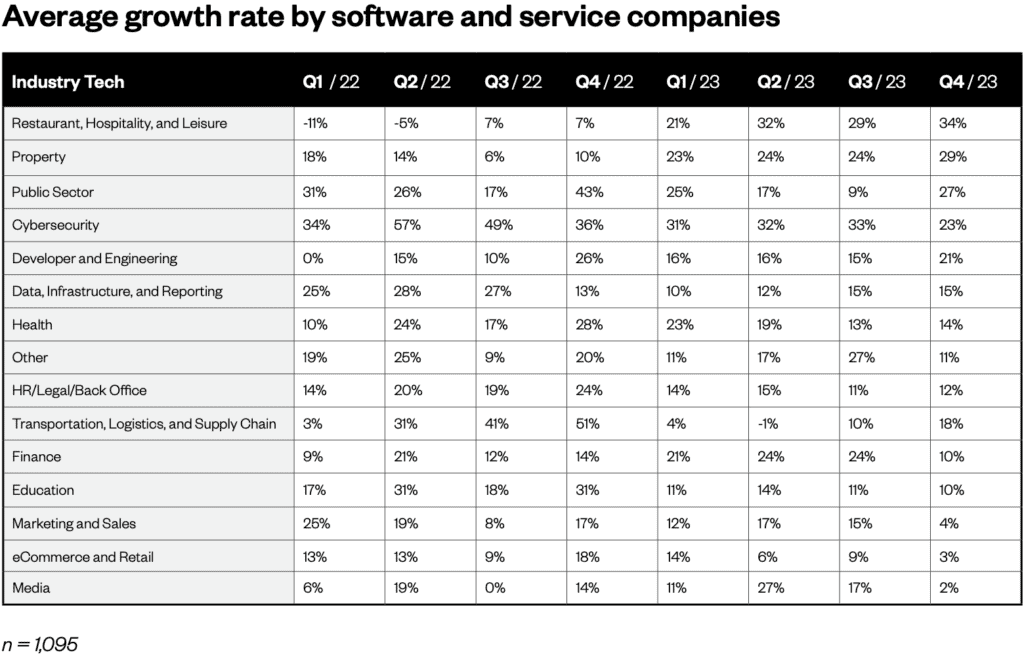

For example, the Southeast maintained the highest regional growth at 21% over the last eight quarters—a prime opportunity for geographic expansion. Meanwhile, the cybersecurity sector exhibited impressive resilience with 37% average annual growth through 2022-2023.

But when you zoom out and observe average growth rates across the board, you’ll see that businesses large and small were typically experiencing fluctuating growth this past year:

Of course, it’s critical to keep context in mind: not all industries recover at the same pace. For example, the eCommerce & Retail industries had just 11% average annualized growth over the last 2 years—lower than the overall 17% B2B average.

Regardless of where your business’s growth rate currently stands, you should constantly be thinking about your next steps toward growth.

If your growth significantly outpaces industry benchmarks, leverage that momentum. It signals unrealized opportunities in your business or customer segments. But if your growth lags the broader market, we recommend you reevaluate your go-to-market strategy, prioritize stabilization, and prepare a contingency plan to ensure your business stays afloat.

The problem: Growth rate stabilization isn’t enough

At first, it seems like good news that subscription growth rates have stabilized at 14% for smaller companies. After all, steady feels better than the ups and downs of the past few years. But there are some risks with stabilization to be aware of.

First, steady growth makes it harder to stand out to investors who want to see faster growth. Second, companies can’t rely on broader market trends to fuel their growth anymore; go-to-market strategies and tactics are evolving differently across industries. Finally, some sectors, like Cybersecurity, are still seeing much faster growth than others post-pandemic outliers like these would fly under the radar if you were studying market trends as a whole instead of analyzing specific industry cohorts.

In other words, stabilization may hide changing conditions underneath. The new normal is unpredictability, and subscription businesses have to optimize for constant changes in growth rates between industries. While stabilization may feel safer, it could put you in a losing position while your competitors continue to pursue steady growth.

Alright, enough fear-mongering. Despite these recent developments, there are plenty of actionable steps subscription companies can take to secure their foothold in the market and stay growing. Here’s what we recommend:

The solution part I: Hybrid billing for capturing product usage

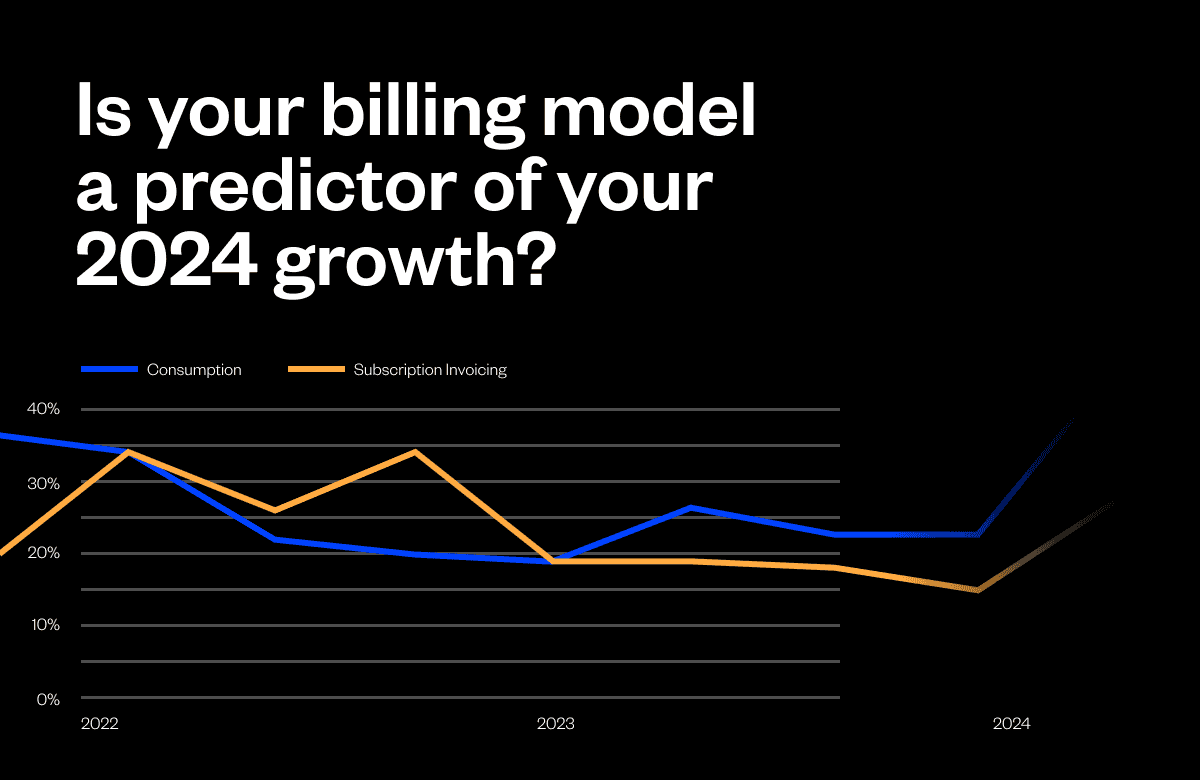

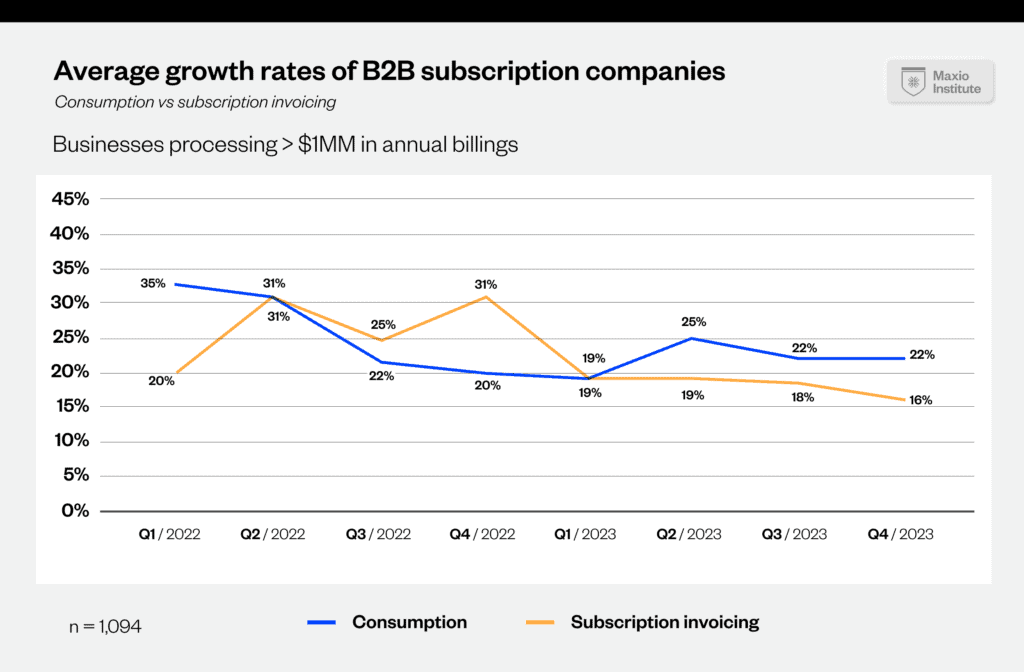

Rather than relying solely on fixed subscription revenue, innovative companies are maximizing their growth through hybrid billing models (combining subscription contracts with consumption-based pricing).

What’s the upside of hybrid billing, exactly?

Consumption billing lets you immediately earn more revenue when customer usage or transactions increase above typical levels. This lets you capitalize on upswings across regions or industries when they happen and outperform your industry peers who are still capped by fixed subscription pricing.

The solution part II: Hybrid billing for downside protection

While growth is nice, many subscription companies are also focused on mitigating risks to ensure their business survives.

Hybrid models also help hedge risks by limiting downside exposure when compared to pure consumption pricing models. This is because fixed subscription revenue can cushion any revenue losses that may result from lowered usage. This is especially helpful during periods of market fluctuation as the steady baseline income provided by a fixed subscription model helps avoid any overdependence on a consumption or usage-based pricing model.

Finding your industry’s ideal billing mix

Every industry’s growth rates are recovering differently from the pandemic. So the right subscription vs consumption balance ultimately depends on what’s happening in your sector.

For example, Cybersecurity maintained extreme resilience even amid normalization, delivering 37% average annual growth through 2022-2023—over 2x higher than other software sectors. Because project workloads are rising so fast with security threats, Cybersecurity companies should focus more on consumption pricing that captures growth as it occurs.

Meanwhile, industries like Hospitality are finally accelerating, but still have uncertainty. A mix of 50-60% steady subscription revenue and 40-50% consumption billing would help them handle the unpredictable seasonality inherent to their business model.

When you drill down even more, you’ll find that each niche sub-sector has its unique growth patterns. Pay attention to what your specific community of customers needs right now. Then, mix subscription and consumption billing in a way that captures seasonal spikes without completely relying on consumption-based billing.

The future of billing: Outcome-based pricing models

While you’re probably already familiar with subscription and consumption pricing, a few new pricing models are presenting themselves. Specifically, we’re seeing outcome-based pricing models start to emerge.

Rather than relying on subscriptions or usage, these outcome-based frameworks tie pricing directly to the exact value a customer receives from your solution. Factors like savings achieved, revenue generated, or milestones hit determine dynamic custom charges. In other words, the more value is delivered to the customer, the more their SaaS vendor will earn in lockstep.

Some forward-thinking companies are starting to test out this kind of value-based pricing today on a small scale. For example, Syncari, an ERP integration, offers dynamic “ROI pricing.” As implementation projects automated by Syncari deliver expanding cost savings, their monthly fee scales up accordingly.

If this model continues to work well, it could replace the old subscription and usage-based models that don’t always match the real value customers get.

Growth rates in 2024 and beyond

Now that we’ve given you the tools to adapt your pricing models and discussed how growth fluctuated over the past year, it’s time to look ahead. Our Growth Index revealed how stabilization took hold in 2023 across B2B subscription companies. But while rates may seem steady, changes are still unfolding rapidly at the sector level.

So what does 2024 have in store?

While we can’t guarantee any predictions, we expect growth normalization to occur industry-wide in the coming year. Most pockets of outlier growth or decline will revert back towards the mean. Cybersecurity may descend from its 37% peak but still expand faster than average. Meanwhile, the Hospitality sector may flag from its 34% spike but still sustain growth at a healthy rate.

This will create a squeeze for subscription-only SaaS companies who are relying on this broad uplift to maintain their outlier growth rates. Despite this stabilization, opportunities still exist for companies who decide to implement complex, hybrid billing models. By diligently tracking microtrends and buyer behavior shifts, companies utilizing consumption billing and outcome-based pricing can continue to outperform their peers.

Keeping up with B2B subscription growth trends

The insights we provided here are only scratching the surface of how growth rates are trending.

If you want an in-depth look at the most recent B2B subscription growth trends, check out the recent Maxio Institute Report to benchmark your performance against 2,000+ B2B subscription companies.

Alec Beard is a writer in the B2B SaaS industry and founder of StoryWon. His work has been featured in SaaS Brief, and in similar industry blogs for Driven Insights and Churnkey. When he’s not writing about SaaS or Finance, you can find him tucked in a local coffee shop or cruising around on the Atlanta Beltline.