Deciding between raising debt vs. equity financing? In a recent webinar, Maxio CEO Tim McCormick and Bigfoot Capital CEO Brian Parks discussed the changes that have taken place across the SaaS financing landscape, particularly those in debt financing of SaaS companies.

While venture capital has historically been associated with SaaS financing, the truth is it’s not suited for every business.

So what’s the difference between debt and equity-based financing, and how do you know which is right for you?

Debt vs. Equity: Equity-based financing

Equity-based financing is a dilutive form of capital, which essentially means you are giving a piece of ownership in your company to the financier in exchange for funds to get you up and running while you’re either pre-revenue or your business expenses exceed your revenue.

Options for equity financing include accelerators, angel investors, venture capital, private equity, corporate venture capital, family offices, and other non-traditional forms of equity-based financing.

Pros and cons of equity-based financing

As with anything in life, there are advantages and disadvantages to this approach. The biggest upside is that equity financiers tend to have the capacity to write bigger checks. So if you’re a company with aggressive growth plans and need a lot of cash to stand that up, it could be a good option for you.

A few considerations: equity-based financing is dilutive, meaning your ownership position in the company as a founder shrinks when you agree to take on equity-based financing. Another thing to think about is an equity financier’s ROI expectations. Investors generally expect a 3-5X return on their investment within five years.

Debt vs. Equity: Debt-based Financing

Debt-based financing is a non-dilutive form of capital that can work alongside (or instead of) equity capital, and it may be secured on assets.

Historically, debt-based financing funded companies with a hardware component to their product offering would offer up their hardware as assets to secure the funding. However, in modern times debt-financing tends to be non-collateral focused.

Options for debt-based financing include bank and non-bank lenders for growth, working, and bridge capital (lines of credit, term, revenue-based financing).

Pros and cons of debt-based financing

Debt-financing has become more prevalent in recent years because the vast majority of SaaS companies are not considered to be “venture viable.”

Debt-financing offers an alternative approach to funding for companies that don’t have that hockey-stick growth trajectory that VC and PE firms tend to look for. Simply put, it allows companies to secure funding while growing at a speed they’re comfortable with.

An obvious downside to raising debt-based capital is that you have to pay it back. Unlike equity-based capital, debt-financed companies must pay the money back, typically with interest. The trade-off between sacrificing equity stake or paying back the fund is a tough decision any company seeking funding will have to make.

However, it is notable to mention that many companies take a hybrid approach, raising both equity and debt-based funds.

Inside a Debt-Lender’s Mind

Bigfoot Capital lends primarily to companies who have hit the $10M in ARR mark and tends to provide loans amounting in the $250K to $1.5M range.

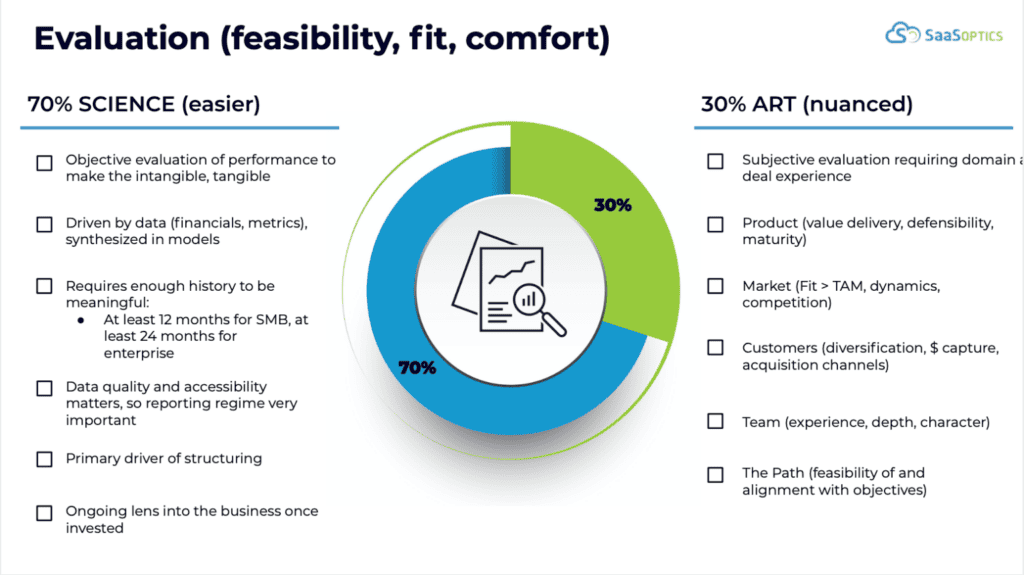

As a debt lender, Bigfoot Capital CEO Brian Parks takes a data-driven approach to choose partnerships to pursue. In a recent webinar, Parks described Bigfoot Capital’s approach as “70% science, 30% art.”

Where Maxio fits in for debt-based financing

Maxio is a financial operations platform that allows SaaS companies with term-subscriptions to automate subscription management, revenue recognition, and SaaS metrics.

Having the right data and reporting structure to inspire potential investors’ confidence is key for any funding method.

900 B2B SaaS companies and $15B in investor capital trust Maxio to provide the data they need to secure funding and operate efficiently.

Learn more about Maxio here.

Debt vs. Equity: Key Takeaways

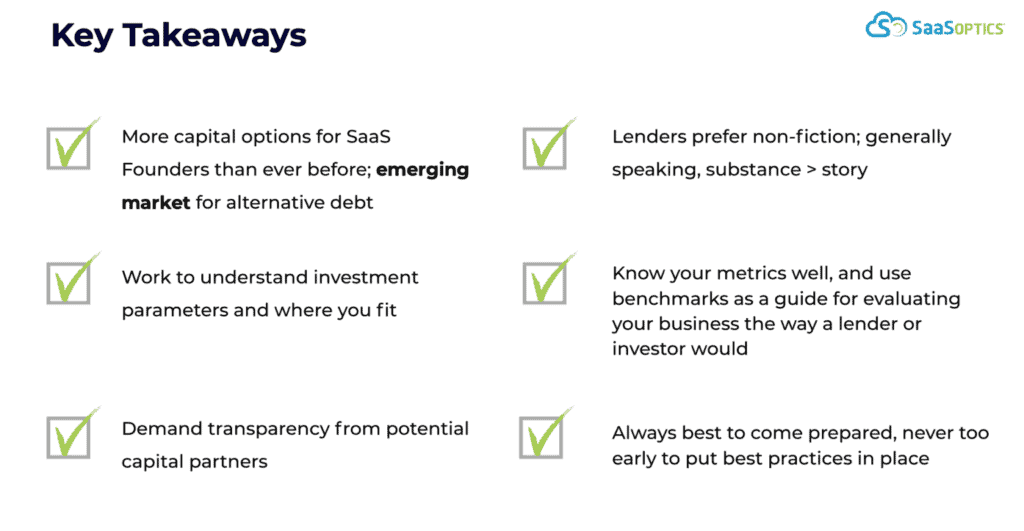

The following are the key takeaways from the debt vs. equity webinar with Maxio and Bigfoot Capital:

To watch the webinar recording or download the presentation, go here.

Haven’t checked out the first webinar in our SaaS funding webinar series? You can watch that here.