Have you ever tried to paddle a canoe with someone else? Even if you both want to reach the opposite shore, unless you’re rowing in sync, you’re going to have a long, frustrating trip. However, when you paddle together, the same force as before is amplified. You’ll arrive at your destination faster and have a smoother trip.

When it comes to your SaaS business, the stakes are much higher than this imagined canoe voyage. The processes and frameworks you implement early on in the life of your SaaS company can make or break your scalability and your appeal to potential investors. That’s why it’s so critical to get everyone in sync—especially FinOps, RevOps, and Sales. One of the most important ways to do that is by building a sales commission structure that everyone can get on board with.

Where Are We Going and Who’s Driving the Boat?

If your organization is using spreadsheets to manage compensation plans and account for sales commissions, you may be doing a lot of rowing without getting very far. Fortunately, implementing a smart commissions structure using QuotaPath, a compensation management platform, and our Commissions Connector can provide benefits for stakeholders across your organization.

4 Reasons to Throw Spreadsheets Overboard

Managing commissions and compensation plans in spreadsheets is a common practice, but it’s also inefficient and outdated. First of all, it can result in lost revenue. Spreadsheets are vulnerable to human error, and that means miscalculations are bound to occur.

Secondly, managing commissions with spreadsheets requires an enormous time commitment from FinOps. Keeping an unwieldy commissions and expenses spreadsheet up-to-date and organized takes time away from other important duties, especially when you take into account inconsistent variables like sales-negotiated contract terms.

Third, owning and maintaining accuracy in commissions spreadsheets isn’t just a time suck for FinOps; it’s also a detriment to RevOps and Sales. When FinOps is the only group with access to compensation and commission plans, RevOps and Sales are forced to go through FinOps every time they want clarification on a payout, wasting valuable time in a revolving door of questions. Sales reps end up tracking deals in their own spreadsheets, which not only duplicates labor, but also creates potential conflicts in documentation.

Finally, placing all the responsibility for and access to sales commissions under FinOps creates unnecessary opacity, which can lead to distrust. QuotaPath provides complete visibility to your sales team about what commissions they’ve already earned and what they’re forecasted to earn. Then the Commissions Connector syncs this data over to Expense Recognition by SaaSOptics, automating the amortization of your commissions for a speedy month-end close. Less work plus open communication equals higher morale for everyone involved.

Expense Recognition and ASC-606

According to the FASB, companies have to capitalize certain expenses pertaining to procuring and fulfilling individual contracts. Those expenses can include prepaid expenses, fixed assets, and of course, sales commissions, which is why it’s so important to streamline your sales commission structure. This is addressed in ASC 340-40 “Other Assets and Deferred Costs,” which provides guidance on contract costs and explains how to capitalize and amortize costs and expenses.

Who Should Build Your Compensation Plan and Commission Structure?

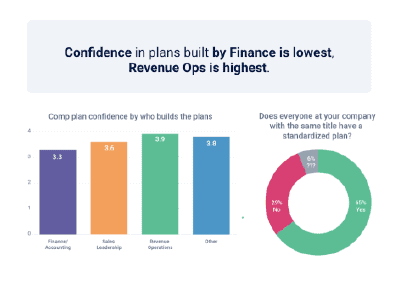

As we’ve discussed, your compensation plan is relevant to Sales, FinOps, and RevOps. So who should be in charge of building it? According to QuotaPath’s survey of comp plan creation across the SaaS industry, RevOps builds the most trusted comp plans. Sales is the runner-up for trustworthiness in their compensation plans, while FinOps comes in last.

Surprisingly, the data on who actually builds comp plans does not line up with those findings.

Companies with less than $30MM in revenue typically leave the responsibility of compensation planning to Sales leadership (73%). However, once a company surpasses $30MM in revenue, the comp plan is more likely to be designed by RevOps (35%) or FinOps (19%).

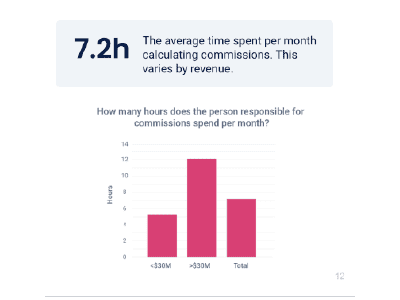

Regardless of who ends up owning compensation planning, it’s a big job. Companies with less than $30MM report allocating over 7 hours per month for managing commissions, running calculations, verifying them with sales reps, and submitting them for processing. Larger companies with over $30MM in revenue report even longer for this task—an average of 12 hours.

How to Write a Commission Policy (And Some Resources to Get Started)

There’s no need to reinvent the wheel when it comes to compensation and sales commission planning. We have everything you need to get started: ASC-606 Compliance in Compensation Planning

As you create your compensation plan, keep these principles in mind.

Keep it simple.

Comp plans should be simple and straightforward. Refer to our Commission Policy Template to help you create an efficient, useful document that works for all departments.

Let the strategy inform the plan.

Your business strategy should always inform your compensation planning. That leaves room for quite a bit of variance depending on your industry, the size of your company, brand recognition, and other factors unique to your business.

Many companies set quotas by multiplying On-Target Earnings (OTE) by a number to arrive at an annual sales quota. That quota to OTE ratio typically ranges from 2 to 24, but for SaaS businesses, the ratio is typically 5.4x.

Find a balance.

One of the most common mistakes SaaS companies make when building a comp plan is including too many measures. A measure is a compensation factor like an extra $500 per new customer closed in Q1 or an extra 20% on everything over quota. Avoid muddying the waters; limit your plan to three measures and make sure each is weighted at least 20%. Including more measures, or reducing one to less than 20% of the total, will end up being pushed aside in favor of the higher-weight measures.

Make it interesting.

Accelerators are a great way to reward top performers while keeping other sales reps motivated. According to QuotaPath’s 2020 research, 75% of the compensation plans surveyed included accelerators based on quota attainment.

Launch plans on time.

The sooner your sales reps have access to their compensation plan, the sooner they can start living up to it. The best time to debut a new or updated compensation plan is at your annual sales kickoff. Building an effective compensation plan and commission structure won’t just make life easier for your Sales, RevOps, and FinOps teams; it will also make a good impression on potential investors and help you comply with ASC-606. The sooner you get your improved comp plan in place, the better; don’t wait until you’re facing down the rapids of an audit or acquisition to get those paddles out and start rowing in sync.

Maxio + Quotapath

At Maxio, we know what SaaS companies need because we’re a SaaS company who grew out of a SaaS company. After experiencing our own growing pains of scaling a SaaS business from 1998 onward, we had to create our own solution: SaaSOptics. We help B2B SaaS businesses optimize their FinOps and RevOps with automated subscription management, revenue recognition, expense recognition, and SaaS metrics.

QuotaPath specializes in creating transparent, end-to-end compensation solutions that measure sales performance and drive consistent ROI. Together, we’ve created a streamlined solution that allows you to automate the calculation and accounting for your sales commissions. Send your commission and expense recognition spreadsheets packing. Instead, switch to an automated platform that sets you up for success and saves you weeks of time.