NetSuite

Maxio + NetSuite: Purpose-Built for B2B SaaS Growth

Automate billing, streamline financial operations, and unlock investor-grade reporting—all with a powerful integration between Maxio and NetSuite. Built for B2B SaaS businesses that need speed, flexibility, and confidence at scale.

Why Maxio + NetSuite?

As SaaS companies scale, financial complexity can quickly become a growth bottleneck. Manual billing processes drain developer resources, pricing changes require workarounds, and disconnected systems lead to revenue leakage and reporting delays.

These inefficiencies do more than slow operations—they create investor uncertainty, hurt cash flow, and block companies from reaching their next stage of growth.

Why this matters:

- Accelerated Growth: SaaS companies with unified financial systems grow 34% faster than those using fragmented tools.

- Operational Efficiency: Bi-directional syncs eliminate manual work, reducing errors and freeing up finance teams to focus on strategy.

- Faster Time to Value: Go live with Maxio + NetSuite in weeks, not months, unlocking revenue insights sooner.

- Investor Confidence: Automated, audit-ready reporting ensures compliance and delivers the investor-grade metrics needed for funding rounds.

What You Get

Maxio’s integration with NetSuite gives you a unified source of truth for quote-to-cash by connecting the most critical components of your financial tech stack—CPQ, billing, payments, revenue recognition, and reporting—into a single, streamlined platform.

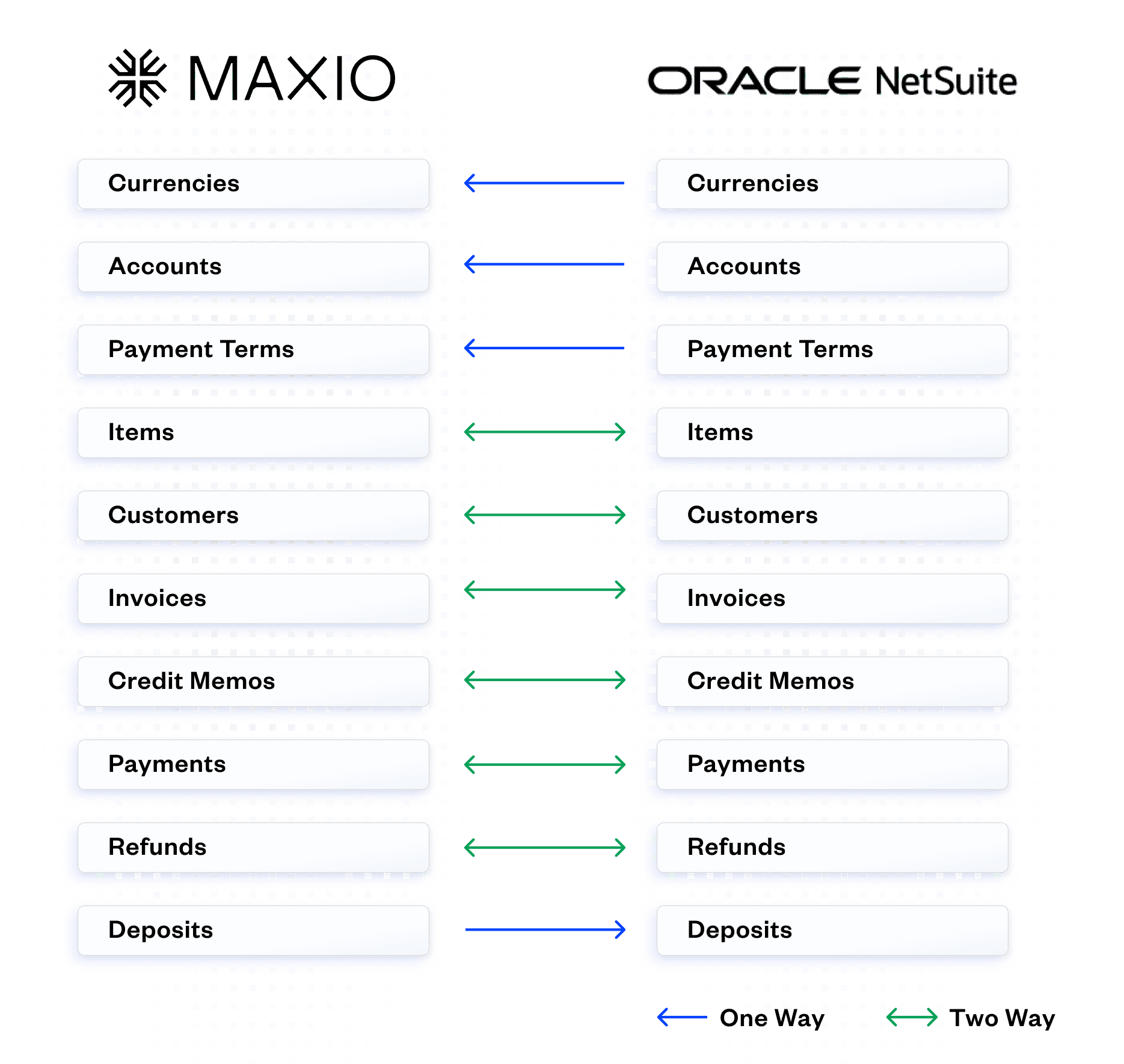

- Bi-directional syncs across key NetSuite objects: Customers, invoices, credit memos, payments, refunds, accounts, currencies, and payment terms stay automatically aligned across systems.

- Automation from deal close to collections: Data flows seamlessly across your CRM, Maxio, and NetSuite—eliminating manual work, reducing errors, and accelerating cash flow.

- Subscription billing and SaaS metrics in one place: Track ARR, retention, and usage in real time—without spreadsheets, disconnected tools, or developer workarounds.

How It Works

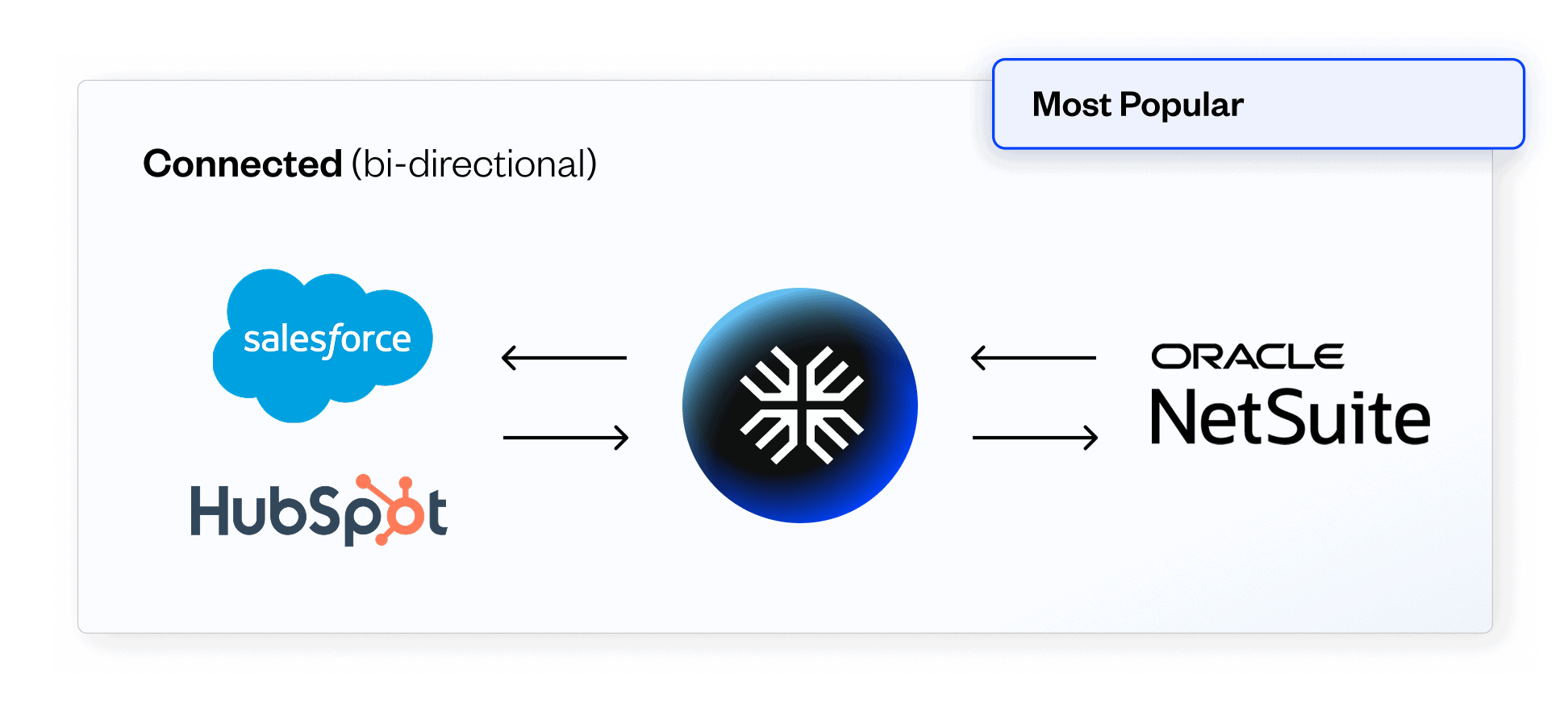

Maxio serves as the operational layer between your CRM and NetSuite, giving your finance team complete control and visibility across billing, collections, and reporting. Choose the integration model that fits your business.

Maxio acts as the primary bi-directional connector between your CRM and NetSuite to automate your quote to deposit workflows and create all customer and billing records.

“Maxio Metrics” is designed to ingest data from NetSuite to automate ARR reporting while leveraging NetSuite for billing and rev rec.

Maxio may be connected to a CRM but can run disconnected from Netsuite. A summary entry is recorded for revenue each month but no customers, invoices, or related records are directly created in Netsuite from Maxio.

Core Functionalities

Streamline complex subscription and usage-based billing without relying on developers or manual processes.

Ensure compliance with ASC 606/IFRS 15 and deliver investor-grade financial reporting.

Connect your CRM and NetSuite to automate quoting, contracting, invoicing, and collections.

Get instant visibility into ARR, retention, and cohort data—no spreadsheets required.