With over $131 billion in online sales in 2009 (U.S), we have definitely become an e-commerce oriented society. This in turn, means we are also a society where customers are more vulnerable to identity and credit card theft.

As a business it’s extremely important that you protect your customers’ data. Luckily, there are a number of solutions out there designed to ensure your customers’ data are secure. Aside from software, there are a few precautions you can take:

Maintain a Secure Network through Firewalls

A firewall installation between wireless networks with a secure password policy will prevent any unwanted visitors from accessing credit card information

Testing and Monitoring

Make sure your privacy settings are kept up to date by consistently checking the status of security controls, limitations, networks and restrictions on at least a quarterly basis.

Disconnect When the Day is Done

While not at the office, especially when the office is closed for the weekend or company vacation, it’s important to shut down. An unattended network connection is an open door for hackers.

Use More than One Server

Putting all the data on one server can be risky if something goes technologically awry with the server. Getting an additional server for more sensitive data is a better idea to control who in your company has access to what data.

Any company who does business online knows how important it is to protect customer’s data with the greatest effort. In addition to keeping customers’ trust, penalties for non-compliance with PCI standards can reach up to $500,000 along with your company facing legal charges.

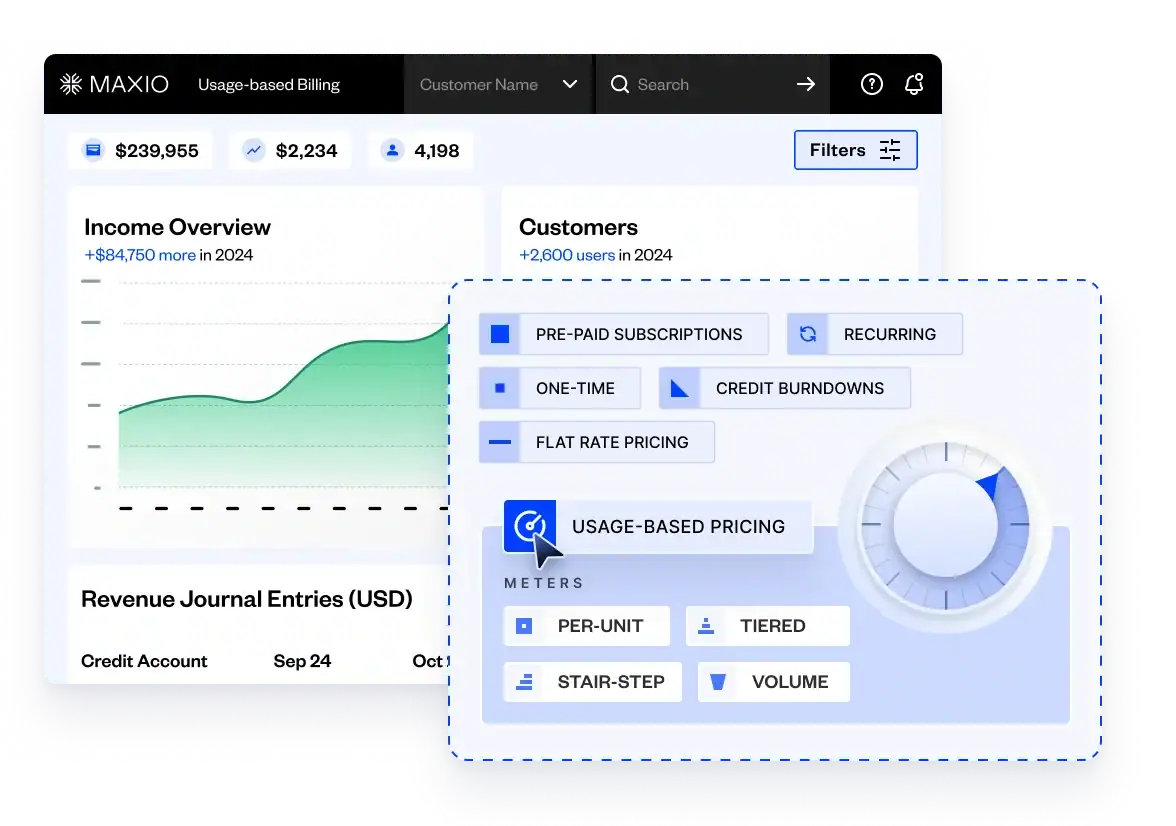

Here at Maxio, we’ve partnered with only the most reputable payment gateways, ensuring that your customers’ billing information stays secure.

UPDATED: Recommended Reading