When it comes to payment data security, PCI compliance is one of those topics that tends to surface only when something goes wrong. But as digital payments evolve, and regulators, processors, and consumers grow more vigilant, understanding what PCI means for your business is no longer optional.

Whether you’re processing thousands or millions of transactions each year, maintaining PCI compliance protects your customers’ data and your company’s credibility. Here’s what’s changed, what’s required, and how a partner like Maxio can make compliance less of a headache.

Understanding the Role of PCI in Modern Payments

The Payment Card Industry Security Standards Council (PCI SSC), founded by major card brands including Visa, MasterCard, American Express, Discover, and JCB International, sets global standards for securing payment data.

At the core of their work is the PCI Data Security Standard (PCI DSS), which every business that stores, processes, or transmits cardholder data must follow.

The latest version, PCI DSS v4.0, was introduced in 2022 to reflect how modern payment ecosystems operate. This includes cloud infrastructure, API-driven platforms, and third-party processors. A minor update, v4.0.1, was issued in mid-2024 to clarify requirements. The older v3.2.1 standard was officially retired on March 31, 2024.

The goal isn’t just to protect data; it’s to strengthen the trust that underpins every digital transaction.

Why PCI Compliance Matters More Than Ever

Data breaches are more frequent, more sophisticated, and more expensive. According to the IBM Cost of a Data Breach Report 2024, the global average cost of a data breach rose to USD 4.88 million, up 10 percent from the prior year. The U.S. leads the world at USD 9.36 million per incident.

Compliance isn’t about checking boxes. It’s about earning and maintaining trust. Following PCI standards demonstrates that your company is protecting sensitive payment information and reducing risk for your customers, your partners, and your business.

PCI DSS v4.0 introduces stronger controls around authentication, access management, encryption, and continuous monitoring. It reframes security as an ongoing discipline, not an annual task.

Do You Need to Comply With PCI DSS?

In short, yes. Every organization that accepts credit card payments must comply with PCI DSS.

However, the level of validation required depends on your transaction volume and how you handle cardholder data. PCI categorizes merchants and service providers into four levels:

- Level 1: Over 6 million Visa or MasterCard transactions per year, or any organization deemed high-risk by the card brands.

- Level 2: Between 1 million and 6 million transactions annually.

- Level 3: Between 20,000 and 1 million transactions.

- Level 4: Fewer than 20,000 transactions annually.

Maxio operates as a PCI Level 1 Service Provider, meaning we maintain the highest level of certification. For our customers, that means your compliance burden is significantly reduced because the systems handling your card data already meet PCI’s most rigorous requirements.

What PCI DSS v4.0 Means for Your Business

The latest version of PCI DSS introduced several updates to make compliance both more flexible and more sustainable:

- Customized Implementation Approach – Companies can now use alternative controls if they achieve equivalent security outcomes to the defined requirements.

- Enhanced Authentication and Access Controls – Stronger multi-factor authentication now applies to all accounts with access to cardholder data.

- Expanded Testing and Continuous Monitoring – PCI DSS v4.0 shifts from annual point-in-time validation to continuous security validation.

- Clearer Guidance on Third-Party and Cloud Providers – The Council now explicitly addresses shared responsibility across vendors and cloud environments.

According to the PCI Security Standards Council, future-dated compliance requirements extend into 2025, giving organizations time to adapt.For many companies, these updates mean more documentation and monitoring but also greater flexibility in how you meet compliance obligations.

Self-Assessment vs. Full Audit: Which Applies to You?

Not every business faces the same requirements. Depending on your transaction volume and data-handling practices, you’ll either conduct a Self-Assessment Questionnaire (SAQ) or undergo a third-party audit by a Qualified Security Assessor (QSA).

Here’s how it breaks down:

- Level 1 & 2 merchants must complete an annual audit by a QSA.

- Level 3 & 4 merchants can typically complete an SAQ, an attestation form that verifies compliance without a full audit.

There are multiple SAQ types depending on your setup:

- SAQ A: For merchants that fully outsource cardholder data handling to a PCI-compliant provider (like Maxio).

- SAQ A-EP: For e-commerce sites that influence but don’t directly handle payment data.

- SAQ C: For merchants who collect card data on their own secure web pages and transmit it to a processor.

- SAQ D: For service providers or merchants not covered by other categories.

If your business uses Maxio-hosted payment pages, customer portals, or tokenized API transactions, you’ll likely fall under SAQ A or A-EP, which means your PCI compliance process is far simpler than managing sensitive data in-house.

Simplifying PCI Compliance with Maxio

PCI compliance can feel like a maze, but solutions like Maxio were built to simplify it.

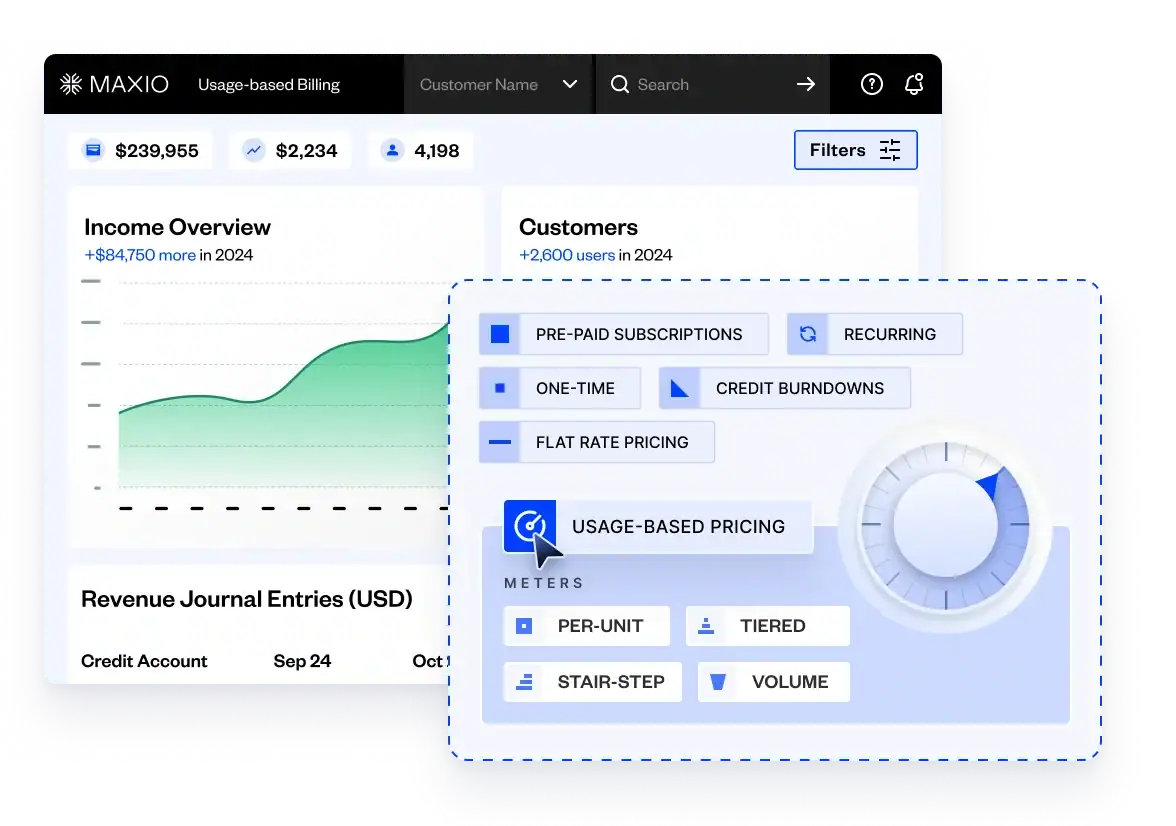

By using Maxio to manage your billing and payments, you effectively minimize your PCI scope. That means you never directly handle cardholder data because Maxio does. We securely tokenize and store payment information, ensuring that your environment remains outside PCI’s highest-risk categories.

Our PCI Level 1 certification means:

- All data transmission and storage meet the most rigorous PCI DSS v4.0 standards.

- We complete annual third-party audits and continuous internal testing.

- Our platform architecture separates sensitive data handling from your business logic.

This allows your team to focus on growth and customer experience, not on encryption protocols or compliance checklists.

How to Stay Ahead of PCI Compliance

Compliance isn’t static; it evolves alongside your technology stack. Here’s how to stay proactive:

- Review your SAQ annually. Even if your setup hasn’t changed, PCI requirements might have.

- Document your payment data flow. Know where data is captured, transmitted, and stored, even with third parties.

- Train your team. Human error remains one of the biggest compliance risks.

- Rely on PCI-certified partners. Working with a Level 1 provider like Maxio ensures your operations align with the latest standards.

- Adopt continuous monitoring. Automated alerts and security scans help maintain compliance year-round.

The Bottom Line

PCI compliance isn’t a burden. It’s a framework for trust. The businesses that thrive are the ones that treat compliance not as a cost center, but as a competitive advantage.

By partnering with Maxio, you can simplify PCI compliance while maintaining the highest standards of payment security for your customers.

When it comes to handling payment data, secure by design isn’t just a standard—it’s a promise.