SAAS REPORTING SOFTWARE

SaaS reporting tools built for fast, confident decisions

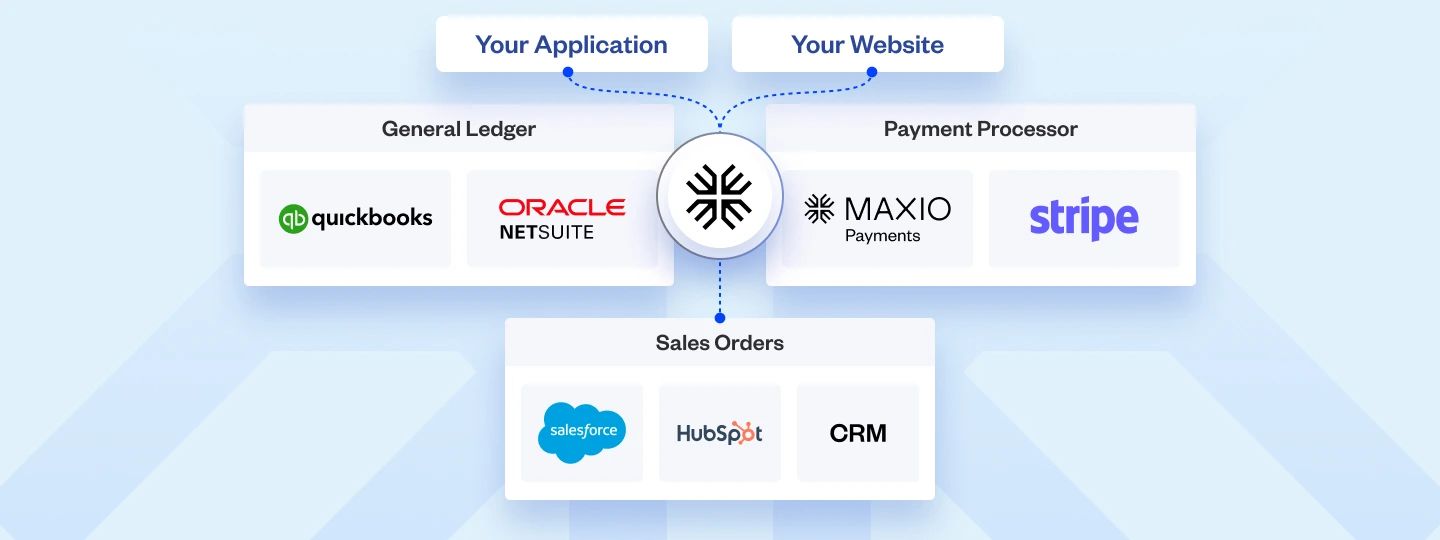

Integrates with:

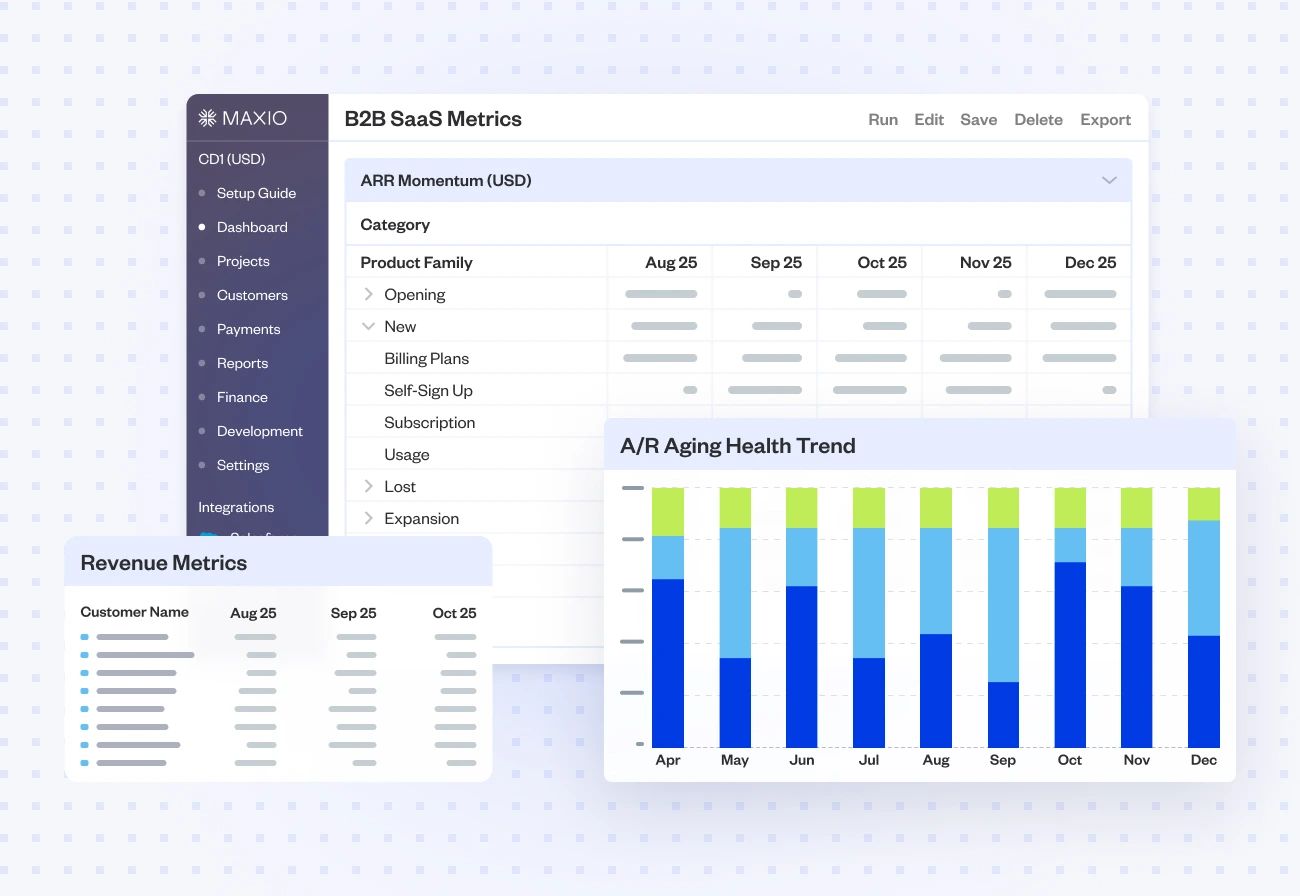

Streamlined, audit-friendly financial reporting

Financial reports

Drill down by customer, contract, product, or custom field. Close the books faster and report on GAAP revenue with audit-ready detail.

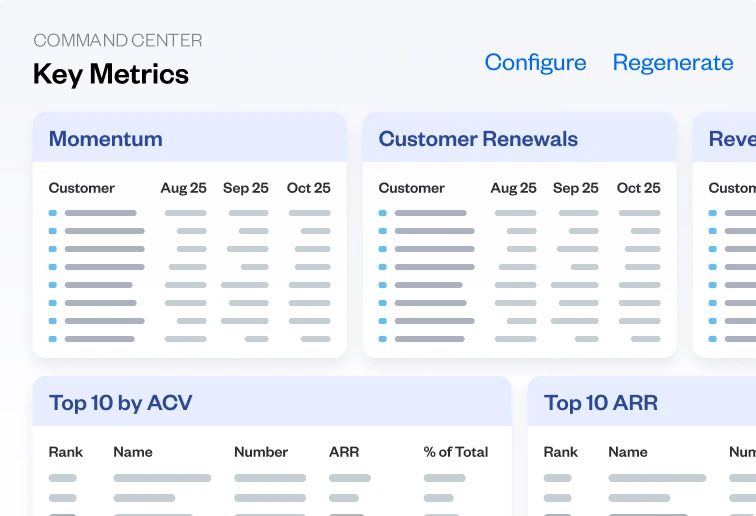

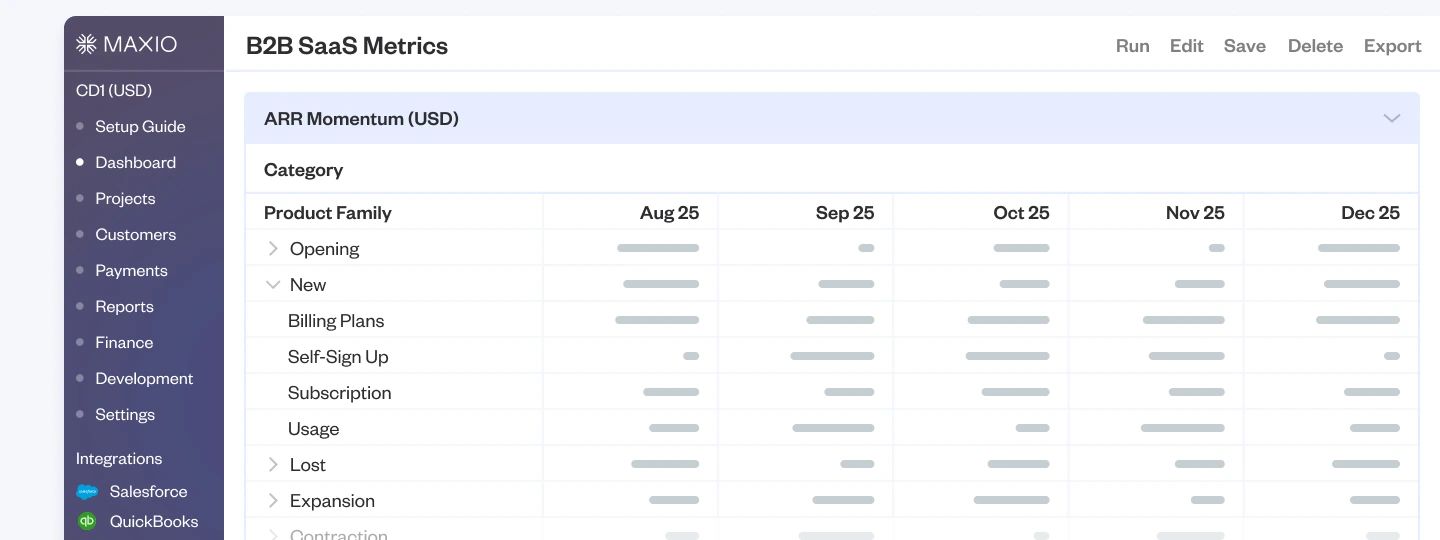

Key SaaS metrics

Track Net Revenue Retention (NRR), churn by cohort, Days Sales Outstanding (DSO), and more. Get valuable insights to diagnose trends, defend valuations, and drive strategic decisions.

Custom interactive dashboards

Get customizable dashboards that let stakeholders visualize trends, monitor churn risk, and manage audits.

The most powerful SaaS analytics platform on the market

Build off rock-solid data

Unify billing and finance data in one system to deliver real time, audit-ready numbers and reliable forecasts.

Easy data visualization and business intelligence

Analyze business health and user behavior with visualization tools. Explore data by cohort, product line, and other key views.

Data-driven decision-making

Drill down into the “why” behind metrics with custom reports and in-depth performance views. Review pricing models, support sales teams, and prepare for investor questions.

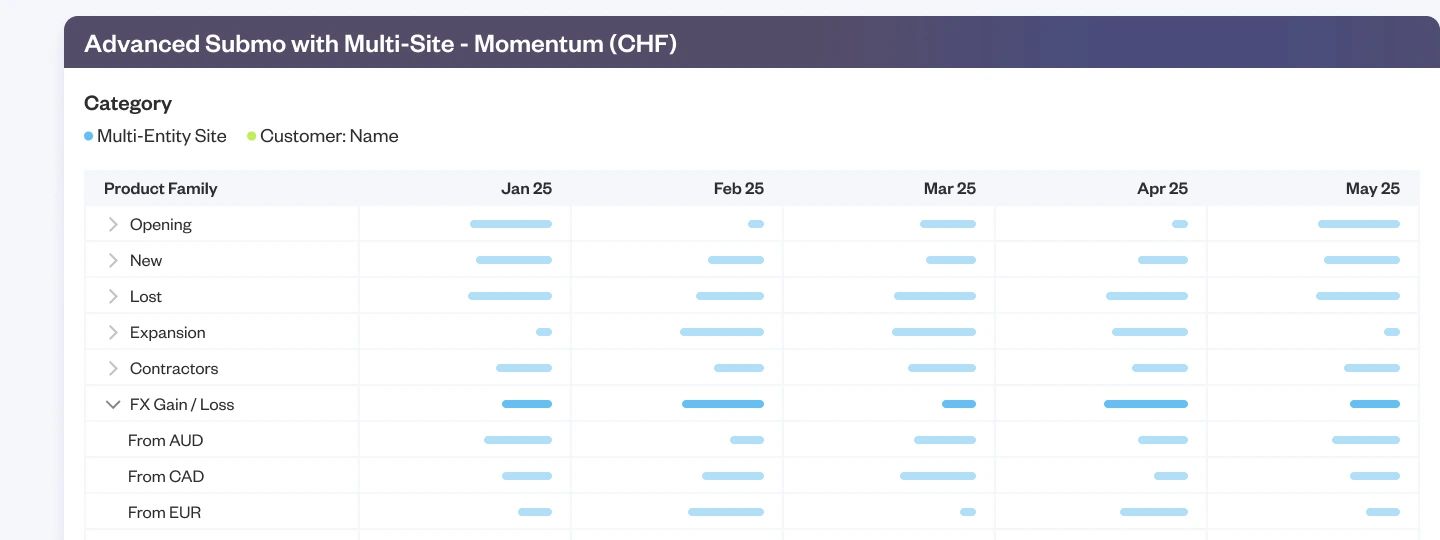

Unified reporting across entities

Consolidate reporting across products, business units, and regions. Track billing data and performance in one place. Monitor results and see what’s working.

Investor-grade SaaS analytics tools

Simplify your reporting process with analytics tools built for SaaS. Get detailed insights into business performance.

Financials & projections

Generate transaction analytics. Calculate amounts, MRR/ARR, quantity, etc. Predict future transactions based on historical data.

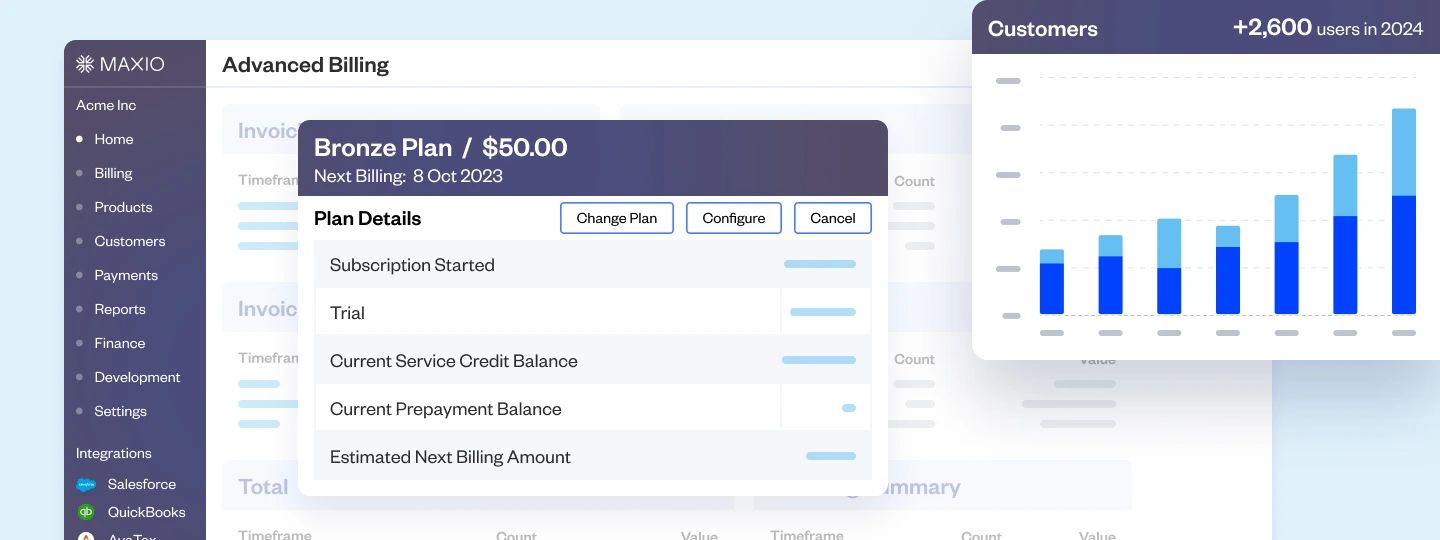

Customer tracking

Get a list of your top customers by MRR, ARR, revenue, or invoices. In your home currency. Count customers & contracts using actual revenue or invoice records.

Renewal rate

Track renewal rates by comparing transactions that expire in a reporting month with transactions that start in the same month.

Cohorts

Report by different cohorts, including start date, item, state, and more.

End-to-end financial reporting

Get full visibility into revenue, contracts, A/R, and more.

Sync data across your finance tech stack

Customer reviews

SaaS Metrics & Reporting FAQs

The best reporting tool connects to multiple data sources, offers flexible functionality, and turns raw info into clear, actionable insights.

For SaaS companies, that is often SaaS analytics software, which monitors financial health and supports use cases like investor reporting, board meetings, strategic planning, and analyzing pricing or retention efforts.

Most platforms cover key metrics like churn rate, monthly and annual recurring revenue (MRR/ARR), customer acquisition cost (CAC), customer lifetime value (LTV), and customer retention.

Stronger platforms go further with in-depth dashboards & reports, including advanced revenue summaries, ARR/MRR trends, marketing analytics, performance projections, accounts receivable aging, and average revenue per user.

This helps executive teams work through complex data, run detailed data analysis, and make informed decisions. Many tools also enable teams to explore trends, compare results, and align performance tracking with business goals.

Maxio brings all of these features together. Its built-in metrics also let you measure growth against up-to-date SaaS benchmarks, helping your team set goals and track performance with context.

SaaS reporting tools let decision-makers access accurate, real-time data, displayed in easy-to-read graphs and reports.This helps them measure key performance indicators against KPI goals.

These tools help leaders analyze performance, make informed decisions, optimize strategies, and boost conversion rates. This ensures that decisions are based on actual performance metrics, rather than assumptions or gut feelings.

When reporting is integrated with automated billing software, it provides even more visibility into revenue performance, helping teams track trends, forecast more accurately, and adjust plans based on live billing data.

The right SaaS reporting tool must integrate with existing systems and offer comprehensive analytics.

For financial insights and performance metrics, Maxio’s subscription billing software and financial reporting solution is consistently rated as the best solution on the market. It provides tailored analytics for SaaS businesses, ensuring access to real-time data, customizable reports, and actionable insights.

Maxio stands out for its ease of use. It includes built-in templates to speed up setup and onboarding, making it the ideal choice for optimizing operations and driving growth.

The key features to look for in a SaaS reporting tool go beyond charts and dashboards.

Real-time data access and data integrations, customizable views, and flexible reporting let you drill down into billing and customer data, without relying on SQL or extra manual work.

Self-service access helps teams get insights in real time.

If your company operates across products, business units, or regions, multi-entity support is essential. Built-in cohort analysis, forecasting tools, and audit-ready financials help track performance over time and stay compliant.

Cloud-based access lets you view reports from anywhere. Integrations with CRMs, general ledgers, and spreadsheets keep your data connected. You should be able to export reports to Excel and Google Sheets while preserving format, so it’s easy to share and continue analysis.

To simplify workflows, your reporting tool should also act as subscription management software, letting you manage renewals, upgrades, cancellations, and MRR tracking from the same platform.

Maxio brings all of this together in an all-in-one platform, giving SaaS companies full visibility into performance and the tools to move quickly & confidently.

Pricing for automated reporting software varies depending on features, usage, and business size. Visit our pricing page for details and plan comparisons. Maxio offers flexible packages with full scalability, built to support SaaS companies at every stage.