If you’ve worked in finance and accounting in any capacity, you’ve probably heard of a little company called NetSuite (they’re only one of the most popular ERP systems that have been around since 1998).

NetSuite has been the tried-and-true accounting solution for enterprise companies for years, but that doesn’t necessarily make it the best choice for growing SaaS companies.

Most growing SaaS businesses start with a smaller general ledger (QuickBooks, Xero) to manage their finance and accounting. Then, after inevitably outgrowing these solutions, they’re tempted to migrate entirely to NetSuite. However, migrating to NetSuite can introduce a lot of complexity to their operations due to the sheer depth and breadth of the platform.

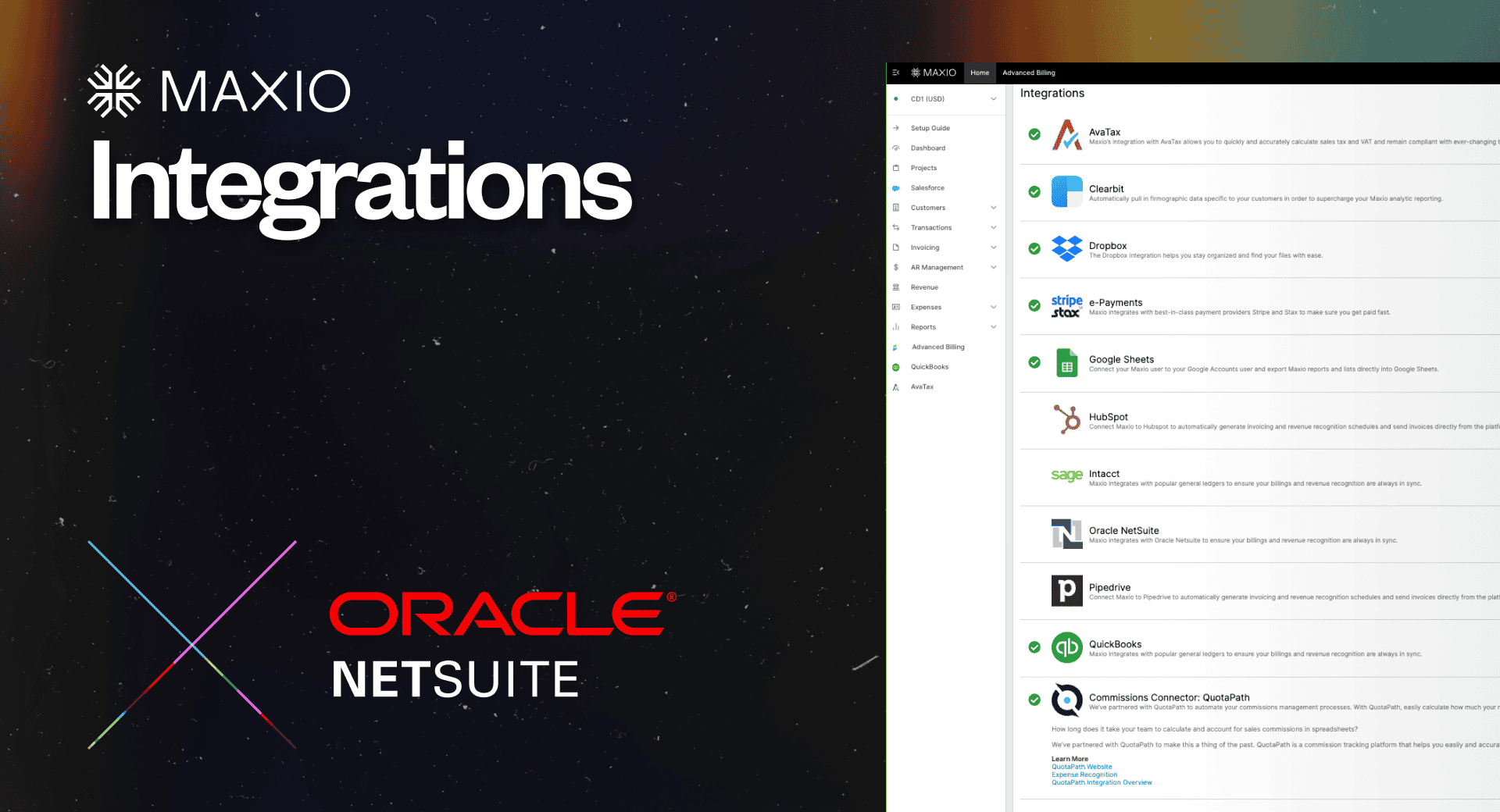

By supplementing an ERP platform with a SaaS-specific tool like Maxio, you get the best of both worlds: you get the full functionality of an ERP, without the pains of having to manage complex financial operations in NetSuite.

With our NetSuite integration, Maxio makes it easy for finance and accounting teams to recognize complex revenue, generate financial reports, and view SaaS metric and analytics dashboards all in one place.

Here’s a closer look at when to use these tools, and why the Maxio/NetSuite integration is a logical choice for busy finance and accounting teams.

Common reasons for implementing NetSuite

NetSuite comes equipped with hundreds of use cases out-of-the-box, but force-fitting an ERP solution to a growing SaaS company is like trying to wear a shoe that’s several sizes too big. Despite that, several early-stage and mid-market companies implement it anyway. Here are the most common reasons business leaders make the move to NetSuite.

Their company is getting bigger

A tool like NetSuite was built for the enterprise. It only makes sense that companies who are approaching enterprise-level headcounts and annual revenues would make the move to a dedicated suite solution to manage their financial operations.

They need multi entity workflows

If you’re a multi-entity or group company that manages multiple subsidiaries, you’ll need an ERP solution to produce consolidated group accounts while also keeping track of individual subsidiaries’ financial performance. If your company has grown up to the point where multi-entity is a “must have,” you’re probably ready to adopt an ERP. Otherwise, you’ll face accounting challenges, such as:

- Setting up different general ledger accounts for individual subsidiaries

- Working in multiple currencies, with a fluctuating exchange rate

- Complex ownership arrangements, in groups where ownership of a subsidiary is less than 100%

- The complexity of viewing and tracking financial performance across multiple entities

Tech stack bias

Tech stack bias is real. You may choose to implement NetSuite simply because your VC firm prefers all their portfolio companies to use it. While this keeps things simple for investors, it can cause headaches for business leaders who are trying to force-fit an enterprise solution into their existing workflow. For small-but-mighty finance and accounting teams, working out of an enterprise solution can create serious tech debt and introduce complexities that aren’t adding value to the business.

(It’s also worth mentioning that NetSuite comes with a steep learning curve. If you’re required to adopt the platform, you’ll need to allocate a considerable amount of time and resources to train new and existing hires on how to use its core features and modules.)

A new executive enters the fold

Every software tool has a power user—NetSuite included. The adoption of ERP tools like Netsuite can be ushered in by new executives who have grown accustomed to working within the platform. So, unless you can make a legitimate business case to move away from an ERP, you may have no choice but to make it work.

Why partner with Maxio

The thing about NetSuite is in most cases, it drastically complicates your financial operations. Migrating your existing financial data is difficult, and can result in data errors during implementation. However, if you’re required to switch to NetSuite, you don’t have to move everything.

By integrating NetSuite and Maxio, you can easily toggle between Netsuite and Maxio to see the records you need to see, without having to manage your financial processes within NetSuite.

Within Maxio Advanced Billing, you can sync financial records between Maxio and NetSuite, including:

- Product catalog

- Customer details

- Invoices

- Payments

How does it work?

Maxio and NetSuite sync bidirectionally, updating records automatically between platforms. What does that mean, exactly?

Whether you’re working in Maxio or NetSuite, you don’t have to worry about manually migrating data or toggling back and forth between platforms to find the data you need. With bidirectional data syncs between Maxio and NetSuite, you can access up-to-date information wherever you are.

How does this help you?

Easier product catalog management

Maxio Advanced Billing also allows you to create items within your product catalog rather than creating them in NetSuite. This helps reduce duplicative efforts when managing your product catalog.

Work where you want

Operate out of either Maxio or NetSuite. Financial data is synced bidirectionally, so you’re not tied down to a single tool. This means you can work out of Maxio, and your VC, the board, and executive leadership team can view all relevant information within NetSuite, without having to perform any manual data migration.

Apply payments directly in your general ledger

If you’re a complex B2B SaaS business dealing with remittance customers, you need to be able to apply payments coming in from a variety of sources (credit card, ACH, e-checks, wire transfers). The ability to collect and process different payment types saves you and your finance team the pains of manually completing each and every payment within your general ledger.

Reduce troubleshooting time

With Maxio Advanced Billing, you have a powerful system of record right at your fingertips. Don’t want to spend hours troubleshooting data migration errors and discrepancies? Not a problem. With Maxio, you can automate the whole process:

- Link backs allow you to easily see what data has (or hasn’t) been synced

- Easy auditing tells you why your data syncs are failing, so you can quickly find a solution

- Robust error logging lets you document any data errors, and the reason they occurred, so you can avoid data sync problems in the future

SaaS-specific accounting made easy

If you’re determined to stick it out with an ERP solution, you can still do all your core accounting in NetSuite. But at the end of the day, NetSuite just isn’t built to support a SaaS-specific workflow.

With the Maxio NetSuite integration, you can get the best of both platforms and keep all your financial data synced—no matter where you want to work.

Want to see how Maxio and NetSuite work together to make subscription billing and GAAP-compliant accounting easier than ever? Schedule a demo with our team to learn more.