Maxio + Anrok: Automated tax compliance built into billing

Connect automated billing with modern tax compliance.

The Anrok integration brings real-time accuracy, visibility, and control to recurring-revenue workflows. It removes manual mapping and spreadsheet tracking ensuring every invoice is accurate and audit-ready.

Why Maxio + Anrok

Automation

Stop tracking tax by hand. Taxes are calculated automatically during subscriptions, one-time charges, and invoicing. This reduces manual work and streamlines the entire billing process.

Accuracy

Confidence in every invoice. Real-time calculation ensures every invoice reflects the correct tax at the right time, helping teams close faster with fewer adjustments.

Visibility

Know your tax impact before you bill. Finance teams can preview and validate tax amounts in real time, reducing surprises and minimizing reconciliation effort.

Compliance

Compliance built in. Anrok manages jurisdiction-specific and international tax rules, while Maxio ensures invoices stay accurate, transparent, and audit-ready across regions.

How it works

The Maxio + Anrok integration works seamlessly in the background to ensure every transaction is taxed correctly, without added effort.

When enabled, Maxio communicates directly with Anrok in real time at each billing event, applying accurate taxes automatically and maintaining compliance across jurisdictions

Whenever a subscription, invoice, or one-time charge is created, Maxio calls Anrok’s tax engine instantly.

Anrok applies the correct rates and rules based on jurisdiction and transaction type, returning precise tax amounts directly to Maxio.

Your product catalog in Maxio syncs automatically with Anrok, keeping product and component data consistent for ongoing tax accuracy.

Tax category management remains in Anrok, giving finance teams visibility and control over how items are classified.

As invoices and subscription previews are generated, Anrok’s calculated tax appears instantly in Maxio, No imports or manual updates required.

Teams can review tax details in invoice views and reports, ensuring transparency before billing.

Anrok manages jurisdictional and international tax obligations, while Maxio provides the detailed invoice and transaction data for audit readiness.

Together, they keep your tax reporting accurate and your billing operations simple.

Request Beta Access

Beta Access is open for Maxio customers who want real-time, automated tax compliance powered by Anrok.

Sign up now for beta access

Avalara

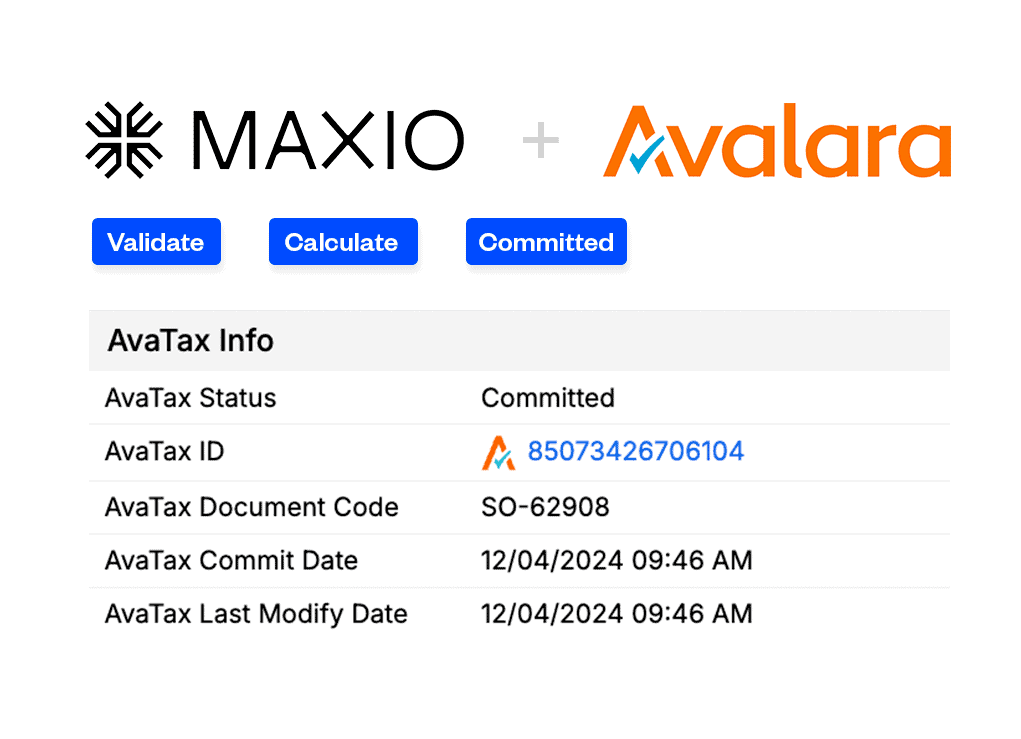

Maxio + Avalara AvaTax integration

Save time and avoid confusion by automating sales tax calculations and filings. Maxio’s AvaTax integration allows you to quickly and accurately calculate sales tax to remain compliant with ever-changing tax laws.

Why integrate Avalara AvaTax with your Maxio account

Address Validation

As you create customers in Maxio, you can validate the business addresses using AvaTax (you can also validate your customers’ addresses in bulk). The AvaTax calculation engine is the most accurate and up-to-date address validation engine available, so you will know that your records are accurate and your Sales Tax will be calculated correctly.

Automate Tax Calculations

With a validated address, AvaTax auto-calculates sales tax based on the local tax code for each invoice. Sales tax is calculated based on the jurisdiction at which the service is delivered. This can be either the shipping address or billing address. When committing sales tax, you’ll have the flexibility to choose between doing so manually or automatically in Maxio.

Accuracy Across all Applications

Maxio is designed to be your source of truth for revenue. All sales tax line items populated by AvaTax can be passed to your CRM or general ledger so you have accurate customer data across all applications.

How the Maxio + Avalara AvaTax integration works

The Maxio + Avalara AvaTax integration is bi-directional. Maxio syncs with your AvaTax account and passes Maxio Items to AvaTax and AvaTax passes your entity use codes to Maxio. Once synced, you can reference the AvaTax information for your Items from both the Item List and the individual Item Profiles within Maxio.

Once configured, AvaTax calculates the sales tax amount for each invoice based on a combination of the item tax code settings in AvaTax, the presence of any exemptions for the customer, and the physical location associated with the invoice.

Sales tax is typically calculated based on the location to which the service is delivered. Using this logic, AvaTax will attempt to use an invoice’s shipping address to assign tax values and will only use the billing address when there are no valid shipping addresses.

To get started using AvaTax with Maxio, contact Maxio Support and we will provide you with instructions for contacting AvaTax. You must first have an account set up with AvaTax in order to use the integration.

Once you’re live with AvaTax, it takes about 10 minutes to enable the integration in your Maxio account.