MAXIO VS. CHARGEBEE

Which is Best for B2B SaaS?

Curious how Maxio and Chargebee stack up head-to-head?

Here’s what you need to know.

MAXIO VS. CHARGEBEE

Which is Best for B2B SaaS?

Get a customized demo

Why Maxio?

Streamline subscription and contract billing.

Automate invoicing. Stay GAAP & IFRS compliant.

What’s the difference between Maxio and Chargebee?

Maxio vs. Chargebee Feature Comparison

| Compare Plans | Maxio | Chargebee |

|---|---|---|

Billing and Subscription Management | ||

| Subscription billing | | |

| Contract billing | | |

| Self-service portals | | |

| Multi-attribute rating | | |

| Prepaid subscriptions | | |

| Prepaid usage | | |

Company Management | ||

| Single product with multiple currencies | | |

| Localized customer support | | |

Revenue & Expense Reporting | ||

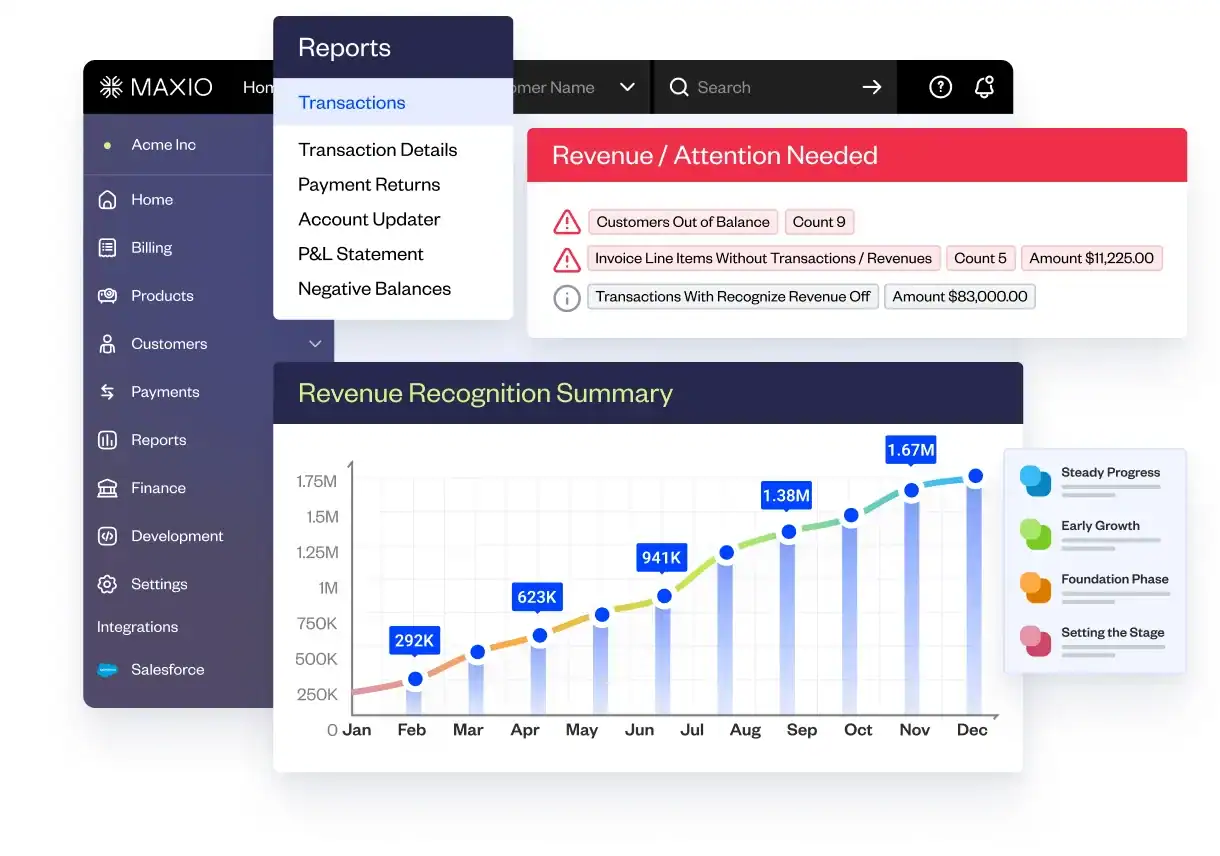

| Basic revenue recognition | | |

| End of period balance reporting | | |

| Carve-outs | | |

| Reallocations | | |

| Expense recognition | | |

Integrations | ||

| AvaTax (Included) | | add-on |

| Salesforce (two-way) | | |

| HubSpot (two way) | | |

| Xero (two way) | | one-way |

| Quickbooks (two way) | | one-way |

| Netsuite (two way) | | one-way |

| QuotaPath | | |

| Clearbit | | |

Maxio vs. Chargebee FAQs

Maxio delivers a hands-on onboarding experience, helping businesses configure product catalogs and billing correctly from the start. Chargebee’s onboarding is largely self-guided, with expensive professional service fees for imports — leaving customers to navigate complexity on their own.

Maxio offers a true two-way HubSpot integration that supports custom pricing. Chargebee’s HubSpot integration is one-way and limited — it treats custom pricing as a “price override,” which is a known limitation. This restricts flexibility and creates inefficiencies for sales teams.

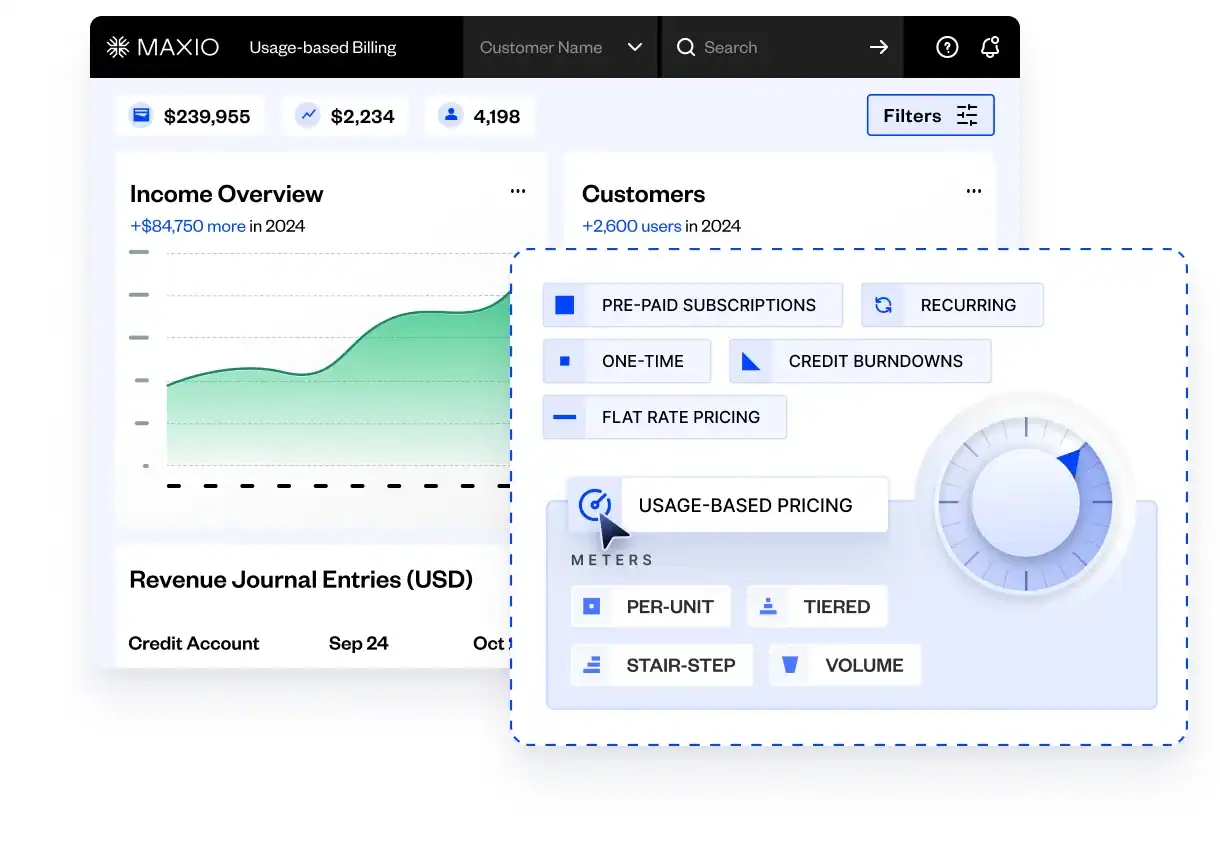

No. Maxio natively supports usage-based billing without reliance on third-party add-ons. Chargebee requires integration with m3ter, which adds complexity, requires a separate account, and introduces risk if the vendor experiences downtime.

Chargebee support is outsourced and often feels like calling a cable provider with slow response times, lack of local context, and inconsistent service. Maxio focuses on proactive onboarding and CSM support, ensuring critical issues are prevented and customers feel supported throughout the lifecycle.

When to use Chargebee

Chargebee serves early-stage and pre-revenue B2B and B2C SaaS companies.

Your primary focus is B2C

Chargebee’s feature set is built to support the needs of most B2C businesses.

You sell physical products

Chargebee is a good choice for subscription companies who run online shops for physical goods.

You prefer to bootstrap

Chargebee’s simple billing engine is a good fit for small businesses who aren’t looking to scale.