MAXIO VS. METRONOME

Which is Best for B2B SaaS?

Curious how Maxio and Metronome stack up head-to-head?

Here’s what you need to know.

MAXIO VS. METRONOME

Which is Best for B2B SaaS?

Get a customized demo

Why Maxio?

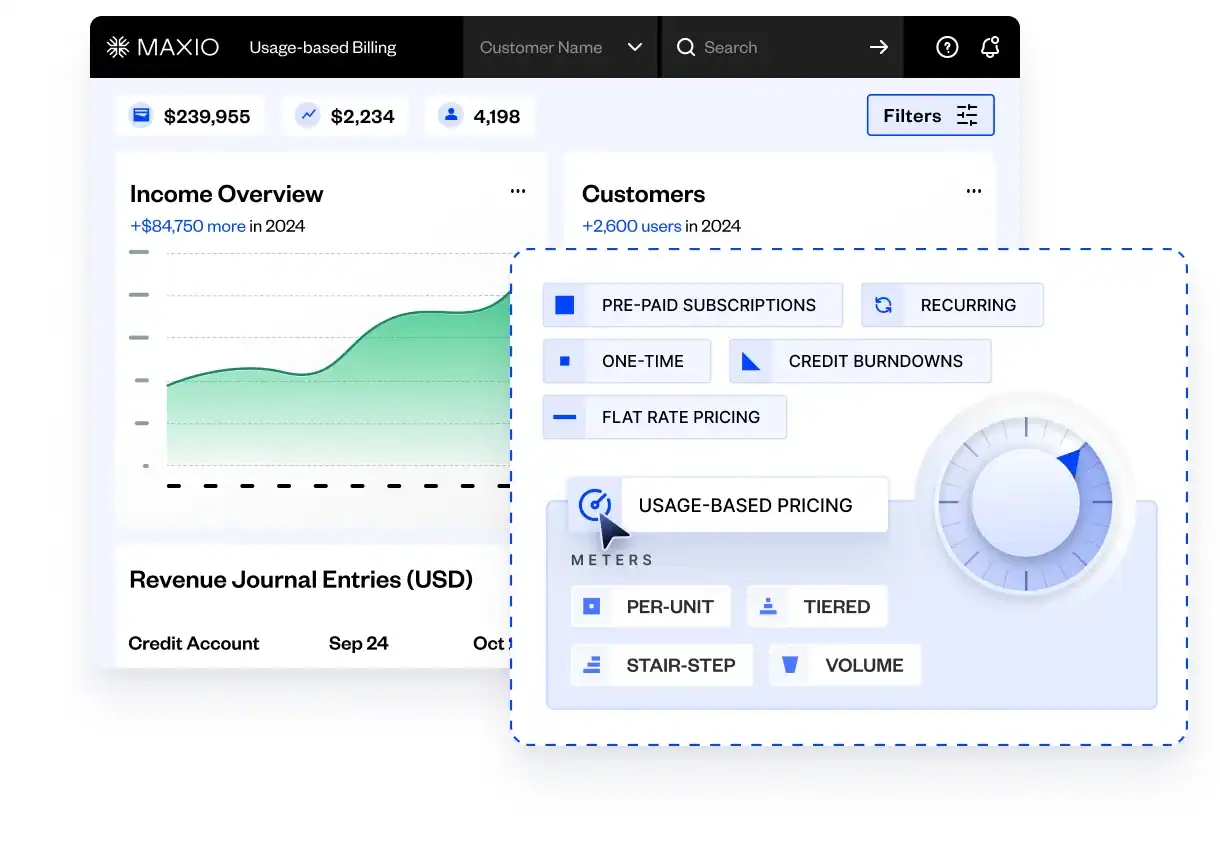

Streamline subscription and contract billing.

Automate invoicing. Stay GAAP & IFRS compliant.

What’s the difference between Maxio and Metronome?

Maxio vs. Metronome Feature Comparison

| Compare Providers | Maxio | Metronome |

|---|---|---|

Billing & Subscription Management | ||

| Subscription billing | | |

| Contract billing | | |

| Self-service portals | | |

| Multi-attribute rating | | Basic |

| Advanced prepaid subscriptions | | Basic |

| Prepaid usage | | Basic |

| A/R Management | | |

| Payment gateways | 20+ | Only Stripe |

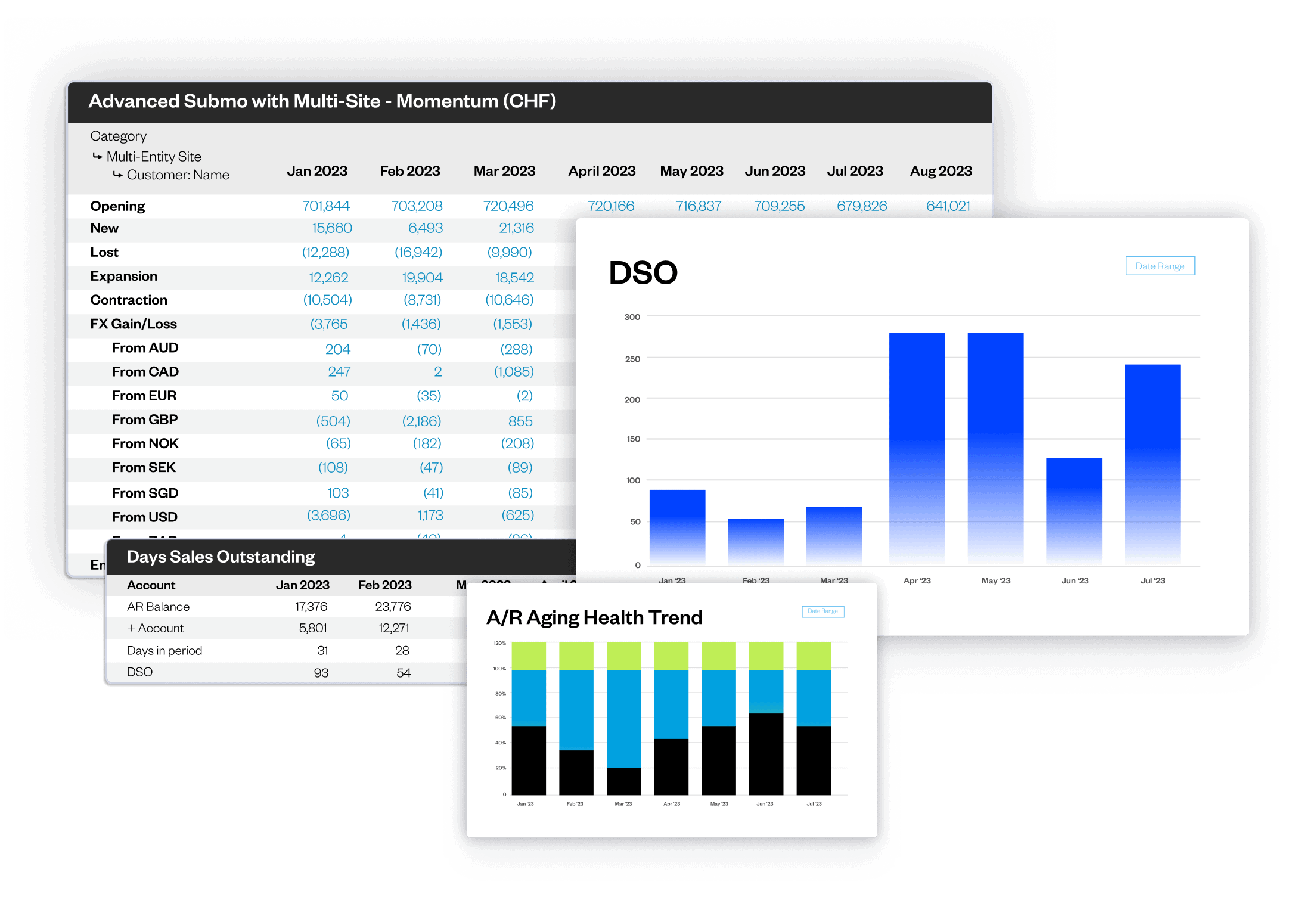

SaaS Metrics and Reporting | ||

| End of period reporting | | Basic |

| ARR/MRR snowball | | |

| Drill down reports | | |

| FX Gain/Loss by currency | | |

| Deferred Revenue | | |

Revenue Recognition | ||

| Revenue recognition | | Basic |

| End of period reporting | | Basic |

| Carve-outs / Reallocations | | |

| Expense recognition | | |

Integrations | ||

| Salesforce (two-way) | | One-way |

| HubSpot (two-way) | | |

| Xero (two-way) | | |

| QuickBooks (two-way) | | One-way |

| Netsuite (two-way) | | |

| QuotaPath | | |

| Clearbit | | |

Maxio vs. Metronome FAQs

Maxio is praised for helpful, knowledgeable support, especially around complex scenarios. Metronome reviews do not frequently mention support.

Maxio pricing starts at base price with custom enterprise plans, emphasizing comprehensive SaaS finance capabilities alongside billing. Metronome’s pricing is custom and tends to be higher, reflecting its enterprise-scale focus and high-volume usage billing capabilities.

When to use Metronome

Metronome is best suited for SaaS businesses focused on basic subscription management, usage or metered based billing solutons and reporting.

Basic subscription management needs

For companies with simpler financial workflows or single-layer pricing models, Metronome’s focus on metering and data-driven billing might be sufficient.

Metered or usage-based billing

If your company requires only usage-based pricing and billing, enabling metering and event-based pricing models then Metronome would be a great fit.

real-time or metered usage insights

Metronome delivers real-time usage data, ideal for companies focused solely on consumption metrics. While strong in usage tracking, Metronome may fall short on integrations for complex financial needs.