MAXIO VS. STRIPE BILLING

Which is best for recurring revenue businesses?

Curious how Maxio and Stripe Billing stack up head-to-head? Here’s what you need to know before making your final decision.

MAXIO VS. STRIPE BILLING

Which is best for recurring revenue businesses?

Get a customized demo

Why Maxio?

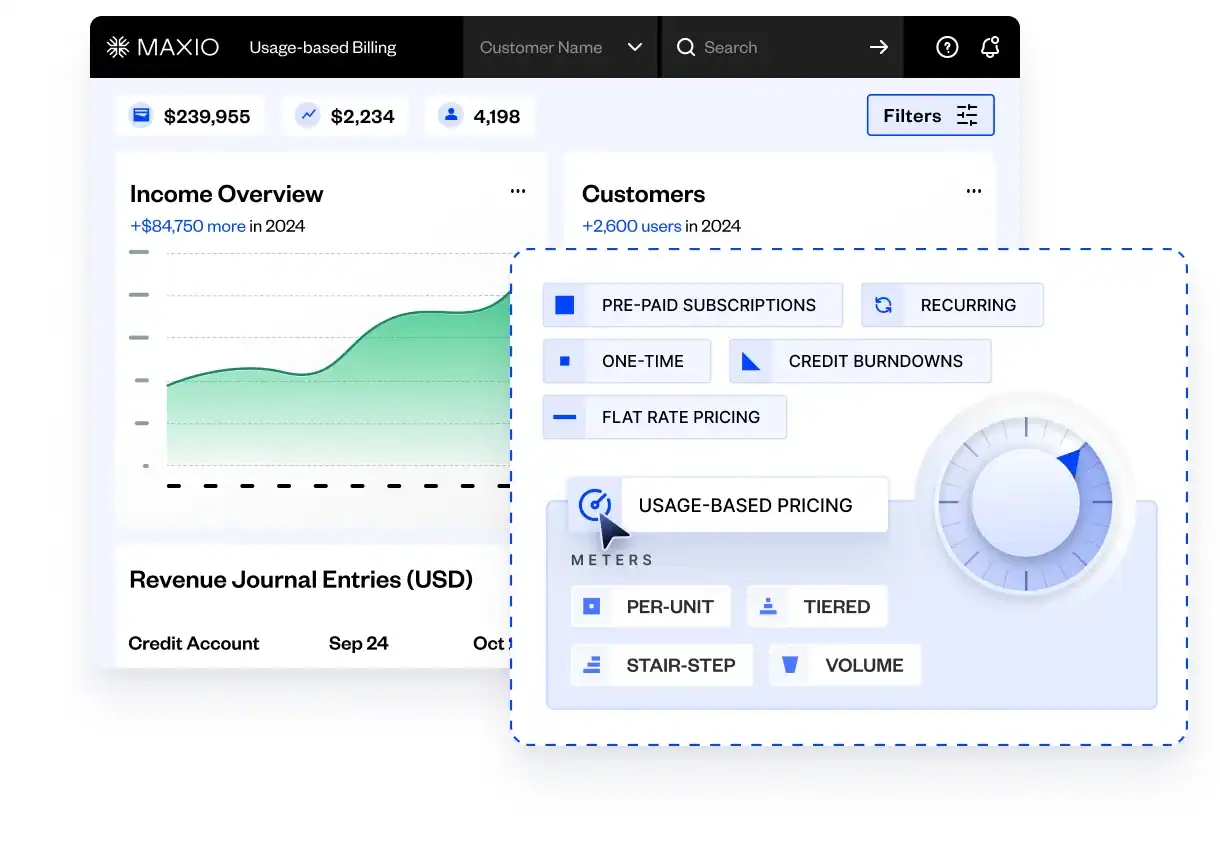

Streamline subscription and contract billing.

Automate invoicing. Stay GAAP & IFRS compliant.

What’s the difference between Maxio and Stripe Billing?

Maxio vs. Stripe Billing Feature Comparison

Maxio Maxio |

Stripe Billing Stripe Billing |

Billing & Subscription Management | ||

| Subscription billing | | |

| Contract billing | | Features in beta |

| Self-service portals | | |

| Multi-attribute rating | | |

| Prepaid subscriptions | | |

| Prepaid usage | | Fixed fee and overages only |

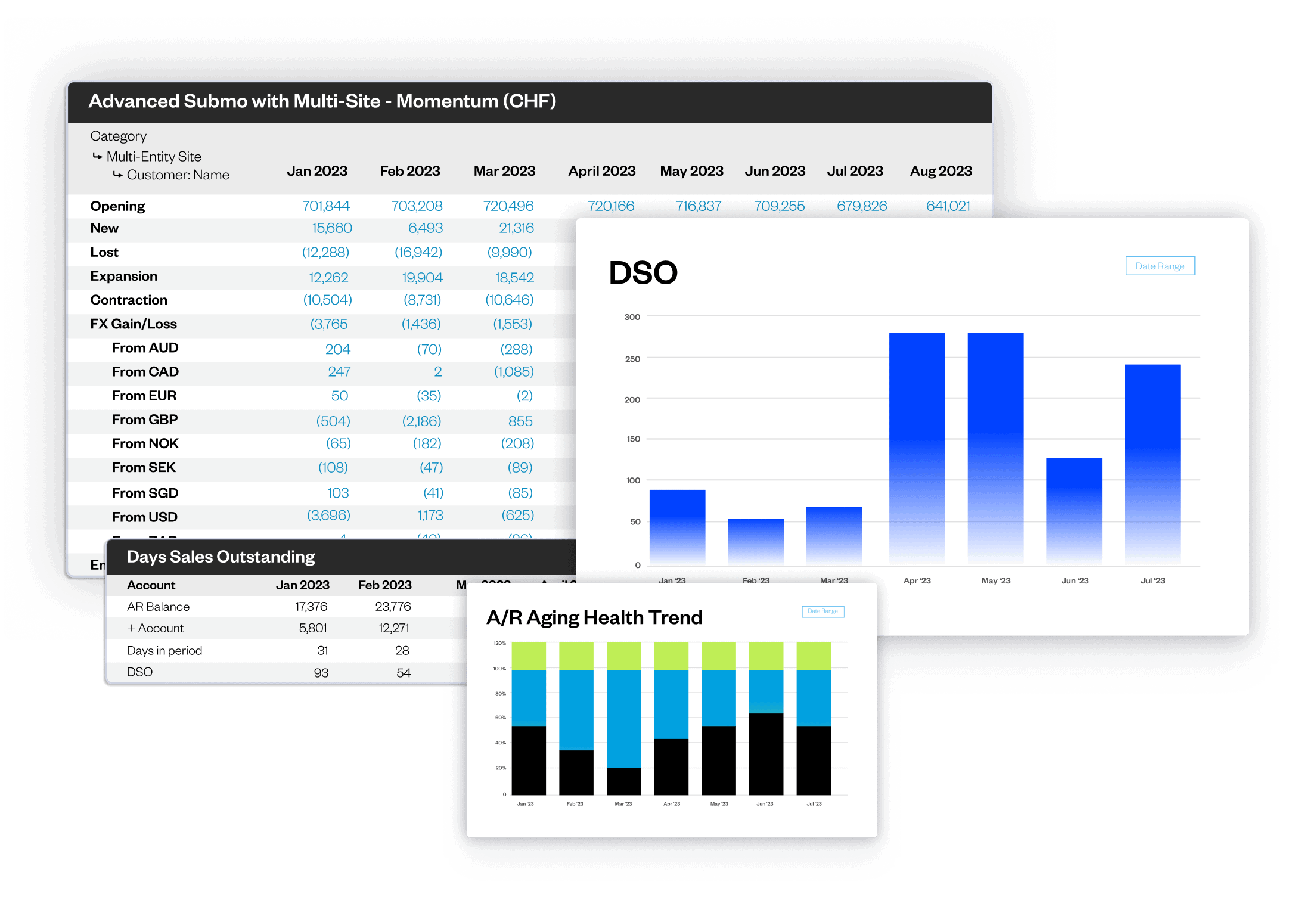

Company Management | ||

| Single product with multiple currencies | | |

| Localized customer support | | |

| Dedicated onboarding for all customers | | |

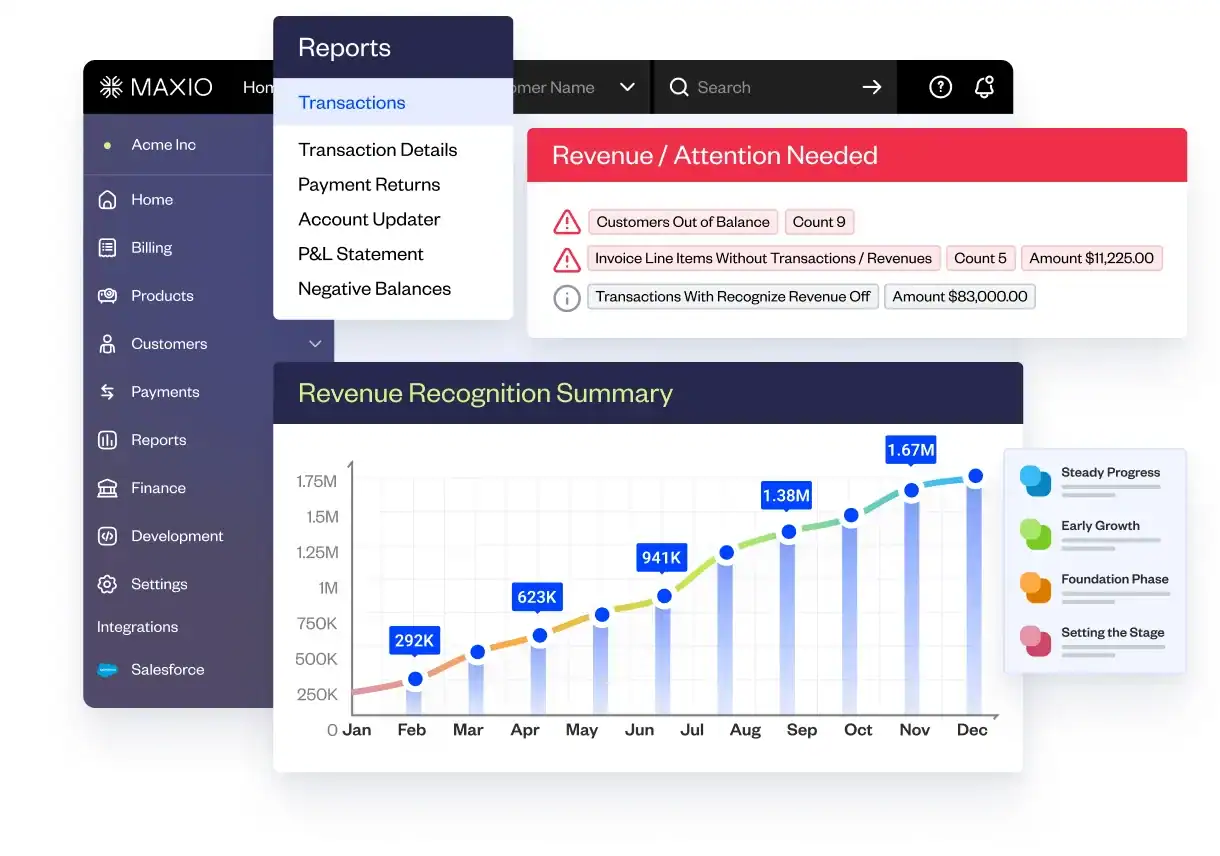

Revenue & Expense Reporting | ||

| Basic revenue recognition | | |

| End of period reporting | | |

| Carve-outs / Reallocations | | |

| Expense recognition | | |

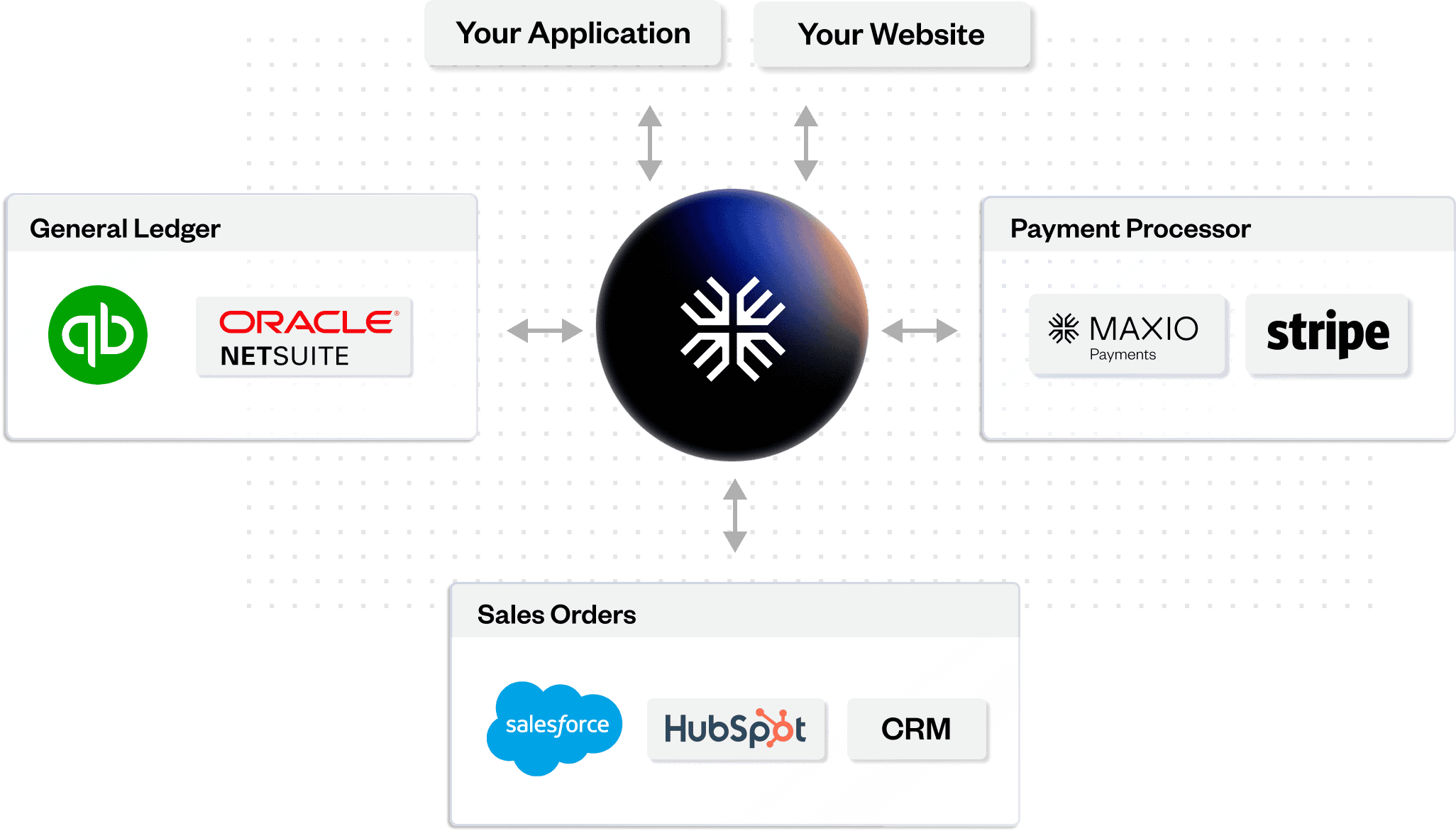

Integrations | ||

| Salesforce (two way) | | |

| HubSpot (two way) | | |

| Xero (two way) | | |

| QuickBooks (two way) | | |

| Netsuite (two way) | | |

| QuotaPath | | |

| Clearbit | | |

Maxio vs. Stripe BIlling FAQs

Maxio offers plans with a base fee that includes a customized revenue amount, making it very cost competitive with Stripe Billing. Stripe’s pay-as-you-go pricing may look simple upfront, but it often requires more developer resources, increasing total cost of ownership. In addition, Maxio doesn’t lock you into a single payment provider, giving you flexibility to optimize processing costs .

Stripe Billing’s reporting is limited and often requires Stripe Sigma (premium add-on) plus SQL expertise to access usable analytics. Maxio provides out-of-the-box reporting with the ability to drill down into underlying data across all reports, ensuring transparency for internal teams, investors, and auditors.

Stripe offers broad partner integrations as part of its generalist approach. Maxio is purpose-built for B2B SaaS, offering native Salesforce and HubSpot integrations tailored to complex billing needs. Unlike Stripe, Maxio maintains its integrations directly, ensuring reliability and depth of functionality

Stripe provides minimal onboarding and implementation support, leaving architecture and product catalog setup to customers. Maxio provides dedicated onboarding specialists to ensure accurate setup from the start, reducing long-term risks and ensuring scalability

What issues do people run into with Stripe Billing?

Most early-stage companies implement Stripe to bill customers and collect payments. But they start running into issues as they scale.

Can’t support GTM complexity

Stripe Billing works well for companies that sell a single product at a single price point in a single channel. Stripe Billing will struggle to accommodate complexities in your go-to-market strategy.

Growth-prohibitive pricing

While Stripe’s pricing strategy is transparent and easy to understand, it’s fixed forever. By contrast, Maxio offers volume-based discounts as you scale, so you never get penalized for your business’ success.

Lack of onboarding and support

While Stripe Billing’s extensive documentation makes it easy to interact with them in a self-service manner, most companies find they need additional support and guidance.

How to migrate from Stripe Billing to Maxio

Here’s how to migrate from Stripe Billing to Maxio in five easy steps.

- Align the product catalog structure

- Map current subscriptions to the new catalog structure

- Design new subscription management workflows

- Define customer touch points and API integrations

- Import and go-live