Accounts Receivable Software for SaaS

Eliminate 87% of Revenue Leakage

Improving cash collections is the fastest and least expensive way to improve your business’s financial position.

Take Control of Your Cash Flow with Automated AR Management

Maxio’s accounts receivable solution allows you to manage your collections process and dunning at scale, so you can track down and collect outstanding revenue without missing a beat.

Maxio’s AR Management in Action

Cash is the lifeblood of your business, and accounts receivable software is how you keep it pumping. Maxio’s collections and dunning, statement management, and unique reports allow you to simplify and measure the effectiveness of your A/R Management processes.

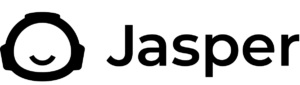

By automating your accounts receivable process and giving you better control over collections, Maxio helps you lower your AR balance and reduce your Days Sales Outstanding. This means more predictable cash flow and less capital tied up in unpaid invoices.

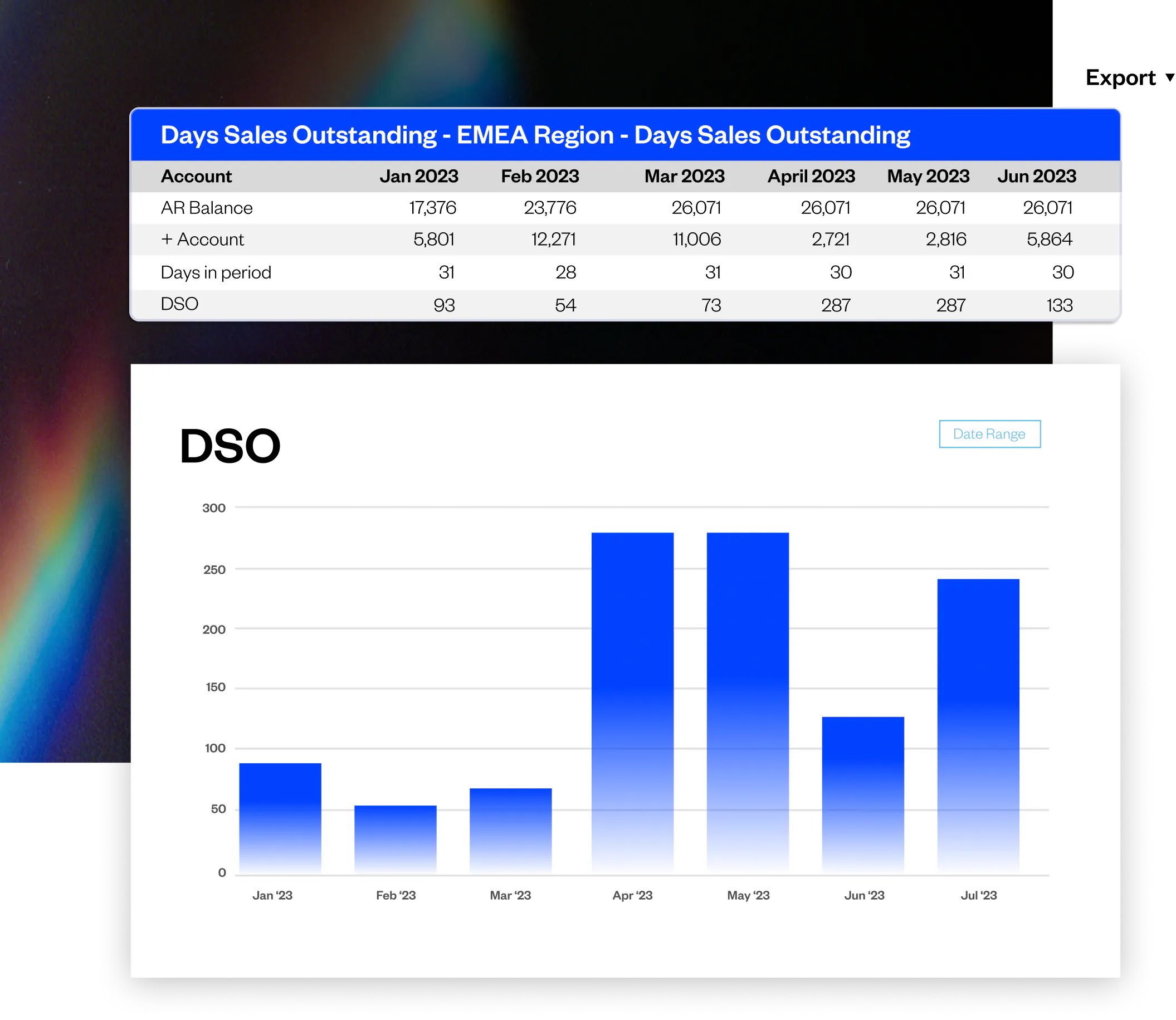

Maxio takes the hassle out of chasing overdue payments. With automated reminders, dunning processes, and customizable workflows, you’ll spend less time managing collections and more time focusing on your business.

Stay on top of your accounts receivable with detailed dashboards and real-time analytics. Maxio provides a complete view of your receivables, from DSO reports to customer payment trends, giving you the insights you need to take action and improve cash flow.

Customers can make online payments directly from custom-branded invoices generated in Maxio, and our e-payment integrations mean your customers have access to multiple payment processing methods from credit card to ACH.

Key Features of Maxio AR Management Software

Automated Dunning and Reminders

Keep your collections process efficient with automated workflows for overdue payments.

Comprehensive Aging Reports

Gain full visibility into your outstanding invoices and late payments.

Collections Cadences

Establish pre-defined escalation paths for past-due invoices to streamline collections.

Custom Workflows

Tailor the accounts receivable process to your business needs with flexible rules and settings.

Detailed Reporting and Analytics

Monitor your AR performance with real-time reports and actionable insights.

Secure Payments

Provide your customers with multiple, secure payment options to ensure faster settlements.

How Maxio’s AR Management Works

Step One

Establish collections cadences and escalation paths

SaaSOptics allows you to create custom collections emails and cadences, or choose from our library to drop customers into directly from the platform. You can also establish pre-defined escalation paths for past-due invoices.

Step Two

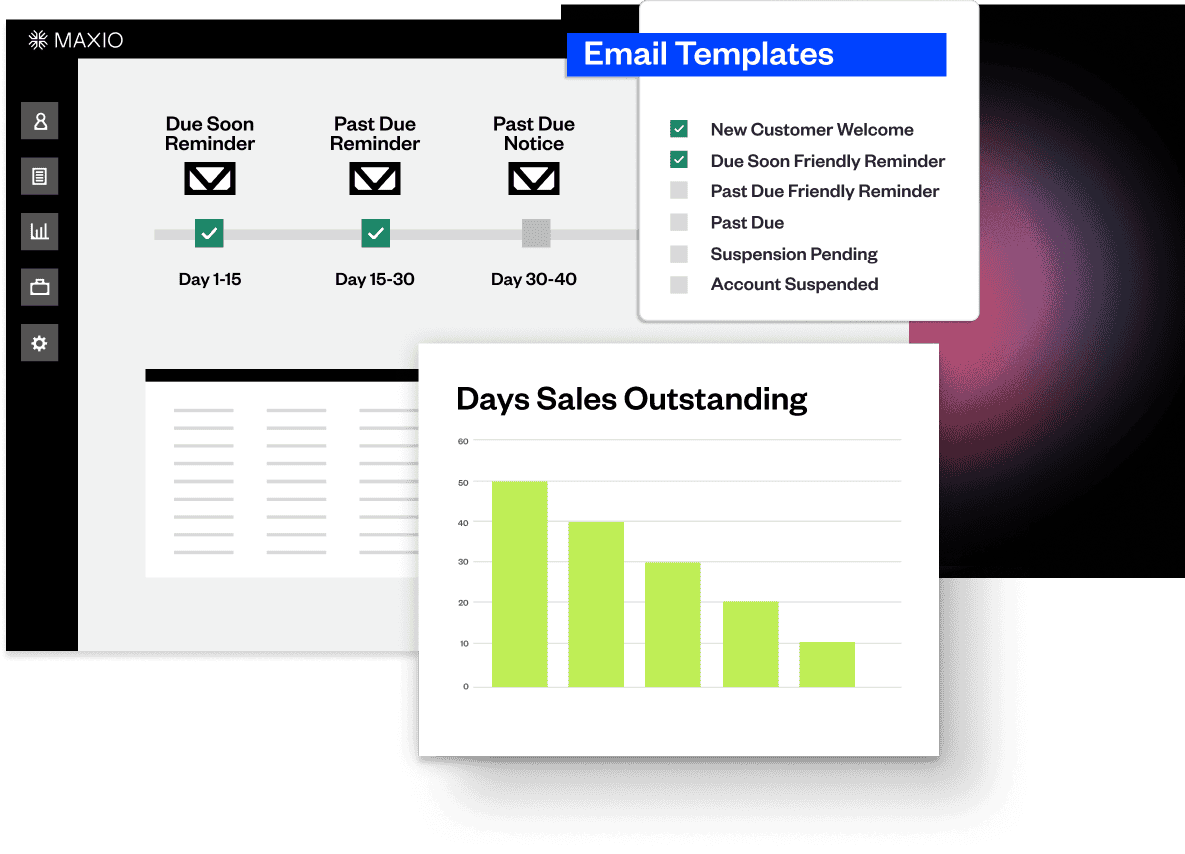

Automatically generate monthly statements

Schedule a time of the month to automatically generate statements or manually generate them whenever you need so you never run the risk of forgetting to follow up on an unpaid invoice.

Step Three

Generate unique reports

Easily generate unique reports such as Days Sales Outstanding (DSO) so you can measure the effectiveness of your A/R Management processes.

Maxio Accounts Receivable Software FAQs

Maxio’s advanced accounts receivable management software streamlines accounts receivable management by automating customer payments and collections management. It allows users to customize invoicing, implement automated dunning processes to recover past due payments, and manage customer accounts efficiently. These features help businesses reduce the time and effort spent on manual collections and improve cash flow.

There are a few key ways companies can collect accounts receivable faster. For example, implementing a customer portal with invoice tracking can help customers see balances and pay online. Cloud-based A/R automation software connected to the general ledger can also expedite cash application and reduce bad debt. Your Controller should then analyze accounts receivable aging reports to identify where bottlenecks occur in the collections process. Setting clear credit terms and following up on past due accounts also keeps cash flow healthy. Overall, A/R automation, online payments, and proactive collections optimize how quickly businesses collect what they’re owed.

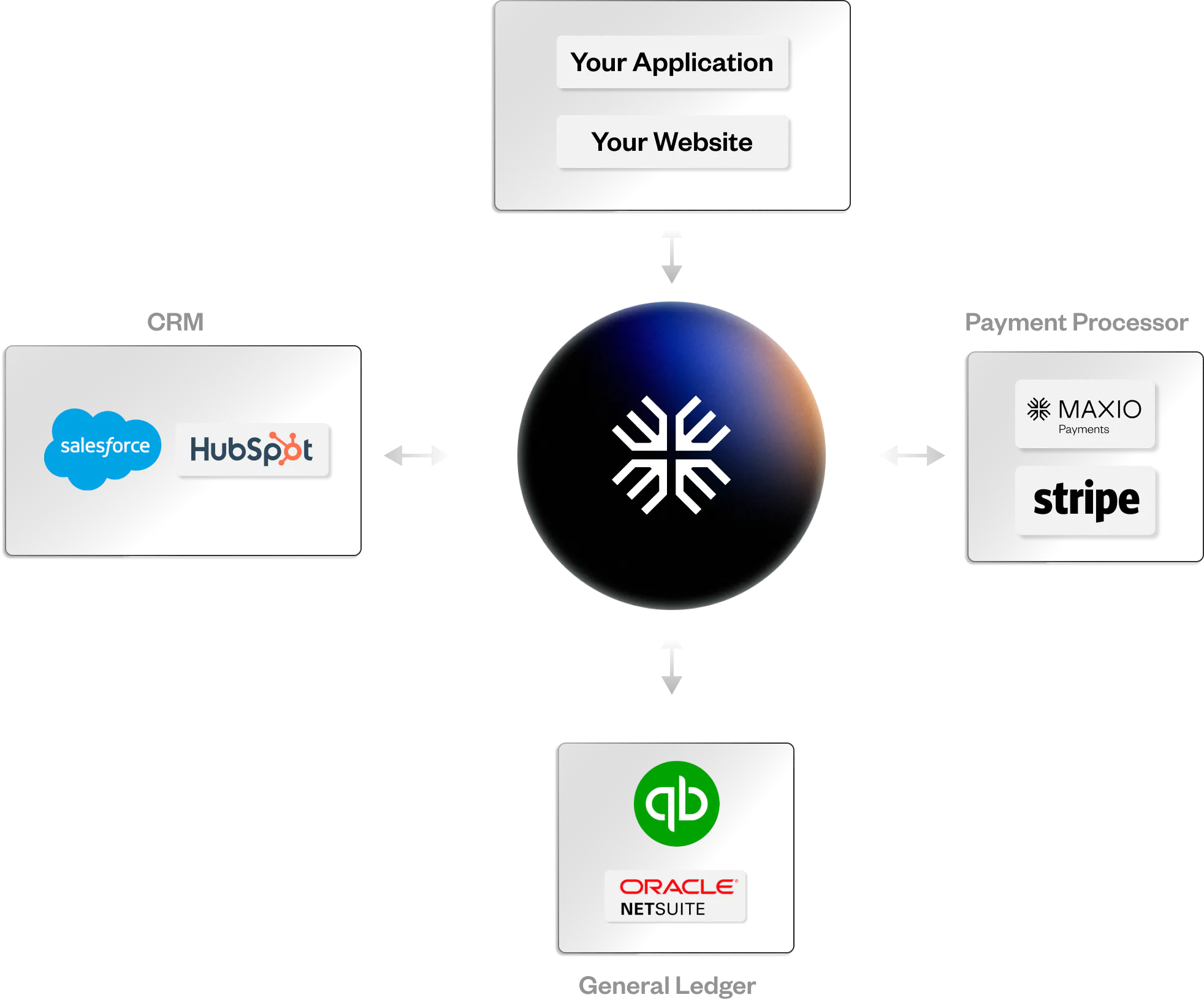

Integrate with Maxio

Maxio has native integrations to key finance accounting systems like QuickBooks, NetSuite, Sage Intacct, and Xero. Our platform also integrates with popular CRM systems to enhance your customer relationship management and streamline the order-to-cash process (like sales order in your CRM automatically triggering key finance workflows).

Maxio’s robust APIs facilitate seamless connectivity with various software solutions, ensuring efficient data flow and streamlined operations across your business ecosystem.

Automate accounts receivable. Get paid faster.

Ready to simplify your AR management process? Get a demo today and experience the future of AR management.