The Power of Product-Led Growth: Unlocking Innovation with Dave Boyce

April 3, 2024

Episode details

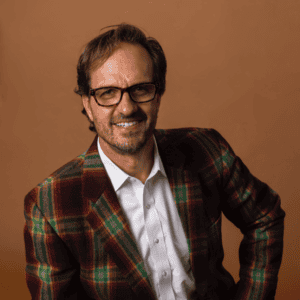

This week on the Expert Voices podcast, Randy Wootton, CEO of Maxio, speaks with Dave Boyce, Executive Chairman, Winning by Design. Dave shares his unique approach to career decisions, focusing on his need for challenging work that ensures personal growth and impact. This approach has shaped his strategies for businesses to adopt a customer-centric mindset that aligns the product with the user’s core needs, creating a successful PLG strategy. Dave and Randy discuss the framework required for a PLG model, identifying the mindset, talent, and timeline necessary for successful adoption, and how go-to-market strategies differ and can coexist in today’s business environment.

Links

Video transcript

Randy Wootton (00:04):

Well, hello, everybody. This is Randy Wootton, CEO of Maxio, and your host of SaaS Expert Voices, the podcast that brings the SaaS experts to you to help us understand where we are today and what’s happening tomorrow. I am delighted to have a friend and actual classmate join me, Dave Boyce. We’ve known each other for many years, but only have gotten to know each other really well in the last couple of years. It’s been a wonderful journey. In setting up this podcast, I had a chance to go back and look at Dave’s background, really impressive.

(00:33):

Started off as a strategy consultant, then focused on product and go-to-market. First company bought by Oracle. In fact, he’s a four-time CEO. He had three exits as an operator, two as a board member. He now operates as an investor and he’s the chairman of Winning by Design, which is just an extraordinary company for anybody who’s looking to figure out how to tune their go-to-market motions. He’s an author. We’ll share in the notes his Substack reference, and he’s written a bunch of articles. He’s got a book coming out on PLG in March 2025. And he’s got… I don’t know, was it four or five kids?

Dave Boyce (01:08):

Six kids, Randy. Six kids.

Randy Wootton (01:13):

Six kids. I just wondered, when do you sleep? This is an extraordinary career.

Dave Boyce (01:17):

You’re so nice. We only have one at home now. We’re getting old. I don’t know if you noticed. We’re getting old. All the Connecticut chaos is winding down and now we just have to deal with emotional support.

Randy Wootton (01:34):

Yeah, totally. With a little bit of financial support on the side as well, right? Everyone’s coming back. We’re getting old. You don’t have the gray hair that I do. You’re doing something right. One of the things about your background, I think as I bring people on and talk about their career journey and now you have had a career journey. Before we get to the topic of PLG, you had this really interesting comment in our pre-brief about how did you make the pivots that you did in your career? What was your guiding principle?

(02:03):

We don’t have to go through the whole career story, but it is a really interesting story. Strategy consultant, product go-to-market guy, early stage startup, sell to Oracle, hang out at Oracle for a while, run a couple other companies. What’s the common through line or golden thread?

Dave Boyce (02:19):

I’m working on codifying this in a way that maybe could help others, but for me, the thing that I know helps me stay the best version of myself is it has to be interesting. It has to be challenging. There has to be a non-zero chance of failure. That’s what keeps me going. And then, I have to really care about what I’m working on. I have to care about who I’m working with, what I’m working on. And then, like I say, it’s got to be interesting. I got to be gaining some skills or knowledge or something.

(02:51):

I know other people optimize for things like money, title, prestige. That just has never really done it for me. It didn’t have the holding power for me. I needed to optimize for just keeping in the game and being interested in what I was working on.

Randy Wootton (03:08):

Yeah. Similarly, I talked to people about setting up a forced rank list of their job satisfaction criteria. In each stage, there may be something different that you’re solving for. And the one for me that has continued to be number one for the last several career shifts I’ve made is interesting. Exactly. It’s intellectually stimulating. I call it operating at the edge of my own ignorance. Where am I going to go and learn something new? For example, leaving go-to-market where I’d been for 20 years and moving into the office of the CFO. It was like, I just don’t want to go have to do another MarTech startup or sit in the ad tech ghetto. It was like, let’s go jump into something else. I totally empathize with you.

(03:49):

I think the other piece which I would put as number two for me and guided which companies I’ve gone to is this idea of being able to make an impact on an industry, a team, and a company. And as you get more senior, you move from being a team to company, but you’ve clearly have been as an investor, making an impact on people as chairman of Winning by Design and the other companies you’ve been board members of and then just CEO gigs where you come in and you’re like, “Hey, this is going to be a problem that hasn’t been solved.” Working with a great group of people, that’s number three for me is actually do I like, respect, and trust the people that I work with.

(04:26):

I’ve left companies. I left Microsoft in part because that wasn’t true anymore. Yeah.

Dave Boyce (04:31):

I’m not afraid to say I left Oracle because of that.

Randy Wootton (04:36):

Don’t tell Satya or Larry.

Dave Boyce (04:38):

But I love that impact. It turns out when your eulogy is read, no one’s going to read a line about how much money you made, but there will be some lines about the impact that you made on the people around you, maybe even on the industries that you served, certainly on your relationships, contributions. All of that is impact stuff. It’s not earning stuff.

Randy Wootton (05:02):

A hundred percent. Well, to that point, and we’ll shift into the conversation today around PLG. It’s one of the areas that you were an early entrant into it. I’m catching up and you’re graciously providing a lot of background and context and help for me and my team as we think about PLG or the promise there. But maybe if you roll back the script a little bit and talk about what drew you to PLG, what was the first company you got involved with it and now it’s become an absolute passion for you? Can you talk a little bit about that as well?

Dave Boyce (05:30):

Yeah, for sure. And by the way, anyone who’s rolling up their sleeves on PLG right now is still in the top 1%. 99.9% of the companies on the planet were built not using a PLG go-to-market strategy.

Randy Wootton (05:46):

Maybe to that point, can you describe the difference? We were just throwing acronyms around, so product-led growth versus sales-led growth. Maybe set the context why this is new. I think you’re making us all feel good. It’s like AI. If you haven’t already built an AI company, you forget about it.

Dave Boyce (06:00):

Not too late. Yeah, no. Not too late.

Randy Wootton (06:02):

Was that two years ago? Okay, go ahead.

Dave Boyce (06:04):

I get asked this all the time. Product-led growth, I think I know what that means. And just in case, could you just explain it to me? I’ve gotten better at it to where my 16-year-old, the one that we have at home can explain it now. It is a product that sells itself. Think about Netflix or Amazon or Uber, all these products in your personal life, Instagram that you’ve learned to use without anyone selling it to you, without anyone installing it. Okay. And then, what about your business life? Slack, Zoom, Calendly.

Randy Wootton (06:49):

Grammarly.

Dave Boyce (06:50):

Grammarly, Figma, Canva. All these pieces of software that we also now use, Google Suite that we use in our business lives, that also have enterprise versions. But I may have just adopted it by myself with no help. And then, I may have gotten to a point where I said, “Oh, you know what? I actually do want to schedule multi-person meetings.” So, I’ll go to Calendly Pro or, “Oh, you know what? I actually do want to standardize this across my company.” So, I’ll go to an enterprise version of it, but I can start on an almost zero friction basis with nobody helping me, nobody teaching me how to do it. I don’t have to watch a training video. I don’t have to watch a demo. I just get into it.

(07:36):

The way we use software in our personal life and the way we use software in our business life is converging. And that whole strategy of product selling and deploying, helping you succeed on your own is called product-led growth.

Randy Wootton (07:49):

And that is in comparison to what would the other alternative be?

Dave Boyce (07:54):

Yeah. We talk about sales-led growth, the easy comparison. There’s lots of go-to-market models, but just to look at the two poles, it would be product-led growth and sales-led growth. Usually sales-led growth either starts with an outbound motion, meaning I identify my target customers. I go map who the target personas are within those ideal customer profile, target customers, and then I start to warm them up with marketing. Or I outbound into them, or both with phone calls, emails, etc.

(08:26):

Sales-led growth is an umbrella term that would include inbound marketing, meaning I put a lot of content out there, people find their way to me, but the call-to-action is not start now. That would be a product-led growth. Like, hey, just start using the product. It’s request a demo or talk to someone. And so, then that kicked off a human interaction.

Randy Wootton (08:46):

There’s a human interaction. Marketing works across both. How marketing strategies are developed, and we’ll get into this in terms of the types of metrics you’re looking at and how you measure the success of a PLG motion versus an SLG motion are different. One of the things I think about just on that topic, Slack. When I went to Rocket Fuel, I just come from Salesforce. At the time, Benioff had built out Chatter. He was talking about the social enterprise, and I thought it was a great idea and having Chatter attached to records and having everyone asynchronously be able to engage on opportunities and provide input, etc.

(09:26):

And I remember I was pushing really hard for the entire organization to adopt Chatter because the value is when you have the entire network and the engineers were using this thing called Slack. And I was like, “Slack, the hell is that?” No, we’re not going to do that. I’m not going to adopt another yet technology. Literally, they rebelled against me and said, “Well, we’re not adopting Chatter.” I was like, “You’re kidding me, right? We’re a public company. We’re going to do what I said.” They said no.

(09:50):

Maybe there’s something about, and Chatter really hasn’t taken off other than when you’re at Salesforce, everybody has to do Chatter, and then they went and bought Slack. I’m totally taking this off script, but what would be the distinction then between the success of Slack and this organic growth? You tell two friends, they tell two friends versus Chatter, and me being CEO and saying, “We’ve got a relationship with Salesforce, here’s an add-on that we want to do because it falls into this broader wall-to-wall experience with Salesforce.”

(10:20):

Because I do think there’s a nuance there. Go ahead. Maybe you have some thoughts on that.

Dave Boyce (10:26):

Great question. The easy way to talk about it and you framed it perfectly, teed me up, fat pitch right over the center of the plate.

Randy Wootton (10:32):

There you go.

Dave Boyce (10:34):

Bottom up versus top down. Top down, we’re used to. The first company that you mentioned that we sold to Oracle, our average annual contract value when we sold that company and it was a SaaS company, was $1.2 million. That means we had a few less than 1.2 and a few more than $1.2 million. That’s a top down sale. Has to be, has to be. You got to make a business case. You got to get financial sign off, business sign off. They have to believe that they’re going to benefit more than $1.2 million per year. If they’re going to sign a check for $1.2 million per year, that’s a top down. But Slack doesn’t require a business case. It’s bottom up.

(11:21):

One engineer, one team… not really one engineer. You need at least two people to speak with each other on Slack. One team at a time, then another team, and pretty soon it’s just meeting needs. It’s meeting people where they are. It’s solving their job to be done in a way that’s friction-free. And it’s almost impossible to stop when you get that right. Once you get that right and then it goes from user to user to user to user. And then, pretty soon, yeah. I’ve had the same experience and it was with Slack. How did this get into the company? Oh, well, I thought we were standardized on Microsoft. Except for Slack, we are.

Randy Wootton (12:02):

Yeah, it is mind boggling. We’ll get into that a little bit more, but this whole idea of, and I think the business model often associated with PLG is like a usage or consumption model versus an SLG is often like an annual contract. You can have people sign up with their credit cards and there’s a direct correlation between the usage and the value that you’re spending. Because the size of contract, it’s below the CFO, it’s probably below the controller. It’s some engineer putting it on their credit card, no one’s seeing it, and then it’s like a cancer. It just gets in and then it infects everything. I should come up with a better metaphor.

Dave Boyce (12:39):

Can I come back? I just want to pull on that thread a little bit. The question you asked, how did you get into this PLG? We sold that company to Oracle with $1.2 million average ACV. I stayed there for a while, to your point, until I decided it wasn’t for me. I left and joined a little five-person startup, and we rebranded, repositioned, did all the thing. Really felt like a startup.

Randy Wootton (13:02):

Was this Fundly?

Dave Boyce (13:05):

This was Fundly, yeah. This was called Fundly. That was the rebranded name. Our ACV was $1000, not $1,000,000, not $10,000, $1000. Several orders of magnitude smaller. We can’t pay a salesperson to sell a $1000 deal. You can barely even buy marketing to acquire a $1000 deal because it turns out I need to bring in more money than I spent every time I get a customer. I moved the company to Silicon Valley from Boston. In Silicon Valley, there was some stuff going on with Dropbox. Basecamp’s not there, but I was looking at Basecamp, Zendesk.

(13:51):

They were talking about I need to be under the expense account threshold where I can indeed use a credit card where a manager can make a decision on her own because it solves a problem for her. And I started thinking, “Okay, yeah, I’m under that threshold, 1000 bucks.” Now, how do I make it so easy to find and so easy to adopt and so easy to succeed with that I’ll entice someone to do something they didn’t plan on doing, which is virtually swipe a credit card in order to continue the benefits of the product.

Randy Wootton (14:25):

That’s great. We talk about SaaS, and a lot of people think SaaS is a business model. It’s actually a software delivery model that you’re moving from on-prem to software delivered in the cloud. It also though, with Mark Benioff and others, presuppose a type of subscription model. So, you move from CapEx to OpEx, and CFOs love that. I think PLG introduces this low threshold of payments that’s tied to value. And I think that also creates discipline in your marketing motion. It creates a discipline in the way you think about satisfying customers’ pain with your claim, the delivery of the capabilities, how you do fast iteration improvements. I think it’s this really dynamic constraint.

(15:16):

I’m mixing two metaphors, but you’ve got these constraints in terms of your business model and what you can afford to do, and that makes you super scrappy. It totally is in line with innovation, fast fail, rapid turn type motions.

Dave Boyce (15:31):

Just to continue on that for one second, every single customer on a PLG motion is a tenant at will.

Randy Wootton (15:39):

Correct.

Dave Boyce (15:40):

They can disappear anytime they want, like stop working for them. They’re out of there monthly. In the beginning, they’re not paying for anything, and a lot of these models start for free, either a free trial or freemium, they could be gone. If you don’t hit the right notes within their attention span, if they’re not experiencing what I call first impact within whatever their attention span is, and some of us have a very short attention span, they’re gone. They’re going to go look at result number two or result number three on their Google search and see if something else can do it for them, because clearly this one didn’t in five minutes or in 20 minutes or in an hour or in a day or however long they’re giving it.

(16:19):

And so, you see a lot of these solutions that in theory should be very, very complicated. An example I like to use is Bill.com. In theory, that should be very complicated. It’s accounts payable, it’s accounts receivable. It’s setting up a schedule of accounts. It’s authenticating for ACH or bill payment. There’s a lot of stuff in there. But I swear, the first time I used Bill.com, I was nervous about it. I was actually avoiding it. I don’t want to get lost in some complicated AP/AR solution. I swear I had an invoice out the door and my bank authenticated within 15 minutes.

(16:58):

And then, from there, I’ve done more. From there, you can build on, but getting that first experience, and then these tenants that will come back. And then, they come back again and then they run into some constraints that say, “Well, if you want to do that, that’s great, but we’re going to bump you up to the next tier.” At that point, I’m happy to pay for it because I’ve actually become dependent on it to solve problems in my life.

(17:23):

One of the key tenets about product-led growth is we’re going to seek to first create value and then extract value. Opposite order of what we do in sales-led growth where we try to convince someone that there will be value, but it’s going to come on the other side of you paying me money.

Randy Wootton (17:42):

And getting implemented and adopted, which again, for the large ERP solutions could take years. So, I think this idea, this focus on time to value. I used to describe it as get live in five. I have this incredible story when I was at Microsoft and we were launching what became Bing, it was Microsoft Search. I brought a customer in to give us feedback on the interface and the engineers at Microsoft, some of the smartest in the world. And they had created this super sophisticated targeting mechanism in how you picked your audiences. You did all these things and you had all these graphs. It was daunting. The UI and the UX was daunting.

(18:18):

The customer said, “Gosh, you don’t have any market share.” Google is super easy. I can get up and running in five minutes. I wouldn’t spend the time on your interface. And our engineers started arguing with the customer why they were wrong. I had to take the customer out of the room… excuse me. I had to take the engineers out of the room and say, “Wait, these guys are right and we need them to be strong advocates.” I think it was like the top SEM agency in the UK.

(18:42):

The Microsoft engineers were arguing because of that perspective, is we’re going to tell you what you need and we’re going to tell you how Windows should be and you’re going to get value over time. What’s interesting is we launched the product, didn’t get a lot of take-up, and then spent the next 18 months making Bing look like Google in terms of the interface.

Dave Boyce (19:02):

I did the same thing with Fundly. It’s like copying, that’s not beneath us. If there’s something up there working, let’s copy and then we’ll make it better from there.

Randy Wootton (19:11):

That’s great. More recently, this whole idea of amplification of B2B apps that everyone expects their B2B apps to work like their iPhone. So then, you have this discipline around UI and UX, which probably wasn’t as invested in with sales-led motions where you’ve got buffer of account managers, etc. You’ve got engineers who are building stuff because we think this is the way it should work. But there is this higher level of expectation to your point with people with short attention span, but also they’re like, “Look, I know there’s other apps out there that feel better, they look better, and it’s easier for me to get done what I need to get done.”

Dave Boyce (19:48):

Amen. The cool thing is it doesn’t have to be either or anymore. I know we’re talking about these two poles, but if you think about all the companies we named and plus some others, Dropbox, Canva, Calendly, Grammarly, Figma, Slack, zoom, these all have enterprise editions. You can start by yourself or with a team, but at some point, you’re going to get to a point where, like you did with Slack where you’re like, “Hey, what’s going on? Why do we have Slack everywhere?”

(20:21):

Some sales person’s going to have a conversation with you and say, “I bet you’d like to know which licenses you have, where, I bet you’d like to know something about usage. I bet you’d like to tie into some of our enterprise security features.” And you’re going to be like, “Well, it wasn’t my plan, but yeah, if we’re going to have it, we better have it right.”

Randy Wootton (20:37):

That’s right. Amen. And so, I think that was one of the questions that we were talking about at least when I started at Maxio, walked in my first day, first all-hands, and I kinda knew PLG, I kinda knew SLG. The distinction was lost on me. One of the people asked in the all-hands, “PLG or SLG, what’s the future?” I thought, “My gosh.” I don’t think it’s either or, but there is this debate of PLG versus SLG, but I think what you’re pointing out is a lot of companies may start PLG. They eventually evolve to an enterprise model where you do have a buying committee and a sales committee.

(21:10):

You do have different aspects of value that need to be articulated into a package and it probably moves to an annual contract. Maybe speak a little bit, do you think this dichotomy between PLG and SLG is false and that the world is really hybrid? How do you think about that?

Dave Boyce (21:29):

Yeah. The easy answer is yes, it’s a false dichotomy, but I need a big asterisk there because I’m going to run the PLG side of the company according to a certain set of metrics that tell me when things are working and when they’re not. When I look at SLG, I’m going to look at a different set of metrics that tell me when things are working and when they’re not. And then, the challenge is going to be to have those two-halves of the company work together. I can’t get mixed up and say, “Well, you didn’t have a six-month CAC payback, so that’s a terrible customer.”

(22:09):

Because on the SLG side, I actually may spend more to acquire a customer than six months’ worth of revenue, but I have much higher retention rates. The benchmarks are different. I can afford a 12-month CAC payback. I can’t apply PLG standards to SLG. Reverse is also true. I can’t require giant contracts out of the PLG customers because that’s just not the way they start. You’ll hear sales leaders say, “I don’t roll out of bed for less than $50,000 or $100,000,” or whatever. It’s like, yeah, okay, great.

(22:42):

On that side of the business, great. But on the PLG side of the business, we’ve actually hired the product to sell itself. If it comes in $1 more than it costs me to acquire them, we’re open for business.

Randy Wootton (22:55):

The unit cost economics being super clear. Because if you get it wrong in PLG, you can turn upside down. I think that your point, just framing it, is their segment-based approach in terms of your monetization strategy. And so, if you’re at an SMB level where customer’s willingness to pay is at 1000 bucks, your ability to deliver has to be at 990 bucks or less and all in. And so, how do you create systems, advertisement for Maxio, to help you understand the nuances and loading up costs? So, you’re getting the unit cost economics.

(23:30):

And then, I think the other thing is, the point that you’re making, I think a lot of salespeople and sales leader are afraid of PLG because they think, “Well, oh, the CEO is going to fall in love with PLG and they’re going to fire all the salespeople.” Instead, it’s the no, no, no, no. PLG is the funnel widener. As long as we can get more people in, start to build a brand building, how do you get people to know who you are? They get to try it, they have a great experience with it.

(23:53):

And then, at some point, they may buy. But even if they’re only paying to your point 10%, that’s probably an okay margin for you to make because of the potential to convert and grow those customers over time.

Dave Boyce (24:07):

We hold ourselves to a pretty high standard on both sides on a percentage basis. But I love the point that you just made about the funnel widener. This is the state of the art today. Have a bunch of companies, multi-billion dollar companies been built up in PLG? Yes. And of course, we know that most of the world was built up in SLG, but how do those things work together? That funnel widener concept is a really interesting thing. Hey, I got my net out there, lots of fish are swimming into it. Once in a while, a fish is going to swim into it that’s called Nabisco or Delta or GE.

(24:46):

When a fish like that gets in there, I’m okay with a team getting started on it, but at some point, I want to know it’s a target ICP and they’ve got some usage metrics that are interested. Now I want to kick it over for a sales conversation because just like you with Slack, somebody owns a bigger budget there. Somebody has a bigger agenda there, and somebody could sponsor a wider deployment. Now I want a salesperson talking to that account.

(25:13):

I don’t want these two sides of the business fighting against each other. I want them working together.

Randy Wootton (25:16):

A hundred percent. Yeah. Gosh, lots of stories you could go down. Given where we are, one of the things a lot of folks you’re talking about are going to be like, “Well, gosh, PLG, I understand broadly what it is, how it’s different than SLG.” Sounds like there’s a lot of work to be done, and your opening comment was only the 1% of the people are even really playing with it right now. Can you talk through your experiences both as an operator and as an investor in terms of the three phases of rolling out a PLG-type business, because it’s more than just self-serve instantiation?

(25:49):

And then, to your point around metrics, maybe we talk through the three phases and then we can talk about the key metrics that you are looking at to ensure that you’re getting it right.

Dave Boyce (26:00):

Cool. Now we’re talking to executives who are involved in sales-led businesses who are thinking about how might PLG relate to me and if I want it.

Randy Wootton (26:08):

And scared because we’re like, “Whoa, this looks really hairy and scary if we get it wrong, it’s a huge level of investment. I know I got to make the product more intuitive, so investing in UI, UX.” But it’s more than just a product thing. It’s this whole business thing.

Dave Boyce (26:26):

It is easier than you think. It can be fairly formulaic, but there are three really hard pills to swallow. One is mindset, one is talent, and one is timeline. And the timeline one just kills us. Mindset, like you just said, I’m going to get in an empathy and generosity mindset where I’m really, really simplifying down and meeting a customer right where she is. Okay, got it. And I’m going to put metrics into the product so that when she’s stumbling or not making her way through, I’ll know about that. I don’t have a human in the room anymore either selling or implementing or coaching or training.

(27:00):

That customer is on her own and I need to know when she’s having trouble. That’s all that UX. It’s empathy, generosity, and metrics help me get that user experience right. Okay, so that’s mindset. Might be hard for some companies, might not be hard for some companies. It’s really a thrilling problem to tackle in my opinion.

(27:16):

Talent is something that probably beyond the scope of this call, but we are going to need to dedicate humans to it. They can’t be anyone’s part-time job. We’re going to need to put humans on it who are very talented and they might be talented at their current job. They’re not going to do their current job anymore. They’re going to do this job and they’re not going to do it with half of their brain. They’re going to do it with all their brains. We’re going to actually have to carve some people off.

(27:37):

And then, timeline, that’s where it gets tough. You talked about the three phases. Each of those phases can be a yearlong, and that is discouraging. Everyone will say, “Well, how can I shorten it? And what if I already have a product and what if I already know my customer really well?” Okay, let’s have all that conversation. But you look at Canva, Figma, Twilio, they all took three, four, five years to get any meaningful ARR going that would get any executive-level sponsor excited about what they just teed off.

(28:11):

And so, in year two, you’re getting pretty nervous. You’re not seeing ARR. What are you seeing?

Randy Wootton (28:17):

What are the three phases?

Dave Boyce (28:18):

That begs the question, what are you seeing? In phase one, we’re going to go after product-market fit. We’re going to take whatever the use case is that our current product solves, and we’re going to reduce the aperture down to a subset of functionality that solve a specific use case for a specific end user that we think has the authority to go on her own behalf or on behalf of her team, go make a decision below the threshold purchase decision like we talked about. We don’t have to solve everything, just like Bill.com. We’re going to solve one thing in the-

Randy Wootton (28:53):

Just that focus, total alignment with something where there’s a lot of pain for an individual who’s willing to give you a shot. How do you measure that?

Dave Boyce (29:02):

We’re going to measure that based on 70% of new account starts achieving first impact within their attention span, and we’ll quantify that attention span. It might be 20 minutes. It might be an hour. It might be a week. It might be a month. But we’re going to say 70% of our new account starts achieve first impact, meaning they publish their first schedule or their first design, or they look at their first dashboard or whatever the thing is that our product does, and let’s say within one day. You’ve got your live by five or live in five. It’s basically that metric because why would I want to bring 1000 more new customers in if I know that half of them are going to fail?

(29:50):

I want 70% of them to succeed, then I can start focusing on the next thing, which is go to market fit. Now I’m looking for a scalable source of new customers to bring into this user experience where I know 70% are going to succeed. And that scalable source of new customers has got to be economic. I’m going to look for CAC payback. It’s an easy thing. Spend $1000 to acquire a customer, take six months to get that $1000 back, take nine months to get that $1000 back. I generally say I’d like a CAC payback of less than one year.

(30:26):

Now there are some industries where you can argue yourself that it’s higher or some that it’s lower, but the thing I love about CAC payback is you’re not speculating about what might happen six years from now because you’re assuming a 90% retention rate and a 90% gross margin.

Randy Wootton (30:42):

Meaning like the LTV to CAC ratio where people are throwing the gross margin and churn in and you’re like, “But really?” You haven’t even been in business a year and you’re saying your customers are going to be there for 10 years. It’s a misassumption. But back to the product-market fit we were talking earlier, I love this 70% of new users achieve first impact, time to value, and forcing to improve that. I even know as an SLG company, we are really focused on that because we’re talking about in comparison to ERPs, which takes months to get up and running. We can get up running in weeks, but for a PLG motion, we’d have to be able to do it in days, to your point, to keep their attention.

(31:20):

You did talk about one other metric, which was the usage retention curve flattening out. Can you talk a little bit about how that’s another indicator of product-market fit?

Dave Boyce (31:30):

Yeah, it takes a little longer to track this. Percentage of new accounts achieving first impact within days or weeks, that takes days or weeks to measure. Usage retention, I’m actually going to measure how often are they coming back and hitting features or logging into the product and achieving impact over time. And a percentage of my customers on day one, it’s 100%. Then it’s going to go to, let’s say 70% are going to get through that first impact before they lose interest. And then, what happens after that? Does it go 50, 30, 10 to zero? And that whole cohort dies?

(32:08):

Or does it flatten off where after one month, I still have 65% and after two months, I still have 64%? And after 10 months, I still have 64%? I want that retention curve to flatten out, which tells me, “Okay, out of the 100 people I brought in, 64 of them actually ended up getting long-term value.” And since we know recurring revenue is a function of recurring impact, I’m now in a really good spot.

Randy Wootton (32:36):

I’ve heard people talk about that in terms of daily average users or monthly average users breaking it out by modules in the product and seeing how people are using it. That then means you have to instrument your product, or do you have some best practices in terms of what technologies people should try to integrate into their application or how to design the application to be able to get those product metrics, product usage metrics, which are going to be different than the financial metrics? The CFO is reporting on the financial statements.

Dave Boyce (33:08):

We’re going to go get Mixpanel or Pendo Analytics or Amplitude or even Google Analytics. Google Analytics is more for a web-based product. If we’re right in the product, we’re going to use one of those other things. The key events along the customer journey life cycle that we want to measure, those at the very least need to be tagged so that I can track a customer journey. Engineers will want to tag everything, that’s fine, and put it all into a big data lake and let your analysts loose.

(33:43):

But at the very least, I need to know things like daily active, weekly active, monthly active usership. I need to have defined what that means. It’s not just a login. It’s actually hitting a core feature. That means my core features have to be tagged. These things are pretty easy. Now, all those platforms I just mentioned, once you tag them, they’ll visualize everything and show you cohorted customer journeys to where your team can now optimize.

Randy Wootton (34:11):

Yeah, I think of that great article that we probably read back in business school 100 years ago, but staple yourself to an order. And how do you think about the information flow, the interaction between customer and, in my world, I usually use is an employee of how they’re getting people up and running. But in this case, it’s information flow, customer interaction with product. How does it simplify? How do you automate it? How do you identify, I think to your point, these key moments of delight where they got something up and running? They get the credit card up and going. Whoa, that worked. Then number two, they launched the invoice to your point in less than 15 minutes in business.

(34:48):

And then, you get your first summary of billing for all your customers at month one. You’re like, “Oh my gosh, this is the greatest thing in the world.” And then, six month trend reports. It’s all these little moments of where the customer, they’re either doing something and it seems… or frictionless or as frictionless as possible. Or they’re being delighted by the way they’re being invited through the product and the experience that you’ve created for them.

Dave Boyce (35:15):

For those of us that are used to running enterprise products, this has got to be simple. We’re probably going to hide a bunch of the power of our platform in the beginning so that we can help that customer be delighted in their initial introduction.

Randy Wootton (35:29):

Yeah, I think that’s one of the things that’s super interesting about being at Maxio. Two companies have been around for 12 years each, about 2400 customers bring two platforms together. It’s a huge surface area product. You’re like, “Well, we can never make that PLG-ish because everybody wants to do this.” But I think to your point, I don’t know, maybe you come out with a sub-brand or you call it Maxio Lite, but what it does is just these things really well. Maybe it’s cash management. And then, from that, you have this logical way for people to add additional capabilities that get lit up or they get turned on through feature flags.

Dave Boyce (36:03):

Amazing.

Randy Wootton (36:03):

It’s like how do you get into the head of the ICP and the persona and understand what is the most critical problem that they’re wrestling with that if you’re able to provide a solution that’s super low cost that delights them is going to get them into your net?

Dave Boyce (36:20):

I cannot improve on that.

Randy Wootton (36:23):

Well, I read all your stuff, so I’m just playing it back for you. Okay, so we talked about product-market fit. We’ve talked about go-to-market fit. The two dimensions on that is scalable source of new customers and CAC payback less than 12 months. Was there a metric that you were thinking in terms of what captures? Do you have enough new customers in your SAM to continue the investment?

Dave Boyce (36:44):

Yes. That would be an analytic exercise, totally. SAM, for sure. Depending on how I’m acquiring these customers, let’s say I’m getting them all. I’m in the Android app store. Okay, great. Well, that’s going to define how many customers you have access to or I’m in the Salesforce marketplace. Okay, got it. Well, that’s going to define, or I’m an English language only, US currency only, whatever for mid-market customers. Okay, that’s great. There’s some percentage of those that would… oh, and I’m acquiring via AdWords. Okay, well, I know something about AdWord auctions. I know something about where I’m going to run out of juice. I’m sorry, I’m not going to pay $1000 a click.

Randy Wootton (37:32):

You have your efficient frontier. You’re getting down to your return on ad spend and all that thing.

Dave Boyce (37:38):

All that stuff. However I define that, yes, I need a scalable source of potential customers that can come through on a unit economic basis that will deliver a CAC payback of less than 12 months.

Randy Wootton (37:50):

Awesome. And so, now we move to the third phase, which is the scale phase, and just now it starts to feel a little bit more SLG. Can you talk a little bit about the broad buckets of metrics that you’re using at that point to have a viable business unit?

Dave Boyce (38:04):

At this point, it feels like SaaS. All of us who are used to running companies we’re like, “Oh yeah, I recognize a growth model,” like a growth model that is driven by bookings, renewals, and expansions. But you know what? That growth model is really important, and this is where I think the office of the CFO and any go-to-market function should be just hand in glove. I need to understand that growth model. I need to understand which portions of that growth are dependent on new customer acquisition and then where’s that going to come from, which portions are dependent on renewals and where’s that going to come from? And so, that gets to our segmented GTM if we have two separate ones.

(38:45):

And then, which portions are going to come from expansion? And by the way, if I’ve got a self-service GTM, that’s landing SMB customers, I might be able to acquire them more rapidly and more cheaply. I might be able to retain them a little bit less well, and I might be able to expand them not very much at all. And the inverse might be true for my sales led. It might cost me way more to acquire a customer, but they’re going to retain better and they’re going to have expansion on the backend, because I’m landing small and expanding within an enterprise.

(39:17):

I just need to understand that, and then I’ll just measure that as a CFO and a GTM leader.

Randy Wootton (39:22):

Yeah, I think that’s where you start to get into the MRR roll forward. You get into your customer cohort analysis, being able to look at by date, by region, by segment, and really understand the ARR build and churn, contraction and expansion and what’s working, what’s not. We’re going to wrap up in just a couple minutes. One thing that struck me when you talked about, I really loved it, the mindset, talent, and timeline as a framework for thinking about the business. I’m reminded of the McKinsey model, the Horizon one, two, and three model. And that as a business, as you’re trying to figure out the next act, you have to be able to do more portfolio management.

(40:00):

And depending on for revenue this year, there could be a set of things you’re betting on. Horizon two, they’re going to come in the next 12 to 18 months, and then Horizon three are the set of things that are going to potentially change your entire business, but they’re not going to pay off for the next three years. Even in my budget and talking with my team and then with the board, it’s like, “Here’s a couple of the horizon three bets.” PLG would be one of those. It’s falling into that.

(40:25):

What is the appropriate level of investment for year one of a three-year payoff? In your experience as companies like ours that are a little bit bigger, Series C, Series D, so we can carve off and have dedicated focus and capacity, what’s the biggest challenge you run into coaching CEOs about no, no, no. It’s a horizon three bet. You got to keep it ring-fenced. They’re not measured on revenue. They’re measured on a number of customers adopting and time to live and those things. What’s been the biggest challenge you found trying to make that case?

Dave Boyce (40:57):

Yeah, it’s just getting that timeframe. Just like you said, it’s just that timeframe like, “Hey, I made this bet 12 months ago, where is my return?” You say, “Well, here’s your return. It’s in usage retention.” And they’re like, “Sorry, that doesn’t pay the bills.”

Randy Wootton (41:12):

That’s right.

Dave Boyce (41:13):

We need to set that up upfront. It’s not a huge, I mean, this is five people. They’re talented people. It’s painful to pull them out of the places, but it’s five people that I need to protect. And then, I need to be willing to let them work on this for three years. Now I need to hold them accountable to product-market fit metrics, and then I need to hold them accountable to go-to-market fit metrics, after which I’m probably seeing ARR show up in a way that I like. But I love your… I forgot about that. I’m going to start using that, that Horizon three investment mentality is going to help a lot.

Randy Wootton (41:49):

Oh, I think so. We did this at Maxio. We had this payments business unit, and it was the exact same thing as how do we ring-fence a group of people? It was a small group of folks. They’ve been working on it for a year, dedicated and committed, and we reported on it separately. Guess what? It’s working and it’s now starting to generate some ARR, but it’s not going to pay the bills at the end of the day. Now we need to invest in how do we get that attached to every customer? How do we get that attached to every new prospect?

(42:14):

But we got it over that initial hump of the Horizon three. We had no experience there. We hired some people to come in and do it. At one point, we were like, “Well, I don’t know if we can make this work on a profit basis.” It was really interesting. But that’s where the executive team should be spending the majority of their time, I think, is on reinventing the business.

Dave Boyce (42:34):

I would love to just double down that. I know we’re wrapping up. I’d just love to speak to the CFOs that I think is your core audience. Just related to PLG, we are building a flywheel. We’re not looking for acts of heroics. A heroic salesperson can drag a $3 million deal in the back door on day 365 of the year and save our quarter. Okay, fine. We’re not looking for that. We’re looking for a flywheel repeatable processes. A flywheel is a piece of a machine, like a weighted wheel that once you get it spinning is very hard to stop. That’s what we’re trying to build. These are not big deals, but they come in reliably. We’re programming it into the product itself. So that usage actually drives more, and then it gets bigger and bigger.

(43:27):

The metrics that I’m going to look at in year two, I need to become convinced if I’m A CFO, which means I need to understand it a little bit that I’m building flywheel metrics. And then, in year two when I’m looking at go-to-market efficiency, I want to be convinced that that’s repeatable and standard, and I’m building a flywheel. Then in your three to your point, when the revenue comes, it’s going to come in a reliable day after day, week after week. When I built Fundly in my first PLG company, it was a complete mind blow for me.

(44:01):

I could wake up in the morning and check the logs and see new customers.

Randy Wootton (44:08):

Like the Promised Land.

Dave Boyce (44:09):

And then, to know where revenue was, I had to go check the logs and nobody knew. It’s not like a salesperson had talked to them, it’s just people had found their way in and they had monetized on their own. I was like, “Wow, this is amazing. If I can get this thing to scale, we’re golden.”

Randy Wootton (44:28):

Oh, man. Great. We’re going to close with the speed round. The speed round, the three components. What’s your favorite metric? What’s your favorite book other than your own, and is there an influencer out there that you like to track? So, favorite metric, as you think about all the metrics we’ve talked about, what do you think is the number one key to success maybe just for getting PLG up and running?

Dave Boyce (44:47):

I think I gave it away already, but I really like CAC payback. It’s cash on cash metric, and you don’t have to-

Randy Wootton (44:53):

It forces discipline in terms of how do you bring things together. You can even roll that into an MPV and think about, “Hey, we’re going to make this investment versus other investments.” And when are you get the return? So, I think there’s a little bit of CAC payback.

Dave Boyce (45:09):

it’s a no-nonsense version. Yeah.

Randy Wootton (45:11):

Favorite book?

Dave Boyce (45:13):

Well, my favorite business book is a book by Clay Christensen called Competing with Luck.

Randy Wootton (45:18):

Oh, I haven’t read that one. Oh, okay.

Dave Boyce (45:21):

Or Competing Against Luck. It carries forward a lot of his theories around the Innovator’s Dilemma and the Innovator Solution, so it repeats a lot of that in the beginning. But then it really gets into this concept of job to be done, really understanding the problem that you’re solving. And it breaks down some of our previously held notions about customer segmentation. It’s really more about understanding the job. Anyway, that’s a great book. I love it.

Randy Wootton (45:46):

Awesome. It’s my favorite part. I get to learn about new books.

Dave Boyce (45:50):

I’m sure you know Playing to Win. That’s my number two. I love that book too.

Randy Wootton (45:55):

Playing to Win, my favorite story about this is, when I went to Salesforce, there was a guy there. Oh, did you do Playing to Win at Deloitte? Is that how you got exposed to it in Monitor?

Dave Boyce (46:04):

Yeah, Monitor. I knew Roger Martin at Monitor. Yeah.

Randy Wootton (46:07):

Oh yeah. Pavel Zamudio-Ramirez was one of the top dudes at Monitor. They had built this process about Playing to Win, which is a strategy book. And they had done it at Monitor, got bought by Deloitte. Pavel Zamudio-Ramirez came over to Salesforce with my boss. Honestly, God, I had this… my entire life in the business sector has been like, “Well, I’m not strategic enough. I don’t know how to do strategy, and if you want to be a CEO, I got to do strategy.” Playing to Win was just incredibly powerful experience in terms of how to lay out strategy across those five questions.

(46:38):

I’ve used it at four companies now. It has been really transformational in terms of, one, me framing strategy for the board, and number two is bringing a team together to rally around how you think about those different questions in an ongoing conversation.

Dave Boyce (46:53):

It’s a great book. Amazing.

Randy Wootton (46:55):

Last one for you, influencers, people, just one, that you think everyone should be getting up in the morning and either listening to on a podcast or reading their stuff on LinkedIn.

Dave Boyce (47:04):

Oh, boy. I’ll tell you, I’m a fan boy of some authors, but I don’t really follow them on LinkedIn or podcasts. I really like Jonathan Haidt. He’s a psychologist and he’s got multiple books. I don’t know how active he is on social, but anything that he publishes, I read because it really helps me understand how to be a human and how to interact with other humans.

Randy Wootton (47:28):

Wow. Well, on that, I’m going to have to go find him too. Dude, you just added six books to my stack of books on my bedside table. But as always, Dave, it’s been a great pleasure to chat, really have enjoyed and appreciated all that you’ve shared and look forward to working with you in the future.

Dave Boyce (47:44):

Amazing. Thank you, brother.