Summer 2023 Product Webinar

Are you Enterprise Ready? You Should Be.

On this webinar, we shared how Maxio’s new (and some not-so-new) features support your FinOps needs today while preparing your for tomorrow.

This webinar has already aired, but you can check out the highlights below!

Summer 2023 Feature Release

On our recent product release webinar, we discussed what it means to be “enterprise ready,” and how Maxio’s newest features will support your FinOps needs today while preparing you for tomorrow.

We showcased several new features, including:

- Multi-entity reporting

- FX gain/loss

- Enhanced Advanced Subscription Momentum report

- Other reporting upgrades

- Milestone-based projects and Salesforce projects trigger enhancements

- NetSuite integration enhancements

Our Chief Product Officer, Barrow Hamilton, also teased some of our upcoming product releases and answered attendees’ questions about current and future Maxio features.

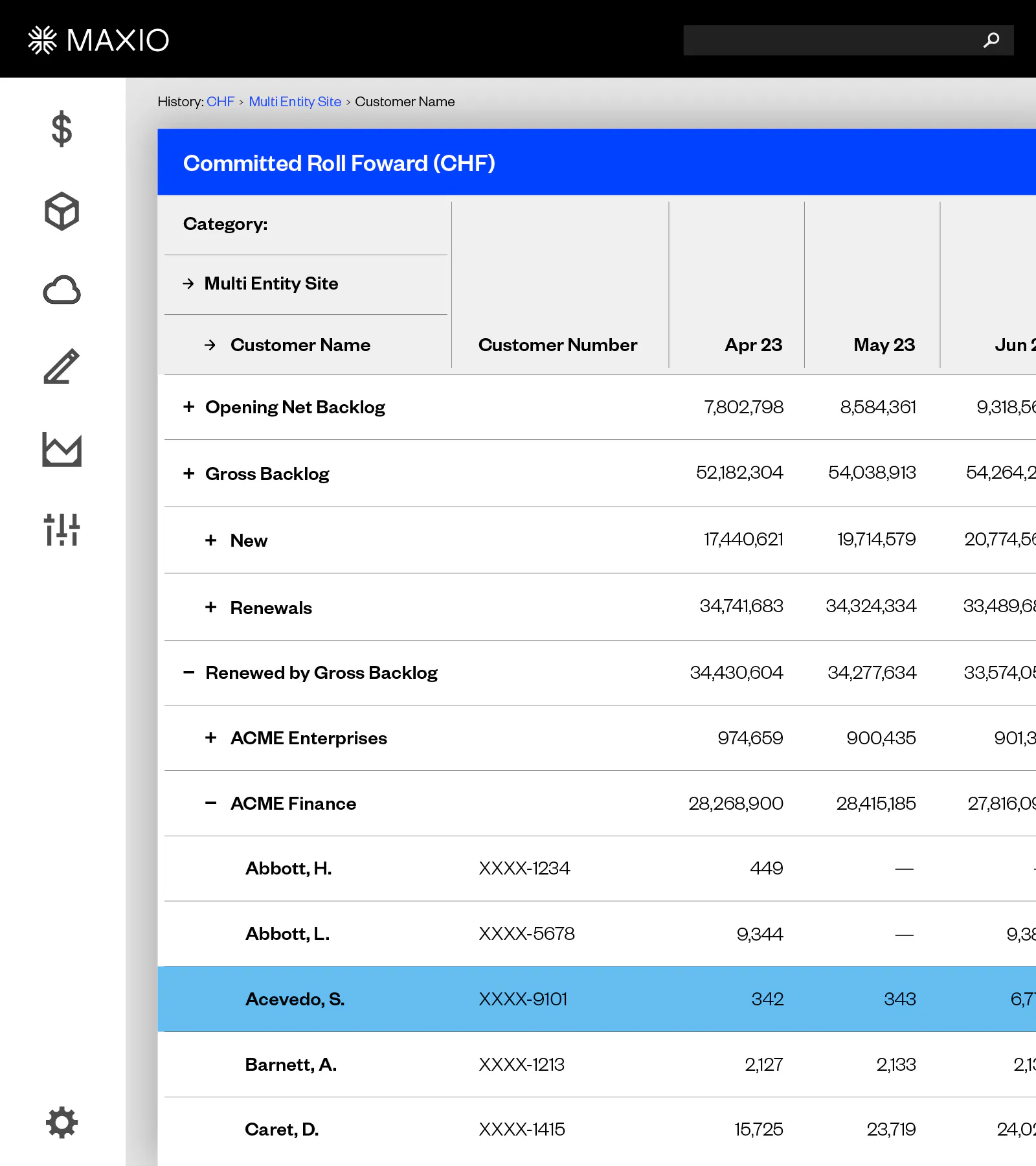

Multi-entity reporting

Multi-site reporting has come to two of our most popular reports, Advanced Subscription Momentum and A/R Aging. This functionality is building on the work we released last year, which allowed reporting currency conversion as well as foreign exchange segmentation on some of your favorite metrics.

FX gain/loss

In addition to the cumulative translation adjustment segmentation available in our Advanced Revenue Summary report, our customers need to be able to segment out noise related to FX movements from their data.

We’re pleased to announce segmentation of FX gain/loss in our payment summary report for unrealized and realized FX gain/loss. And this allows users to see their true economic movement versus what may be chalked up to macro changes in the FX market, while also adhering to ASC-830 for GAAP purposes.

Enhanced Advanced Subscription Momentum Report

Net dollar retention is a critical SaaS metric for those in high growth mode, as segmenting which customers you’re retaining in your growth numbers gives a more appropriate picture of your metrics. So, we’ve added a new section for net dollar retention to the Advanced Subscription Momentum report.

This update allows your board of directors and investors to see granular movements.

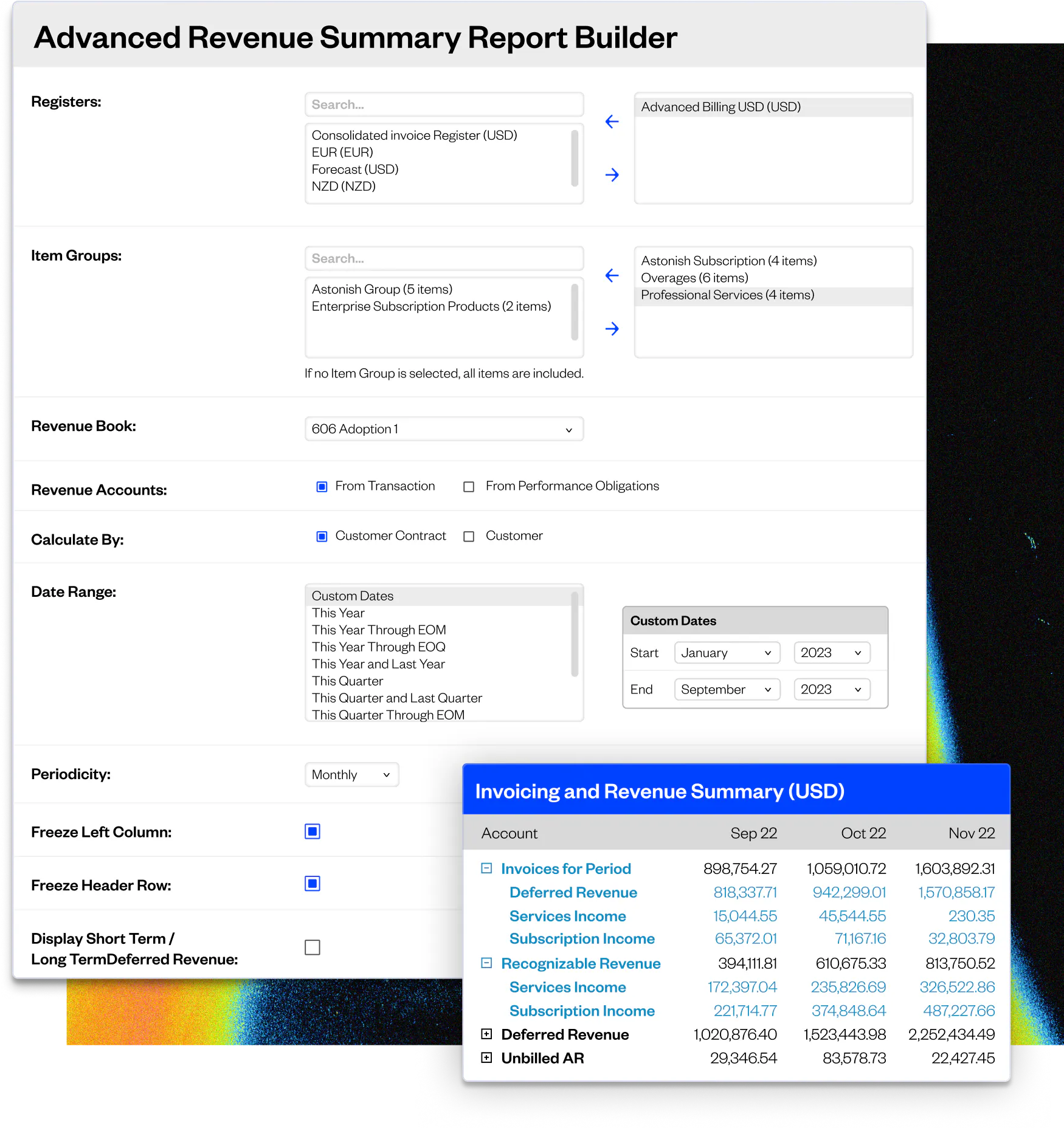

Reporting upgrades

You can now generate reports up to 80% faster. Multi-select fields allow you to enjoy bulk selections for report detail sections. And freeze panes offer an Excel-like user experience, allowing you to freeze the first column or row in each report for better readability.

We’ve increased the detail columns on both the DSO and A/R aging reports, which allows a much more granular view for any of your dunning efforts, net dollar attention, as well as the segmentation of FX gain/loss and CTA.

Milestone-based projects and Salesforce projects triggers

Milestones are configurable markers that correlate with specified contract events in Maxio. When marked complete, milestones fire actions that trigger required invoicing, revenue recognition, and subscription dates.

Projects track milestone-based billing and revenue recognition events triggered by actual milestones achieved during a project or an implementation. This keeps implementations from falling through the cracks, and keeps you from having to manually review the contract once the project is complete.

Additionally, automated Salesforce project triggers allow you to manage projects in either Salesforce or Maxio. Previously, team managers had to connect with the finance team to update projects. Now they can do it themselves directly within Salesforce. Tracking projects, notifying the finance team, and following up, are now done one step—right from where you work best.

NetSuite integration enhancements

Maxio’s NetSuite integration is a bi-directional, highly customizable solution for growing businesses. It ensures our customers have critical financial information when and where they need it.

We’ve made a number of improvements to this integration, including the ability to send items and deposits to NetSuite, automatically add currencies to NetSuite customer records, and several custom mapping additions.

What’s next?

We’re continuously developing Maxio to better meet the needs of growing SaaS businesses. Here’s a sneak peak of our product roadmap.

While you’re always free to process payments through one of our payment partners, our recent release of Maxio Payments allows you to further automate your order-to-cash process by integrating reconciliation directly with all the great reports Maxio has to offer. Process payments in the same platform that you use to invoice, recognize revenue, report on financial data, and sync to your general ledger.

Maxio Payments is available to customers now, and we are continuing to enhance this capability in 2023.

Maxio’s developer tools save you time by enabling your engineers to quickly and easily integrate your web applications with our platform. Improving these tools continues to be a big focus for us moving into 2023 as we roll out additional SDKs to make your customers’ billing experience even better.

Part of the value of Maxio is the ability to push Maxio data into other critical business systems (and vice versa). In 2023, we’ll continue to make Maxio data more actionable and accessible, including the exploration of integrations with Business Intelligence and data visualization tools.

Finally, we’re continuing to enhance the breadth of integrations we currently offer.

In addition to the previously-mentioned updates to our Salesforce and NetSuite integrations, we are enhancing our integrations with QuickBooks, Xero, HubSpot, and more to help facilitate the business processes you need to work seamlessly between Maxio and your other critical applications.

Get a customized demo to see how Maxio will help you:

- Streamline your order-to-cash process

- Reduce churn and stop revenue leakage

- Get cash in the door faster

- Drive strategic decisions with real-time SaaS metrics and analytics