What is Deferred Revenue in SaaS?

Deferred Revenue (also known as “deferred income”) is a specific aspect of the larger Revenue Recognition Principle and an accounting method for reporting revenues received before delivering goods and/or services. The method of allocation and the period of time for reporting are determined by the application of rules, guidelines, and findings from organizations like the Financial Accounting Standards Board (FASB) and the SEC.

Deferred revenue is applicable anytime a customer makes an advance payment for goods or services that will be delivered at a future date. Rent payments and retainers are two common examples of prepayments that constitute deferred income for a small business or other organization. However, deferred income is also a key category on the financial statements of SaaS and subscription-based businesses with pricing models that require customers to pay for prepaid expenses in exchange for ongoing services.

Why is deferred revenue important?

Deferred revenue is especially important for business owners and FinOps managers of subscription-based SaaS companies, especially those that offer annual subscriptions.

Deferred revenue is a balance sheet liability account. When a company receives sales revenue for goods or services that will be provided at a future date, it’s recorded as a debit to its cash or accounts receivable account and as a credit to the deferred revenue account. This reflects the fact that the revenue is not yet earned revenue, and that the company still has to provide the products or services at a future date.

Deferred revenue is equal to the value of invoices to date over the recognizable revenue to date calculated by customer contract and then aggregated and reported in summary form. Because deferred revenue is an item on a company’s balance sheet, it is always calculated at a point in time.

Note if the calculation for a contract produces a negative number, the value is included in Unbilled AR, a balance sheet current asset.

What is deferred revenue?

In a nutshell, deferred revenue is an accounting principle whereby revenues from a contract are recognized over time as the services performed.

For example, you sign a 12-month, $12,000 contract with a customer and the customer pays the invoice in full, upfront. You recognize the revenue as soon as the invoice goes out the door. You should typically recognize pieces of revenue over time as you perform the service.

In our simple example, how much revenue would we recognize after a month? Well, this is easy. 12-month contract, $12,000. So after month one, we’d recognize about a thousand dollars in revenue and the remaining $11K would be put into a current liability account sometimes called unearned revenue.

Is deferred revenue a liability?

Now, we know what you’re thinking. You’re thinking “A liability? Shouldn’t it be an asset, especially if I already got paid upfront?” Nope. And accrual accounting (the exchange of cash) is largely disconnected from your revenue recognition.

Your revenue recognition is all about your performance obligations, and 11 months of unearned income that’s already been received means you have promises to keep. If you’ve only delivered 1/12th of the service to your customer, you still are on the hook for the other 11/12ths. So, yes, deferred revenue can be a long-term liability.

Revenue Recognition Policy Template

Auditors require lots of documentation to ensure accuracy. Having a solid revenue recognition policy in place is the first step toward ensuring compliance.

How do you calculate deferred revenue?

Deferred revenue can be calculated as follows:

Total Invoices for All Contract Elements for a Single Contract – Total Recognizable Revenue for All Contract Elements of a Single Contract = Deferred Revenue

An easy rule of thumb, or perhaps another way of saying the same thing, would be to look at it his way:

Deferred revenue = What’s been invoiced – What’s been recognized

Now it is accounting, so there are exceptions in gray areas and landmines and prison shanking and swarms of locusts. But that rule should keep you straight. Note that, if the calculation for a contract produces a negative number, the value is included in unbilled AR; a balance sheet current asset.

Examples of deferred revenue

Let’s look at two examples to illustrate how deferred revenue for a subscription is impacted by invoicing differences and how these differences impact a subscription-based company’s bookkeeping/income statements:

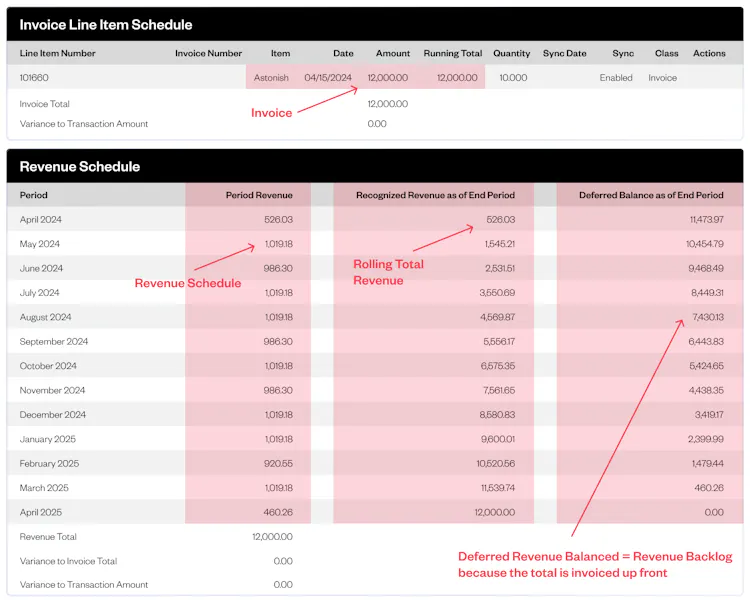

Example subscription #1

In this image, there is an invoicing schedule with one record and a revenue recognition schedule with a record for each month of revenue recognition over the term. In use is the proper daily amortization schedule following generally accepted accounting principles (GAAP).

Period Revenue is the revenue schedule by month, Note that April 2014 is approximately 1/2 the other months because the start date is April 15.

Recognized revenue as of the end period is the rolling total of revenue recognized as of the end of that month.

“Deferred revenue balance as of the end of the period” is the last column. This displays the value as of the last day of the month. If the schedule were shown in daily records, the deferred revenue balance would be $12,000 as of April 15 and would decline by an equal amount until April 30, where the balance would be $11,473.97, the first row in the revenue schedule table below.

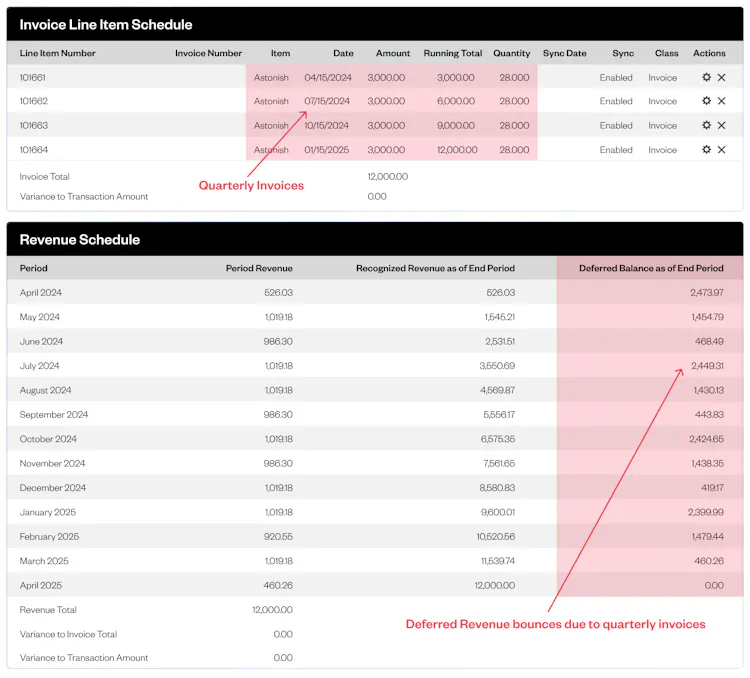

Example subscription #2

n this example, the only change is that the invoicing is quarterly over the term. The value and dates of the subscription are identical. A one-year $12,000 subscription has an order date of April 1, 2014, a subscription start date and revenue start date of April 15, 2014, and a subscription end date and revenue end date of April 14, 2015.

In the revenue schedule table, the values in columns 1, 2, and 3 are identical to that in Example 1 above. The last column, “deferred balance as of the end period,” is different. Here you can clearly see the impact of invoicing on deferred revenue. Notice how the value at the end of the period bounces up and down, with peaks in the months where there is an invoice.

Easily manage deferred revenue across all clients

Most situations in these examples seem easy enough, but this is only one customer. When you start scaling to hundreds or even thousands of customers and you factor in those pesky exceptions and landmines we just talked about, keeping track of deferred revenue becomes very difficult and error-prone.

At Maxio, we do these complex calculations at scale. So you don’t have to worry about a botched Excel sheet or inaccurate metrics. Get a demo to learn more about how you can simplify your revenue recognition and cash flow management at scale.

Revenue Recognition Policy Template

Auditors require lots of documentation to ensure accuracy. Having a solid revenue recognition policy in place is the first step toward ensuring compliance.