Multi-Currency Accounting Software

Global business expansion, minus the complexity

Maxio helps you manage multi-currency invoicing, reporting, and currency management with accuracy and ease as you expand into new markets.

Multi-currency software makes global expansion easier

Easily bill and accept payments in over 150 currencies, making international financial transactions straightforward and stress-free.

Up-to-date exchange rates

Stay accurate with real-time exchange rate updates that eliminate manual tracking and keep your data current.

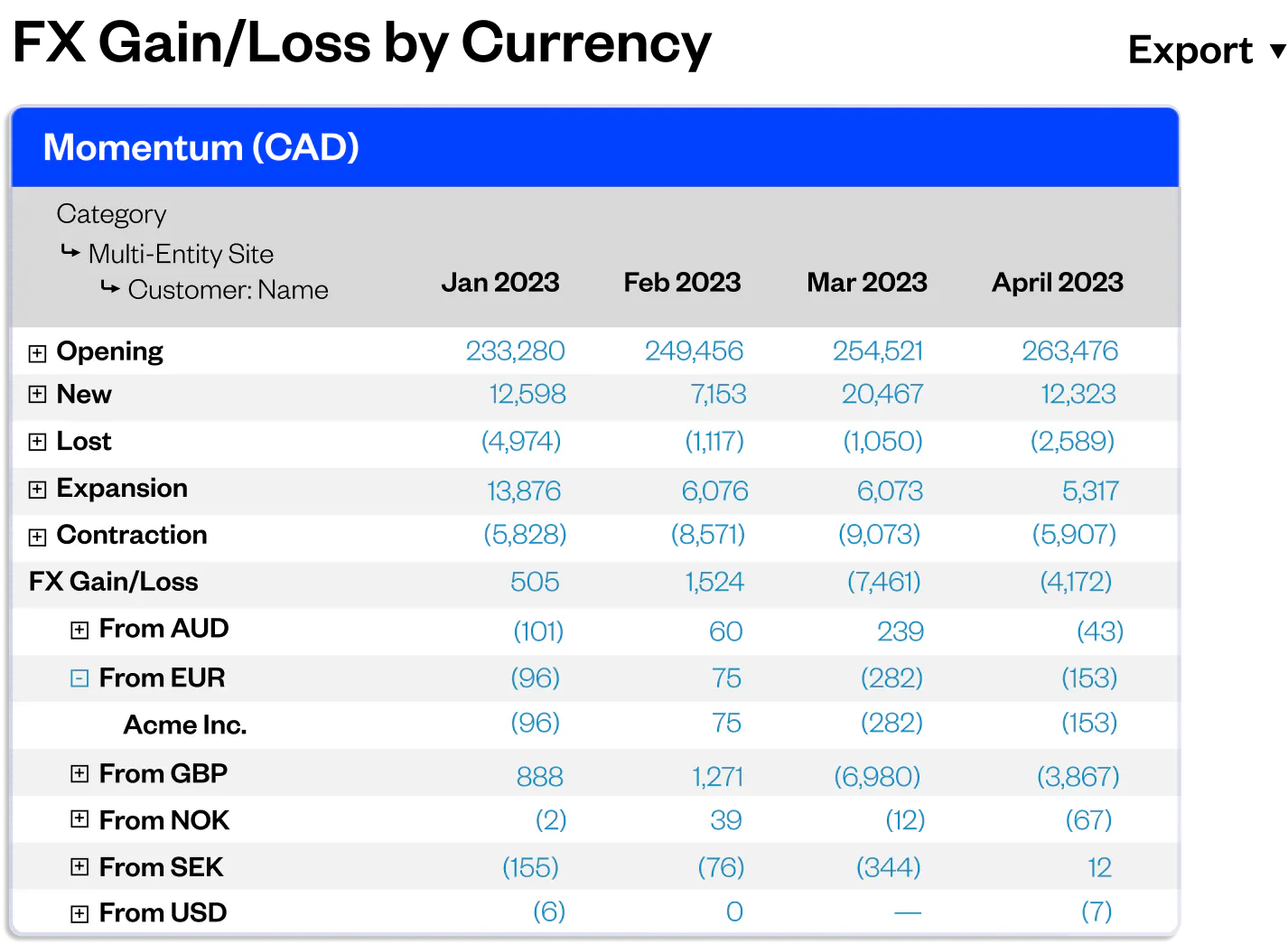

Consolidated financial reporting

Combine financial data across currencies into clear, consolidated reports, enabling real-time visibility into global revenue and performance metrics.

Automatic currency conversion

Handle international transactions effortlessly with automatic currency conversions, which reduce errors and save time.

Key features of Maxio’s multi-currency accounting solution

Invoice customers in their local currency

Maxio supports over 150 different currencies. Whether you’re billing across borders or scaling into new regions, your customers get a seamless local experience while you stay in control of your revenue operations.

Automate exchange rate accuracy

Expanding internationally isn’t simple, especially when currency exchange rates are constantly shifting. Maxio automates foreign exchange calculations to streamline invoicing and help protect your cash flow.

Consolidate reporting with real-time insights

Managing financial activity across various currencies can create complexity for your finance team. Maxio consolidates your data into a clear, unified view so your team can track performance and create accurate financial statements with ease.

Accurate financial reporting and currency conversion

After invoicing in other currencies, you still need accurate reporting in your base currency for reliable financial management. Maxio converts each transaction in real time using reliable SaaS reporting tools, ensuring accurate consolidation without manual steps or delays.

Multi-currency accounting software FAQ

Multi-currency accounting allows businesses to record, track, and report financial transactions in different currencies. This functionality is especially important for companies that operate internationally or serve customers across multiple regions. It ensures that every invoice, payment, and report reflects the correct currency values, both at the transaction level and in the company’s base currency.

With multi-currency accounting, finance teams can comply with reporting requirements and produce accurate balance sheets, even as exchange rates and currency fluctuations impact daily operations.

Multi-currency accounting software helps businesses keep bookkeeping organized and accurate when working with different currencies. Instead of relying on manual updates or external tools to track exchange rates, your finance team can manage conversions automatically within the system.

This reduces errors, improves reporting accuracy, and saves time on currency-related tasks. It also makes it easier to maintain accurate records in your base currency, even when you’re billing or receiving payments internationally. With less manual effort, your team can stay focused on financial management while supporting growth across regions.

Additionally, for businesses with automated recurring billing, multi-currency support reduces the risk of billing errors over time and keeps subscription cycles running smoothly across currencies.

The best multi-currency accounting software depends on the size of your business and the complexity of your financial operations. Choosing the right solution means understanding how your team handles invoicing, reporting, and currency conversion today, and what you’ll need as your business grows.

Small businesses often need a solution that’s easy to use and supports basic invoicing, pricing in local currencies, and simple currency conversion. Meanwhile, larger companies with multiple entities or complex reporting needs often require a more robust accounting system with features like customizable reporting and ERP integration support.

Maxio is built to support both small teams and large finance departments, offering the flexibility to manage multi-currency workflows with SaaS billing software that scales as your business grows.

Many accounting platforms offer some level of foreign currency support, but the depth and automation vary. Tools like QuickBooks Online and Xero offer basic multi-currency support, but their capabilities are limited when it comes to real-time exchange rates and advanced reporting.

Maxio stands out by combining multi-currency invoicing, reporting, and real-time foreign exchange updates with subscription billing software designed specifically for SaaS businesses. If you’re managing international customers, multi-currency transactions, or accounts across providers, Maxio gives you the functionality and automation needed to stay accurate and efficient.