If it feels like you see the term “ASC 606,” everywhere you look, it’s probably because you do.

The clock is ticking for private companies as the FASB has mandated that 606 must be adopted by December 15, 2020, to maintain GAAP/IFRS-15 compliance. Depending on your business processes, though, this could have a minimal or significant impact on your day-to-day business operations.

In a recent webinar, Senior Maxio Product Manager and current CPA Jon Cochrane broke down three practical steps you can take to achieve 606 compliance.

According to a poll conducted during the webinar, 43% of respondents said they had complex revenue recognition in their businesses, including carve-outs, re-allocations, etc.

Step 1: Write a Revenue Policy to ensure ASC 606 Compliance

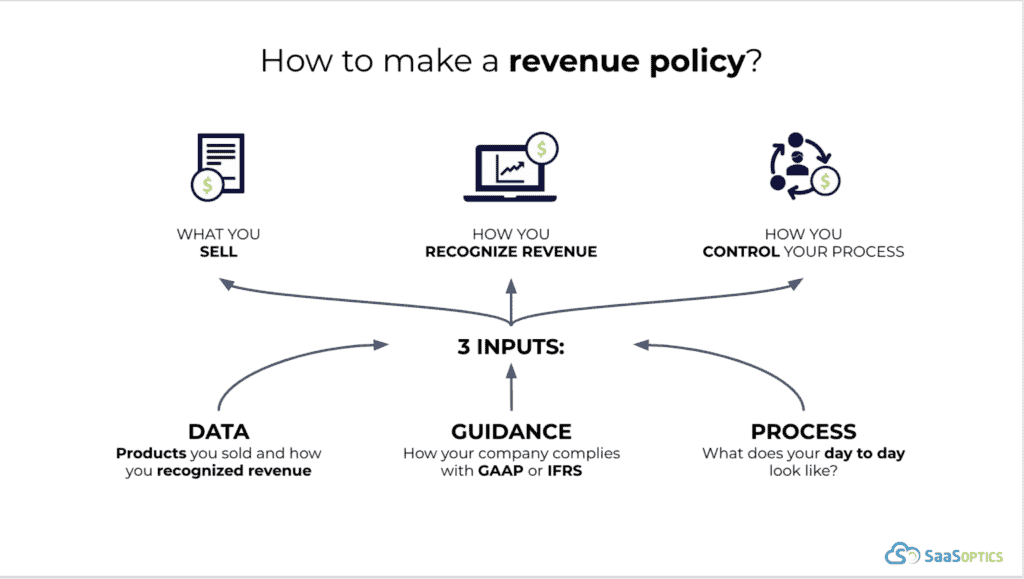

The first step toward adopting 606 is to write a revenue recognition policy. The idea here is that most of 606 adoption boils down to having clear and consistent documentation in place around revenue recognition practices in your business.

There are three inputs you’ll need to include in your revenue recognition policy:

- Data (Products you sold and how you recognize revenue)

- Guidance (How your company complies with GAAP and IFRS-15)

- Process (What does it look like on a day to day basis)

Understanding the data (should be) easy enough if you’re managing your sales orders through a CRM; it’s the guidance and process aspects that may prove to be tricky.

To help you get started on crafting and implementing a policy, Maxio offers a free revenue recognition policy template that you can download and adapt to your business.

Step 2: Wrangle Your Data

Remember when we said getting your data should be the easy part? Well, in theory, it should be. But we understand that’s not always the case.

If it feels like you see the term “ASC 606,” everywhere you look, it’s probably because you do.

The clock is ticking for private companies as the FASB has mandated that 606 must be adopted by December 15, 2020, to maintain GAAP/IFRS-15 compliance. Depending on your business processes, though, this could have a minimal or significant impact on your day-to-day business operations.

In a recent webinar, Senior Maxio Product Manager and current CPA Jon Cochrane broke down three practical steps you can take to achieve 606 compliance.

According to a poll conducted during the webinar, 43% of respondents said they had complex revenue recognition in their businesses, including carve-outs, re-allocations, etc.

Step 1: Write a Revenue Policy to ensure ASC 606 Compliance

The first step toward adopting 606 is to write a revenue recognition policy. We covered this in greater detail in another blog post, but the idea here is that most of 606 adoption boils down to having clear and consistent documentation in place around revenue recognition practices in your business.

There are three inputs you’ll need to include in your revenue recognition policy:

- Data (Products you sold and how you recognize revenue)

- Guidance (How your company complies with GAAP and IFRS-15)

- Process (What does it look like on a day to day basis)

Understanding the data (should be) easy enough if you’re managing your sales orders through a CRM; it’s the guidance and process aspects that may prove to be tricky.

To help you get started on crafting and implementing a policy, Maxio offers a free revenue recognition policy template that you can download and adapt to your business.

Step 2: Wrangle Your Data

Remember when we said getting your data should be the easy part? Well, in theory, it should be. But we understand that’s not always the case.

To “wrangle your data” properly, you’ll need to understand what was sold (from your CRM), but you’ll also need to know how revenue was recognized as well as what the deferred revenue and unbilled AR balances are at the date you want to adopt ASC 606.

For a comprehensive list of SaaS accounting terms and their definitions, visit SaaSpedia.

In addition to answering questions about what you sold and your revenue position at any point in time, you’ll also need to understand the following:

- Sales & Revenue history With details by Customer, Contract, and Item to help you determine your Standalone Selling Price or SSP

- Legal terms and conditions A representative sample of promises that you made to customers and the rights your customers have to help you determine your Performance Obligations

HINT: our rev rec policy template gives practical language and guidance on how you can bring all these things together)

Step 3: Implement a System to maintain ASC-606 Compliance

The reality is that you can have the best process documentation and data in place and still fail to maintain compliance because you don’t have an accurate and reliable way to consistently apply ASC-606 standards to revenue recognition in your business.

A few things to keep in mind when evaluating systems that help you maintain 606 compliance are:

- Can it handle complex revenue calculations where the sales price does not equal the SSP?

- How long will it take to implement?

- If anything changes in your business, how will it affect your contract populations and allocation rules?

The Good News

The good news is that Maxio can do all of those things. We can ensure you have everything you need to achieve and maintain ASC 606 compliance in a single, easy-to-use platform that you can be up and running within a matter of weeks.

Got complex revenue recognition issues? Talk to a Maxio Solutions Consultant today.