I knew Maxio needed to move to an ERP system just a few months after I joined as VP of Finance.

Having integrated various ERPs over my past 7 years in fast-growth companies, I knew an improvement was needed. Pressure from our investors and internal leadership was intensifying daily as Maxio rapidly expanded, demanding more robust financial tracking capabilities.

With five total entities, including two international entities, to consolidate; I faced serious headaches without a unified system tying everything together seamlessly. It also became clear to me that our lean accounting team needed tighter controls and separation of duties. I was also managing an inefficient, error-prone process of relying on Excel for financial consolidation and reporting.

If we wanted to scale, we needed to switch from QuickBooks to an integrated ERP platform like NetSuite.

My hope is that by the end of this article, you’ll understand exactly how we were able to migrate to NetSuite in just 8 weeks keeping Maxio, our own product, as our order to cash and revenue subledger. Having Maxio in place through the transition from QuickBooks to NetSuite allowed us to streamline the implementation and saved us hundreds of hours (and even more dollars).

Here’s what the process looked like.

The challenges of switching to an ERP

First, we had to take into account all of the challenges we would face if we wanted to switch to an ERP platform like NetSuite. After all, transitioning to something as comprehensive as an ERP platform certainly doesn’t come without growing pains.

Implementing an enterprise-level system like NetSuite requires cash, surpassing the costs of our previous QuickBooks setup. The financial investment of implementing was not as high as it could have been since we of course kept Maxio. An ERP migration would also demand substantial time before we went live so we had to wait until we were out of audit season to free up our team. We chose to utilize standard NS functionality vs customizing, saving additional time .

With NetSuite touching so many critical business functions in one integrated system, our accounting team grappled with the unknown at times. Since we chose to keep Maxio, our team only had a learning curve as it related to the NetSuite application. We did not have to plan for revenue recognition configuration because it was already in Maxio. We only had to consider reporting changes and training our people on a handful of processes in NetSuite.

An ERP doesn’t bend easily to your existing workflows; it asks you to transform processes to fit the software’s design. We had an expert guiding us, but we chose to not customize and keep NS and Maxio standard functionality. Keeping standard functionality helped us go-live faster and more efficiently. We also faced some initial data migration headaches getting historical information structured properly within NetSuite, and mapping our QuickBooks data into a new GL structure to assist with our reporting designs.

Once we laid out all of the challenges, we were ready to get to work. But we needed to figure out the right order of operations when it came to building our tech stack – this meant implementing an ERP before an FP&A solution.

Why we implemented an ERP before an FP&A solution

With pressures mounting from leadership and investors, I had to be pragmatic about our order of operations. As much as I valued adding a full-fledged FP&A tool for financial planning and analysis, getting our underlying financial actuals in order took priority.

Relying on Excel projections and models wasn’t sustainable from accuracy and productivity standpoints as Maxio grew. However, the lack of reliable, consolidated actuals and reporting from our disjointed QuickBooks/Excel setup posed a bigger impediment day-to-day. We couldn’t confidently forecast anything without real-time visibility across our business units.

Moving to NetSuite provided that missing foundation, giving me the confidence that our reporting was audit-ready and scalable before layering on an FP&A tool.

The best practices that enabled our 8-week ERP launch

Given Maxio’s relative speed in transitioning to NetSuite, I’m often asked how we made it happen without derailing normal business operations. While it wasn’t an easy process by any means, it really boiled down to these four steps:

Securing executive sponsorship

Securing executive alignment early in the process was by far the most vital to our ERP success.

Unlike other software rollouts that just impact one department, transitioning our financial system would affect almost everyone, and I knew that getting leadership support from heads of Customer Success, Sales, and Product was integral before we even selected NetSuite. Their teams would bear the burden of integrations and process changes too. Rather than going at it alone, I actively solicited executive input during vendor selection.

Once we kicked off the migration, our executive steering committee met bi-weekly to align on the timeline, resources, and milestones. Having regular touchpoints for guidance, oversight, and course corrections helped us avoid any potential roadblocks we might face during the migration.

Creating a detailed project plan

Once all our executives were on the same page, our next vital step was creating a comprehensive project plan. Our plan considered key players from Finance, Customer Success, Product, IT, and our expert implementation consultant.

We defined guiding requirements, mapped existing workflows, and identified improvement areas. We also partnered on visualizing our ideal future solution before setting firm milestones. Getting granular on which modules would take priority, our desired configuration, which integrations were essential from the start, and what could get phased in later kept everyone grounded in reality over the 8 weeks.

The Finance & Accounting team developed our full project timeline encompassing risk/dependency management, resourcing/budget, test scenarios, contingency protocols, etc. With my past experience, we were able to develop an aggressive but attainable timeline in line with Maxio’s culture, capabilities, and bandwidth.

This kind of meticulous scoping and project orientation we pursued ultimately helped us prevent scope creep down the line. It also granted us the flexibility to adapt since all teams participated in plotting the course. If you plan on pursuing any kind of cross-functional software rollout, this step is a must.

Defining the target chart of accounts architecture

With finance leading the charge on our ERP selection and rollout, we knew upfront that aligning on foundational elements like our chart of accounts (COA) framework was non-negotiable. Given Maxio’s growth trajectory, we needed our chart of accounts and accounting structural decisions to scale all the way from the early stage to future IPO readiness.

Our CFO had already done a lot of research and analysis to design Maxio’s future state COA before I joined. I did have an opportunity to review this based on my past experience and made a few minor adjustments. One thing to consider is to ensure each segment of your COA has one purpose. For example, do not mix departmental use or location within a natural account. We got granular on new segments and reporting needs from FP&A while ensuring historical continuity for trend analysis. We also sized up ancillary accounting needs around billing, fixed assets, planning modules, etc. to shape the scope. Ultimately, we realigned our COA to balance sophisticated enterprise scalability with intuitive usability for our current needs.

Resourcing accordingly with internal talent and external experts

Once we had our COA structure figured out, we could pursue the rest of the migration – this meant finding the right blend of internal and external talent to assist with the implementation. As eager as my team was to tackle the NetSuite implementation themselves, the platform’s technical intricacy surpassed our current skill levels. Rather than attempting to upskill them on the fly amidst an aggressive rollout, we took a blended staffing approach.

From a resourcing lens, I relied heavily on a NetSuite implementation expert our CFO had partnered with previously. Her breadth of platform expertise and implementation experience proved invaluable from the planning through the testing stages. Leaning on a seasoned consultant also allowed my accounting managers to focus wholly on data migration, configuration reviews, and training.

Once our consultant was onboarded and ready, we formed a team that was cross-trained across integrated modules like Maxio billing, Salesforce data syncs, and other core Maxio components. Keep in mind, our consultant had not used Maxio in the past and we had to partner up with a Maxio implementation manager. Our team worked through issues together during working sessions so the could fast track the learning curve.

Ultimately, combining the skills of an experienced consultant and the knowledge of our in-house team is what allowed us to roll out an ERP like NetSuite at such a rapid pace.

Our 8-week NetSuite migration playbook

Our highly accelerated 8-week NetSuite rollout could seem improbable to some. However, our success actually stemmed from diligent governance, resourcing, and upfront vision setting.

Here is the playbook I would use if I had to implement NetSuite all over again:

1. Garner executive alignment

We gained executive sponsorship across Finance, Customer Success, and Product during our initial software selection.

Getting leadership support from department heads who would be impacted by this implementation was essential for ensuring a smooth rollout. We actively shared with executives a vision of what our business would like after implementing NetSuite.

Once the project was agreed upon, our executive steering committee met bi-weekly to align on the implementation’s timeline, resources, and milestones.

2. Conduct rigorous pre-planning

Before we started, we scoped an aggressive 8-week project timeline encompassing milestones, risks/dependencies, and modules in focus for the phase 1 launch.

I assembled key players within Finance and Implementation to complete scoping and envisioning workshops that would help us determine which modules needed to be prioritized during our launch. Together we defined guiding requirements, mapped existing workflows, and identified improvement areas while visualizing the ideal future solution.

3. Migrate general ledger data

We had to convert around 24 months of general ledger history from QuickBooks into NetSuite for continuity.

We chose two styles of converted data. For one year, we converted balances only. For the most recent year of conversion, since we converted mid-year, we converted transactions. While reconfiguring our chart of accounts for growth, we considered future analytics needs and added new reporting segments. However, we ensured that our key accounts tied to historical trend data remained intact through the migration. Converting historical transactions into this new COA framework helped us prevent any disruptive gaps in our GL data.

4. Allot 4 weeks to testing

We allocated a full month to running transaction testing for standard workflows between the Maxio and NetSuite systems. Resolving workflow kinks prior to launch enabled us to focus wholly on adoption. As you plot out your own implementation plan, allotting additional time to test your workflows is crucial if you want to ensure your data syncs are reliable and to prevent any disruptions down the line.

Within this testing was another conversion of Maxio data into NetSuite. Once we converted our open transitions into NetSuite, we had to compare this against QuickBooks to ensure all our data came over in the conversion.

5. QBO cutover and go-live

Once we were about two months into our implementation, we transitioned all finance transactions from QuickBooks directly into our new NetSuite modules. While the first month-end close was challenging, as typical for ERPs, our systems were now unified. While we are still making ongoing improvements, we were able to reach operational continuity faster by addressing all our systems’ critical workflows prior to full utilization.

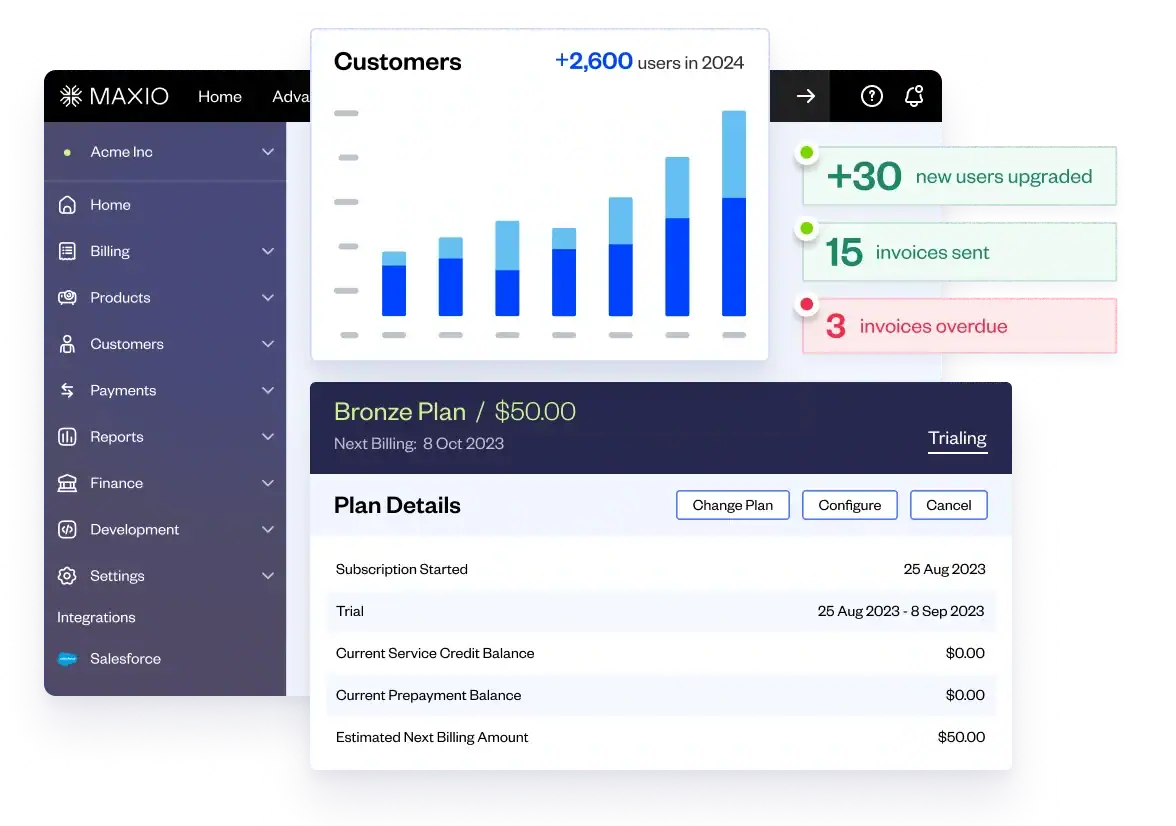

Streamline your NetSuite implementation with Maxio

At Maxio, we like to use the phrase, “we drink our own champagne,” when talking about how our own product helps us manage critical finance and accounting tasks – and that includes implementing an ERP like NetSuite. By leveraging our own integration with NetSuite, we were able to save countless hours and dollars to make the transition as smooth as possible.

There are multiple other ways our Maxio + NetSuite integration can help your finance team stop chasing dollars and focus on what’s next:

- GAAP-compliant revenue recognition

- Invoice scheduling and highly customizable e-invoicing

- Milestone-based revenue and invoice management

- Out-of-the-box subscription metrics and analytics

- Accounts receivables and collections management

Click here to learn more about the Maxio + NetSuite integration.