Imagine steering a ship with only your hunch to guide you, in the dark heart of the ocean. That’s almost the same as running your SaaS business without an effective financial model. Perplexing, right? It’s time to illuminate your course.

Every year, over countless SaaS businesses are launched, yet 65% of new startups fail during the first ten years, a bitter truth that could often be attributed to poor financial planning. Your SaaS business is anything but a quick sprint; it’s more like a marathon that requires the strategic management of your monetary resources to thrive and survive in this digital ocean.

On the crest of scaling your SaaS business? Let’s light your way to victory by digging into the dos and don’ts behind effective financial modeling.

Mastering SaaS revenue forecasting: the key to predictable growth

Here’s the TLDR of what we’ll cover in this section:

- A foundational understanding of SaaS revenue forecasting concepts

- The steps to design a substantial SaaS revenue forecast

Understanding the basics of SaaS revenue forecasting

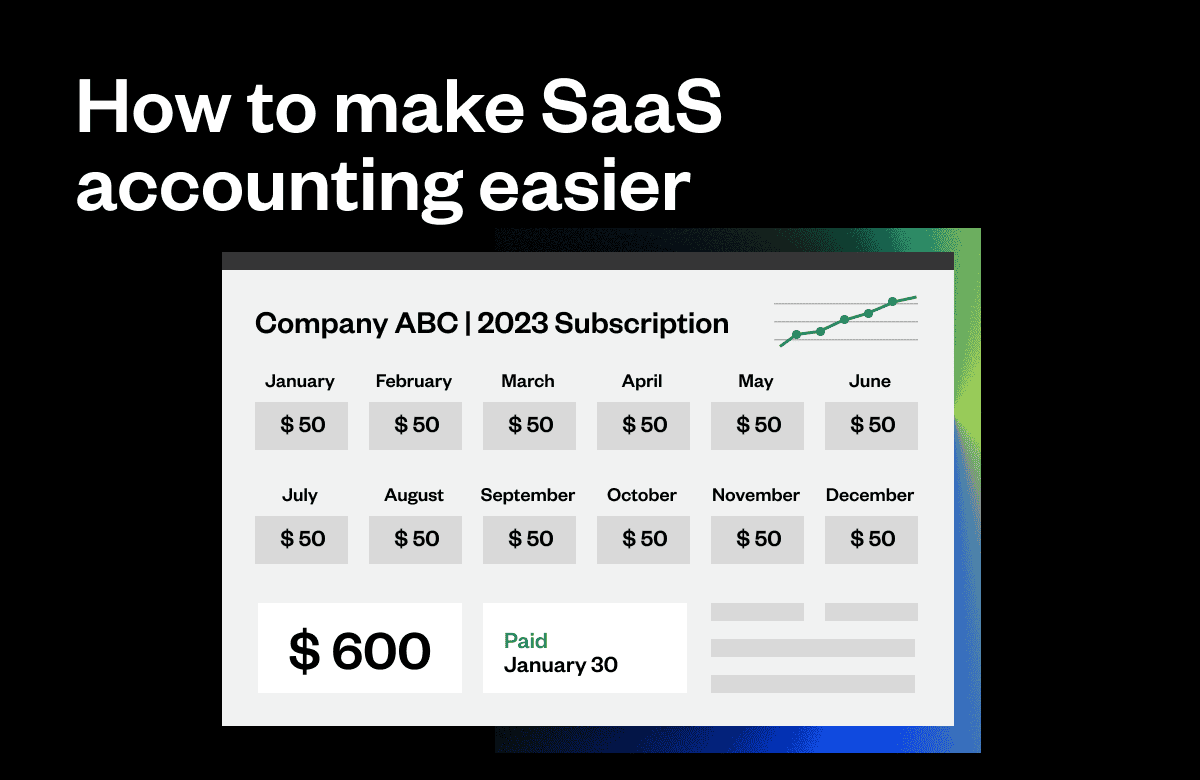

Revenue forecasting is the lifeline of any SaaS business. It serves as a roadmap to your enterprise’s monetary future, enabling you to prepare for potential financial pitfalls and explore lucrative opportunities. SaaS revenue forecasting differs from forecasting traditional business models due to the recurring nature of revenue in SaaS. In short, accrual accounting, upsells, downgrades, renewals, sales-negotiated contracts all make revenue forecasting more complex for SaaS companies.

When done right, revenue forecasting helps to keep SaaS companies financially healthy by guiding decisions about scaling the business, managing cash flows, and long-term strategic planning. It’s a bedrock of knowledge for any SaaS business in the growth stage or aspiring to scale to the next level.

A step-by-step guide to creating a robust SaaS revenue forecast

To create an effective SaaS revenue forecast, first, you need to calculate your Monthly Recurring Revenue (MRR). This is the predictable and calculable income that a SaaS business can count on every 30 days. You can then multiply this number by twelve to get a rough estimate of your annual recurring revenue (ARR) – excluding any fluctuations cause by churn, upsells, and downgrades of course.

Next, you should identify your churn rate – the percentage of your customers who are leaving over a certain period. A lower churn rate indicates that your company holds onto most of its customers, which is beneficial for forecasting stability. Not only does this correlate with revenue growth and a higher customer lifetime value, but it’s one of the key metrics that VCs analyze when determine the valuation of a SaaS business.

Lastly, you should consider the growth rate of your new MRR. This can indicate the potential average revenue of your product in the market.

By applying mathematical forecasting models to this data, you can anticipate future monthly recurring revenue, growth rates, churn rates, and the overall future growth of your business. This might appear as a daunting task, but leveraging the right tools and techniques simplifies this process substantially.

SaaS unit economics: the foundation of your financial model

SaaS unit economics form a critical core of any SaaS startup’s financial model. As the financial backbone, unit economics demonstrate not only how profitable each customer can be but also hint at a business’s long-term financial health. It’s the tiny threads weaving together to form the financial tapestry of your SaaS business.

SaaS unit economics metrics help outline the anticipated cost to acquire customers (CAC), the expected lifetime value of a customer (LTV), and the rate at which customers churn.

The significance of these SaaS metrics isn’t solely in their numerical values but in what they symbolize about your business’s health and future. They provide clarity around the state of your company’s financials, and can make it easier to conduct financial forecasts and adjust your business plan as needed.

A quick dive into key SaaS unit economics metrics

In SaaS, the battle isn’t won simply by understanding the role of unit economics; one must also be well-versed in maneuvering its calculation. There are three essential metrics: Customer Acquisition Cost (CAC), Customer Lifetime Value (LTV), and Customer Churn rate.

Let’s dissect each:

Calculating customer acquisition cost (CAC)

CAC represents the average cost of acquiring a single customer.

Determining customer lifetime value (LTV)

LTV is the total revenue a company can expect from a single customer over the duration of their relationship.

Understanding Churn Rate

The churn rate, also known as the rate of attrition, refers to the percentage of subscribers to a service who discontinue their subscriptions within a given time period.

Accounting for cost of goods sold (COGs)

In SaaS businesses, Cogs refers to the direct costs attributable to producing and delivering subscription services to customers. Tracking COGs allows SaaS companies to determine their gross margin. As subscription revenue grows, the gross margin tends to improve as well since cogs does not rise proportionately.

Amping up your SaaS unit economics with effective strategies

With a solid comprehension of SaaS unit economics, your CFO, business leaders, and other key stakeholders can all get on the same page about the health of your business. Once you’ve pored over your company’s financial statements and seen where you can improve your company’s KPIs, you can then employ these strategies to improve your unit economics.

Optimizing your customer acquisition cost (CAC)

Lowering your CAC goes a long way in fortifying your unit economics. Consider strategies that lower your marketing, sales, and R&D costs without compromising on acquisition quality. If the situation is dire, you may decide to lower your companies headcount.

However, you can also play offense by pursuing opportunities to increase your average revenue per user (ARPU) by increasing your pricing or monetizing your existing user base. Ultimately you want to lower your CAC ratio and shorten your CAC payback period – this will save you countless fundraising dollars and lost revenue as you scale.

Fortifying your customer lifetime value (LTV)

Increasing your LTV often results developing a remarkable customer experience, leading to increased customer retention and upsell opportunities within your existing customer base. While increasing the number of customer who sign up for your SaaS or improving closed/won conversion rates are often seen as the fastest ways to generate revenue for early-stage companies, improving your LTV can reap massive monetary rewards at scale.

Managing your churn rate

Mindful churn management ensures healthier unit economics. Plain and simple. You can implement effective retention strategies and customer satisfaction initiatives to keep your churn rate low. A quick look at your cash flow statement, income statement, or balance sheet should tell you how much revenue is being lost to churn each month.

Once you identify what’s causing churn in your SaaS business, you can work toward improving your retention rate month over month. By continuing to benchmark your churn rate each month, you’ll gain a better understanding of what growth levers you need to pull to reduce churn and keep your customers signed up and sticking around.

Want to improve your unit economics? Download our SaaS financial model template. Just download the template, plug in your company’s existing metrics, and start building out your very own startup financial model in minutes.

SaaS cash flow management: ensuring your business’s financial health

In SaaS, like most businesses, cash is king. That’s why, in this section, you’ll learn the following:

- How to keep the lifeline of your SaaS business, your cash flow, in check for ensuring your long-term survival.

- How to implement best practices for effective SaaS cash flow management.

- And, how to utilize tools and resources specifically designed for SaaS cash flow management.

The importance of cash flow management in SaaS businesses

The era of Software as a Service (SaaS) businesses has brought about the concept of scalable growth, where optimizing financial resources is imperative to survival. Cash flow management stands as the pulse check of any SaaS entity, gathering its significance from the unique subscription-based revenue model and high upfront investment.

For any subscription-based business, cash collections occur over a span of time, while expenses might be upfront. Hence, maintaining an efficient cash flow can shield the organization from disastrous economic downturns and also enable it to seize growth opportunities during a downturn. In essence, effective cash flow management gives you the power to control your financial destiny.

Similarly, a SaaS business’s valuation is largely affected by its burn rate or the rate at which it’s consuming its cash reserves. A higher burn rate often sends a red signal to investors, waring them to reconsider their investment decision.

Best practices for effective SaaS cash flow management

To effectively manage cash flow in your SaaS business, you need to live by some best practices. First, strive to understand and manage your operations and financing cash flows. Developing a thorough understanding will provide you with the clarity to take informed decisions during challenging economic times.

Second, be proactive, not reactive. To do so, attempt to forecast your cash flow based on various plausible scenarios. This hypothetical projection will equip you with the resilience to withstand real-life cash crunch situations. A stitch in time, indeed, saves nine.

Third, focus on increasing customer lifetime value (CLTV) and decreasing customer acquisition costs (CAC). By maximizing this ratio, you are essentially maximizing your profitability, consequently aiding cash flow. Such practices help to foster a business that’s resilient, adaptable, and capable of thriving in the most turbulent market environments.

Tools and resources to help with SaaS cash flow management

In the digital age, several tools are available to assist you in your cash flow management journey. Accounting software platforms, like Maxio, provide real-time insights into your financials. The Maxio platform offer features like real-time cash flow projections, which enable you to see both the current and future states of your cash flow.

You can also use the Maxio platform to keep track of metrics that directly impact your cash flow, like CLTV and CAC. With these tools, you can track changes in these metrics over time and understand the trends impacting your business.

Many SaaS cloud platforms – that aren’t exclusively fintech – also offer financial management embedded within their service. Salesforce, for example, provides a complete solution for sales, service, and finance in a single application.

Remember, managing financial health requires more than just tools; it requires an understanding of your business’s financial ecosystem. However, seeking help from these resources can take you closer to attaining that proficiency, ensuring your business prospers in your competitive space.

SaaS financial metrics: what to track and why

Curious what metrics actually matter in your SaaS business? Here are the KPIs and SaaS metrics you should keep an eye on to ensure future growth and make sound business decisions.

Overview of essential SaaS financial metrics

Among the vast sea of data available to a SaaS business, certain numbers take precedence over others when it pertains to financial health. These financial metrics can be aptly compared to vital signs in medical checks – indicating the overall condition of the company.

The first critical metric, MRR, reflects the income garnered from subscriptions in a month. CAC, on the other hand, reflects how much is being invested to bring new customers aboard. Finally, LTV displays the predicted revenue from a customer over their lifetime. It helps weigh if the acquisition cost was justified or not.

How to track and analyze these metrics effectively

While knowledge of these metrics is crucial, even more important is the understanding of how to track and analyze them effectively. Financial metrics are your business’s map and compass, and knowing how to read them can be the difference between sailing smoothly or being shipwrecked.

Investing in a trustworthy SaaS dashboard for tracking these metrics is invaluable. They provide realtime insights reducing the risk of decision-making based on outdated information. Pairing this with regular and thorough analysis, you can keep your finger on the pulse of your business’s health.

Using financial metrics to inform strategic decisions

The real value of tracking and accurately analyzing these metrics culminates in their ability to support and guide strategic decisions, transforming your financial data into your business’s crystal ball. By keeping a close eye on these metrics, you can preemptively identify opportunities for growth or potential financial challenges.

For instance, if your CAC is escalating, it could be signaling the need for a more cost-effective marketing approach. Continually high LTVs, on the other hand, may suggest an under-tapped market waiting to be explored.

Effectively leveraging these metrics takes you from being reactive to proactive, setting your SaaS business on the path from zero to hero.

Crafting a comprehensive SaaS financial plan: your roadmap to success

A solid financial plan is crucial for growth in SaaS businesses. But building and executing on a financial plan is easier said than done (just ask anyone who has done accounting at a SaaS startup before). In this section, we’ll show you everything you need to build a comprehensive financial plan of your own.

The indispensable role of a financial plan in a SaaS businesses

A financial plan is not just a roadmap; it’s the GPS guiding your SaaS business towards success. It serves as a tactical tool, helping to make informed decisions and forecast future performance. Without a financial plan, a business might as well be venturing into the unknown.

For SaaS businesses, the stakes are even higher. With a unique set of challenges such as high customer acquisition costs, unpredictable revenue flows, and scaling issues, financial planning is not optional; it is a must-have. A robust financial plan is vital in navigating these challenges while ensuring business growth, sustainability, and avoiding unexpected pitfalls.

Key components of a successful SaaS financial plan

A winning financial plan for SaaS businesses consists of several critical elements.

Realistic revenue forecasting

SaaS revenue is mainly recurrent, making it different from traditional business models. Understanding each revenue stream – be it monthly, annual, or ad-hoc – is essential for realistic forecasting.

Analysis of customer acquisition cost (CAC)

In SaaS businesses, the cost of acquiring a customer often exceeds the initial revenue they bring. Understanding the interplay between CAC and long-term customer value is vital.

Retention and churn rates

Keeping an eye on churn rates gives insight into the stickiness of your product. The lower the rate, the higher the potential for growth – simple as that.

Cash flow management

Last but not least, tracking operating expenses versus revenue is paramount. The idea is to manage cash flow effectively to support growth while maintaining fiscal health.

Tips for maintaining and updating your SaaS financial plan

A financial plan is not a set-and-forget tool. It requires regular maintenance and updates to remain relevant and effective. Here are a few tips to make sure you stick to your plan.

Regular monitoring and adjustment

Business environments change, and so should financial plans. Regular tracking and adjusting of financial indicators is required to keep pace with changing circumstances.

Using right tools and technology

Financial planning can be tedious and complex. Automating the task by using dedicated tools, like Maxio, can streamline the process, improve accuracy and provide insightful analytical data.

Remember, the goal should always be progress, not perfection. A good financial plan is a continually improving work in progress, informing all your strategic decisions as it adapts and matures with your business. With the right approach and diligent effort, you can transform your SaaS business from zero to hero!

Sealing the deal: up your SaaS game with effective financial modeling

SaaS businesses survive and thrive based on the effectiveness of their financial modeling. It’s their way of staying competitive, resilient, and growth-driven in a volatile market.

But how should you ensure continuous improvement in your modeling game? For starters, you’ll want to build a financial model that gives you visibility into the health of your business.

Don’t worry. We made it easy for you.

You can download our SaaS financial model template, plug in your company’s existing metrics, and start building out your very own startup financial model in minutes.