Financial modeling for SaaS businesses is a tall task. Because of the recurring nature of SaaS revenue and the range of customer billing approaches, it can be tricky to build a model that will accurately reflect your future cash position. SaaS financial models require that you build an income statement, balance sheet, and cash flow statement. These models include inputs such as annual recurring revenue (“ARR”), GAAP, Revenue, cost of sales, operating expenses, working capital, deferred revenue, fixed assets, and debt/equity financing.

Why model revenue?

The simplest answer to the question, “why SaaS revenue modeling?” is that you’ll need it to manage business growth and to procure funding. While historically many companies did not need a fully-baked revenue model until their first institutional round of funding (Series A), that attitude is shifting in today’s landscape and companies are increasingly adopting revenue models earlier.

The following is the first chapter of our new guide, The Complete Guide to SaaS Revenue Modeling, a collaboration between Maxio and Burkland.

ARR

Annual Recurring Revenue, or ARR, is a key metric used by SaaS or subscription businesses to measure the annual run rate of recurring revenue from the current install base. It represents the annual revenue for the next twelve months, assuming no additional business is added or churned. Some companies use a Monthly Recurring Revenue (MRR) metric, which is the same concept as ARR but expressed monthly. In general, companies that have a larger proportion of annual or longer-term contracts will use the ARR metric, whereas companies that have monthly contracts may opt to use the MRR metric. In this e-book, we will refer to ARR, but please note that the concepts still apply for MRR.

For more information on SaaS metrics such as ARR and how to calculate them, check out David Skok’s SaaS Metrics 2.0 Guide or Maxio’s SaaSpedia.

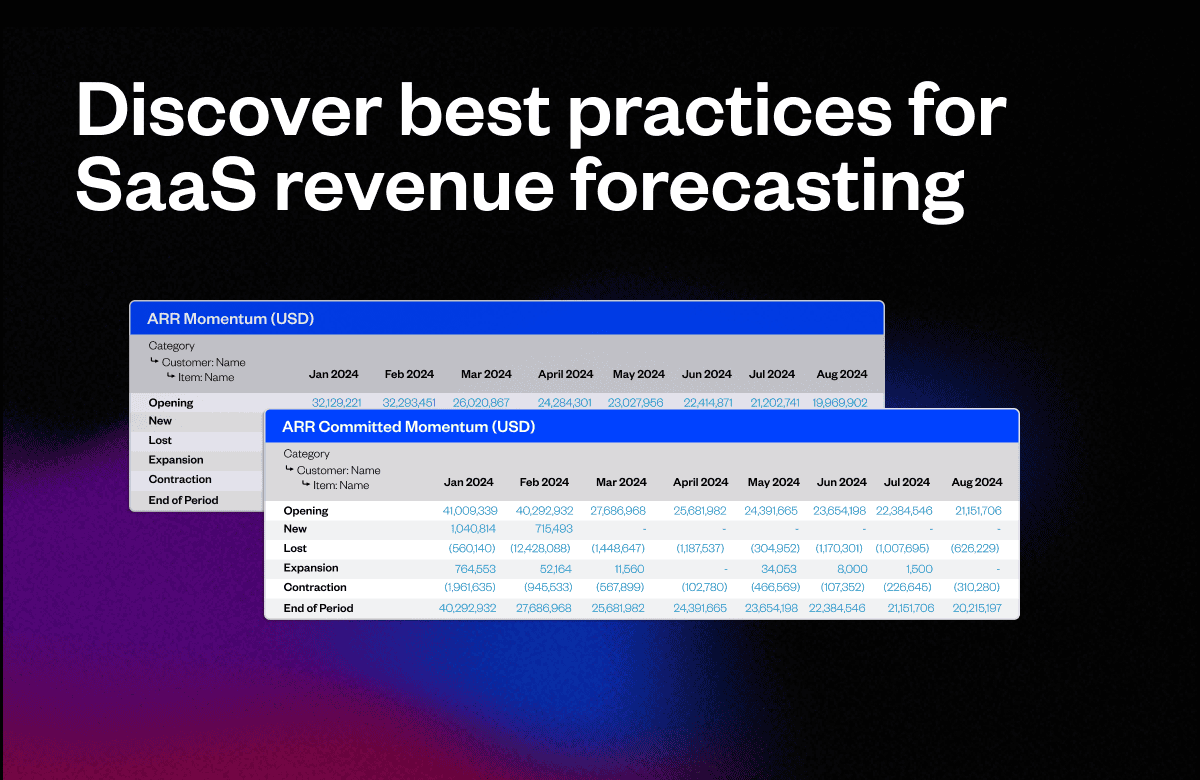

Momentum ARR Table

In the next two chapters, we will walk through two methodologies for forecasting ARR: a bottoms-up ARR forecast and a top-down ARR forecast. While the two approaches differ, the outputs from these two approaches will look the same: a monthly momentum ARR table as shown in the exhibit below.

The momentum ARR table breaks out monthly ARR growth into four components:

- New ARR: Increase in ARR driven by onboarding new customers during the month.

- Expansion ARR: Increase in ARR driven by growth from existing customers during the month. Expansion can be driven by a variety of factors, including product upgrades, an increase in user counts, and price increases.

- Contraction ARR: Decrease in ARR driven by declines from existing customers who remain customers at the end of the period, but at a lower ARR.

- Churn ARR: Lost ARR from churned customers during the month.

As different factors drive each of these growth components, it is important to forecast them separately. An ARR momentum table tells a lot about a company’s revenue model and growth prospects.

SaaS companies that are focused on a “land and expand” growth model will have a large proportion of their growth driven by expansion over time, whereas other companies may have growth primarily driven by new customers.

Companies that have lower levels of churn ARR as a percentage of their beginning ARR mean that they are better at retaining their customers, and thus have longer customer lifetimes.

In addition to looking at the ARR dollar movements in an ARR momentum table, it is also typical to view the changes in ARR as a percentage of the ARR at the beginning of the period.

Understanding how these percentages move over time is key in drawing insights into the company’s historical growth trajectory and forecasting future growth. They are a key input to the top-down forecasting approach we will discuss in Chapter 3.

Translating an ARR Forecast into a Revenue Forecast

In Chapters 2 and 3, we will delve into two methodologies for forecasting ARR. However, it should be noted that while ARR is a metric commonly used by SaaS and subscription companies, it is not an accounting metric and is distinct from the revenue number you find on a company’s income statement.

ARR is a single point in time measurement (e.g. What is your recurring revenue on a specific date?), whereas revenue is measured over a period of time (e.g. How much revenue did you earn in a month or quarter?).

The recommended approach for translating an ARR forecast into a revenue forecast is to take the forecasted ARR number in a given month and divide it by 12. However, there can be some pitfalls to this approach.

In practice, revenue is recognized for a customer that has a signed contract starting on the day the service is launched.

A company with an annual contract would recognize 1/365th of the contract value each day as revenue. When trying to determine how to translate an ARR forecast for a given month into forecast revenue, the timing of signing a new customer (or expanding, contracting, or churning) during that month will impact what the revenue during that month will be.

If a company signs a new customer on the first day of the month, the revenue will be higher than if they sign that same customer on the last day of the month.

A conservative revenue forecasting approach to address the timing issue outlined above is to forecast revenue based on the beginning of month forecast ARR. That is to say that the revenue forecast for a given month would be the beginning of month ARR divided by 12.

Note that while this is a conservative approach for a growing company, a company in decline may instead opt to forecast revenue based on the end-of-month ARR.

Contracted ARR vs. Deployed (Live) ARR

Another possible pitfall to watch out for in forecasting revenue is large time lags between signing a new customer contract and implementing the service.

While new ARR is counted at the time a contract is signed, revenue is not recognized until the service is implemented. If there is a 6-month lag between signing a contract and implementing the service, there will be a large discrepancy between ARR and revenue recognition.

In these cases, many companies opt to track two separate ARR metrics:

- CARR, or, “contracted ARR,” which represents the ARR of contracts that have been signed

- LARR, or, “live ARR,” which represents ARR for customers with signed contracts where services have been launched

For companies that have these two separate metrics, the revenue forecast should be calculated as the beginning of month LARR divided by 12.

To read on, download The Complete Guide to SaaS Revenue Modeling.