According to Gartner, the SaaS industry is projected to grow to a staggering $197B in 2023. And this trend will continue. Based on a 2019 survey, Gartner forecasts that 84% percent of new software will be delivered as SaaS, and this percentage is expected to increase as existing providers transition to a subscription model.

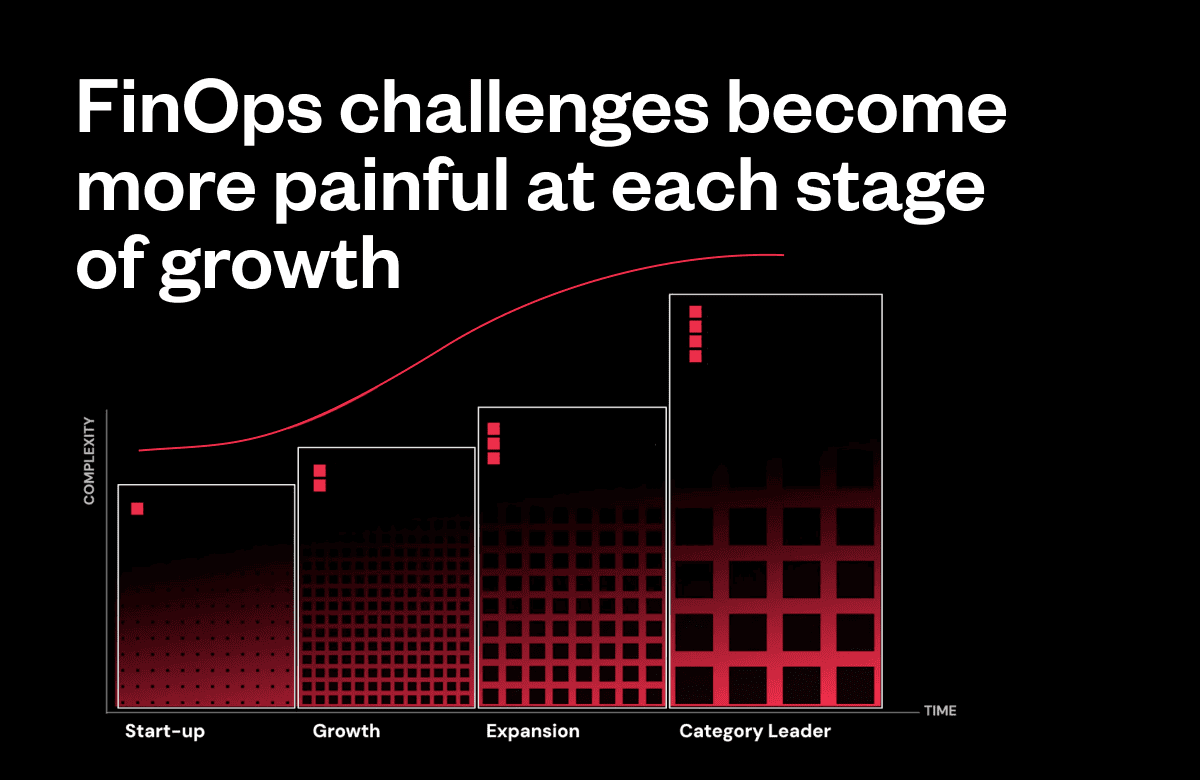

Yet, many software providers are ill-prepared for the unique challenges and opportunities that come with managing customer subscriptions and transitioning to a SaaS model.

From managing deferred revenue to dealing with customer churn to accounting for contract modifications and add-ons, there are a lot of challenges that CFOs at SaaS companies are required to navigate. To help you manage these challenges, let’s take an in-depth look at the various metrics, methods, and KPIs that define SaaS accounting.

What is SaaS accounting vs. traditional accounting?

SaaS companies often follow a unique subscription business model. It makes sense, therefore, that they would also require a unique accounting system.

SaaS accounting is a subscription-friendly accounting method that involves practices and methodologies which aren’t usually applicable in traditional accounting. This includes a number of methods for revenue recognition, ensuring performance obligations are met, managing usage-based pricing, and a variety of other accounting methods that are tailored to the SaaS model.

Here is a breakdown of the primary difference between the methods used in SaaS accounting vs the methods used in traditional accounting:

Cash-basis accounting

The main difference between accounting for a subscription vs. a traditional business is the methods used. Many traditional businesses—large and small businesses alike—use the cash-basis accounting method. This means revenue is recognized at the time of the transaction. For example, when you go to Macy’s to buy a shirt, Macy’s recognizes the revenue from that shirt sale as soon as you hand over your credit card and cash is deducted from your bank account.

Accrual accounting

In a subscription business, on the other hand, revenue cannot be recognized all up-front. It must be recognized over the duration of the subscription, and any revenue received, but not yet recognized, is noted as a performance obligation. If you sign a one-year agreement with a streaming service for example, you could potentially pay for the year up-front to obtain some kind of discount, but that provider cannot recognize all of the revenue from that sale until the services have been completely rendered. This is known as accrual accounting.

Common challenges associated with SaaS accounting

One challenge is how software providers manage accounts receivable and capture, share, and use financial metrics internally. When transitioning to a SaaS business model or developing a SaaS startup, many companies utilize spreadsheets, disconnected systems, and other manual processes to manage their recurring revenue.

These companies also tend to take the same financial management methods and principles used to maintain a traditional software business and implement them in the SaaS business. The result? A mess of calculations that don’t accurately give insight into the budgeting processes and overall state of the company. If you aren’t already working with a SaaS business in some capacity, the chances are high that you will soon. As an accounting professional, it is crucial to understand the differences in managing the financial operations of a traditional software business versus those of a SaaS business.

Revenue recognition: an integral part of SaaS accounting

There’s a reason revenue recognition gets complicated with SaaS businesses; it’s incredibly easy to mistake accounts receivable for revenue.

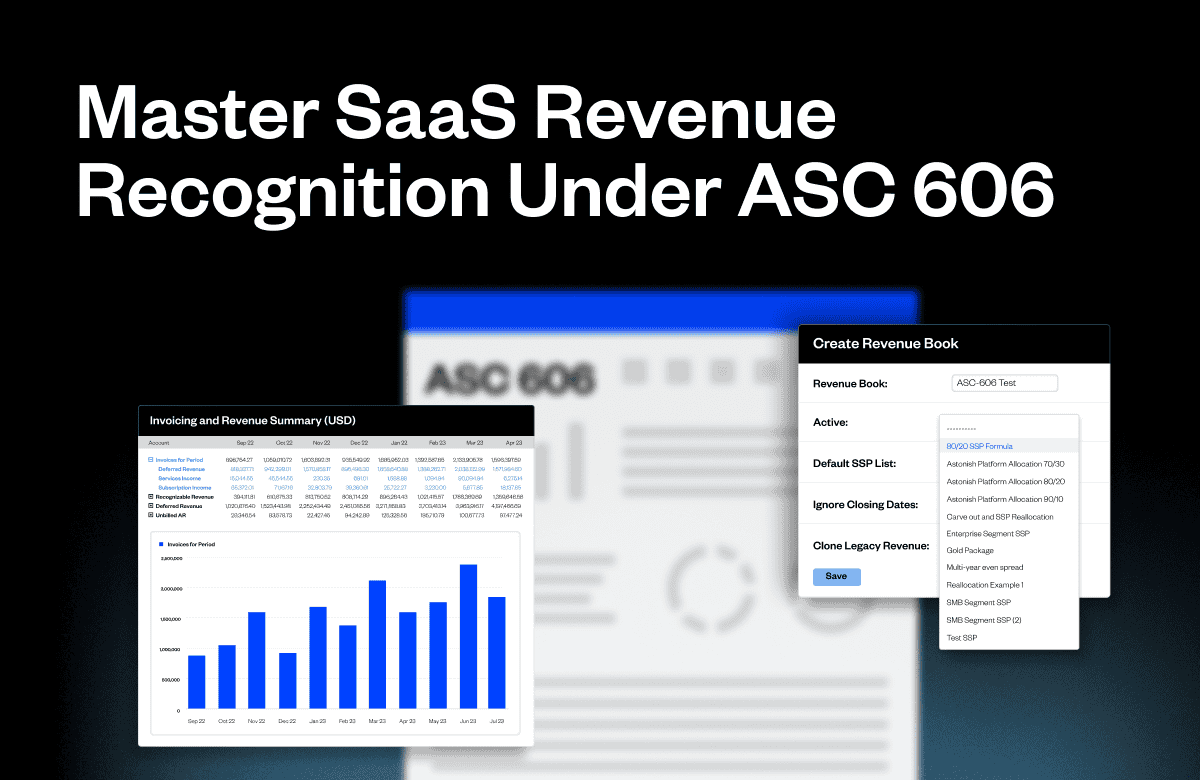

Revenue recognition is easy to understand, but can become extremely complicated in practice. QuickBooks, Xero, and other softwares have tools to help with this, but the challenge continues. The Financial Accounting Standards Board (FASB) and regulatory agencies have established complex guidelines to reign in aggressive revenue recognition actions that inflate actual performance. Thus, it’s critically important to ensure recurring software revenue is recognized consistently and adheres to ASC 606—a standard developed jointly by the FASB and International Financial Reporting Standards (IFRS).

When can SaaS revenue be recognized?

In accordance with the U.S. Generally Accepted Accounting Principles (GAAP), an entity cannot fully recognize revenue from a contract until the agreed-upon services have been delivered. With varying contract terms, bundled services, and add-on services, SaaS businesses require the ability and the flexibility to recognize revenue in a manner consistent with their agreements (and following GAAP). This also extends to understanding the cost of goods sold and ensuring any associated sales tax is correctly accounted for.

In B2B SaaS, this may include a combination of amortizing revenue over the term and recognizing revenue upon the completion of certain contractual milestones. This is further complicated by the inherent customer contract volatility in SaaS businesses. Software upgrades, downgrades, renewals, re-negotiations of renewals, upgrade-extensions, cancellations, and early terminations are all fair game in B2B SaaS. These term changes all put pressure on finance teams as general ledger software and spreadsheets are poorly suited for revenue accounting due to the extensive contract variations among customers.

What is the criteria for SaaS revenue recognition?

To ensure consistent revenue recognition across the SaaS industry, the Security Exchange Commission (SEC) provides guidelines in SAB 101 outlining the criteria for SaaS revenue recognition. Per SAB 101, the criteria for SaaS revenue recognition includes:

- Persuasive evidence of a legally binding customer contract between the service provider and the customer

- Delivery has occurred or services have been rendered

- The fee for the service is fixed or determinable

- Collection is reasonably assured

Once all of these criteria have been met, SaaS businesses are free to record revenue. In addition to SAB 101, another common framework for SaaS revenue recognition is ASC-606.

How deferred revenue is recognized

Deferred revenue (also known as “unearned revenue”) describes the income received by a company for goods or services that have not yet been delivered. For SaaS companies, deferred revenue usually comes in the form of upfront payments or subscription fees that are paid in advance. Deferred revenue represents a liability on the balance sheet until the services are provided, and recognizing it properly is an important key to SaaS revenue recognition.

How accrued revenue is recognized

Accrued revenue refers to income that a company has earned but has not yet received from the customer. It comes into play when services have been provided to a customer but payment has not been received at the time of the transaction. Recognizing accrued revenue helps SaaS companies match revenue with the period when it was earned. This provides a more accurate representation of the company’s financial performance.

GAAP financial statements and SaaS metrics

For SaaS companies, accurate GAAP financials and metrics are vital, since SaaS models primarily rely on future revenue and performance. For example, it’s always imperative to know if the lifetime value is higher than customer acquisition costs if the company is offsetting churn with expansions, and more—and relying on spreadsheets to report those numbers accurately is very problematic.

GAAP financials indicate where the business stands today but reveal very little about the composition (new vs. existing) and reliability (high vs. low churn) of recurring revenue.

Understanding GAAP financial statements

GAAP financial statements consist of three primary components: the income statement, balance sheet, and cash flow statement.

The income statement details your company’s profitability over a specific time period—typically a quarter or a year. It details revenues generated from sales and other sources and subtracts various expenses such as cost of goods sold, operating expenses, and taxes to arrive at the net income or loss.

The balance sheet, meanwhile, provides a snapshot of the company’s financial position at a specific point in time. It details the company’s assets, liabilities, and shareholders’ equity to provide a broad overview of the company’s current financial position.

Lastly, the cash flow statement offers insights into a company’s cash inflows and outflows over a specific period of time. This statement is vital for assessing a company’s ability to generate and manage cash—an essential requirement for ongoing operations and growth.

SaaS metrics you need to know

Subscription businesses track SaaS-specific metrics such as monthly recurring revenue, annual recurring revenue, customer lifetime value, churn, and customer acquisition costs to accurately report on what’s working well and what needs to be improved.

Monthly Recurring Revenue (MRR)

Monthly recurring revenue (MRR) is a vital metric for subscription businesses since it represents the predictable, recurring revenue earned from subscriptions in a given month. Tracking MRR on your income statement provides insight into your business’s financial stability and growth trajectory as it helps you monitor how well you are retaining existing customers and acquiring new ones.

Annual Recurring Revenue (ARR)

Annual recurring revenue (ARR) provides a more long-term view of your business’s performance by extrapolating MRR over the course of a year. Like MRR, this metric is useful for forecasting and long-term financial planning.

Customer Lifetime Value (LTV)

Customer lifetime value (LTV) is a measure of how much total revenue a customer is expected to generate over the course of their lifetime. Understanding your company’s average LTV is key to determining how much you can afford to spend on customer acquisition, ensuring that your marketing efforts are profitable and sustainable.

Churn

Churn is a measure of the rate at which customers cancel their subscriptions. High churn rates can negatively impact a SaaS company’s financial health, impacting both the balance sheet and cash flow statement. By closely monitoring your churn rates, you can ensure that your products and services are optimized for customer retention.

Customer acquisition cost (CAC)

Customer acquisition cost (CAC) is a measure of how much, on average, it costs your company to acquire a single customer. Comparing your CAC to your LTV is an essential part of making sure your sales and marketing efforts are profitable. If the cost to acquire customers exceeds their lifetime value, your sales and marketing efforts may not be sustainable.

Get Your Free SaaS Metrics Template

Template provides you with a comprehensive set of pre-built SaaS metrics (that you can trust) to wow investors and make key business decisions with confidence.

The problem with spreadsheets for SaaS accounting

Spreadsheets are old news. Embedded in the foundation of traditional accounting and bookkeeping, they are unable to function effectively in the dynamic and constantly shifting nature of a SaaS business.

For starters, subscription terms can vary, they come in multiple forms and end-user agreements can change daily. With that kind of volatility, a business can quickly end up managing multiple, disconnected spreadsheets. Plus, periodic financial reporting becomes inefficient, taking far longer than it should.

The spreadsheet process is also highly susceptible to errors, and it’s nearly impossible to generate accurate operational and financial reporting data efficiently. The worst part? With spreadsheets, real-time, accurate financial metrics are difficult to produce, and as the metrics are often inconsistently defined, there’s a high risk that the data is unreliable. This can have a profound effect on the ability of a business to use financial and accounting data to make informed decisions.

Also, during an audit, the inability to produce reliable operational and financial data makes the process extremely cumbersome and painful for your team, your board members, and yourself. In the early stages, many SaaS businesses supplement their spreadsheets with general ledger software as an “easy option.” However, they quickly realize that general ledger software doesn’t efficiently manage subscription revenue recognition or subscription billing, especially if the contracts include sales-negotiated behavior, which is required by ASC-606 Revenue from Contracts with Customers.

Automate your order-to-cash workflow with Maxio

One of the keys to successfully managing the finances of a subscription-based business is automation. SaaS-specific automation technology is essential for using benchmarks and metrics to gain visibility into the company’s performance—and it’s also critical for assessing your company’s health.

SaaS accounting solutions can eliminate the need to manually enter data by automatically turning closed opportunities into GAAP-compliant customer, contract, subscription, revenue, and invoice schedules. SaaS accounting software also provides the polished, accurate revenue recognition and financial metrics that inform operational decisions, streamline audits, and satisfy potential investors or buyers.

At Maxio, we help you solve the problems that are most painful for the growth of your business. If you’re interested in learning about cloud-based SaaS accounting, be sure to check out SaaSpedia, our in-depth encyclopedia of SaaS finance terms and metrics.