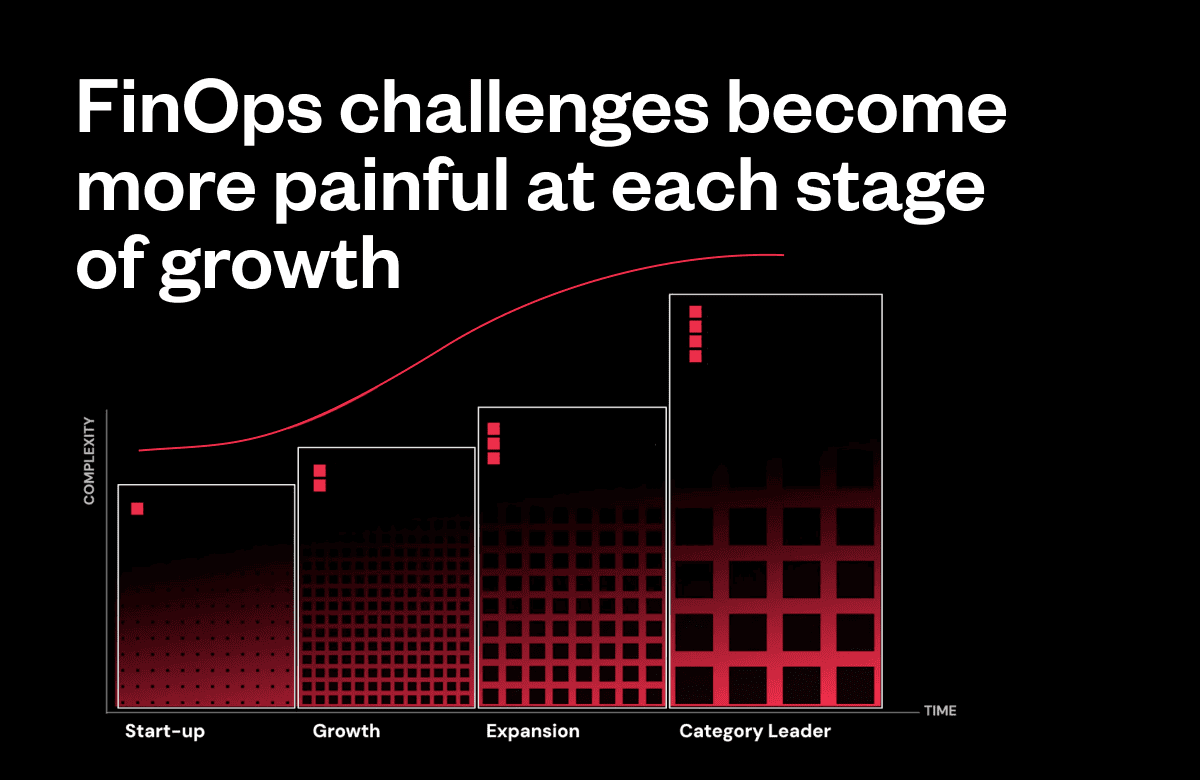

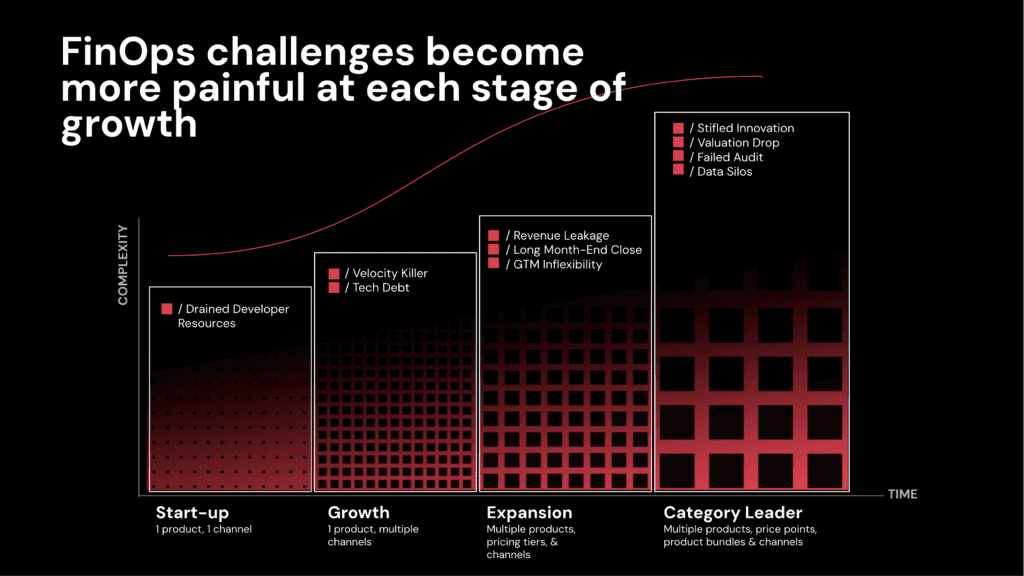

From founders’ scuttles to running out of money, there are a plethora of challenges you might encounter when embarking on a new business venture. Financial Operations (FinOps) challenges are among the most common and impactful roadblocks a company can face at any stage.

Through our work helping B2B SaaS resolve their FinOps bottlenecks, we’ve identified the 4 challenges we see businesses face time and time again. The key to overcoming each of these challenges is to mature your FinOps operation as your company matures.

In this post, we’ll show you how to do that.

4 financial operations challenges every early-stage SaaS business faces

1. Getting stuck in spreadsheets (specifically for revenue recognition)

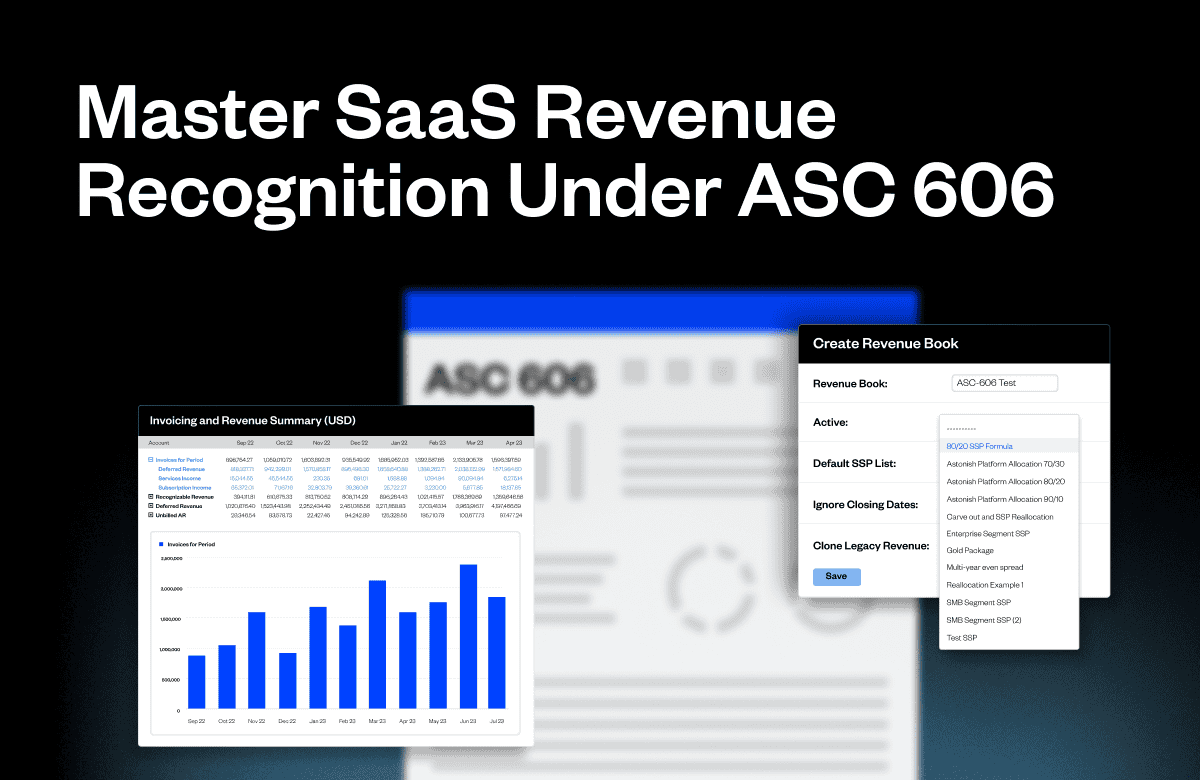

Revenue recognition is the process for recognizing the amount of a transaction or contract at a point in time or over time as the revenue is “earned.”

Standards boards and regulatory agencies such as the Financial Accounting Standards Board (FASB) and the SEC have established complex rules and guidelines (ever heard of ASC 606?) to rein in aggressive or improper revenue recognition actions which may inflate or misstate the actual corporate performance of public companies.

While simple in principle, revenue recognition can get really complicated when you factor in non-standard contract lengths, unusual billing frequencies, early termination clauses, mid-term upgrades, downgrades, renewals, discounts, re-allocations, etc.

It’s common for startups to manage revenue recognition and other FinOps in spreadsheets. However, this quickly becomes unmanageable as your business starts to scale. We recommend startups invest in their finance function as early as possible to avoid future finance bottlenecks.

2. Tripping up during the due diligence process

For many startups, Series A is the first time they really begin to think critically about the state of their financial operations. Embarking on due diligence processes is scary, stressful, and downright frustrating at times. But it doesn’t have to be.

There are a few sure-fire ways to make due diligence smoother.

The first is to have a buttoned-up revenue recognition policy in place. Your revenue recognition policy is where you establish the rules that govern the consistent application of the ASC 606 framework at your company. Maxio offers a free, 30 page revenue policy you can download and use when creating your own policy.

Download a Revenue Recognition Policy Template

This template will help you identify your contracts, SSPs, and Performance Obligations, and provide guidance on both the allocation of transaction prices and how to recognize revenue.

Another key step is to think about what your investors are looking for from a SaaS metrics perspective. Because there’s no governing body that defines SaaS metrics, it can be challenging to nail down an exact calculation. (And, let’s face it, every investor will have their own specific set of metrics they want to see.)

Investors all tend to speak the same language when it comes to metrics—ARR, MRR, LTV, CAC, Cohorts, etc.)—but what those terms actually mean at each company can vary widely. The key is to ensure consistency in how your company defines and applies each metric.

No matter what you do to track your SaaS metrics, the key is consistency. Create an internal policy for how metrics are calculated (and do it the same way every time). This often starts in the form of a comprehensive spreadsheet (like this SaaS metrics template) with edit access granted to only one or two gatekeepers.

Of course, as we mentioned before, as you grow spreadsheets become more of a hindrance than a help.

Implementing a scalable metrics reporting software will ensure you’re calculating your metrics the same way every time, right from the beginning. This is absolutely crucial for those trying to raise funding, as the smallest error can throw your entire evaluation into question. Additionally, trading in spreadsheets for software like Maxio enables you to pull the highly specific—and sometimes, unusual—metrics your investors are asking for at the drop of a hat. (Think: minutes to generate a new report vs. days to build one.)

3. A leaky accounts receivable process

Collections are the least sexy part of running a business, but arguably the most important. Like revenue recognition and metrics reporting, many startups manage A/R in spreadsheets. This opens your A/R process up to human error, which can lead to missed invoices, lots of time wasted, and enough frustration to last a lifetime.

Building an efficient A/R management process ensures the longevity of your cash runway. This is especially important in 2023, when investor money is harder than ever to come by. Without a steady stream of cash coming in from your customers, you’re just not going to make it. SaaS businesses need a renewed focus on efficient growth. Funneling your effort toward reducing A/R aging and decreasing DSO is the first step.

4. Poor tech stack integrations

You’re definitely on the right track if you’ve been able to button up your revenue recognition, SaaS metric definitions, and you have a robust A/R Management process. But where is all of it? It’s not uncommon for young SaaS businesses to manage all three of these processes in three different systems.

You’ll never be able to scale if your financial operations systems don’t play well together.

Finding a solution to gather all these processes under one roof can actually be more difficult than you’d think. Many softwares might do one or two of these things well, but few actually excel at all three.

Maxio is one of the few.

B2B SaaS professionals choose Maxio because it sits between your CRM and GL, creating a seamless process, from billing to collections to reporting and analytics. Let your Sales team work in their preferred CRM and rest assured those orders will seamlessly funnel into the correct billing and collections schedule. From there, Maxio automates the calculation of your revenue recognition with bi-directional syncs with your preferred GL and allows you to actually trust the metrics your company relies on for growth. Learn more about Maxio.

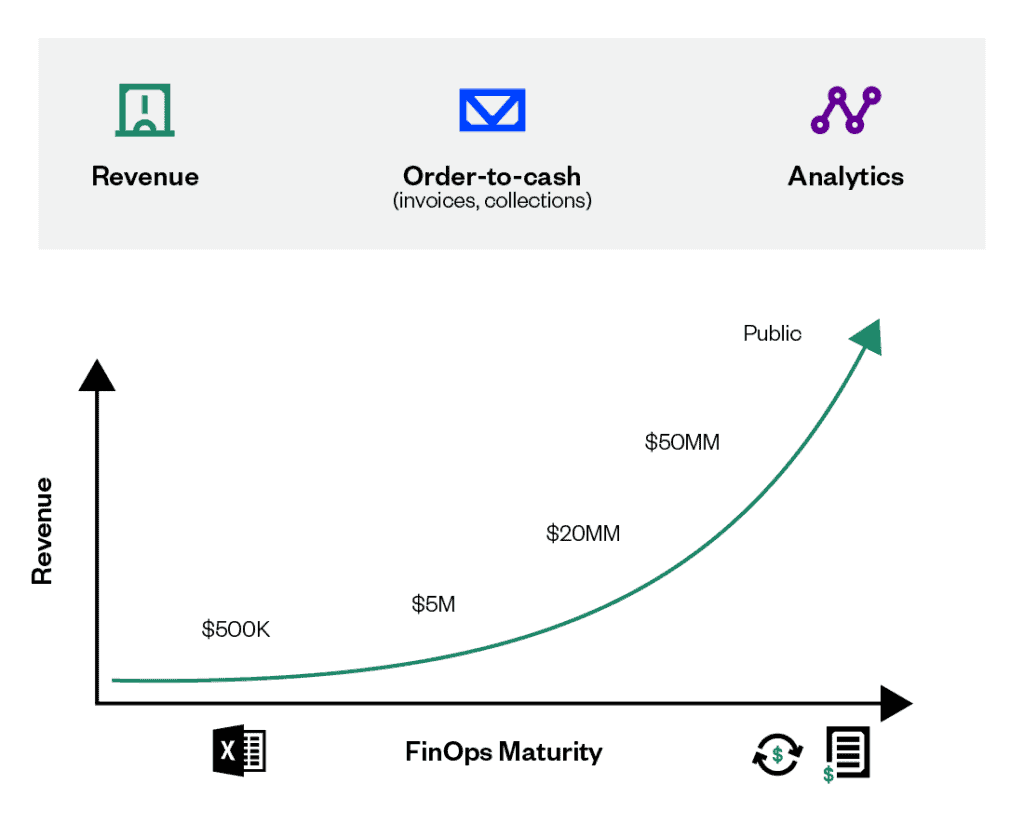

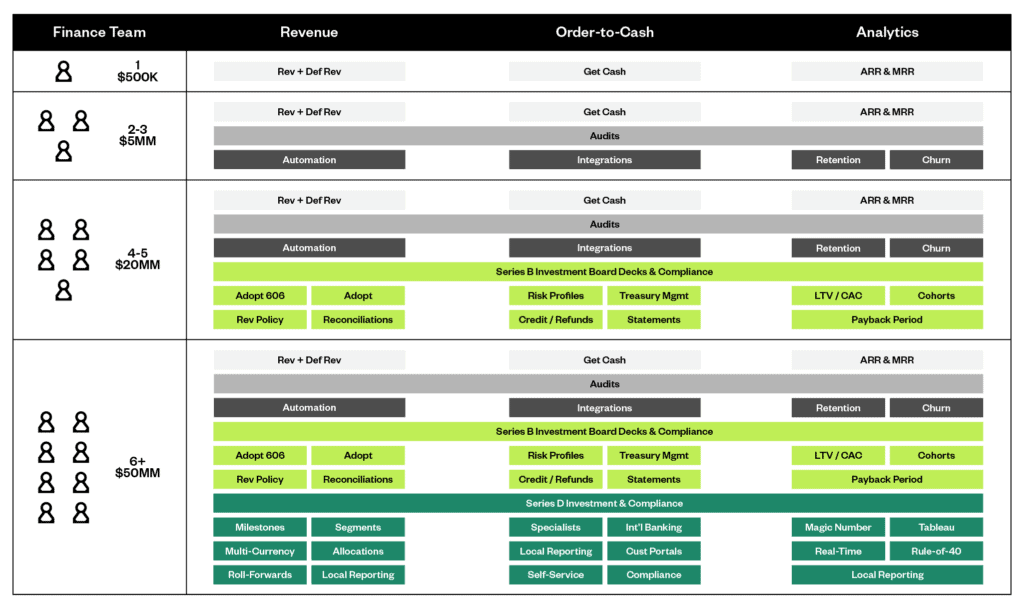

Where do I start? Finding your place on the Financial Operations Maturity Curve.

There are a lot to consider when maturing the financial operations of your business. Obviously, you can’t tackle them all at once, and you don’t need to. We’ve broken out the three main aspects of FinOps maturity, revenue, order-to-cash, and analytics by company stage and size in the following graphs.

As can be expected, your business’s financial operations should mature as you grow in size and stage. A company with less than $500K in ARR is not going to operate at the same level of sophistication as a $100M ARR company.

However, if your goal is growth, one thing is undeniable: you need to implement a FinOps process and technology that will scale alongside you. The longer you wait, the harder it will be.