Last week, I had a great conversation with Alli Tiscornia, COO of Churnzero on aligning your CS and Finance teams. Toward the end of our conversation, we answered viewers’ questions as they came in—but we ran out of time to answer them all live.

These questions span a large array of challenges in SaaS, not just CS challenges. We want to share as much as we can with you, so Alli have each tackled half of the remaining questions. (You can find the other half on Churnzero’s webinar recap post.)

Let’s get into it:

Your questions on pricing, customer success, and SaaS financial reporting

Q: How do you calculate churn differently from month-to-month contracts vs annual contracts. Do you calculate two separate numbers or lump them together?

Yes, track the two separately.

What’s up for renewal changes every month, so you want to track whose contract is expiring, and that can be a monthly, quarterly, or annual contract. What you’ll find is there can often be more volatility with monthly contracts, so folks will try to isolate the two types of billing terms.

To determine the annual retention for MRR (1 minus churn), take monthly retention and multiply it by 12. Sometimes people will take the last 3 months’ average retention and multiply by 4 to reduce some of the volatility inherent in having lots of monthly contracts.

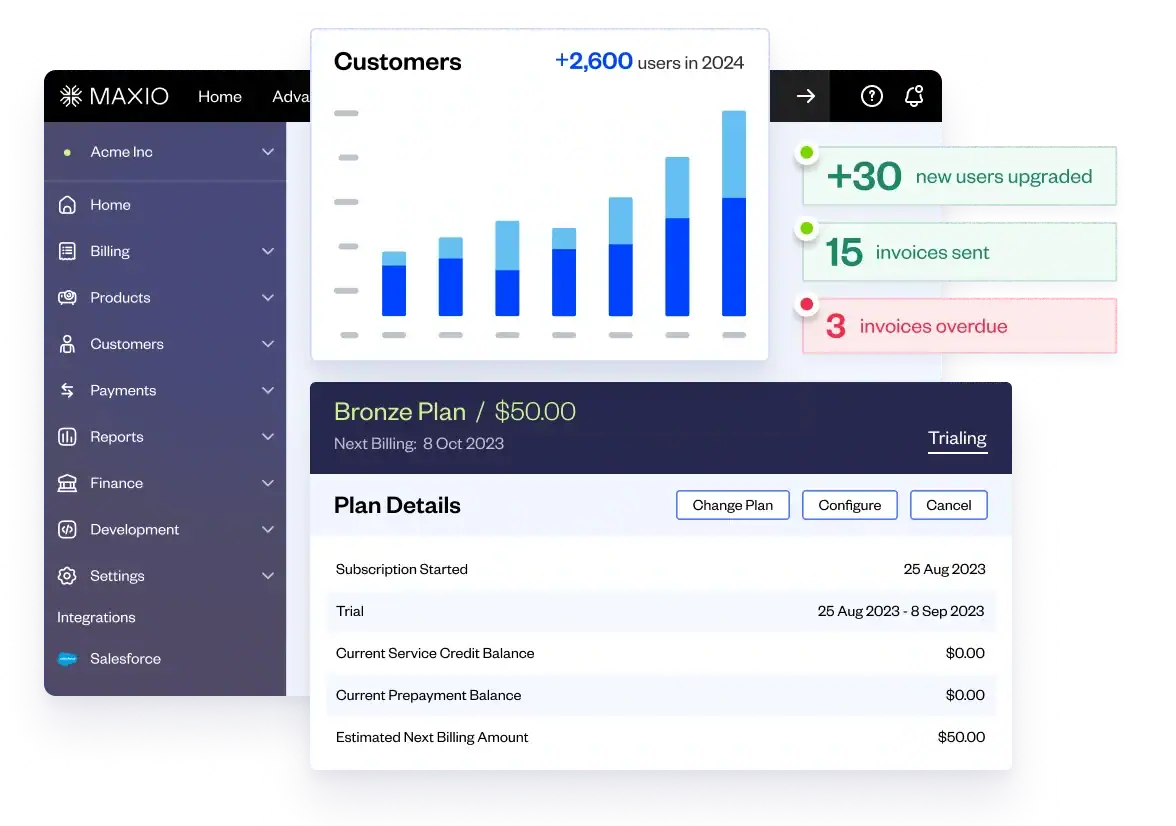

Annual contracts coming up for renewal in a specific month are part of the superset of the “available ARR” for renewal for that month, so it is important to isolate these. For example, we at Maxio have both annual and monthly customers, and we isolate the 2 types (annual and monthly renewals) to understand what’s happening in each cohort.

There are a couple of “gotchas” when looking at renewals. Mostly Metrics wrote a great article that goes into more detail about the nuances between renewals vs gross retention and net retention. The author also touches on some of the nuances of managing renewals.

Q: If my business requires a CSM irrespective of the contract value, does this mean my company should not be acquiring lower contract value? Or should we take that hit to our revenue in the name of brand recognition (and hope for an upsell)?

Ultimately, I think people recognize that if they’re buying software, they’re going to have to pay for services. They’re typically ok with that as long as it is a reasonable cost (e.g., 10-15% of the software fee). Your goal is to make it as easy as possible to get your customers up and running (aka time to value) so they feel like they’re seeing a return on that investment.

So how do you make the decision?

For me, it really comes down to unit cost economics and the tradeoff you want to make in terms of investing in acquiring customers upfront with the assumption that they will stay with you for a long enough period of time to justify this investment.

At the end of the day, if your product requires configuration, you will need some sort of post-sales service org to help those folks get implemented and then help with adoption over time. The tricky part is where you capture those costs. Most companies account for implementation costs in cost of sales. This impacts their gross margins. One rule of thumb is that if your gross margin is less than 75% in a SaaS business, something is wrong, and you have to figure out how to sort that out first before anything else. You will not get “software” investors to value your company as software if your starting point is <70% gross margin. If you are in this zone, you are more of a tech-enabled service, which has a different valuation profile.

Next, the Customer Success function is usually captured in Sales and Marketing expenses and will impact your operating margin. This impacts your overall customer acquisition cost. Again, you’re faced with choices in terms of investing in this category based on what you think is going to give you the most bang for your buck in the short, medium, or long term. There is no one answer, but there are industry benchmarks for different size companies with different ACVs.

Q: What metrics should we focus on if our business model is subscription-based for B2C, and a discounted annual price for B2B clients?

The metrics are similar. You want to understand how much it costs to acquire each type of customer, and how you should attribute marketing and sales spending.

From your question, I’m assuming the type of B2C you’re referring to would be more of a product-led growth (PLG) model where customers are paying you on a monthly basis. If so, there’s a set of PLG metrics tied to product engagement that’s helpful. Kyle Poyar at Open View has a full set of these, and has written a lot on this model. The other model is more of the standard B2B SaaS model, which I assume requires sales team involvement. The discount can be captured in how the contract is written and then carried through on the order.

For each: the key is to really understand your customer acquisition cost. To this end, make sure you have everything baked in for each segment that’s appropriate. Then, layer in churn so you can approximate a lifetime value and start to understand what you’re making on these different types of customers. For example, you probably have higher churn in B2C than B2B, so isolate those. Understand the predictability of the revenue.

Q: If my company has both subscription renewals and renewals for maintenance and support on perpetual licenses, should we try to move all to subscription? What is the benefit to the customer?

I’m most familiar with a perpetual license model being associated with “on-prem” software. This is often referred to as the legacy software model.

When you’re paying for perpetual licenses vs subscriptions, you’re effectively buying a house instead of renting an apartment. The customer can get more value over time when renting an apartment because they don’t have to manage the upkeep, and they don’t have to pay as much upfront.

The other advantage of the subscription model is it can be treated as OPEX vs CAPEX. I’m not an accountant, but my sense is most companies prefer to leverage OPEX because the accounting is much simpler and usually more cost-efficient due to operating expenses being fully deducted in the year they’re incurred. This reduces income taxes for the year and produces immediate cash flow benefits.

I know some SaaS companies use a perpetual model, but it seems odd, as the advantage for the vendor is you’re continually updating and releasing the software, which justifies price increases over time. In general, everyone’s moving to SaaS/subscription models, and I would encourage you to look closely at the pros and cons of each model.

To that point, I would recommend checking out the Technology & Services Industry Association (TSIA), which has many books, articles, and conferences focused on the migration of on-prem to cloud-based software and the associated pricing models. While you may be a SaaS software company vs on-prem software company, the lessons regarding the two pricing models would be informative for you to consider.

Q: What should we be looking at for a churn analysis, and at what cadence do you recommend doing it?

Everyone says it’s 5x more efficient to keep customers than to get new customers. As such, I recommend starting with “operationalizing” renewals by setting up a weekly renewals red account program. During this meeting, you gather functional leaders together and discuss accounts that may be struggling with implementation, adoption, or value realization over time. This helps you get in front of potential churn.

You then do basic churn analysis on a monthly basis, where you look at who is churning and why. It’s most helpful if you can break your customers into cohorts by product, by segment, and by region to see if there are any trends in the reasons they are churning.

We do churn analysis every single month and provide a monthly churn update to the board.

Understanding and reporting on churn are as important as digging into win/loss analysis for Sales opportunities. We use the churn analysis to understand what’s working and what’s not in the customer lifecycle. If you don’t get them onboarded for the 3-4 years you need to return on LTV, you’ve lost money!

For board reporting, we use a trailing 3-month (T3M) and trailing 12-month (T12M) trend to see if things are getting better or worse—again at the product, segment, and regional level.

During the middle of a contract period, you want to be looking at usage and adoption metrics to help predict churn.

Q: We’re considering rolling out an event-based/usage pricing model—any pros/cons you can share?

Events-based pricing and billing can be really powerful because it can be closely tailored to the value your customers are getting from their usage of your services. With this model, you can bill not just on the events count, but also on the attributes of the events. For example, you could charge just per API call, or you can further refine pricing by charging a different rate based on time of day of the API calls or based on some type of API origination source information. It really is the most value-based of value-based pricing models, and that can be incredibly appealing for your customers.

The “con”: it’s a lot of work to set up.

In order for EBB to work, first you need a billing solution that supports EBB (like Maxio). Then the events must be streamed into the software for the pricing calculations to be formatted per your solution architecture. This might require development work on your end.

Additionally, you need to set up and configure the computations (e.g. count, sum, or average) to be applied to events and event attributes. The complexity of this configuration depends on the complexity of your pricing model.

If you want to learn more about how B2B SaaS companies are implementing usage-based pricing right now, Maxio recently put out a usage-based pricing benchmarking report based on a survey of 490 SaaS professionals, and you can download it here.

***

Whew! What great questions, and what a great event. My conversation with Alli was truly enlightening, and if you didn’t get a chance to attend, here’s the recording. We go much deeper into discussion around aligning your CS team with the CFO—and answer many more questions like the ones above.