Revenue modeling. It’s the most difficult aspect of financial planning, especially for startups that don’t have historical data to extrapolate future revenues. If you’re new to the software-as-a-service (SaaS) space, you may be wondering what the differences are between revenue modeling for subscription businesses as opposed to non-subscription companies.

In this post, we’ll outline the two primary differences between revenue modeling for each type of business model.

The primary differences between revenue modeling for a subscription SaaS business model vs. non-subscription business are how revenue is recognized over time vs. up-front and how your billings will affect your balance in deferred revenue.

Revenue modeling: revenue growth over time

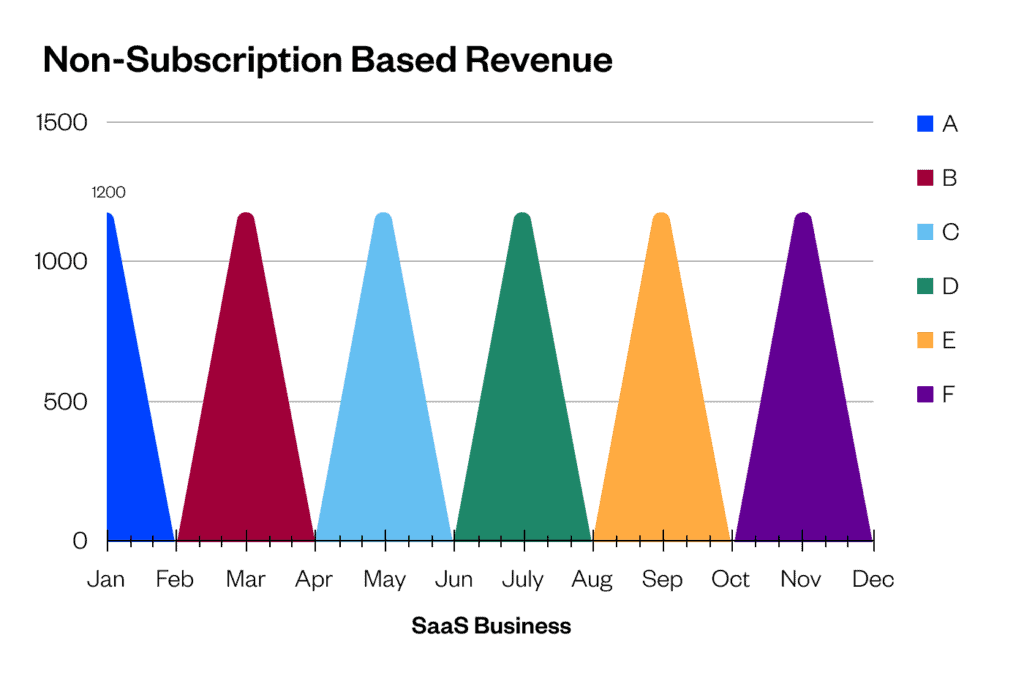

For non-subscription businesses, future revenue is unknown because it depends on future sales that have not yet occurred. This can cause major headaches when trying to estimate future revenue and cash flows. Non-subscription businesses often do not have an associated term; therefore, revenue is recognized on the date of sale.

See the following example:

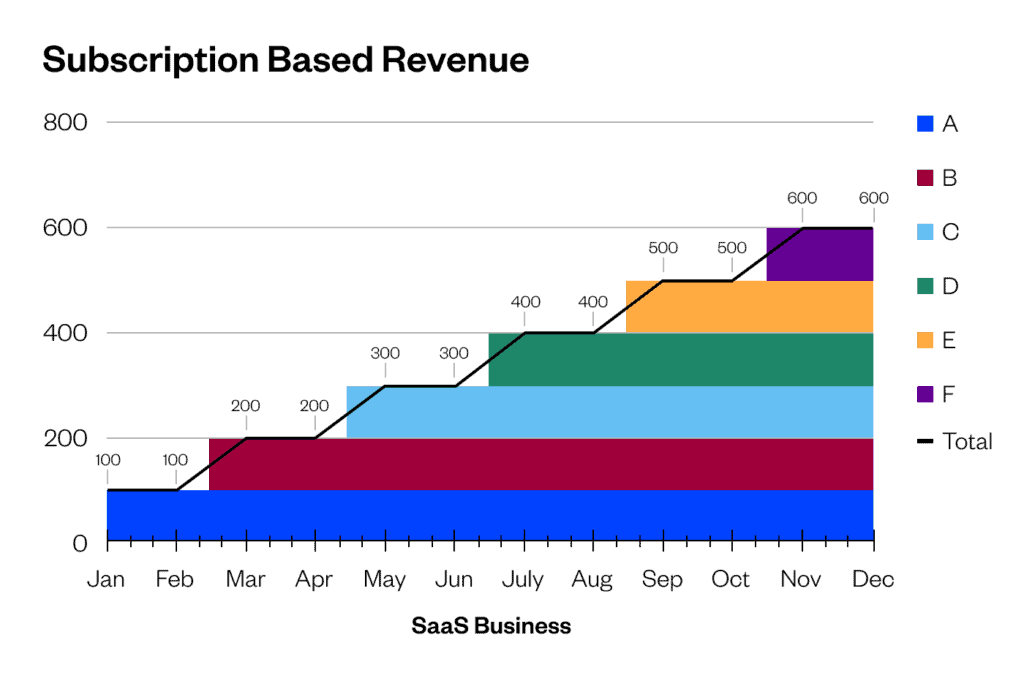

By contrast, most SaaS solutions sell subscriptions with a start and end date, and revenue is recognized over the stated term. There are also several different types of pricing strategies that you need to consider before building a SaaS revenue model. For example, a single SaaS company may offer a freemium model, a flat-rate monthly subscription, and custom sales-negotiated pricing across their different product offerings.

However, modeling revenue in a SaaS business comes with its own set of upsides too.

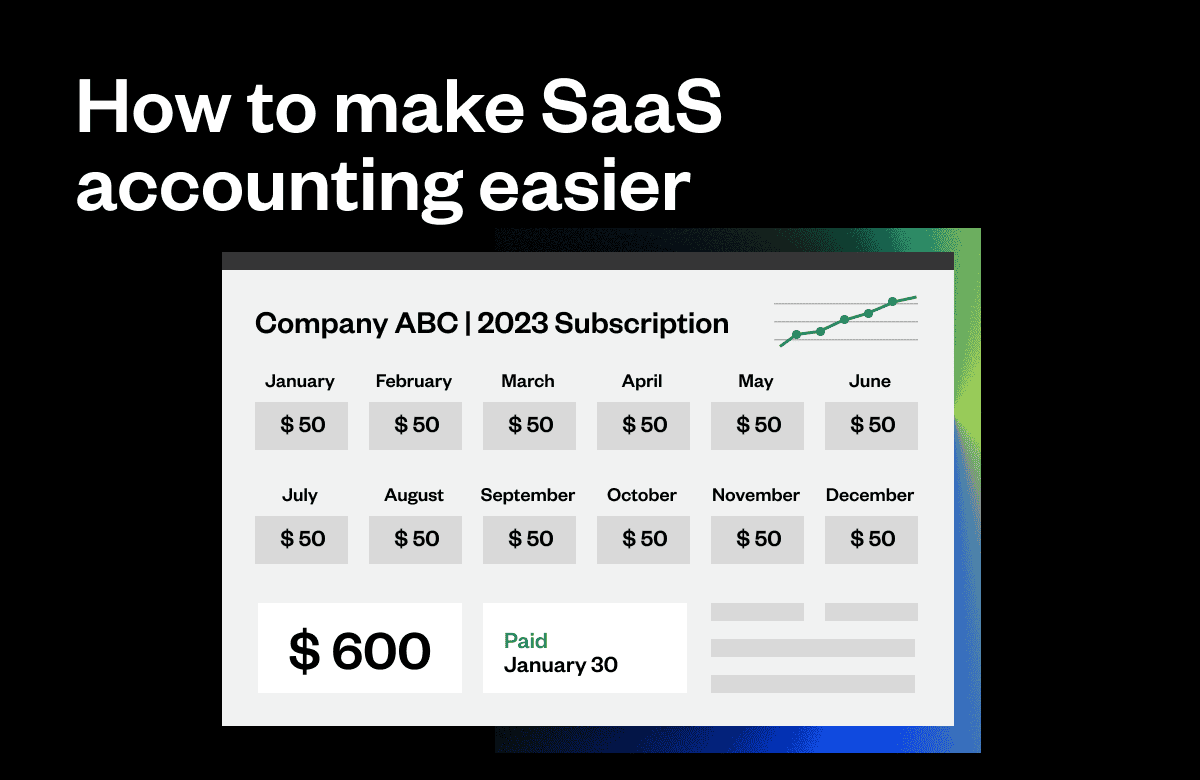

For instance, it’s easier to forecast future revenue in a SaaS business because the future revenue recognition is known on the date of sale. See the following example:

When modeling revenues for subscription-based businesses, think of the layers of a cake. Your Total ARR number is the entire cake, but you need to understand how that revenue grows over time, i.e., the cake layers that make up the whole. That growth is measured as follows:

New business: Number of new customers*Average ARR

Expansion: Growth from existing customers, including upgrades, price increases, users or products added

Contraction: Declines in business from existing and continuing customers, including downgrades, price decreases, fewer users or products

Churn: Loss of existing customers

Revenue modeling: deferred revenue

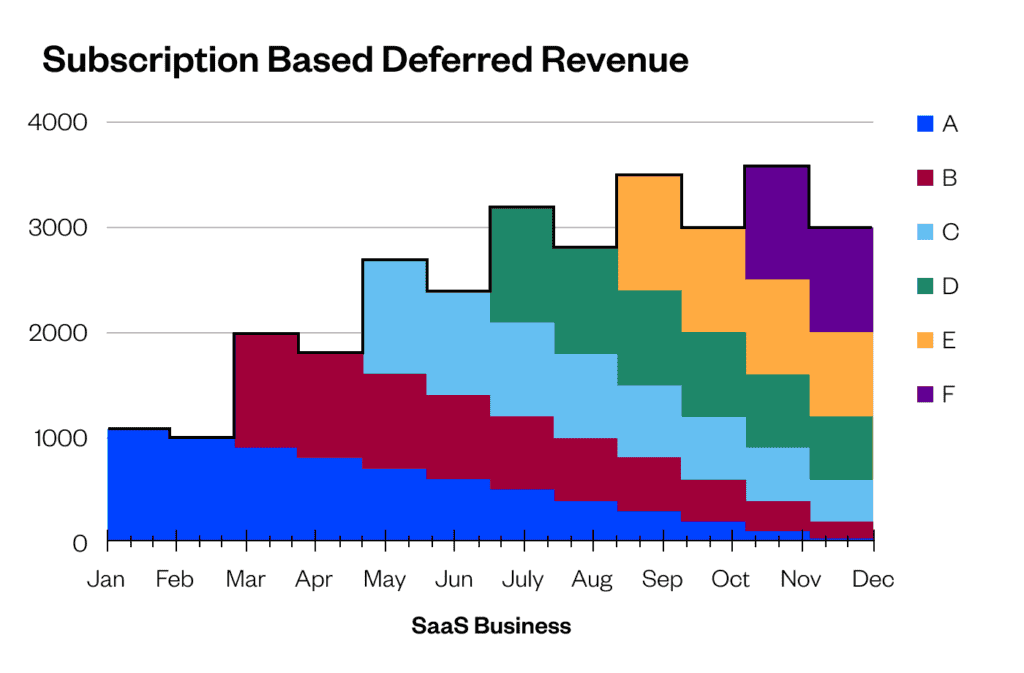

Deferred revenue is an accounting principle related to the accrual method we talked about before. Deferred revenue is revenue that you can’t recognize just yet because the service hasn’t yet been performed.

In non-subscription businesses, sales are transactional, so revenue is recognized immediately. There is no need to defer revenue recognition because all revenue is recognized as soon as it occurs. See the following example:

In subscription businesses, by contrast, the service is performed over a period of time; therefore, revenue is recognized bit by bit over the duration of the term. As the term goes on, your revenue goes up, and your deferred revenue balance goes down. This is important for reporting purposes because deferred revenue is recorded as a liability on your balance sheet.

The equation becomes more calculated when you factor in billing frequencies. At many SaaS companies, customers are billed all up-front to simplify things. After all, it’s always better to have cash-in-hand sooner rather than later.

However, for companies where that’s not possible, billing frequencies have a huge impact on the cash runway, something that’s essential to budgeting for business operations and reporting to potential investors.

8 common pricing and revenue models found in SaaS businesses

There’s no one-size-fits-all revenue model for SaaS companies. Instead, most software businesses use multiple revenue models to fully represent the value provided by their tools and services. It’s also equally important to choose the correct pricing model for your business as this is what will be responsible for capturing the value.

Choosing the right mix of revenue and pricing models can put your company in the perfect position for revenue growth and stickiness. But on the flip side of that coin, if you choose a pricing model that doesn’t align with the unique value your company provides, you could experience huge revenue leaks and missed opportunities.

In this section, we’ll explore the eight revenue and pricing models that SaaS businesses frequently use to strike that perfect balance between value provided and revenue generated. You may even consider using one of the following models in your own business.

1. Subscription model

The subscription model involves charging a recurring flat fee, usually monthly or annually, for access to a SaaS product. It’s also the model people typically associate with the popular SaaS tools. Under this model, customers pay a recurring subscription to continually use a software tool or platform on a month-to-month basis.

How It Works

In the subscription model, users pay a flat monthly rate to access the core feature of a SaaS product — this doesn’t include any add-ons or additional models. These subscriptions can also be tiered to feature limits, number of users per account, usage capacities, or other levers to justify a fixed monthly rate. As a result, this model lends itself well to both business and consumer use cases.

Pros and Cons

The subscription model provides predictable recurring revenue streams by design. This is because it incentivizes software providers to focus on improving customer relationships to ensure they continue paying for software access each month. Offering customers discounts for annual commitments or multi-year terms is another big perk of this model, as it allows business leaders to increase their customer lifetime value and forecast future revenues more easily.

On the flip side, companies also run the risk of customer churn on a monthly basis under this model. But overall, monthly subscriptions are a staple SaaS monetization strategy, and they’re not likely to disappear anytime soon.

2. Usage-based model

Unlike flat-rate subscriptions, the usage-based model prices access to SaaS products based on actual volumes consumed. In other words, customers pay precisely for what they utilize rather than bundling a set amount of features or models into a single subscription tier.

How It Works

In usage-based pricing, certain SaaS metrics are used to measure how customers are charged for their usage — metrics like:

- API calls made

- Data storage space used

- Computing power leveraged

- Data transfer volumes

…drive incremental usage charges.

This model also gives customers better bang for their buck based on their usage of a SaaS product — lower utilization customers pay less, while higher activity ones pay more.

Pros and Cons

Usage-based pricing aligns costs very closely to the value delivered per customer. This is because companies only need to pay for the precise resources their customers are using at any given time — generally speaking, at least.

However, there are some challenges that still exist within this model.

For instance, spiky or volatile usage across a customer base can make it difficult to accurately forecast revenue throughout the year. Additionally, other variables like seasonality and swings in the market can impact a company’s bottom line unexpectedly if they’re solely operating under a usage-based pricing model.

3. Per-user model

Next up on the list is the per-user pricing model. The per-user approach charges subscription fees based on the number of individual user accounts on a SaaS platform (e.g. number of employee licenses or seats on Zoom, Slack, etc.).

How It Works

Per-user pricing aligns directly with the number of employees or end users that need access to the software tool in question. Typical pricing includes:

- $5 per user per month

- $50 per user per year

- Volume discounts at tier levels like 10, 25, 50+ users

Pros and Cons

Charging per user allows companies to scale their tech stack costs in direct proportion to the number of users in their organization who need access to these tools. This means that small teams typically pay less, while larger companies using a greater number of licenses will pay more.

However, the “per user” approach discourages account sharing behaviors as it can lead to unwanted revenue leakage for software vendors. Similarly, per user pricing also makes it more difficult to forecast future revenues when compared to a less volatile pricing model like flat-rate pricing.

4. Transaction fee model

Unlike fixed or consumption-based pricing, transaction fee models charge a small percentage based on activity volumes like payments or shipments handled within a SaaS platform.

How It Works

Most transaction fee models work by taking a small cut of volumes transacted through a SaaS platform. These fees can be based on different variables such as:

- Payments processed

- Subscriptions billed

- Orders shipped

- Appointments booked

- Leads generated

The most common transaction fee percentages range from 1-5%, but these percentages can vary widely based on the industry, use case, TAM, and any other variables that impact who is using the software and what they’re using it for.

Pros and Cons

Similar to consumption-based pricing, the transaction fee pricing model ties revenues tightly to platform usage. This makes it easy for SaaS vendors to scale revenue as transaction volume increases.

However, the revenue generated from transaction fees can ebb and flow based on the types of transactions they’re using to generate revenue, as well as any seasonality that could impact the volume of these transactions. Startups using this pricing model may also find it difficult to get funded at first because they don’t have the same fixed monthly recurring revenues you’d typically find at companies using a flat-rate model. Additionally, building the payment and transaction capabilities required to leverage this type of model requires significant development work.

5. Freemium model

With a freemium model, companies offer a free, limited version of their SaaS product to attract user signups. Then, they can leverage their existing user base to upsell a small percentage of these customers to paid premium plans.

How It Works

Freemium models are designed to get potential customers in the door by giving them access to basic features and functionality. Once those users begin to show signs of retention, they can be upsold to a premium plan that would give them access to a greater number of features. Some of these premium features could include:

- Greater usage capacities

- Premium customer support

- Brand customization and white-labeling

- Dedicated account managers

This incentive-based approach is what makes the freemium model so profitable. First, you get users hooked on your software. Then, you upsell those users to scale revenue.

Pros and Cons

SaaS companies can use freemium models to leverage broad accessibility and organic sharing to rapidly build and scale their user base.

But only a small fraction of these free trial users will turn into paying customers. Because user acquisition and monetization are wildly unbalanced in this pricing model, companies considering this model will need to forecast their user conversion rates ahead of time. If companies can only convert a small percentage of free users into paying customers and still turn a profit, then this pricing model may be a good choice.

6. Integrated value-added services

Rather than just providing access to their software, some SaaS providers sell packaged bundles — these “bundles” typically include a blend of software subscriptions with customized professional services added on top.

How It Works

Within a value-added model, SaaS companies seek to scale revenue by upselling powerful add-on features that provide additional value to their users. A few value-added offerings include:

- Implementation and rollout services: This typically includes done-for-you implementation services, data migration, and user onboarding and change management support

- Ongoing administration: This includes platform management and updates, automation tools, and custom integrations

- Training and enablement: This offering includes online and onsite user training, admin and power user education, and additional playbooks and collateral-related software training

This “white glove” approach allows software companies to unlock additional streams of revenue without needing to develop new products, features, or modules. Instead, they can leverage human-powered services to scale revenue and create a more personalized experience for their users.

Pros and Cons

Bundling professional services alongside a core SaaS offering can quickly raise a company’s average deal size and increase their customer satisfaction scores. However, the costs associated with these white glove services scale as well. Ultimately, companies using this model will need to determine if the additional revenue generated and increased user retention rates driven by these value-add services are worth the costs they incur.

7. Referral and affiliate fees

A referral or affiliate program rewards existing users for driving new customer sign-ups via word-of-mouth marketing. This is a great way for SaaS companies to generate additional revenue without needing to offer additional features, add-ons, or professional services.

How It Works

Typically, existing customers will share a unique referral link or code with peers who go on to purchase a piece of software. This can earn both the new and existing users incentives like:

- Account credits

- Free months of access

- Cash rewards

- Gift cards

- Entry into contests

Pros and Cons

Referral programs incentivize organic evangelism, increase brand awareness, and can drastically reduce a company’s customer acquisition costs (CAC) when done well. However, getting these programs off the ground takes time and typically only works if you already have an engaged user base. There are also some short-term revenue impacts that companies should take into consideration when offering discounts and account credits to new users.

8. Feature-limited tiers

A feature-limited tier works by packaging and restricting advanced features and functionality based on pricing tiers. Users are then encouraged to upgrade their subscription plan at a higher cost to gain access to additional features, modules, integrations, or other features that could provide additional value.

How It Works

With feature-limited tiers, companies can put a paywall in front of certain features, including:

- Number of connected apps/data sources

- Advanced reporting and analytics

- Real-time visibility

- API access

- Premium support

Pros and Cons

Feature-limited tiers give SaaS companies the flexibility to serve both SMB and enterprise buyers through incremental plan constraints. However, the feature gaps between these pricing tiers shouldn’t overwhelm your basic users or underserve your premium ones — each pricing tier needs to strike the right balance of value provided and cost required for this model to be successful.

Key metrics to include in your revenue model

If you want to determine whether or not your business is sustainable, you need to make realistic assumptions about your revenue growth rate and customer retention patterns. Here are the metrics we recommend you include in your revenue model to track these patterns:

- Churn Rate: The percentage of customers canceling subscriptions each month. A high churn rate signals a company is facing issues with customer retention.

- Customer Lifetime Value (CLV): The total revenue expected from an average customer over their entire lifecycle. A higher CLV typically means more revenue generated per user overall.

- Annual Recurring Revenue (ARR): Your projected yearly recurring billings for renewals and new signups.

- Average Revenue Per User (ARPU): This is the forecasted average payments collected per subscriber each year.

Correctly tracking the metrics above is key to properly assessing the health and long-term viability of your business.

Common pitfalls when transitioning between revenue models

Switching to a subscription-based revenue model comes with its own set of growing pains, and many SaaS leaders don’t know how to properly set up or interpret these models to accurately track their financial performance month-over-month. These are the most common pitfalls that occur when transitioning to subscription-based revenue models (and how to avoid them).

1. Underestimating the impacts of deferred revenue liability

Shifting to subscription pricing can create a “deferred revenue liability” in most SaaS companies — this is money collected upfront for services that are yet to be delivered over the contract term. And when you factor in annual contracts, these deferred revenue balances can pile up into the hundreds of thousands to millions of dollars range.

The key to avoiding these deferred revenue balances is by reconciling your new sales with your existing deferred revenue drawdown rates. For example, if $10 million liability exists, and it draws at $2 million per quarter, then 8 million net new billing is required to post $10 million revenue that quarter. In other words, if you don’t reconcile your compounding upfront payments, you’ll be facing some pretty severe discrepancies during your monthly and quarterly financial reviews.

2. Focusing on new sales over renewals

In SaaS, renewals are just as important as new customer acquisition — especially as you start to scale.

With this in mind, your pricing strategies and sales commission structures should incentivize renewals equally to new customer acquisition. Not only do high renewal rates make it easier to forecast future revenue, but they also decrease the risk of volatility in your business caused by churned customers.

Once you’ve built out the infrastructure needed to ensure customers, you need to ensure that your revenue models are capable of tracking new sales vs. renewals. This will give your executive team greater visibility into how revenue is ebbing and flowing in your business and whether these changes are the result of customer acquisition and churn or user monetization and subscription downgrades.

3. Not linking the model to a broader financial plan

When transitioning to subscription pricing, your revenue model can’t exist in a silo — it needs to connect with your broader financial planning efforts. For example, how is your monthly subscription revenue impacting your company’s revenue targets, profit margins, and cash flows?

If you don’t have visibility into how your monthly recurring revenue (MRR) is impacting your company’s financial health across these different variables, it will be near impossible to assess the health of your business on a monthly basis or make accurate future forecasts.

The complete guide to SaaS revenue modeling

Want to learn from the experts how to build a successful SaaS revenue model? Download The Complete Guide to SaaS Revenue Modeling today to get started with your own model.

In the guide, Burkland’s Debbie Rosler and Maxio’s Jon Cochrane dive into the key components of revenue modeling and even provide a template to help you get started. Here’s a quick preview of what you can expect to learn:

Chapter 1: Fundamentals of SaaS ARR and Revenue Modeling

Chapter 2: Bottoms-Up or Revenue Driver ARR Modeling

Chapter 3: Top-Down or Trendline ARR Modeling

Chapter 4: Forecasting Cash Flow Associated with ARR

Chapter 5: Key Takeaways and Free Metrics/Revenue Modeling Template

Key takeaways

- The main difference between revenue modeling in a subscription vs. non-subscription businesses is how revenue is recognized.

- Projecting future revenues from a subscription business is less subjective because they are recognized over a specific period of time, whereas there’s no guarantee of future revenues in a non-subscription business.

- Clearly understanding deferred revenue balance and how your future billing schedules may increase or decrease that balance becomes essential when projecting your future cash flows.

For more tips and tricks on how to build a revenue forecast, check out Ben Murray’s SaaS Revenue Forecast Model.