If you’re in the midst of pricing research for your SaaS product, you’re doing important work.

Taking the time to understand which price points position your product for success can have a huge impact on your appeal to customers — and ultimately on your bottom line.

Pricing research and experimentation can be a little overwhelming, with seemingly limitless combinations of pricing models and price points to consider.

Tackle your pricing research with confidence by asking yourself the following questions before you dig in:

- What do I need to charge to stay profitable?

- What type of pricing model is best for my business?

- How can I productize pricing to promote upsells and expansion opportunities?

- What are potential customers willing to pay?

- How can I test my pricing?

What do I need to charge to stay profitable?

The first thing you need to understand is exactly how much you need to earn per customer to break even — and to stay profitable.

To get that information, calculate:

- How much it costs to acquire each customer (Customer Acquisition Cost)

- How much value each customer is likely to add to your organization over the long-term (Customer Lifetime Value)

As we wrote in our blog post Understanding Customer Lifetime Value and Acquisition Cost, aim for a CLV that’s 3 to 5 times greater than your CAC.

Peak profitability might not be an immediate concern for your startup depending on your funding and goals. However, most companies that don’t quickly get this ratio under control find themselves running out of cash.

You won’t always have a ton of reliable data on CLV starting out, and your CLV will fluctuate based on the pricing you end up choosing. However, ensuring you are operating based on your best, data-driven estimate can help you nail down an acceptable range as a starting point.

What are potential customers willing to pay?

Understanding how much your product should ideally cost isn’t helpful without another key piece of information: How much are your potential customers are willing to pay for it?

As Dave Bailey of The Founder Coach writes, getting this info certainly isn’t as simple as asking potential customers what they would pay or collecting survey results.

It’s much more accurate to observe and gather information about actual experiences than it is to ask about hypotheticals.

To get a sense for how much customers would pay, Bailey suggests asking questions such as these:

- How much did you spend on [solving your problem] last time?

- Did you research any products to help with that?

- Which products did you consider?

If you’re selling your software to other businesses, add a few more questions:

- Which budget would a service like this come out of?

- How large was the budget last year?

- Who generally makes the software buying decisions at your company?

The fact is that it might make sense to charge some customers more or less than others based on their needs and what they’re using it for.

This is called “differential pricing.” A common example is the “student discount” rate that many stores offer to students. Students get the same products or services as non-students, but for a different price. The price change is based solely on their ability to pay.

SaaS companies often use the same tactic. When it makes sense, they develop pricing solutions for customer groups with different needs and different budgets.

It’s inevitable that most SaaS companies eventually need to develop custom pricing for a big client whose needs fall outside the range of their normal pricing tiers.

It’s worth considering how you’ll handle those cases from the outset.

What type of pricing model is best for my business?

For basic subscription services, a flat monthly rate usually works great.

For most SaaS businesses, though, pricing needs are more complex. These companies must adopt a pricing strategy that aligns with how customers use the software.

You may consider just a few of these common pricing model options:

Freemium

In some cases, the best fit is to offer a basic version for free and encourage users to upgrade to paid versions. “Freemium” offers can boost traffic, increase adoption and make upsell opportunities more attractive. Depending on your software, it may cut down on your sales and customer service resources, because people can simply see the app for themselves with no intervention on your behalf.

Usage-based

In many cases, customers prefer to pay based on how much services are used instead of sticking to a flat rate. The most common example of this pricing structure is how phone companies charge for data.

Multi-frequency

A business opts to bill customers for multiple subscriptions at different intervals, such as a hosting company charging $100/year for hosting and $5/month per static IP address.

Minimum/maximum

This sophisticated pricing model establishes a price “floor” or “ceiling” that can affect what customers pay. An example would be a marketing company charging the greater of $1,000/mo or 2.0% of media spend.

Hybrid

A hybrid pricing program is any combination of more than one type of pricing structure. For example, a payment gateway may charge $50 a month plus 2.9% of revenue plus $0.30 per transaction.

To learn more about potential billing scenarios, check out Maxio’s full pricing structures page.

Which pricing packages promote upsells?

One of the most important ways for a SaaS business to grow is through the upgrades and growth of existing customers — commonly known as as “expansion MRR.”

This type of growth costs very little compared to the cost of acquiring new customers, so it’s especially valuable.

Companies can use specific pricing strategies to boost upsells and internal growth. Namely, companies can pave the way for more expansion MRR by thoughtfully creating pricing tiers that incentivize upgrades.

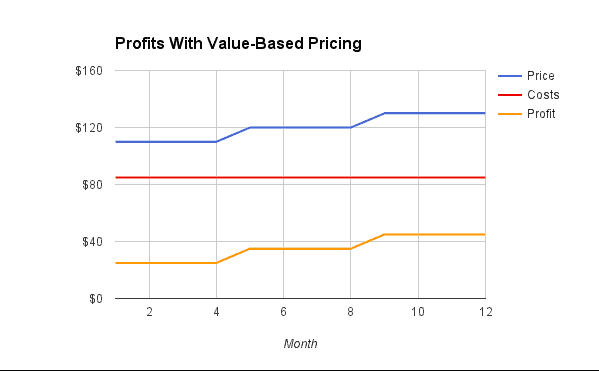

This type of pricing is sometimes referred to as “feature-based” or “value-based” pricing. It requires plenty of research into what your customers need at each stage of growth and which points in their lifecycle they will be the most likely to require an upgrade. Once you have a good handle on your customers’ needs, you can adapt your services to meet them, ultimately ensuring you are providing the most value at every stage in their growth.

When you do value-based pricing right, your profits could look like the ones in this graph from ProfitWell.

How can I test my pricing?

Once you have the answers to the first four questions, use your new insights to set a preliminary pricing model. And from there, you’re done… right?Wrong. Pricing should be an ever-evolving experiment. You should make it a common practice to analyze the results of your pricing and it impacts on your business performance on a regular basis.

Without ongoing testing, your pricing won’t stay relevant. The best pricing adapts to your customer’s changing needs, the changing marketplace landscape and the increased value your software is hopefully adding for customers.

Consider this: Each time Maxio client HappyFox analyzes its customer behavior and makes a price change as a result, it typically sees sales increase anywhere from 50 percent to 100 percent.

That’s why before you launch your new pricing, make sure that you have the tools in place to analyze its success properly. Your billing platform should let you easily see churn rates, adoption rates and lifetime revenue for each pricing tier or plan.

Of course, you can always reach out to us to learn more about how Maxio can lend you these powerful insights. Click here to learn more and discuss your billing needs with one of our experts.