Pricing can make or break a company. A well-considered pricing strategy accounts for free trials, how much you need to charge, discounts, and billing frequency—and the latter is paramount for a B2B software-as-a-service (SaaS) company. While monthly billing plans are common among B2C recurring-revenue businesses, annual billing plans offer tremendous benefits for both your company and your subscribers and may be the better choice for B2B businesses.

In today’s blog you’ll learn how annual billing:

- Increases cash flow

- Creates more stable, predictable revenue

- Reduces churn

- Can benefit your customers

We’ll also discuss how to determine if annual billing is right for your company and how to incorporate annual plans on your pricing page.

Managing cash collections and structuring sales contracts are some of the most impactful initiatives a SaaS company can undertake to maximize their chances of success, particularly in the early days of the company’s life.

Tomasz Tunguz

Monthly Subscription Vs Annual Subscription Billing: What Are the Differences?

One of the key decisions SaaS businesses must make is which billing cycle to offer – monthly payments or an annual billing cycle? This decision shouldn’t be made lately. After all, the billing model you choose can significantly impact your cash flow, customer retention rates and lifetime values, your revenue management methods, and the operational effort to bill and collect. In other words, the billing methods you use impact almost every aspect of your business.

Let’s explore the core differences between these two types of billing and pricing models:

Payment Frequency and Cash Flow Impact

With an annual billing cycle, customers pay for the entire year upfront on the billing date. This provides a higher initial cash inflow compared to the frequent but smaller payments with a monthly billing period. For growing SaaS companies, optimal cash flow management is critical, which gives an edge to the annual billing option.

Revenue Recognition and Accounting

Regardless of billing options, SaaS companies must follow ASC 606/IFRS 15 revenue recognition standards. With monthly payments, revenue is recognized over time as services are delivered each month. For annual billing, there are different rules around recognizing varying portions upfront vs. over the billing period. This can create a potential cash flow vs revenue recognition mismatch to manage.

Customer Psychology and Buying Commitment

Annual plans require a higher upfront financial and psychological commitment from customers. Monthly billing allows lower risk for trying the software initially before deeper commitment. This impacts customer acquisition and onboarding – monthly plans may have higher trial sign-ups but require more hand holding, while annual plans likely undergo more vetting but have higher intent to stick around.

Customer Retention and Churn Dynamics

Because annual subscriptions contractually lock customers in for the entire year, they can help reduce churn. Monthly billing provides an easier off-ramp for dissatisfied customers. Robust customer success and value realization efforts are crucial for both billing models to maximize retention.

Pricing Flexibility and Discounting

To incentivize annual over monthly, SaaS companies often discount the total annual price vs. the monthly equivalent summed over 12 months. There’s also pricing psychology differences in showcasing a larger single “annual” price vs. smaller recurring “monthly” charges. Discounts on annual plans can be used to convert monthly subscribers.

Operational Impacts and Accounting Workload

Annual billing provides a more seamless, predictable revenue stream. But it also has a higher up-front accounting/invoicing workload compared to the recurring monthly cycle. For enterprise customers with intensive procurement processes, an annual vs monthly billing period may be preferred to minimize re-approvals.

Final Thoughts: Give Your Customers Options

While annual billing may be in the best interest of both your business and customers, it can be worthwhile to also offer a monthly subscription plan. This option may help you sell to those individuals who are looking to test out your B2B SaaS application without having to commit for the full year.

Another strategy that B2B SaaS companies use is breaking down annual prepay pricing into a monthly cost to combat the sticker shock that comes with seeing the total yearly price.

One final tip on how to convert monthly customers into annual subscribers: Lars Lofgren, the former director of growth for Kissmetrics, says it’s never too early to market and upsell to monthly subscribers. “One month after a monthly user subscribes, send an email with a link to get your annual discount,” Lofgren advises.

Ultimately, the optimal billing model will depend on your company’s cash flow needs, customer profile, sales/marketing motion, and operational capabilities. So, now that we’ve covered the differences between monthly vs annual billing, let’s dig into some of the big advantages of using annual billing.

Annual Subscription Advantage No. 1: Increased Cash Flow

Growth requires cash. Collecting payment for an annual subscription at the beginning of the term will result in an instant boost in available cash on hand that can be reinvested immediately into your business.

Saasmetrics founder Leo Faria gives a good example of the power of increased cash flow from annual billing. Imagine a subscription-based B2B SaaS company that charges $480 per month and has a $4,000 customer acquisition cost (CAC). Faria’s hypothetical situation focuses on a 12-month period, with an understanding that the retention period would ideally be much longer. The below chart plots out the acquisition cost, subscription payments, and cumulative cash flow for one customer over a year.

“Note the classic problem: all the cash invested on customer acquisition must be spent in the first month, while the revenue comes over a long period,” Faria writes. The graph clearly shows the company would have negative cash flow until Q4.

However, if that same customer prepaid for the year at the beginning of their subscription, the company would receive $5,760 in up-front cash:

In both scenarios, the CAC is $4,000, but in the prepaid annual billing scenario, Faria points out that “you don’t get negative cash flow. You get a $1,760 balance that could be used to finance the acquisition of more customers.”

Tomasz Tunguz, venture capitalist at Theory, took this idea a step further in a blog post entitled “A Surprisingly Powerful Mechanism for Growing a SaaS Startup.” While Tunguz’s post focused on startups, his theory holds true for most established B2B SaaS companies. In the graph below, Tunguz plots the cash position of a hypothetical startup over a 24 months period based on the following billing structures: monthly, quarterly, biannually, postpay annually, and prepay annually. The results are telling.

While the cash positions converge at the end of each year (the 12- and 24-month data points on the graph), note the huge differences in available cash the rest of the time.

“It’s plain to see that annual prepay is the most advantageous position for the company. In the annual prepay scenario, the company generates negative working capital,” explains Tunguz. “Customers are financing the company’s growth by lending the startup money at effectively zero interest. The startup can take that capital and double down on growth if it makes sense for the business, a luxury the other parallel financial universes don’t allow.”

While cash flow is important, note that an increase of cash on hand doesn’t necessarily equal a sudden boost in revenue. With the newly implemented ASC 606 and IFRS 15 accounting standards, there are very specific revenue recognition rules that subscription businesses must follow. Maxio recently acquired ProRata to help our clients better automate revenue recognition that complies with these new regulations.

Annual Subscription Billing Advantage No. 2: More Predictable Revenue

Predictable revenue is one of the primary reasons businesses are switching to a subscription-based business model in the first place. By collecting a yearly payment upfront, businesses are better equipped to understand the financial state of the company, which leads to more strategic long-term planning and stability.

Quaderno’s Annie Musgrove states that “with the predictable revenue of a subscription model made even more predictable through a yearlong commitment, these companies can more confidently forecast and make decisions concerning their growth down the line.

But in addition to the stability that comes with an annual contract, there is another implicit benefit that you will soon see when it comes to customer retention.

Annual Subscription Billing Advantage No. 3: Churn Reduction

One of the greatest advantages of annual subscriptions is that customers have to use your software over a year, rather than dump it just because they find the learning curve steep or have an issue one month. This is not to say that your product should be onerous for users, but the nature of B2B SaaS solutions is that they are complex. Think of behemoths like customer relationship management or warehouse inventory management applications.

“My experience is that customers tend to view an upfront annual payment as a sunk cost. This means they will probably have taken more time to make their purchase decision but will also make more effort to get the most from their purchase,” writes Jonathan Gettinger, CMO at Pipe17.

Plainly put, users need a lot of time to become familiar with, adopt, and realize the value in these kinds of solutions. Overcoming this initial user friction is key to retaining customers—the gift of time is vitally important for a smooth transition and reduces the chance of customer churn.

Over the years, your customer success team must help your customers get to that “aha moment” when they experience the value in your product. And in doing so, your success team must also provide a positive customer experience, helping turn a customer into a true promoter. After all, happy customers renew their annual subscriptions, champion your product, and refer to new prospects, which also reduces CAC.

The caveat here is your product must be worth an annual commitment. Knowing that customers may take more time to purchase if they face annual billing, savvy B2B SaaS companies often provide longer trials, more in-depth demos, and a wealth of helpful blog posts and white papers to assist with that decision.

Annual Subscription Billing Advantage No. 4: Customer Convenience

While annual billing holds a lot of advantages for your company, it also provides some convenience for your end customers—especially in the B2B world. The largest benefit arguably has to be the fact that your customer will go through their internal procurement process only once a year.

Anyone who has ever purchased on behalf of a company knows how burdensome it can be to go through the procurement department and navigate that maze of corporate bureaucracy. Why would anyone want to inflict this pain on themselves 12 times a year? Annual billing solves this problem for your customers—at least for 11 months out of the year.

However, there’s also some connivance hidden in here for service providers using annual billing too. For instance, by using annual billing, you don’t have to worry about constantly updating existing customer details in your billing solution like the number of licenses they get, their preferred payment method, or their credit card info. These same rules apply to new customers too. Once they’re in your billing system, you can set and forget their information until it’s time for renewal the next year.

Finally, since most annual plans offer some kind of discount over their monthly counterparts, your customers can use these cost savings in the ROI calculation to further justify their selection of your B2B SaaS solution. This provides yet another tool in your customer’s toolbox to slash through the red tape.

Wrap-up

As you can see, annual billing increases cash flow, reduces churn, and provides predictable revenue, giving your B2B SaaS business stability and supporting its long-term planning. For your customers, it can often mean cost savings and only one trip through their internal procurement process each year.

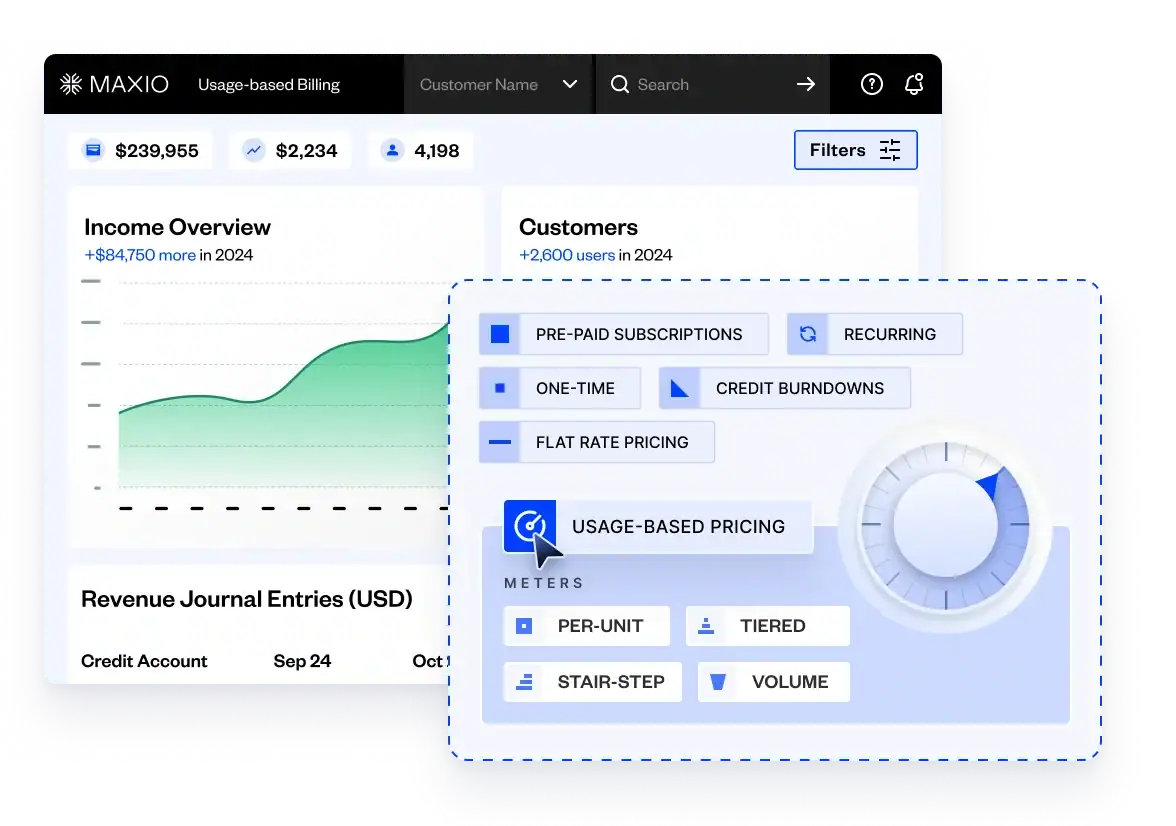

Regardless of whether your customers opt for an annual or monthly subscription, Maxio is there to support you. Our robust platform can handle any permutation of recurring billing for your customers, on top of the fact that it lets you easily provide discounts and coupons out of the box.

Additionally, we offer built-in analytics and insight tools so that you can understand the health of your business.

Our subscription management features mean you can cater to your customers throughout their life cycle. It’s all protected by our enterprise-grade security, built on a PCI DSS Level 1–compliant system, the highest level of PCI compliance for a service handling sensitive payment data. Be sure to contact our billing experts if you have any questions about how Maxio can support your subscription business.