Most SaaS companies are worried about generating and retaining new customers. But have you ever given much thought to what happens when those deals are marked as closed/won? Or when a new free trial user converts to a paid plan?

Once money begins to change hands, this sets off what is known as the “order-to-cash” cycle—and if you don’t understand it, you could be creating serious cash flow problems as you start (or continue) to scale your business.

So, throughout this article, we’ll show you everything you need to know about the order-to-cash process, including what it is, how to optimize it, and where you can identify opportunities to automate it.

What is the order-to-cash process?

The order-to-cash (O2C) process, also known as the order-to-cash cycle, encompasses all steps from the time a customer places their initial order to the transaction completion, when the business receives payment.

At a high level, the O2C process includes key stages such as:

- Order management

- Invoicing and billing

- Collections and dunning

By managing all the stages of this O2C process effectively, businesses can accelerate order fulfillment, streamline cash flow, and ensure compliant revenue recognition across their business.

This is especially important for SaaS companies because with recurring billing cycles and ongoing subscriptions, there are more complexities around invoicing and revenue recognition than with your typical one-off transactions. Without the right controls, like revenue recognition software, and smooth hand-offs between sales and accounting teams, it becomes nearly impossible to accurately track the status of deals, revenue, or collections.

O2C vs configure, price, quote

Now that we’ve covered the O2C process at a high level, let’s take a closer look at a similar process: configure, price, quote. While the order-to-cash process focuses on everything that happens after an order is placed, Configure, Price, Quote (CPQ) comes into play earlier, during the sales cycle. CPQ solutions help sales teams build and send accurate quotes by automating how products or services are configured, priced, and approved. This is especially useful for SaaS companies with custom packages, tiered pricing, or usage-based models.

That’s why you’ll often see comparisons between quote to cash vs CPQ. CPQ is just one part of the broader quote-to-cash (Q2C) process—it streamlines the quoting stage but doesn’t handle what comes next, like invoicing, revenue recognition, or collecting payments. Those tasks are part of the O2C cycle.

In short, CPQ solutions help close deals faster with fewer errors, while O2C systems make sure those deals are fulfilled, billed, and paid for. Both play important roles in driving revenue, and when integrated, they give sales and finance teams a smoother handoff and better data visibility.

O2C vs quote-to-cash

While the order-to-cash cycle refers specifically to the steps after an order has been placed, the quote-to-cash (Q2C) cycle is much more comprehensive.

The Q2C process includes every touchpoint, starting from the initial capturing of customer purchase intent before an order is even placed. Q2C also encompasses all the discovery, relationship building, and pricing negotiation that happens pre-order. This includes processes like configuration and pricing and quoting that can occur if your SaaS business offers sales-negotiated contracts for certain customers.

Q2C also includes contract lifecycle management, spanning initial subscription agreement to renewal and expansion. In other words, once a contract is signed, the order is placed, and the subscription billing software is activated, only then does the narrower order-to-cash process begin.

So while Q2C takes a more holistic view of the entire revenue operations process, O2C focuses strictly on order fulfillment to payment. However, optimizing both of these cycles is key for subscription and SaaS businesses to accelerate their deals and smoothly transition customers from prospects to long-term buyers.

Importance of the O2C process

At this point, you should have a solid understanding of order-to-cash, but why should you spend your time optimizing this process?

For starters, O2C has a direct impact on cash flow and profitability. By ensuring accurate, on-time customer billing and collections, the O2C cycle keeps revenue recognition and cash availability consistent. This predictable revenue stream is the lifeblood that will fuel a SaaS company’s expansion goals and satisfy its investors.

Second, the O2C process needs to be improved to ensure customer satisfaction. Missing charges, complicated bills, or discrepancies due to misaligned data will create a poor customer experience for your users, which may ultimately cause them to churn.

Finally, a streamlined O2C process aligns teams across sales, accounting, finance, and operations to work in lockstep throughout the lifecycle of your SaaS deals. But without a dedicated platform or set of tools to coordinate everything from order management to collections, your departments will quickly fall out of alignment. Misunderstandings between these departments can then result in billing mishaps, order mistakes, and compliance gaps that could spell disaster for a SaaS business that’s trying to scale.

This is why we suggest that growing SaaS companies invest in tools like Maxio, a dedicated platform that helps them streamline their entire order-to-cash process without needing to invest in multiple-point solutions or overpriced enterprise software.

Key components of the order-to-cash process

What exactly does a streamlined order-to-cash process look like?

To truly be efficient, the order-to-cash cycle depends on multiple interconnected components working together in harmony, from the moment a customer places an order to the final receipt of payment.

Specifically, the key components of the O2C workflow include order management, credit analysis, and order fulfillment.

- Order management: Involves intaking purchase orders across channels, validating details, establishing pricing and payment terms, and tracking through order histories. Streamlined order management ensures accuracy from initial order placement to delivery.

- Credit management: Examines customer creditworthiness to limit default risks that could disrupt a business’s cash flow.

- Order fulfillment: Confirms products or services are delivered on schedule as promised, ensuring customer satisfaction. If fulfillment suffers problems, customers frustrated by these delays or mistakes will ultimately churn. The downstream effects of poor order fulfillment can further bottleneck invoicing, collections, and revenue recognition.

Step-by-step breakdown of the order-to-cash process

We’ve discussed the O2C process in high-level detail so far. Now, let’s examine each part of the order-to-cash process step-by-step.

Order management

The order-to-cash process starts with order management—the capturing, order processing, and tracking of customer orders.

Using order management system software, businesses intake purchases across channels, validate details, connect orders to catalog/pricing data, establish a timeframe for fulfillment, and manage through final delivery. Tight order management integrates inventory management visibility to confirm product availability. It also aligns with the supply chain to schedule order fulfillment.

Streamlined order management ensures accuracy from the customer’s initial placement through backend order delivery, providing transparency into an order’s status for both customers and customer service teams.

Credit management

After capturing the order, the credit management stage handles credit approval and conducts a risk analysis on the customer to prevent uncollected SaaS payments in the future.

Evaluating past purchase history, payment reliability, and financial health helps qualify suitable credit limits and terms. Strong credit management minimizes the chance of delinquent customers who fail to pay on time after services and product delivery. Especially with invoices paid in arrears, steady receivable collection relies on vetting customers upfront before extending credit. With visibility into customer credit health and patterns, SaaS and subscription businesses can apply measures to route high-risk orders to managers for review.

Order fulfillment

Once the order passes credit checks, the fulfillment stage ensures that the products or services are delivered on schedule as promised.

While this stage is typically associated with physical goods and services, order fulfillment is crucial for maintaining healthy customer relationships. If the fulfillment process encounters delays, substitutions, or mistakes, customers will rapidly churn out of frustration with a lack of inventory, shipping problems, or failure to meet their expectations. Efficient order fulfillment also requires integration between order, inventory, and supply chain management systems. Order details should dictate priorities as procurement teams plan, manage warehouses, and coordinate logistics.

Order shipping

Once items are pulled and packed, streamlined order shipping gets purchases transported to the customer’s location. Of course, this isn’t the case with SaaS businesses, but this is a common stage in the O2C business process when physical goods are involved.

Order shipping leverages carrier integrations across freight modes to connect order data with logistics for delivery scheduling. Shipping teams can then route each order through carrier APIs to purchase labels, retrieve rates in real-time, print documentation like packing slips, and validate estimated transit timelines.

Customer invoicing

Once orders are fulfilled—or your customers’ SaaS subscriptions have started—the next phase involves invoice generation and sending those invoices to collect payment.

Successful customer invoicing relies on integrating order data with invoicing systems to trigger accurate invoices that include all the line items, fees, taxes, and credits owed. Your billing and invoicing teams should then promptly send these invoices through your customers’ preferred channels, like email and customer portals, to start the clock on your net payment terms and prevent any unwanted payment delays.

Accounts receivable

Once invoices are sent, the accounts receivable (AR) stage focuses on collecting and reconciling customer payments. Accounts receivable software can help speed up this process by automatically matching receipts to open and outstanding invoices.

The ultimate goal of an accounts receivable (AR) should be to link incoming customer payments with their owed invoice balances. By rapidly matching receipts to open and outstanding invoices, your finance and accounting teams can update those account balances accordingly, feeding directly into your accounts payable system for a full view of your cash position.

Additionally, AR staff should also monitor aging reports that show past-due invoices. Using this data, they can contact customers with overdue payments, with the ultimate goal of decreasing the “days sales outstanding” metric for faster cash flow turnaround.

SaaS and subscription businesses also face extra AR management complexity. As recurring billing cycles for existing customers renew each period, new corresponding invoices must be generated dynamically. AR teams reconcile these rolling invoices with customer-hosted payment methods that are already on file. They also oversee renewal payment collection for continuity, often using renewal management software to track dates, automate reminders, and reduce churn risk.

AR teams then apply the dollars received to balance the linked open invoices as customer payments come in. Unfortunately, sometimes bad debt must be written off when customers can’t pay, which hurts crucial working capital needed to run and grow the company—this is why your business’ AR process must run smoothly.

Payment collections

Once invoices have been sent, the payment collection process ensures that a business will receive its funds on time.

Depending on the collections software you’re using, you can set up automations to route overdue invoices to collections agents for follow-up. Or, if you’re operating a mainly product-led SaaS business, you may consider setting up a self-service portal where your customers can view balances owed and manage their payment processing preferences.

Reporting and data management

At the end of the O2C life cycle, you’ll want to review deals from the previous month or quarter and gain real-time visibility into your organization’s financial performance. This means you’ll need dedicated SaaS metrics tools to monitor these trends.

Key O2C metrics, like your days’ payables outstanding, billing accuracy percentage, and first pass yield should all be viewable within a central dashboard—and no, we don’t mean a homegrown spreadsheet.

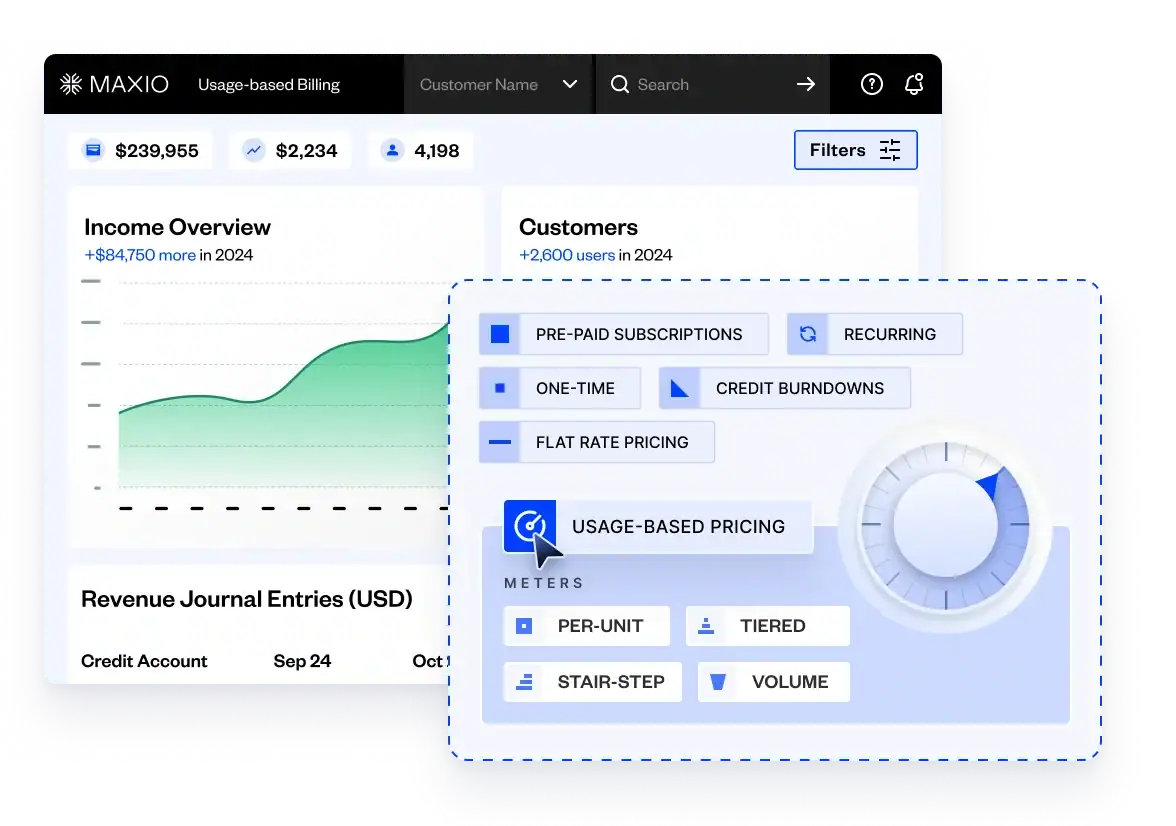

For example, with Maxio’s SaaS reporting tools, you can filter data to reveal trends related to unpaid customer invoices and help you forecast future cash flow or churn risk.

Challenges in the order-to-cash cycle

A disjointed order-to-cash process will quickly spiral into lost revenue and frustrated customers if you’re not careful.

Typical trouble spots can range from out-of-stock inventory failures to invoice errors and payment delays. These O2C breakdowns enable bad debt accumulation while restricting your company’s cash flow. And sure, your billing and accounting teams can try to reconcile these data gaps manually, but will ultimately take them away from higher-level work needed to scale your business.

However, with the right tool(s), you can optimize the O2C cycle in several key ways, including:

- By eliminating manual processes that are prone to human error, you can ensure accuracy across your order documentation, inventory checks, invoicing, and payment posting.

- Optimizing each stage of your O2C workflow will smooth the handoff between individual departments across your sales and finance teams, allowing you to get deals across the finish line and start collecting on invoices in less time

- Improving your data management with dedicated financial operations tools will provide your teams with a consistent customer record from initial quote through to accounts receivable, empowering your staff with real-time visibility into your company’s financial performance.

And if you’re looking for a tool that can do all this, Maxio is your best bet. We even created a complete guide that will show you exactly how Maxio and Hubspot work together to keep sales and finance teams connected and streamline the order-to-cash process.

Automation opportunities in the OTC process

To fully cover the topic of optimizing your order-to-cash process, we need to touch on the power of automation.

The repetitive manual processes involved throughout the O2C process, for one, present several opportunities for automation, like rules-based order validation, dynamic invoicing, and payment collections. Ultimately, you should have dedicated, automated systems and tools in place to handle the grunt work, enabling your people to focus on the higher-value tasks that will really move the needle in your business.

For example, with order management automation, you can standardize data intake from all your sales channels into a single, unified structure. Validating all of your sales details early will prevent any mistakes that could propagate through your fulfillment and billing stages later on in the O2C life cycle.

The same principle of automating standardized systems applies to recurring customer invoicing, or in this case, automated recurring billing. By investing in tools like an automated billing software that allows you to generate high volumes of invoices without manual effort, you can ensure that no revenue is lost through billing delays.

Collections automation also helps the O2C process through gentle payment reminders and notifications sent to customers with balances due. These friendly nudges encourage fast settlement so your customers avoid late fines or other penalties that could only cause them to churn later on.

Optimize your business performance with Maxio

An optimized order-to-cash cycle is crucial for business growth and customer loyalty. Streamlining everything from order intake through timely fulfillment, accurate invoicing, and smooth payment collection directly impacts revenue and satisfaction. All you need is a dedicated tool to automate these processes, and you’ll be able to scale your business without giving O2C a second thought. That’s exactly why we created Maxio, a dedicated financial operations platform for growing SaaS businesses.

Maxio offers an integrated financial operations solution purposely built to connect with your ERP system, smooth order-to-cash friction, and support growth. As a connected hub spanning ERP, CRM, and other systems, Maxio centralizes data for a single source of truth.

Don’t settle for disjointed financial operations that sap your teams’ productivity as you scale. If you want more helpful tips on how to streamline your O2C process, check out this complete webinar we created on how to avoid order-to-cash mistakes in your SaaS business.

Ready to see how Maxio can simplify your order-to-cash process? Get a demo and let us show you what’s possible.