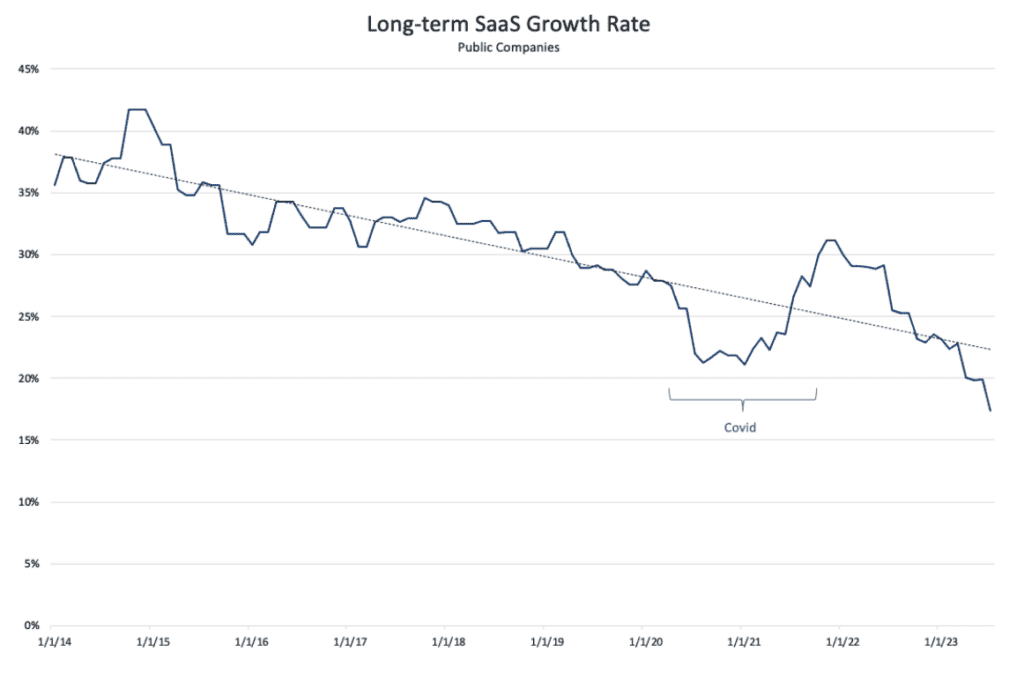

The decline in SaaS growth rates did not start last year; it started a decade ago. Much of this is a natural maturation of the industry as it gets harder to grow as you get larger. That said, this decline is still notably sharp.

The graph includes all B2B SaaS companies that were public in this period as defined by the SaaS Capital Index. On 1/1/14, there were 17 companies; by 7/31/23, there were 69, so this is not simply a static pool of maturing companies. Many new companies have been added, yet growth is clearly declining.

Growth is simply getting more challenging as the industry gets bigger. More competition is fighting over new bookings and putting pressure on pricing and renewals. And if AI impacts software development the way most experts predict, even more software will hit the market in the next few years, and growth will get harder still.

Knowing growth is harder to achieve, management and investors must adjust their plans and spending accordingly. And as many have pointed out, you better have a great product as well.

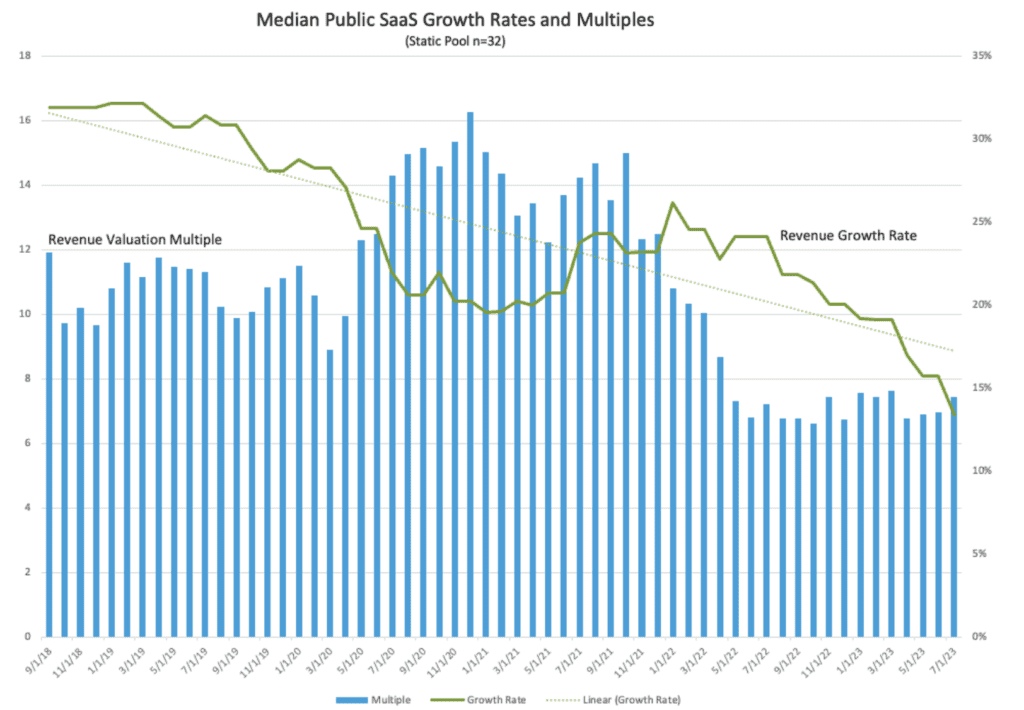

SaaS Valuation Multiples

If we line up SaaS valuation multiples with the SaaS growth rates, we see some interesting trends and anomalies.

For this analysis, we used a static pool of SaaS companies, so new IPO entrants or acquisitions do not influence the growth.

The data suggest that investors have been pretty good at predicting the future growth rates of SaaS businesses. The run-up in multiples during 2020 preceded the post-COVID revenue bump in 2021, and the decline in multiples starting in the fall of 2021 foreshadowed the revenue slowdown that began in 2022 and continues today.

Why, then, have valuation multiples remained steady over the last 15 months, while growth rate has absolutely plummeted?

First, the market anticipated this level of contraction 15 months ago, and its lower expectations have been met. This is undoubtedly part of the equation, given how fast multiples declined early in 2022.

Second, the slowdown in growth has been mostly offset by an increase in profitability.

Mature public SaaS companies have gone from 13% to 11% on the Rule of 40 over the last year—a relatively modest net decline. From a valuation perspective, improving margins increases the likelihood of future profits and pulls them forward. Both factors offset the negative impact of slowing growth on the valuation multiple.

Third, the expected target interest rate for the Fed has remained consistent in the last 15 months, even as actual interest rates increased. Meaning that the interest rate impact on valuations was all adsorbed in the first half of 2022.

Where do we go from here?

If we look over the long term, SaaS multiples averaged about ten times revenue, and growth averaged about 30%. Currently, multiples are down 30% from the long-term average, while growth is down more than 50%. That would indicate more downside in multiples is undoubtedly possible.

In terms of revenue and profit, the current trend lines are relatively straightforward and steady, indicating a continued deceleration in growth and a margin improvement.

For this cohort, revenue growth is in long-term decline as the companies scale and mature; however, their recent decline is well in excess of what can be explained by natural maturation. That said, growth will get easier mathematically as the rate decreases, and any economic outlook improvement may help accelerate bookings.

Profit margin is more controllable than growth and is likely the more certain bet going forward. Because the businesses will continue to grow, at least modestly, and the SaaS model has such high operating leverage, I expect operating margins to continue to improve. This will support higher valuation multiples at all levels of growth.

The critical takeaway from this data is that while current SaaS multiples are well below those reached in 2020 and 2021, they are actually higher on a growth-adjusted basis and, therefore, have as much or more downside as they have room to bounce back. In addition, continued margin improvement will be needed to support valuations regardless of the growth trajectory.

Investments, both by VCs and management, need to be aware of the likely range of future SaaS performance and valuations to make better capital allocation decisions for 2024.

I will dive more deeply into this data and correlate private SaaS data from the Maxio Institute at Expert Voices in Austin, September 20th. SaaS CEOs and CFOs are welcome for dinner, conversation, and community. Maxio is buying!

About the Author

Todd Gardner is the Managing Director of SaaS Advisors and the founder and former CEO of SaaS Capital. Todd was also a partner in the venture capital firm Blue Chip Venture Company and was a management consultant with Deloitte. Todd has worked with hundreds of SaaS companies across various engagements, including pricing, capital formation, M&A, metrics, valuations, and content marketing. Todd is a graduate of DePauw University and Indiana University.