There have been endless posts (many of them mine) on what impacts a SaaS valuation MULTIPLE: growth rates, the Rule of 40, retention, etc. But what about the variable we multiply by the multiple, ARR?

How should you think about the relative importance of ARR?

ARR vs. Valuation Multiples: Why ARR Matters More Than You Think

Bigger revenue companies are worth more than smaller ones in absolute dollars, and dollars are what matter. You can’t buy a boat or start a foundation with a multiple.

When thinking about selling, one consideration is whether valuation multiples are reasonable and where they might be heading. I wrote a post on this a few weeks ago; the link is here.

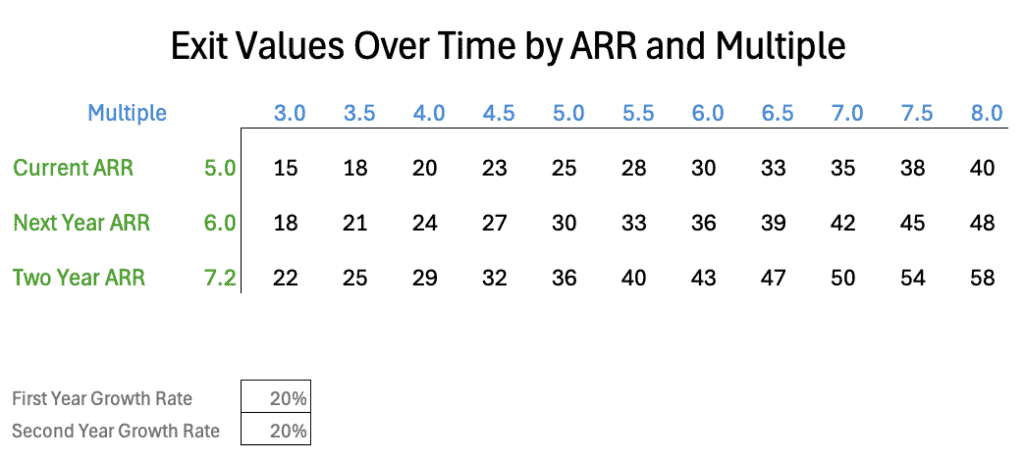

However, you can’t evaluate valuation multiples in isolation. They need to be understood in the context of the business’s future ARR. What will ARR look like in two years, and what risks are associated with achieving it? No one knows the future, but those running the company have the best chance to predict ARR accurately.

For example, let’s assume a $5 million ARR business is predictably growing at 20% and is not consuming cash. In two years, the ARR will be around $7.2 million. If multiples stay the same, 6.0, for example, the business will be worth $13 million more. That’s 44% more in two years.

In contrast, a 1x improvement in the multiple from 6 to 7 is only worth $5 million. Don’t obsess over the multiple.

The Interplay Between ARR and Valuation Multiples

This is not rocket science, and I’m not suggesting everyone wait to sell. I’m posting this blog to help founders and investors better visualize the interplay between ARR and valuation multiples. These are the things that matter, and in a sale process, it’s easy to lose perspective and get buried by minutia.

When considering whether to sell a company, take a few minutes and fill out the matrix provided. This is a simple way to calibrate your thinking.

The “Bad Stuff” Factor: What Can Derail Your Valuation

There’s an even higher-level consideration that no valuation matrix can fully capture — what I’ll call “bad stuff.”

Things that impact churn, for example, will slow growth and depress the valuation multiple. It’s a double hit.

In addition, if the business needs capital in the next two years, weak financial markets raise the risk of failing to raise capital, increase its cost if successful, and lower exit values. You will own less of a less valuable business, even if you are executing.

Bad stuff tends not to shift the business’s value from one box on the matrix to another but rather crushes the matrix and threatens the company’s viability. Bad stuff does not happen all the time, but it must be recognized because the negative outcome is so consequential on an expected value basis.

Balancing Risk and Optimism

The good news? If SaaS founders and CEOs were scared of the future, we would not have an industry at all. Thankfully, they are not, and the industry continues to thrive and show its resilience despite headwinds.

ARR Is Your North Star

When considering the factors involved in timing an exit, don’t overlook the most obvious and important driver: ARR.