Revenue forecasting is the backbone of every successful SaaS business. It informs strategic decision-making, helps secure funding, and ensures financial stability. But without accurate data, proper segmentation, and structured modeling, finance leaders risk making costly miscalculations.

In a recent webinar, Maxio’s VP of Finance, Tina Christofferson, and SaaS CFO expert Ben Murray broke down the best practices for SaaS revenue forecasting. They explored essential SaaS finance metrics, the mechanics of reliable revenue forecasts, and the tools that make this process seamless.

Below, we’re diving into the key takeaways from that discussion—including the foundational data sources you need, the role of segmentation, and how to improve forecast accuracy.

Why Revenue Forecasting Is Critical for SaaS Growth

For SaaS finance leaders, forecasting isn’t just about predicting revenue—it’s about staying agile in a volatile market. Whether you’re planning for investor meetings, setting hiring goals, or optimizing your go-to-market strategy, a reliable forecast is essential.

Key reasons why accurate forecasting matters:

- Cash flow management – Know how much runway your company has and plan accordingly.

- Investor and board expectations – Venture capitalists, private equity firms, and banks demand reliable financial projections.

- Headcount and resource planning – Ensure that your hiring pace aligns with revenue growth.

- Operational and product investment – Allocate budget effectively to product development and market expansion.

Poor forecasting can lead to missed revenue targets, inefficient spending, and difficulties securing funding. To prevent this, SaaS CFOs need to base their forecasts on the right data.

The 4 Essential SaaS Finance Data Sources

A strong revenue forecast is built on clean, structured data from four primary sources:

- Financial Data – Sourced from accounting platforms like NetSuite, QuickBooks, or Sage, this includes revenue recognition, deferred revenue, and cash flow trends.

- Bookings Data – Data from CRM systems like Salesforce and HubSpot helps predict future revenue based on sales pipeline activity.

- HR Data – Payroll and HR software provide essential inputs for headcount planning and employee cost forecasting.

- Customer Revenue Data – The MRR waterfall and ARR momentum reports provide visibility into revenue expansion, contraction, and churn.

Each of these data sources contributes to an accurate revenue forecast and allows finance teams to identify trends, set benchmarks, and make data-driven decisions.

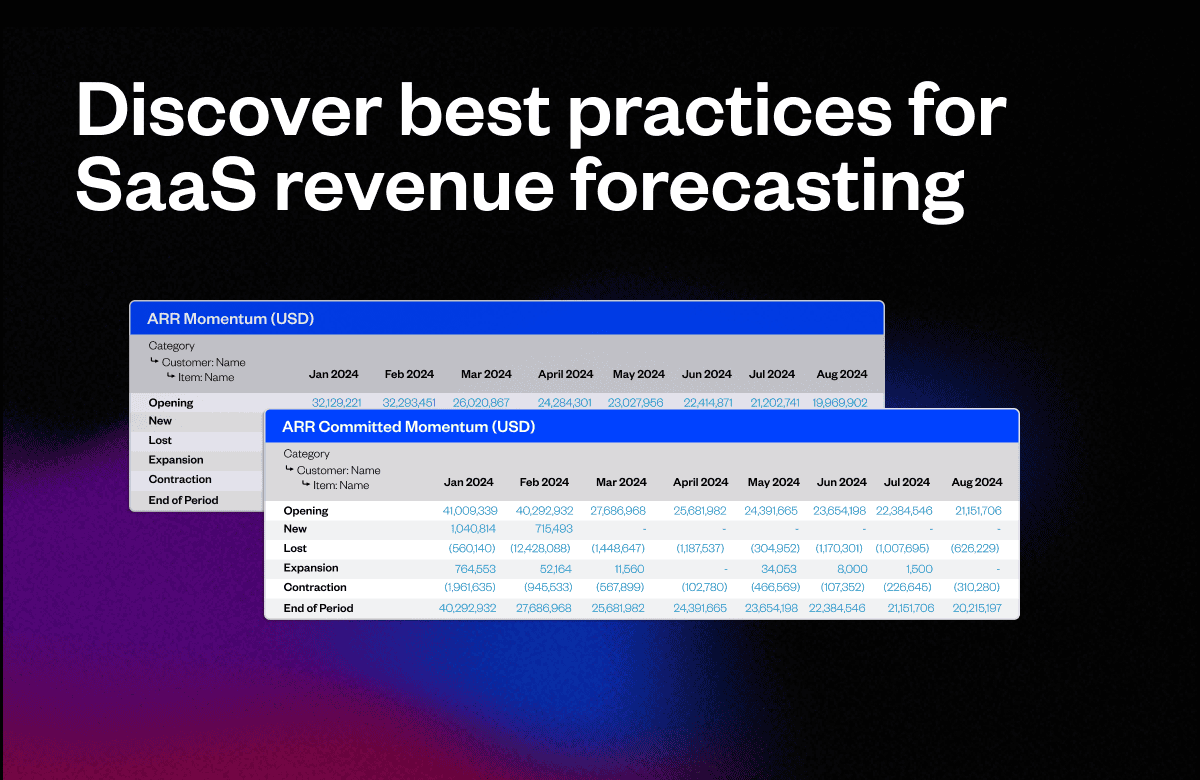

The MRR Waterfall: The Bedrock of SaaS Forecasting

One of the most important reports in SaaS forecasting is the MRR waterfall (also called the MRR momentum report). This tool provides a breakdown of:

- New MRR – Revenue generated from new customer acquisitions.

- Churned MRR – Revenue lost due to customer cancellations.

- Expansion MRR – Revenue gained through upsells, cross-sells, or increased usage.

- Contraction MRR – Revenue reductions from downgrades or discounting.

Understanding these layers is essential for predicting revenue trends and optimizing financial planning.

For example, a SaaS company that primarily serves SMBs might see higher churn rates but stronger new MRR growth, while an enterprise-focused SaaS business might experience lower churn but slower expansion MRR.

By segmenting MRR data into different categories—such as go-to-market strategy (sales-led vs. PLG), customer size, or geographic region—CFOs can gain a clearer picture of revenue performance and future growth potential.

How SaaS Companies Can Improve Forecasting Accuracy

Building an effective SaaS revenue forecast requires more than just plugging numbers into a spreadsheet. Here are three key ways to improve accuracy:

1. Refine Data Segmentation

Not all revenue streams behave the same way. Segmenting your revenue forecast by factors such as customer size, industry, or sales motion can provide more reliable insights.

For instance, enterprise deals often have longer sales cycles and higher retention, while self-service SaaS businesses might see shorter customer lifetimes but greater volume.

2. Leverage Historical Trends

Using past performance as a benchmark can help identify seasonal trends, churn risks, and expansion opportunities.

For example, if Q3 historically has the highest customer churn, forecasting models should account for that trend instead of assuming a steady retention rate.

3. Integrate SaaS Metrics Software

Manually collecting and cleaning data can slow down the forecasting process and introduce errors. SaaS metrics platforms like Maxio streamline reporting by consolidating financial and operational data into a single source of truth.

By automating data collection and report generation, finance teams can spend less time wrangling spreadsheets and more time on strategic decision-making.

Want to See This in Action?

For a detailed breakdown of how SaaS finance leaders can enhance their revenue forecasting, watch the full on-demand webinar featuring Ben Murray and Tina Christofferson.

They cover real-world forecasting models, demonstrate segmentation techniques, and share best practices for improving financial predictability.