While no advice on budgeting is universally applicable, I spoke with dozens of leading CFOs, and these were the key takeaways.

Stop doing more

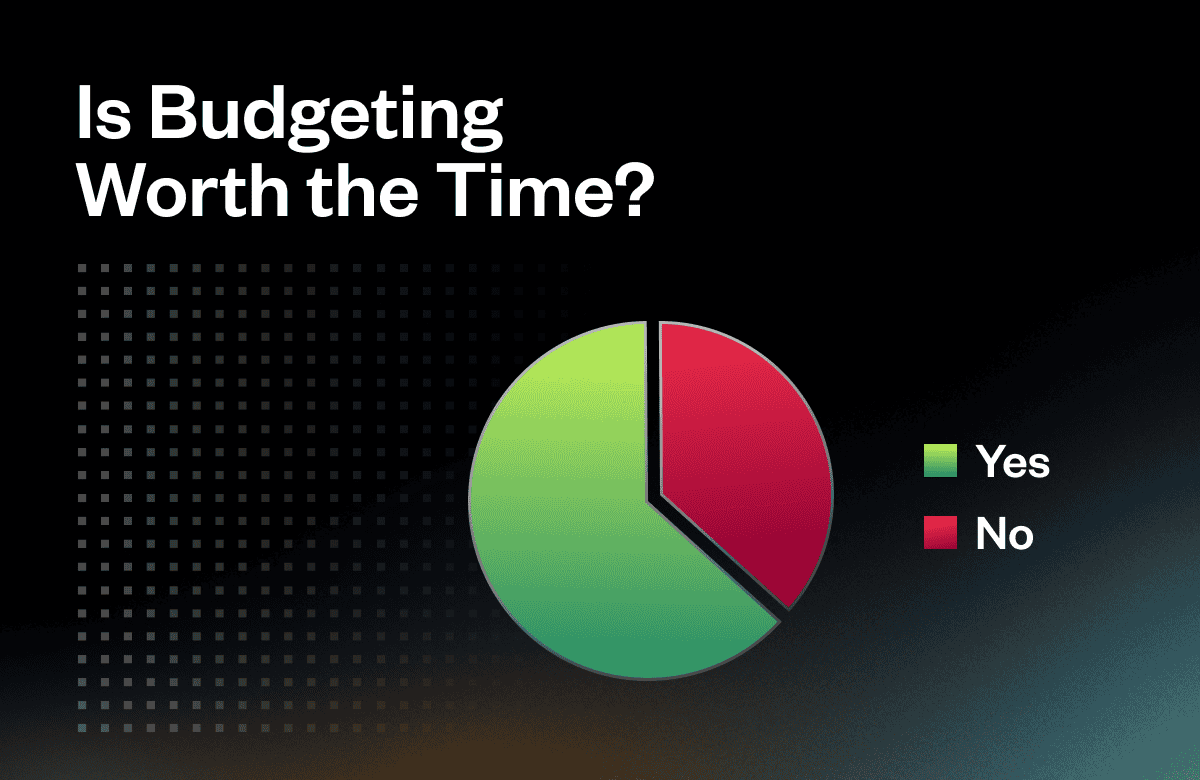

Budgeting is a series of guesses, all of which are wrong. Attempting to add more precision to a budget only makes it “precisely wrong”, not more accurate. There are diminishing returns in the budgeting process, and at some point, negative returns occur, meaning that the more time you spend on the budget, the less accurate it becomes.

Additionally, higher levels of detail do not help manage the business. A good friend of mine was the CFO at Duracell, which Berkshire Hathaway owns. He inherited a set of detailed variance reports, which he sent to Omaha every quarter (after much work by his team explaining the dozens of line-item variances). After a year or so, he asked HQ if they found the reports helpful, and they said, paraphrasing, “We don’t read those reports.” Of course they don’t, and the Duracell management team did not pay much attention to them either. Good teams don’t drive business results by managing to a detailed budget.

Budget your best guess

Best guess budgeting is better than stretch budgeting for three reasons.

Budgets help plan investment activities by answering questions like, How much money will I have? When you build a stretch budget, you intentionally make a less acute forecast that’s more likely to be revised later and thus disrupt investment activities.

Second, stretch budgeting is a game played throughout the organization that requires back-and-forth negotiation, consuming a significant amount of time, and often results in gamesmanship. Alternatively, building a best-guess budget is easier and faster because everyone shares the same objective: “What do we think will actually happen?”

And finally, after numerous studies, there is no credible evidence that stretch budgets improves performance.

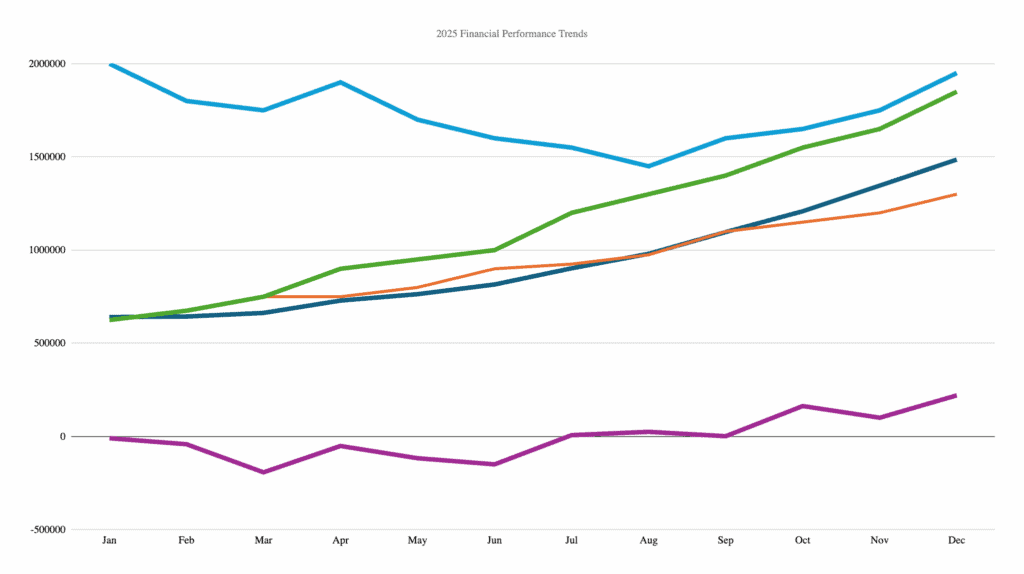

Report actual results to budget, forecast, and prior year

This will seem obvious to many of you, but a surprisingly large number of management and board reports are not structured in this way.

To clarify, the budget is the annual plan, and the forecast is the updated budget based on actual results for the year, as well as any new information. Companies low on cash often reforecast monthly, while others tend to reforecast quarterly.

Understanding performance relative to the original budget is helpful. Still, the budget can quickly become obsolete, which is why tracking performance against the forecast can provide more insight throughout the year. Performance relative to the prior year is what ultimately matters and provides important context.

So, as you approach budgeting season, keep these ideas in mind. Some suggestions here might not be right for your company, and others you may not be able to effect on your own, but hopefully, there are a few ideas here that will make your upcoming task more straightforward and also create a more useful budget.