Dunning is the process of communicating with customers to collect payment of past due accounts prior to account cancellation.

While the primary purpose of dunning is to recover as much revenue as possible, communication in the dunning process can also foster goodwill between merchant and customer, introduce a customer to new or upcoming features or simply remind the customer of what they will be missing if their account is canceled.

Maxio’s own dunning process is simple: we offer a 21-day grace period as a courtesy. We send reminders to customers on the 1st, 7th and 14th days of the dunning period followed by a cancellation notice at the end of the third week.

We do not interrupt a merchant’s recurring billing. We want to keep your cash flow flowing! We also understand that entrepreneurs face many challenges including the timing of revenue to meet expenses. We want to be as accommodating as possible. This strategy works well for us. Our merchants are happy because they have the extra time to make payment and they remain loyal as a result.

Of course, our merchants have different policies that vary by industry and whether they are B2B, B2C, or both. Some merchants cut off service almost immediately while others offer up to a month or more. A merchant’s measure of a successful dunning strategy may be achieving or outperforming a target churn rate due in part due to lower cancellation rates for nonpayment.

At Knobby, we use Maxio’s dunning email workflows to help ensure that past due accounts are re-engaged and maximum revenue is achieved. It works!

Rob Rand, Managing Director, Knobby

Examples (based on real customer data)

A B2C company may be happy to recover only 60% of past due revenue while a successful, established B2B SaaS company would be underperforming if it recovered any less than 5-10%.

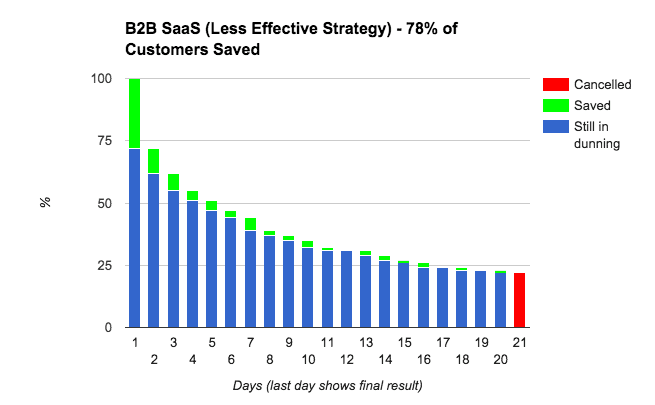

Here is an example of a B2B SaaS company prior to the implementation of a more effective dunning strategy using the tools provided by Maxio:

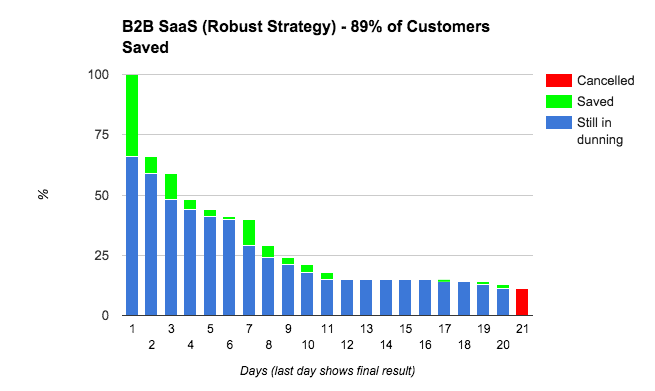

The same company adopted a more robust dunning strategy, including card expiration emails, renewal notifications and more frequent customized past due notices. They added a link for support issues to ensure that their customers understood that help was available, and they also clearly communicated a cancellation date so that their customers knew the time frame in which they needed to act.

You can see that the percentage of recovered revenue increased from 78% to 89%. Over time, these improvements have a big impact on a merchant’s bottom-line.

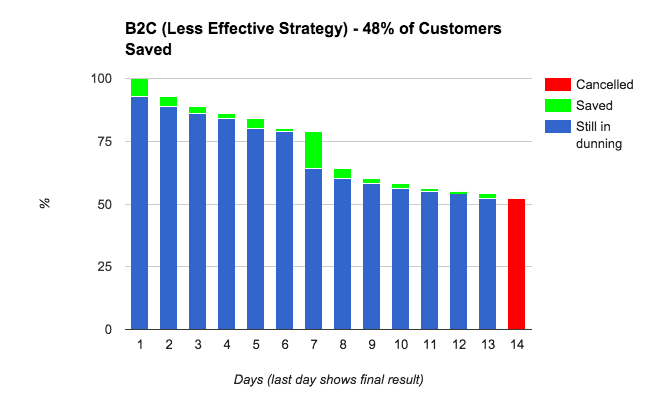

In the case of B2C, higher churn is often expected but effective dunning can make a dramatic difference. The dunning period is often shorter so a more aggressive strategy may be adopted. A sample B2C company with a minimal dunning strategy yielded the following results:

The merchant used similar tools to the ones described above and also included promotional materials and discounts to achieve a remarkable improvement with 73% vs. 48% of past due customers saved:

Your results will vary (we hope they’re even better!), but we see time and time again that these dunning tactics work!

First steps – Prevention

Maxio’s admin interface provides many out of the box settings to help facilitate a successful dunning strategy. You can take two important steps towards preventing accounts from going past due in the first place.

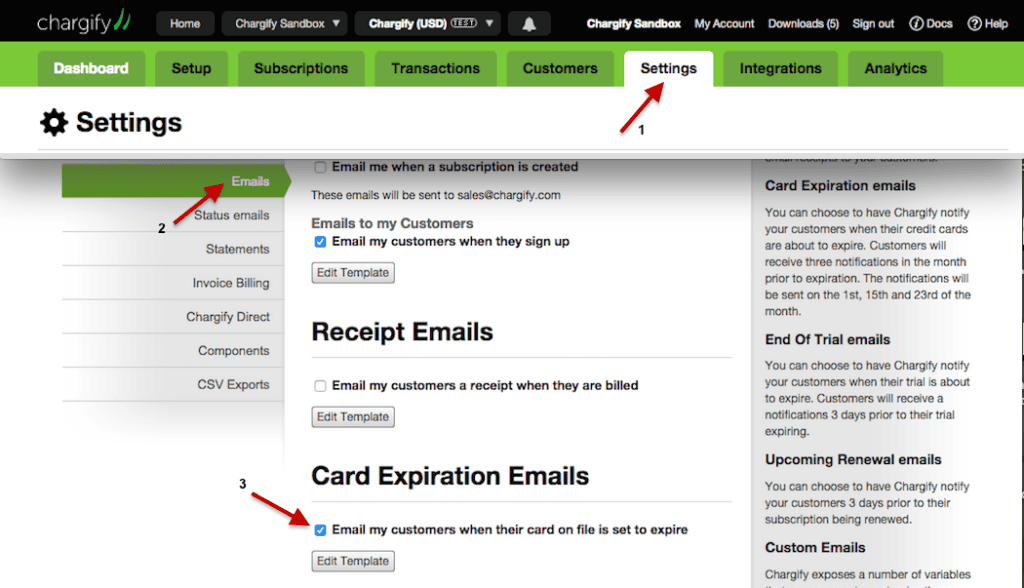

Card expiration emails

You can enable card expiration emails so that your customers are notified on the 1st, 15th and 23rd day of the month prior to expiration.

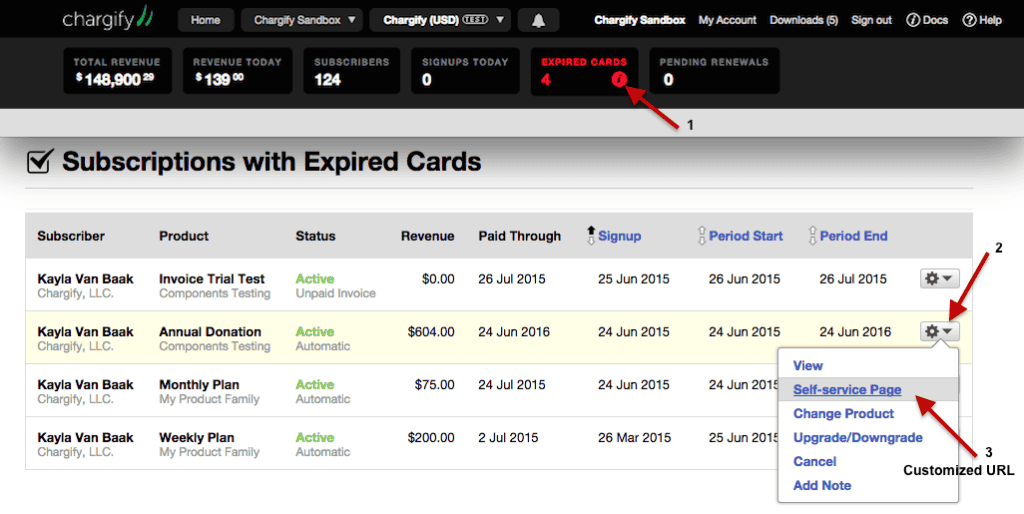

You can also see a list of subscriptions with expired cards if you wish to manually contact them individually. You can generate a customized URL that will link your customers to a payment update page, making it as easy as possible for them to enter new credit card details.

Please note that as a security measure, clicking on the Self-Service Page link will log you out of the Maxio UI. You can avoid this by right-clicking on the link and opening it in a different browser.

Payment Reminder Emails

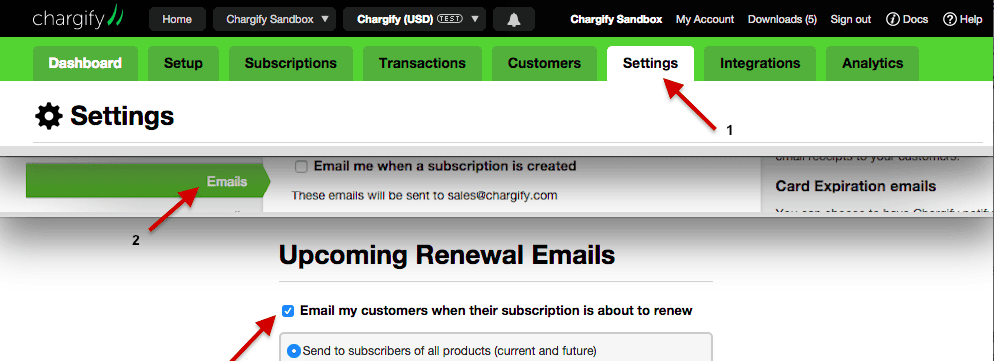

You can also enable payment reminder emails so that your customer are notified three days before so they are prepared to make payment.

Next Steps – Treatment and Cure

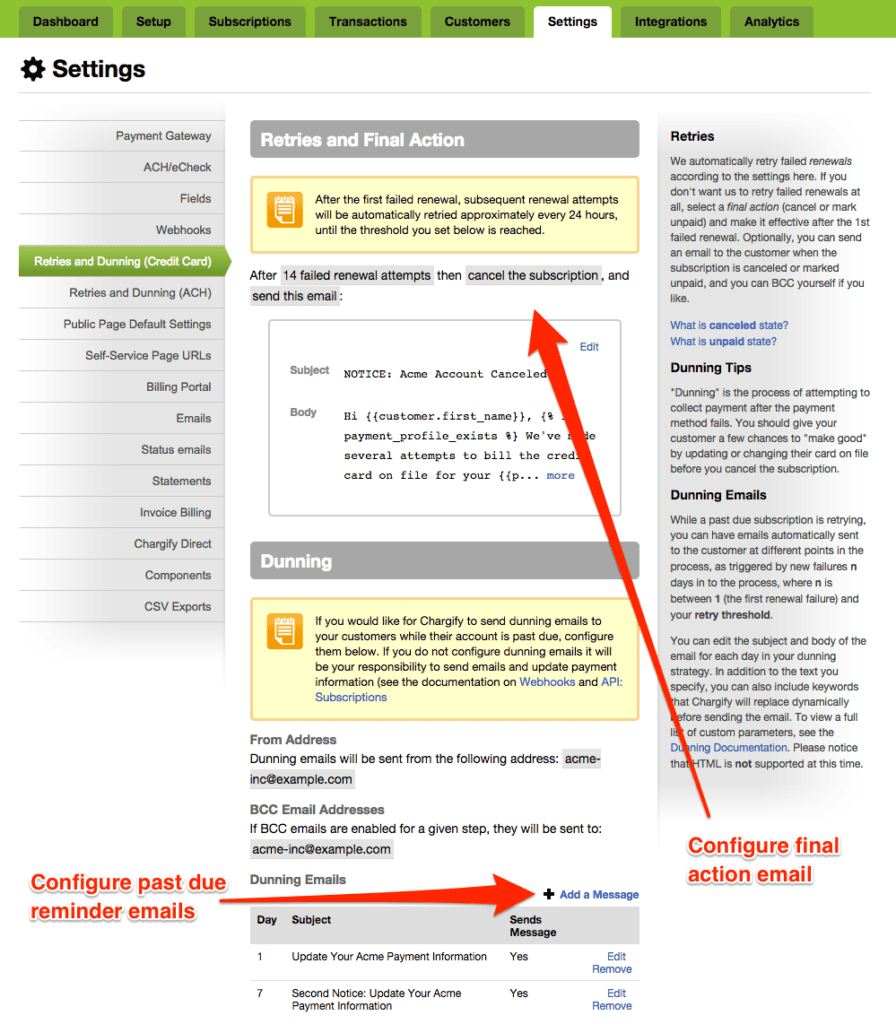

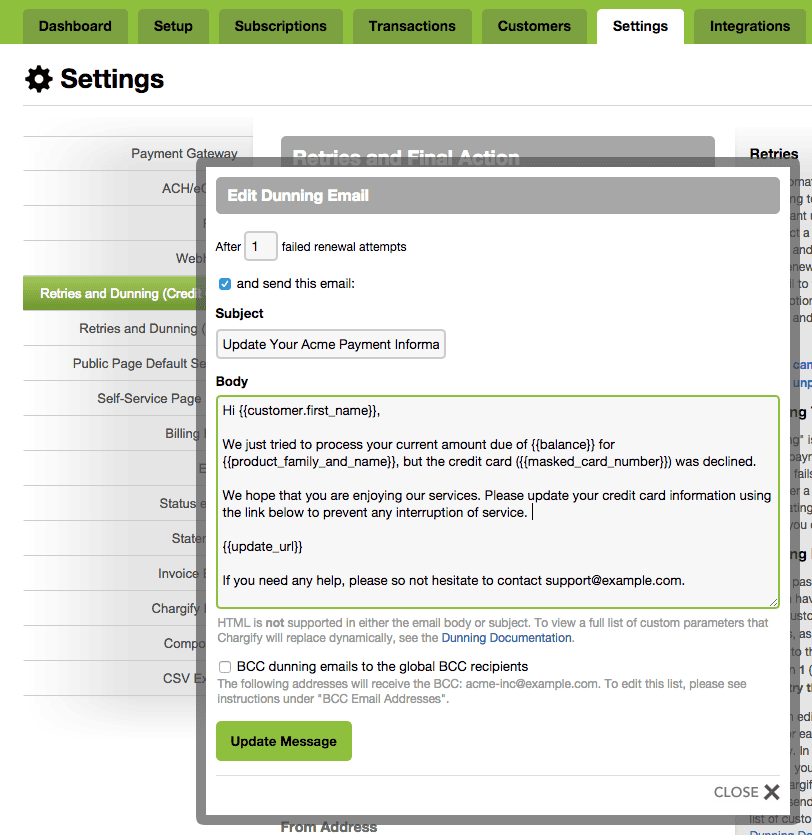

You can then plan what happens when a customer’s account becomes past due:

- How many days you will retry the customer’s card before canceling the account?

- How many times will you notify the customer during that dunning period?

- What will be the tone and content of those emails?

Dunning Email Tips

- You may choose to notify the customer immediately with a gentle reminder to update their card.You can then set the interval before the next reminder and shift the tone of the dunning notice so that it is more urgent.

- The frequency of those contacts is based largely on the number of days before you cancel an account. In our experience, you should send at least two emails prior to cancellation.

- It is important that you include {{update_url}} in the body of the email. This takes the customer to the customized credit card update page referenced above. Or if you use Maxio’s Billing Portal for customer account management, you can use {{subscription.billing_portal_management_url}}.

- You can use many of the variables found here to include important information for your customer (their name, their product, the amount due, etc).

- You can also modify the text to include some marketing material: what the customer will miss, what new features are coming, an incentive to stay)

The following is a sample of a dunning email used prior to account cancelation. A cancellation email template can be found under the Retries and Dunning page of your site’s Settings.

You can easily measure the success of an updated dunning strategy from one month to the next by tweaking your process and analyzing the results. Do you have a success story? We would love to hear it in the comments below.

If you would like help configuring your dunning settings, please contact Maxio support at support@maxio.com.

To learn more about Maxio’s dunning features, check out: www.maxio.com/features/dunning

[UPDATE] To learn more about the Revenue Retention Analytics available to Maxio merchants, check out: https://www.maxio.com/features/revenue-retention