In the Dunning 101 post, we covered “the art of retaining past due accounts” which included the timing and content of past due and cancellation emails. If you have not read the prequel to this post, we highly recommend you check it out.

Below we will take your dunning strategy a step further and discuss how to:

- Track past due accounts so you can be even more proactive about outreach

- Reactive cancelled accounts to meet the desired billing logic

- Measure the success of your dunning strategy to better understand recovered revenue

Tracking past due accounts. Be proactive!

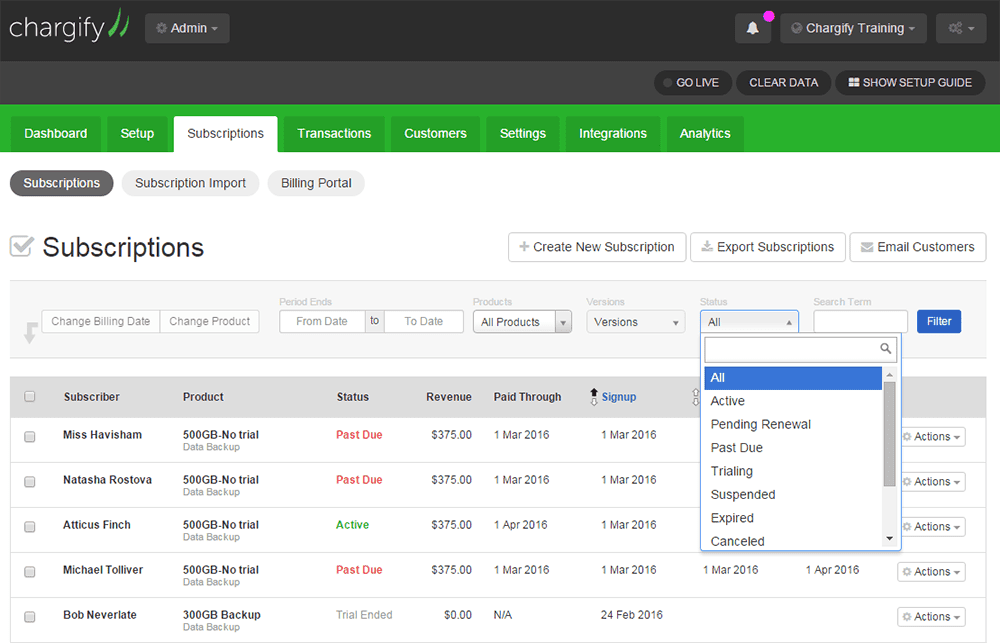

Maxio makes it easy to track past due accounts. You can filter your subscriptions by product, version and status. You can further refine the search using keywords.

To get started, click on the Subscriptions tab on your dashboard.

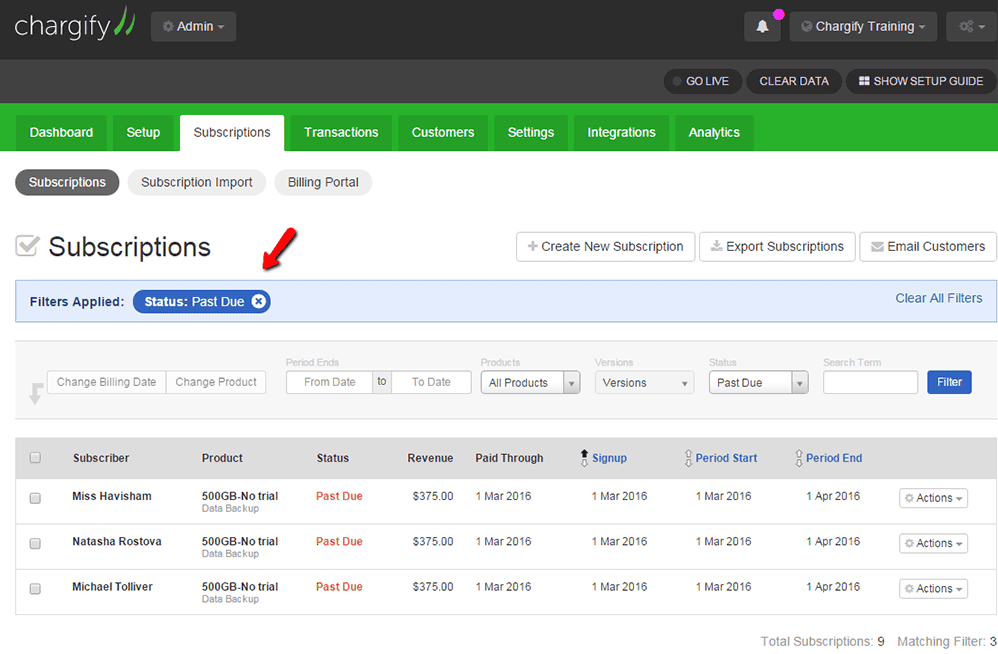

In this case, we can filter for past due customers:

You can then review the list at your convenience. There are links to each subscription so you can easily access detailed individual subscription data.

You can also export the subscription data in CSV format to generate a list of past due subscribers. Contact information is included for each subscriber so you can augment the Maxio dunning process with phone calls or emails initiated by your customer success team.

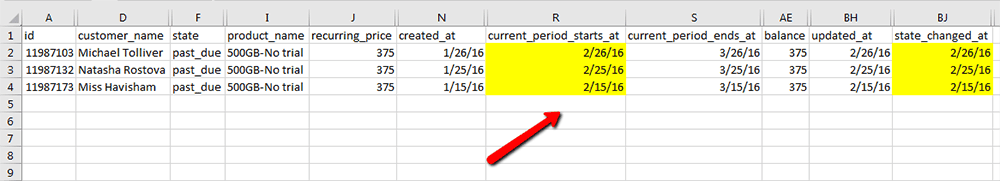

The file includes the date the subscription became past due. You can calculate the number of days since dunning began to determine which email reminders have been sent to the customer. You can also track the number of days remaining before the subscription is canceled.

The following is an example of an edited CSV file listing past due accounts. Most fields have been hidden for this demonstration. They can be unhidden to show full subscription detail.

Some merchants use this file to determine when they will stop providing service to a customer. For example, a merchant may suspend shipments to a customer after five days but not cancel the subscription for non-payment until 21 days after the due date.

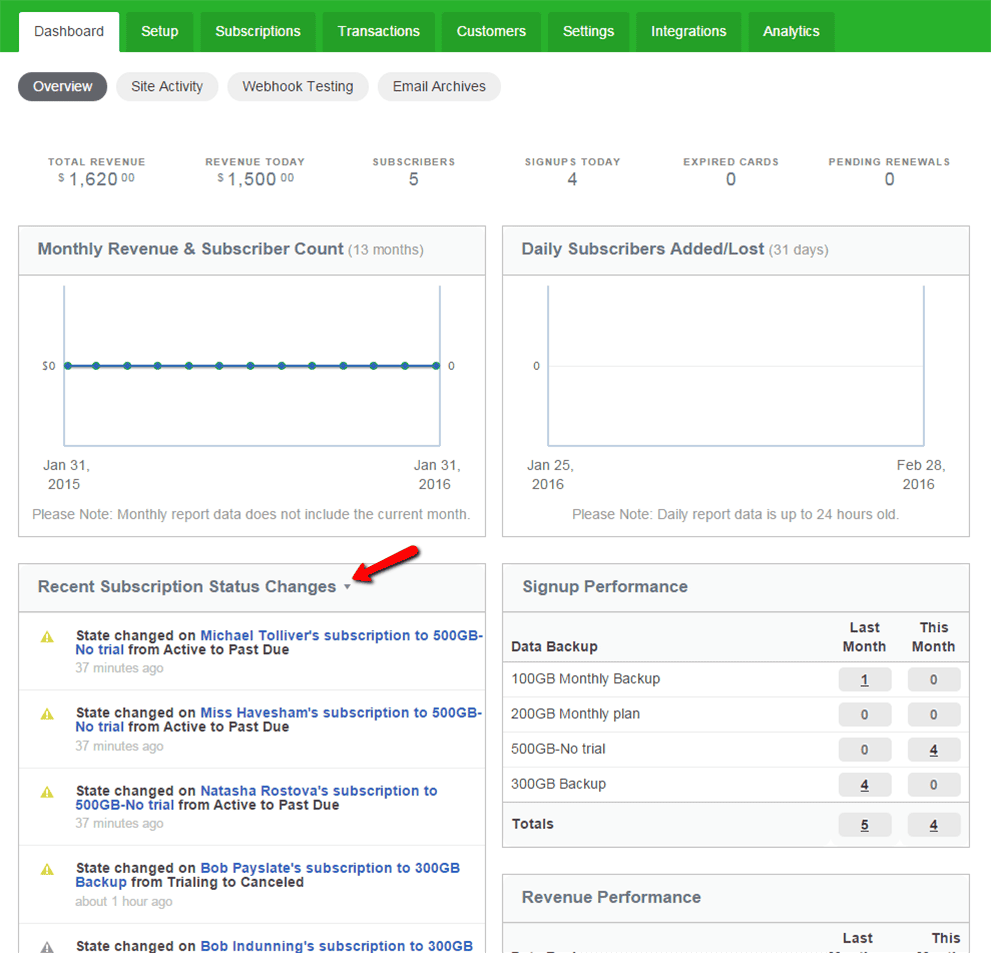

In addition to filtering the subscription list for past due accounts, you can also see subscription activity on your Dashboard. For example, you can see all Subscription Status changes. This would include accounts moving from Active to Past Due, or vice versa, as well as cancellations and completed trials. There is a link to the overview page for each subscription for ease of reference.

Reactivating cancelled subscriptions

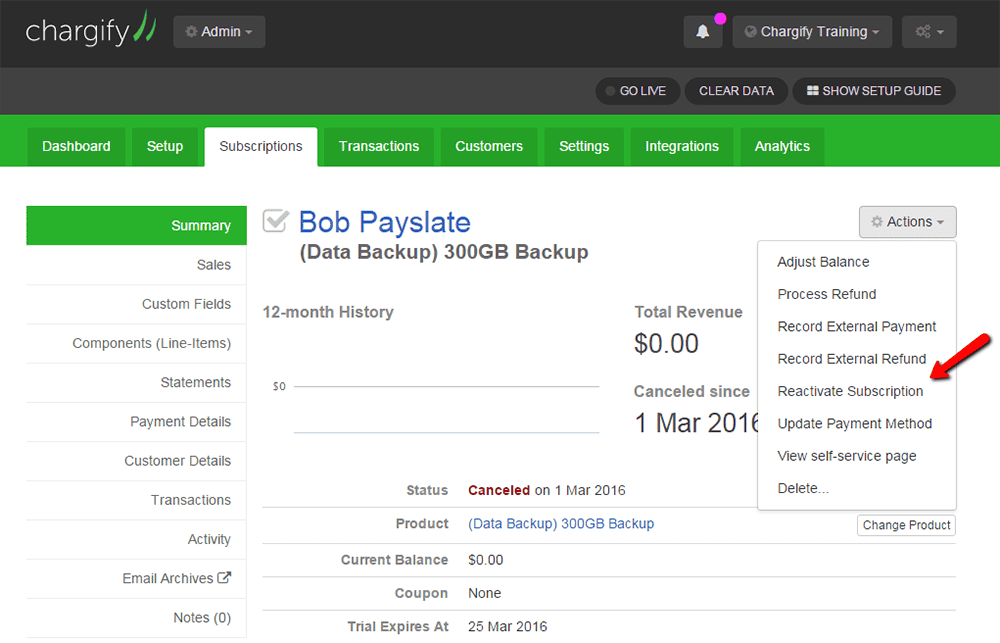

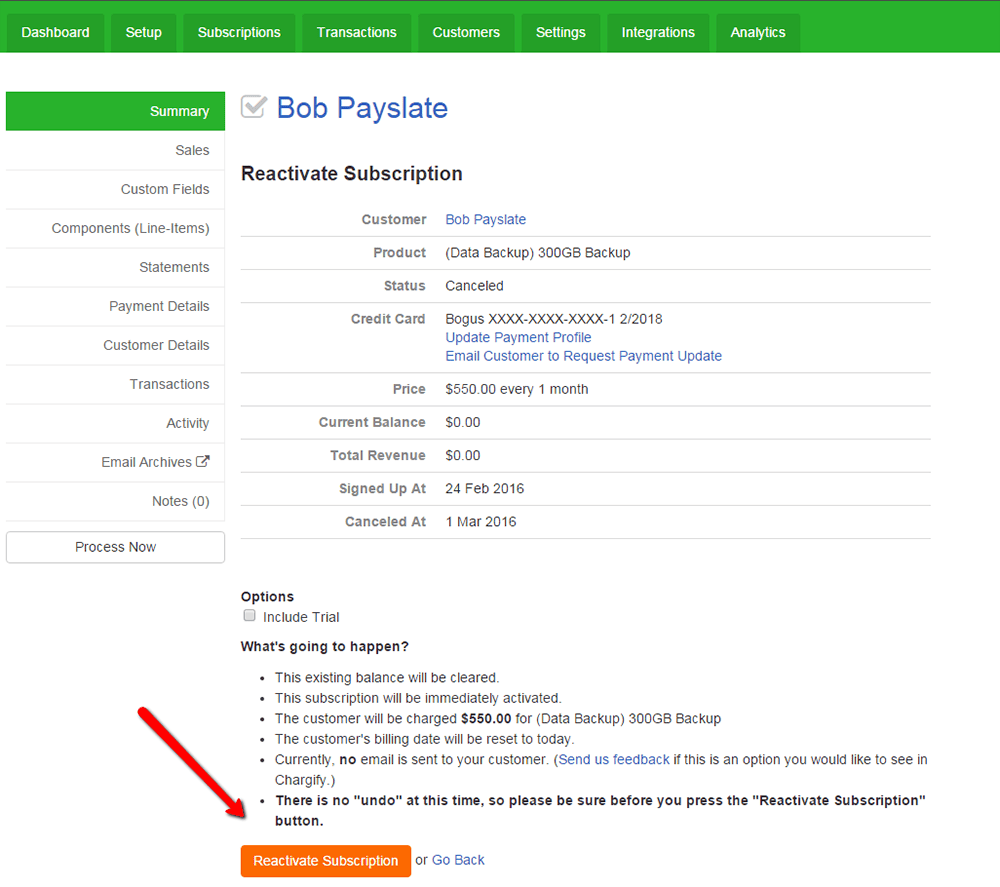

If a customer updates their credit card information prior to account cancellation, the outstanding amount is charged immediately, and the subscription returns to an active state. Once a subscription is canceled, it must be reactivated manually, unless you build custom logic via Maxio’s API.

There are many possible options for reactivation. Some merchants may charge a prorated amount or keep existing billing dates. Others may clear an outstanding balance and change the billing dates. Trial periods may also be included. There are many approaches.

Maxio’s default method, which you can initiate manually, resets any current balance and processes a full periodic charge. The billing date is reset to the date of reactivation with the renewal date updated accordingly.

There is an option to charge the existing balance or create a new trial.

Billing dates can always be changed once the subscription is reactivated.

If you do not want to charge the customer upon reactivation, you can use a balance adjustment to create a negative balance on the account and then opt not to reset the balance. The reactivation cost will be offset by the credit balance and the customer will not be charged.

For more information on subscription reactivation, check out docs.chargify.com/reactivation.

Measuring dunning strategy success to understand recovered revenue

We love to measure the success of our dunning strategy as it shows us how much revenue we recover each month.

We also love it when our customers calculate their recovered revenue so they can see that the sum is almost always a multiple of their Maxio fee. We rarely find a merchant with a good dunning strategy who doesn’t save at least several times their monthly fee.

Maxio does not have a predefined report to calculate these savings because merchants have different approaches. You can, however, export detailed data to create your own.

The Subscription CSV file described above contains the data necessary to measure key dunning metrics including:

- Number of subscriptions canceled during a given period

- Number of days from past due or canceled to active status

- Estimated revenue saved

For canceled subscriptions, you can sort by subscription cancellation date. Failed dunning cancellations are indicated by the cancellation reason: “Canceled after failed automatic dunning process expired.” The number of days to cancellation can be calculated by comparing the period start date with the cancellation date.

To identify active subscriptions which were formerly past due or canceled, you can compare the “State_changed_at” date with the period start date to calculate the number of days the subscription was in dunning.

To calculate the estimated revenue saved, you can enable the Estimated Next Billing Amount on the subscription CSV export and then sum the total for each of the subscriptions above. You can also calculate lost revenue for canceled subscriptions in the same manner.

We hope that these tools allow you to better manage your past due accounts and dunning practices. We love to hear success stories from our merchants along with tips on how they measure their strategies’ effectiveness in recovering this potential lost revenue.

To learn more about how Maxio’s dunning features help recover revenue, check out: www.chargify.com/features/dunning