Revenue recognition, affectionately referred to as “rev rec,” is a process that outlines when and how revenue should be recognized within a company’s accounting cycle. While the myriad of details and technicalities are too vast to be described in a single blog post, it’s still important to understand the basics of how revenue recognition works—especially if your company provides services via term subscriptions or licensing agreements.

Why Does Revenue Recognition Matter?

The FASB (Financial Accounting Standards Board) is the Securities and Exchange Commission’s designated organization responsible for setting the accounting standards for companies in the U.S. Those standards are laid out in the Accounting Standards Codification (ASC) and are occasionally updated. One such update occurred in 2020 is ASC 606, which sets new revenue recognition standards for all companies that offer goods or services. ASC 606 is intended to improve consistency across industries for a more transparent and comparable system of revenue recognition.

Revenue recognition was already a tricky subject for SaaS companies due to the nature of the industry: sales negotiated agreements, term subscriptions, professional services, etc. However, ASC-606 added new, more complicated requirements that must be observed in order to remain compliant. Compliant revenue recognition is not only required by auditors, but can also be crucial to the valuation of your company in the event of a strategic investment or acquisition.

What Are the Five Steps of the Revenue Recognition Process?

Step 1: Identify the contract with the customer.

This is generally one of the most straightforward phases of revenue recognition. The contract must fulfill several criteria, including:

- Has the approval of both parties

- Explains the rights and obligations of each party

- Identifies the payment terms

- Indicates commercial substance (the transaction will cause a significant change to future cash flow)

- Implies that the vendor will be paid for the goods or services rendered

Step 2: Identify your contractual performance obligations.

ASC-606 dictates that you must identify your “distinct performance obligations,” which can be deceptively simple. A performance obligation is a deliverable—a good or service. But what makes a performance obligation distinct?

You can classify a performance obligation as distinct if it’s useful to the consumer on its own. For example, say the performance obligation is a piece of equipment. The customer takes possession of the equipment, and your performance obligation is complete. You could also sell a piece of equipment along with a limited warranty for future repairs. In this case, the customer can use the equipment without taking advantage of the warranty service, meaning that the item and the warranty are distinct from each other.

On the other hand, SaaS transactions can often include performance obligations that seem distinct but are not actually separate. One example would be training, customization, or specialized installation. Say you’re upgrading a hospital’s computer network with custom software integrations that connect to existing systems, and the employees of the hospital will need training from your company to be able to use the software. Even though the design, installation, and training may seem like different deliverables, the hospital’s ability to use the new network is dependent on all three deliverables functioning together.

Step 3: Determine the overall price for the transaction.

This is another fairly easy step in the revenue recognition process. Your contract should include the overall price of the goods or services you’re providing. Considerations that may affect the price include discounts, rebates, and bonuses. In more complex situations, you may also need to account for sales-negotiated agreements.

Step 4: Allocate a price to each of the performance obligations.

If there is more than one performance obligation, you will need to determine how much of the total price is allocated to each one. How much would a performance obligation cost if sold alone as a single service? That’s your Standalone Selling Price (SSP).

Sometimes allocating an SSP to each obligation is challenging. If a standalone price is hard to determine, it may be useful to compare the relative individual prices of each obligation and assign a proportion to each one. Think of it like cutting slices of a pie. Once you determine the other slices, you’ll be able to estimate the proportional value of a hard-to-pin-down performance obligation.

Step 5: Recognize the revenue when you have completed/delivered the performance obligation.

The final step of the revenue recognition process occurs when the goods are delivered or the services are rendered and control is handed over to the customer. The customer is considered to have control once they can benefit from the good or service. When a performance obligation has been satisfied, you can then recognize the revenue.

Retail transactions are the most straightforward example of this. You sell an item to the customer, they leave the store with it, and you recognize the revenue. For SaaS companies, it’s not so straightforward. You may have a year-long technical support contract with the customer; your performance obligation of providing technical support is transferred to the customer over time. In that case, you would recognize the revenue throughout the year (say, monthly) as the performance obligation is fulfilled.

Get a Jumpstart on Your ASC-606 Compliance with our Free Revenue Recognition Policy Template

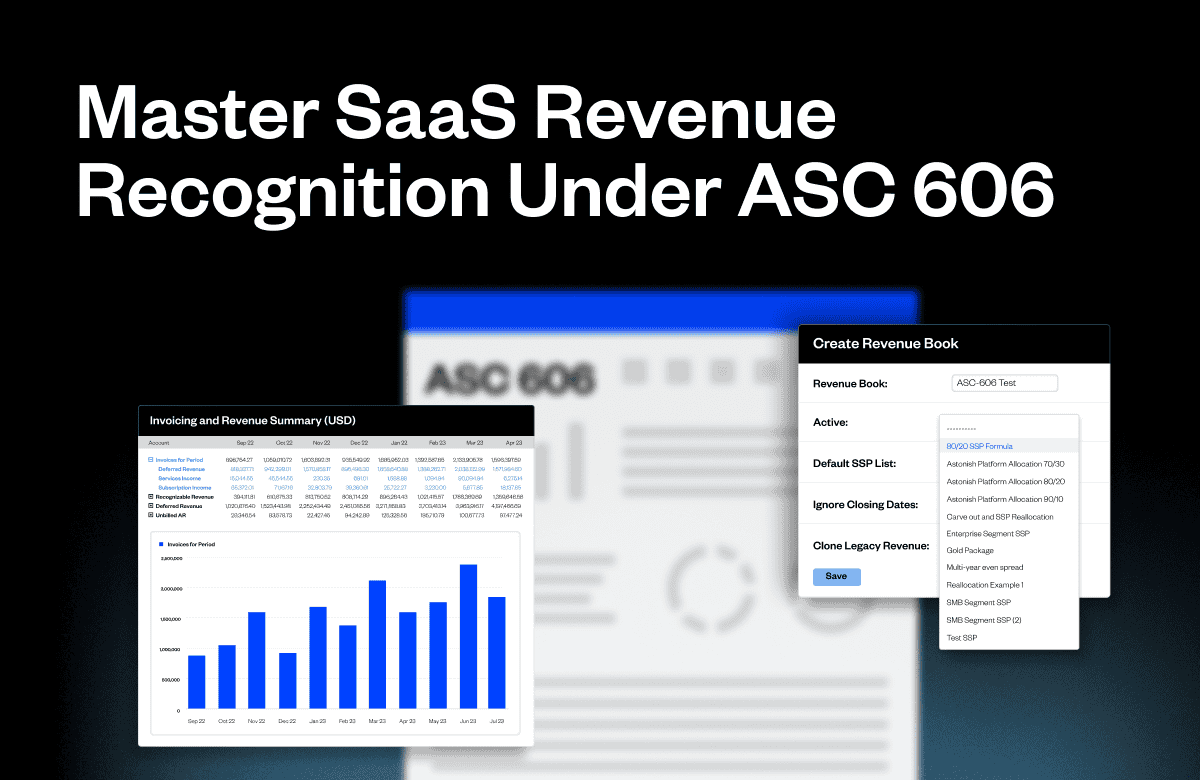

Our goal at Maxio is to help you set your business up for growth with effective, automated financial operations solutions, from generating invoices and reports to automating revenue recognition schedules. We simplify rev rec with Advanced Revenue Management, allowing you to maintain separate SSPs, customize allocation rules for your business, compare data sets, and much more.

Revenue recognition is a common stumbling block for growing businesses, especially if you’re relying on spreadsheets in a risky, inefficient, manual system. As you grow, your company will be subjected to increasingly complex revenue recognition scenarios and performance obligations. Don’t let compliance issues slide until you find yourself in the middle of an audit, wishing you had a more robust revenue recognition policy in place!

Are you ready to kickstart your financial compliance policy and set your business up for success from the start? Take the first step now: Download our Revenue Recognition Policy Template for free.