SaaS Payments

End-to-End Payments Lifecycle Management

Maxio Payments automates disputes, reconciles deposits, and supports multi-currency transactions and international payment methods—so SaaS businesses can streamline global payment operations and close books faster.

Maxio Payments fills the gaps of your current payment process

Managing payments isn’t as simple as sending an invoice and waiting for the funds. Maxio Payments fills critical gaps by automating reconciliation, reducing disputes, and simplifying global payment operations.

Prevent lost revenue

Reduce revenue leakage by automating chargeback management, reconciling payments in real time, and consolidating transactions across gateways and currencies so nothing gets lost between payment, billing, and accounting systems.

Reclaim wasted time

Stop reconciling deposits manually. Automate processes across borders, banks, and billing systems.

Reduce team frustration

Keep systems in sync by integrating Maxio Payments into your billing workflows. Automate multi-currency management and reconciliation to reduce manual cross-currency fixes for your finance and customer teams.

Controller-approved payment platform insights

Maxio Payments reduces manual effort and increases visibility with a unified, international-ready platform. Easily track payments, invoices, and contracts across currencies and geographies, all in real time, so your finance team spends less time in spreadsheets and more time driving strategy.

Maxio Payments Global

Now supporting multi-currency, international payment methods and global onboarding, Maxio Payments helps SaaS businesses expand into new markets and automate multi-currency billing and reconciliation.

Integrated SaaS payments, billing automation, and reporting

Create recurring payment plans

Let customers pay on their schedule with recurring payment plans that automate invoicing, collections, and renewals.

Automate invoicing & billing

Reduce manual billing effort with templates, tax rules, and recurring invoice automation.

Accept multiple payment options

Accept ACH, credit cards, multi-currency transactions, and international payment methods through built-in, PCI-compliant payment gateways.

Use built-in payment gateways

Skip third-party processors and consolidate payment operations with integrated global gateways.

Keep up with upgrades and downgrades

Automatically adjust billing, payments, and revenue schedules when customers change plans.

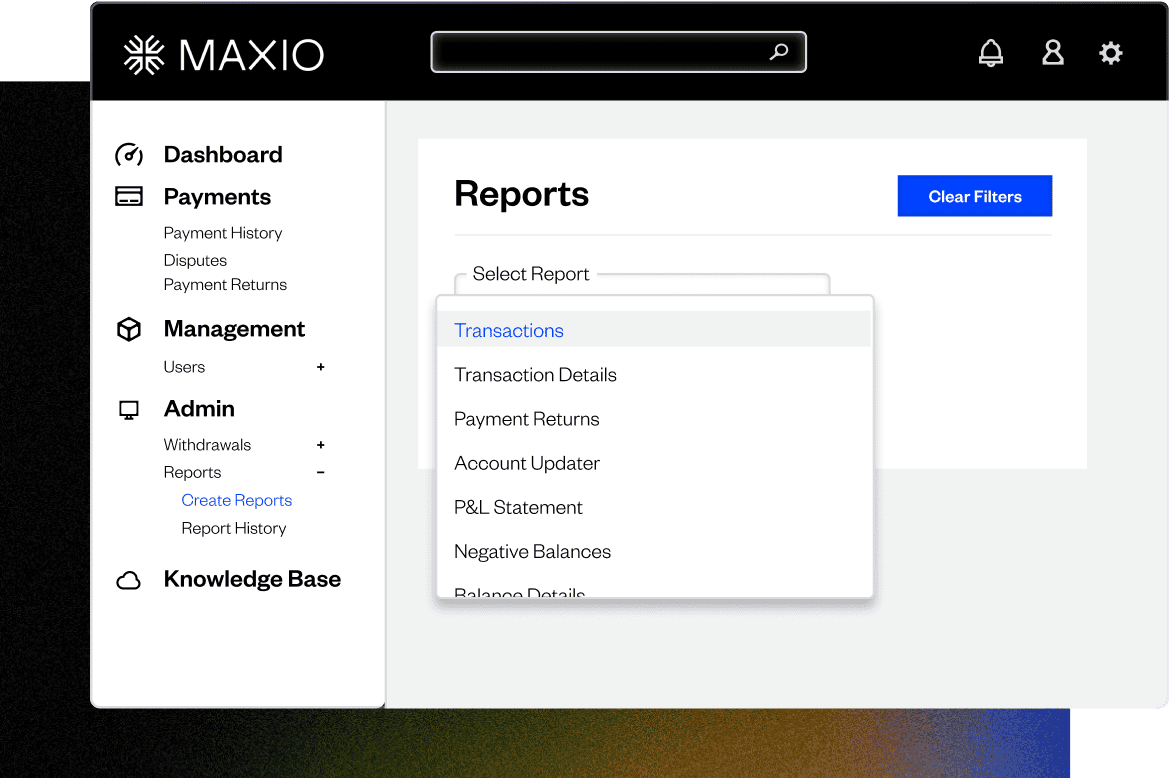

Gain real-time payment insights

Monitor payments, reconciliations, and chargebacks with built-in reporting for real-time financial visibility and control.

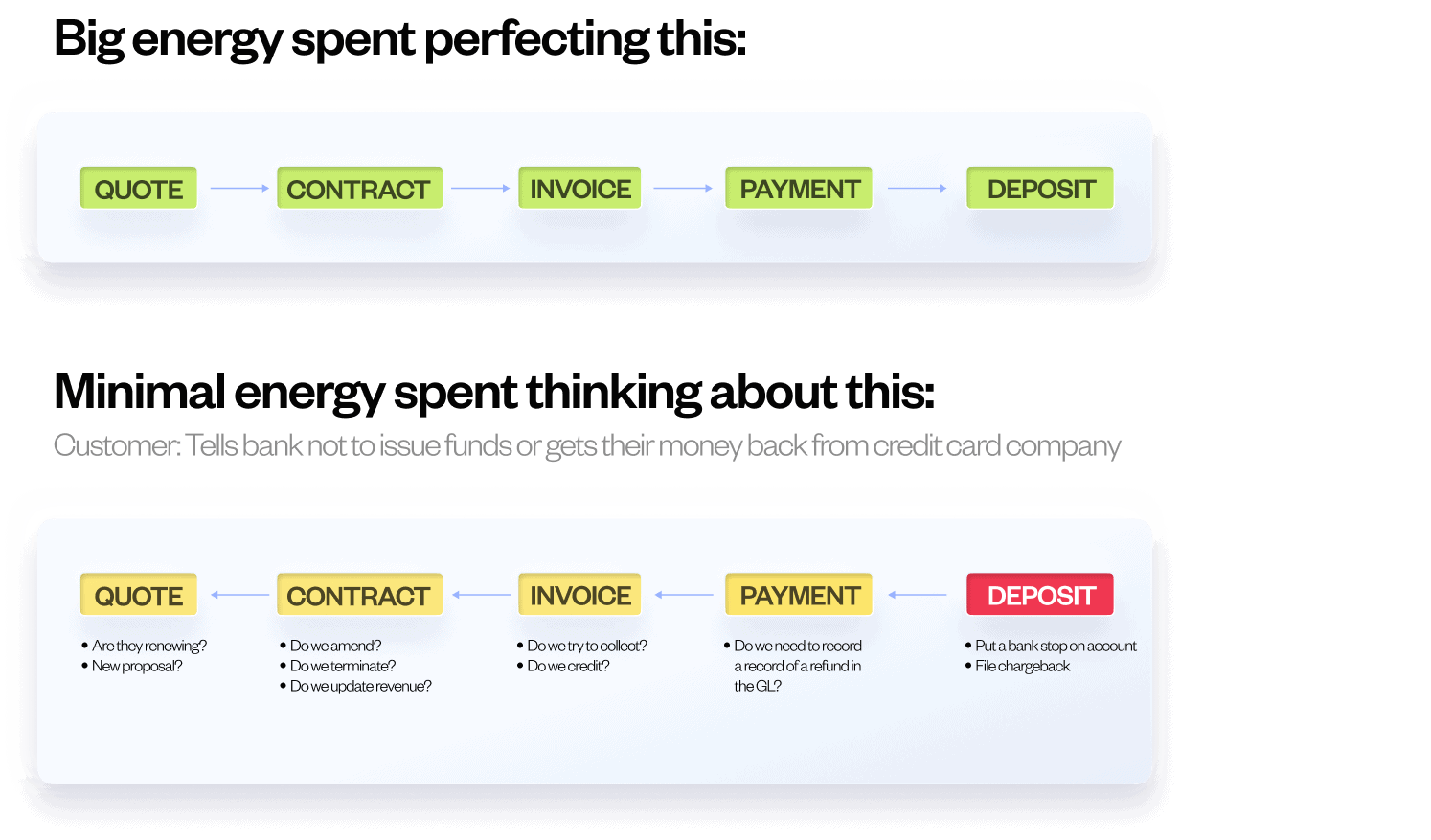

Automate reversed payment flow actions with ease

Maxio automates chargebacks, refunds, and international disputes—saving time and streamlining global revenue reconciliation and recovery.

Simplify the process of identifying, tracking, and resolving customer disputes with built-in automation that alerts your team, enables faster action, and helps you recover revenue with less manual work

Recover revenue faster by automating the chargeback process. Maxio Payments identifies, tracks, and processes disputes in real time, helping reduce leakage and minimize the workload on your finance team.

Automatically issue refunds with workflows that ensure compliance, accuracy, and reporting integrity, improving your customer satisfaction without slowing down operations or increasing the load on your billing team.

Security authentication that keeps customer data safe

Maxio offers enterprise-grade security to protect your payment operations and customer data to keep your subscription billing processes running smoothly and safely. We are fully compliant with:

- SOC 1 & 2

- ISO 27001

- PCI DSS level 1

- GDPR

There is no better time than the present to get into a system like Maxio. If you want to continue to grow, you will need a system in place, do it now before your historical data becomes overwhelming. The devil you know is not always better than the devil you don’t.

Trevor Swim, Ninjacat

Director of Finance

Maxio Payments FAQs

SaaS businesses choose Maxio Payments to simplify complex payment operations and reduce reliance on multiple gateways. With built-in automation for reconciliation, chargebacks, and invoicing, Maxio improves efficiency across global payment workflows.

Deep integration with your billing stack and real-time visibility give teams better control and fewer manual tasks.

Backed by in-house support and transparent pricing, Maxio transforms payments from a source of friction into a reliable growth engine.

Maxio Payments offers seamless two-way links with your CRM and GL. This ensures deposits, invoices, and payment records sync in real time, reducing manual updates and eliminating discrepancies between systems.

Maxio uses Interchange Plus Pricing for Maxio Payments. Interchange Plus Pricing is transparent. It separates card network fees from Maxio’s service fees, so you only pay for what you use.

This helps you save on high-cost transactions, such as international cards or manually entered payments.

Maxio makes migrations seamless. We use a secure, step-by-step process to transfer payment tokens from your existing gateway using PCI-compliant best practices. This ensures uninterrupted service for your customers while validating active cards for accuracy.

Yes! Maxio Payments supports multi-currency, international payment methods and global onboarding. Accept payments worldwide, settle in USD, CAD, or AUD — with EUR and GBP support coming soon — and stay compliant with regional regulations while onboarding SaaS businesses in the U.S., Canada, the UK, and Australia.

Bank Payments are the most effective way to reduce your overall processing fees. Most card fees come from card brands (ex: VISA, Mastercard, AMEX, etc.). Maxio helps you qualify for the lowest card fees possible by sending Level 2 & 3 information (e.g., tax details, item descriptions) to the networks which can save you considerable amounts on eligible transactions.

Additionally, Maxio offers volume-based discounts which can help you save more as you grow on the Maxio platform.

Absolutely! Maxio Payments provides detailed insights into failed payments, such as reasons for rejection (e.g., exceeded card limits). This allows you to take immediate corrective action, like retrying payments or contacting customers.

Maxio offers in-house support with a dedicated payments team. Whether you’re onboarding, managing disputes, or troubleshooting integrations, you’ll work directly with our experts, not a third-party service.

Explore the #1 finance & billing platform for B2B SaaS

Billing Automation

Streamline every step of your customer’s lifecycle, from onboarding to renewal and beyond

Revenue recognition

Help your finance team sleep at night with revenue recognition built for the complexity of B2B SaaS.

Reporting and SaaS metrics

Never lose sight of your business performance with accurate, reportable SaaS metrics.