For finance teams at SaaS companies, managing payments is more than just processing transactions—it’s about ensuring accuracy, efficiency, and visibility across every stage of the revenue lifecycle. As companies scale across borders, those goals often get buried beneath a pile of manual reconciliation, disjointed gateways, and limited currency support.

Maxio Payments is designed to keep that complexity in check.

Maxio is a unified billing and payments engine that brings invoicing, reconciliation, and reporting into a single platform. With built-in capabilities to support multiple currencies and regional payment preferences, finance teams stay in control, even as they expand into new markets.

That means:

- Payment methods that fit local customer expectations

- Multi-currency billing and settlement

- Streamlined reconciliation and cash reporting

- Centralized management of payment operations from acceptance to settlement

A Closer Look at Maxio Payments (with Global Capabilities)

1. Support Major Payment Methods for SaaS Customers

Maxio Payments gives your customers the flexibility to pay the way they prefer, with seamless support for major payment methods. Accept credit card payments and ACH bank transfers—both fully integrated into your billing workflows—with Plaid-powered bank verification for faster, more secure onboarding. Giving customers the experience they expect without adding complexity to your operations.

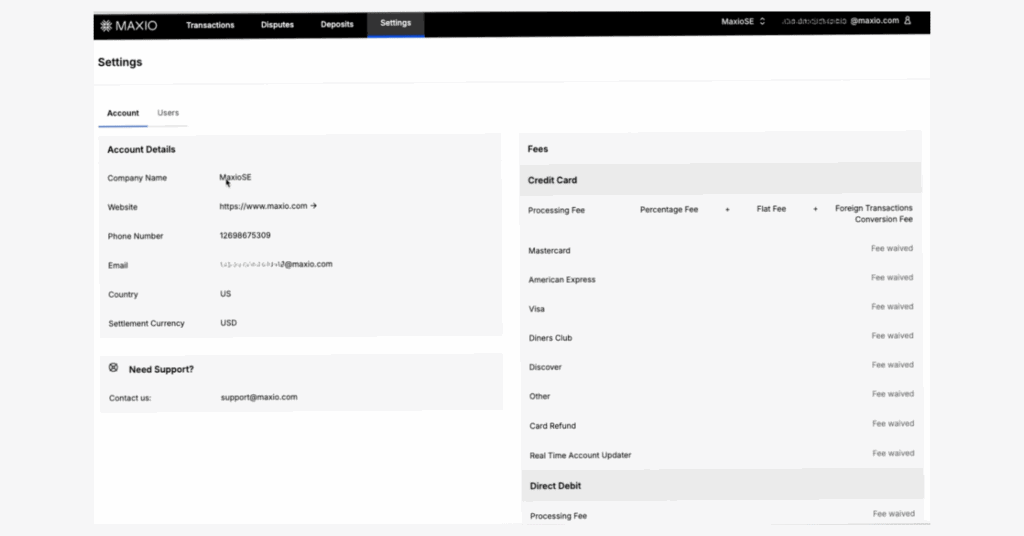

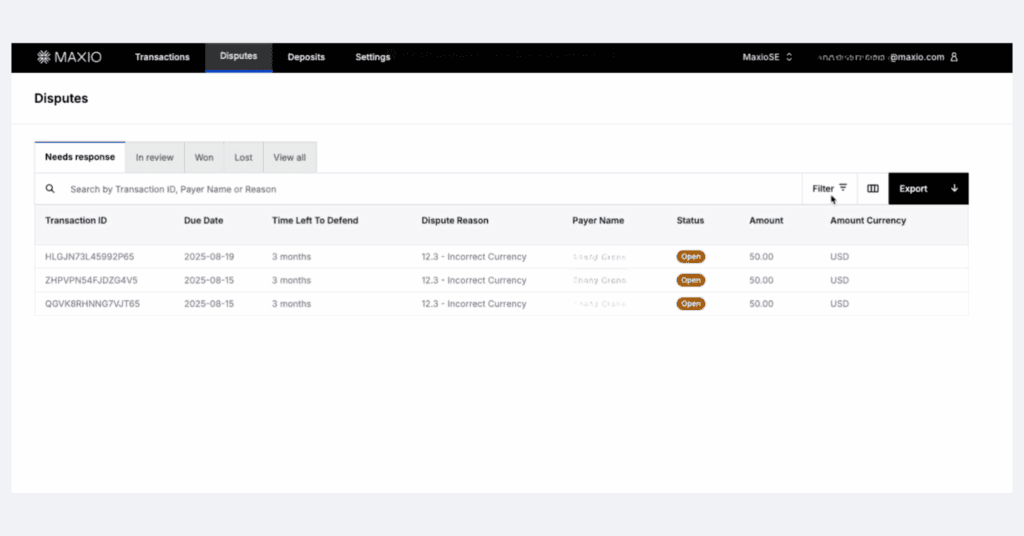

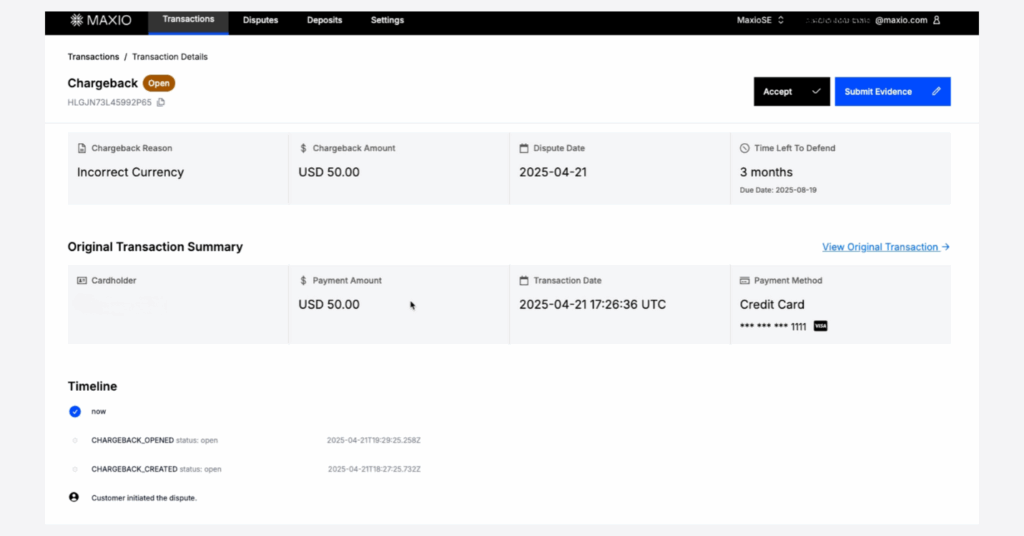

2. Simplify Chargeback Management

When disputes happen, Maxio makes them easy to manage. The platform surfaces chargeback alerts, categorizes them, and tracks resolution progress in a single dashboard—so your team can act fast and maintain accurate records without jumping between tools.

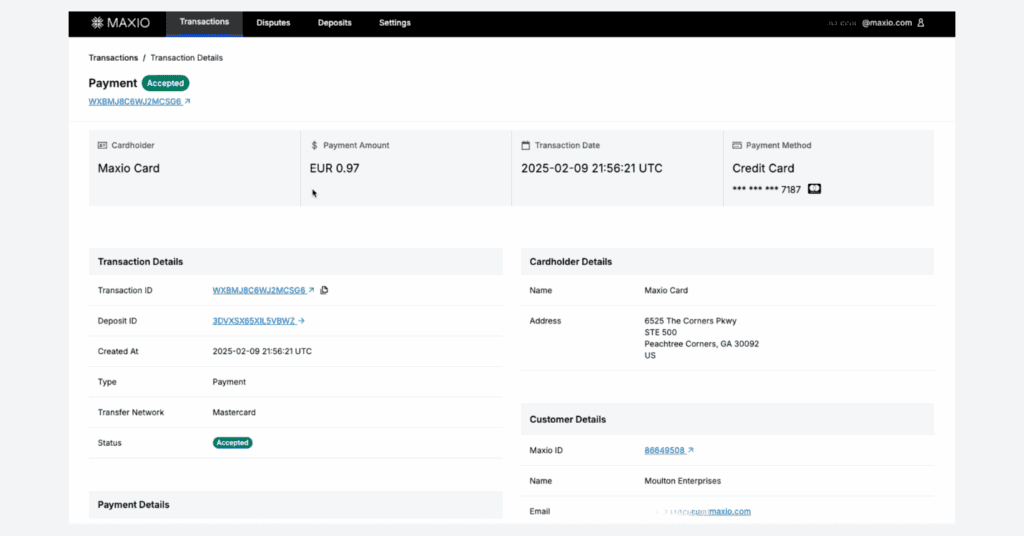

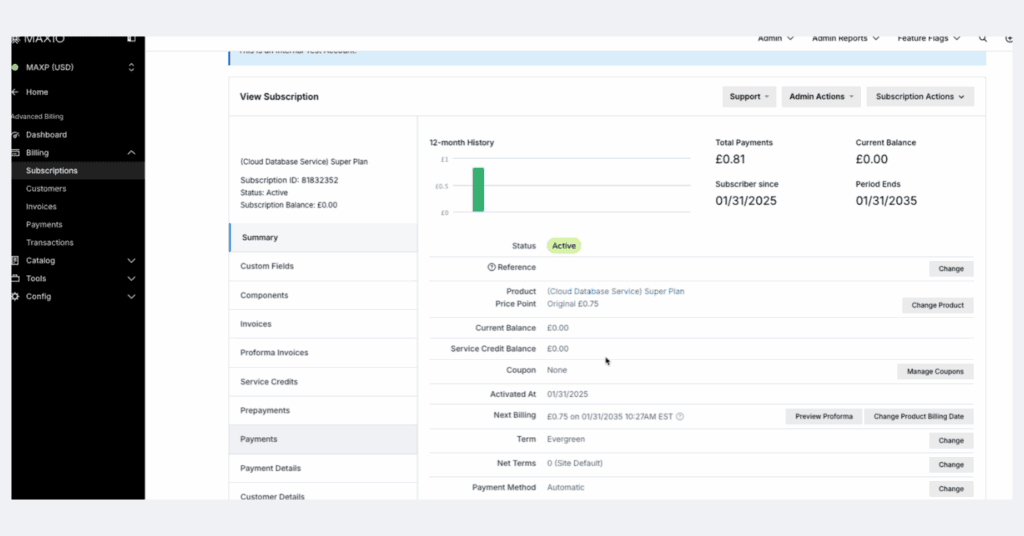

3. Collect Payments in Your Customer’s Currency

With Maxio Payments, you can collect credit card payments in the same currency your customers are invoiced—supporting a smoother, more consistent payment experience. This allows your customers to pay in their local currency while your finance team maintains accuracy and control over collections.

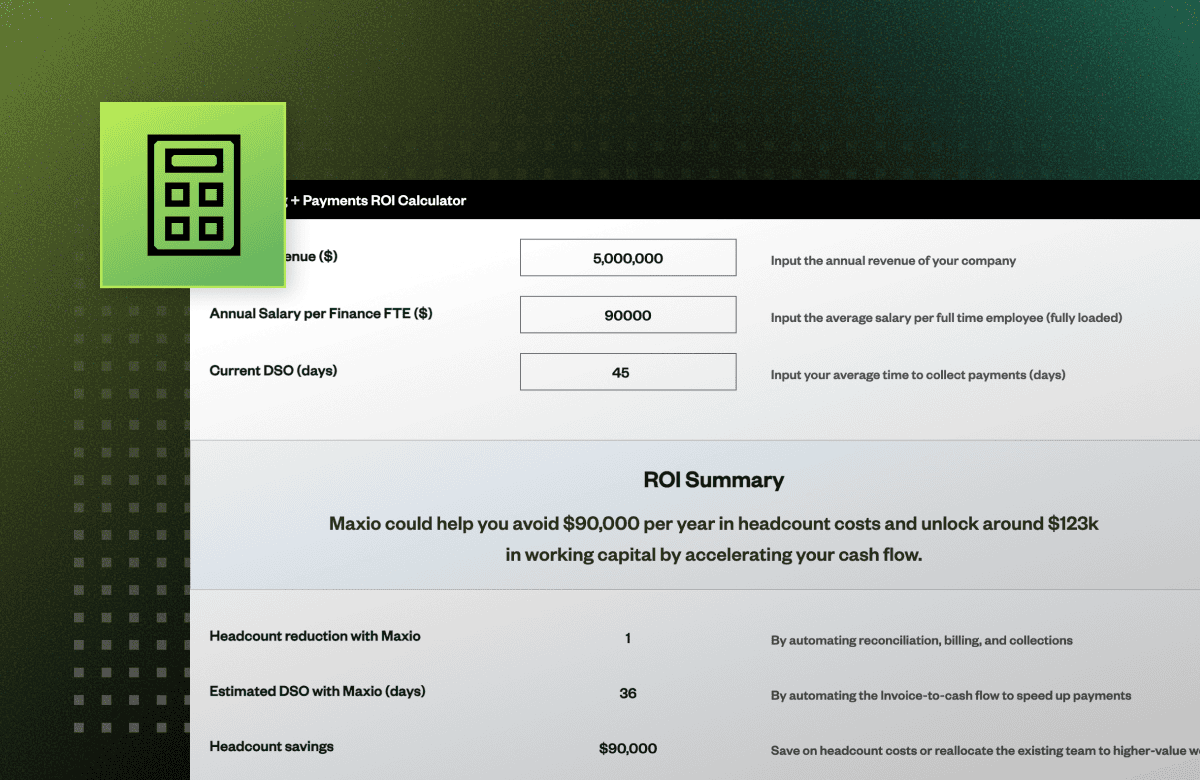

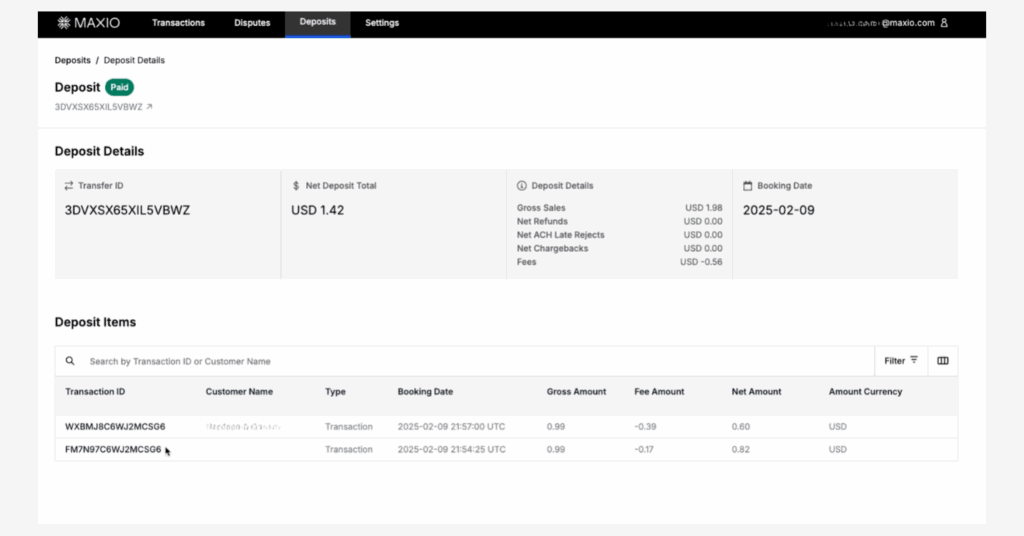

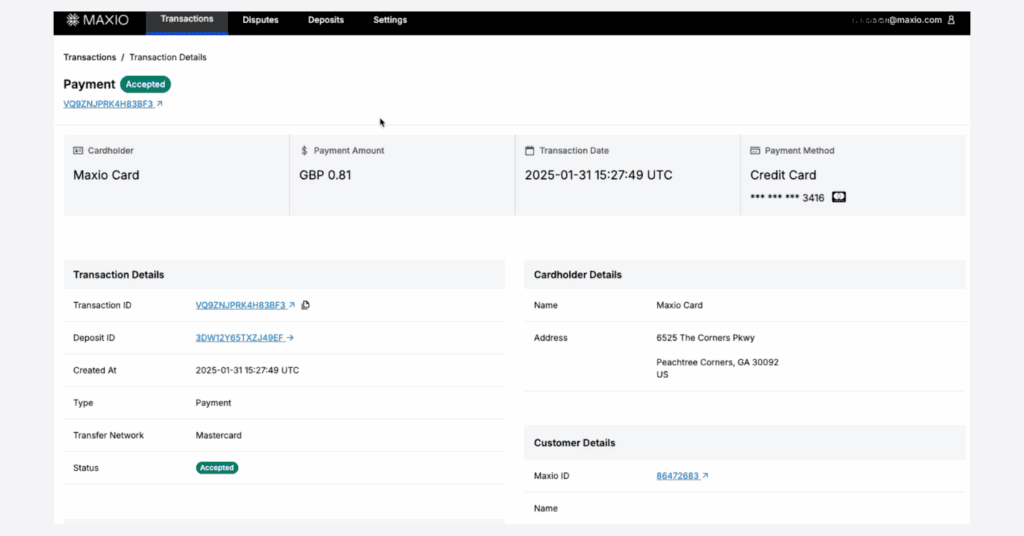

4. Improve Reconciliation and Cash Flow Visibility

Maxio Payments makes it easier to track deposits, refunds, and transaction statuses by syncing payment data directly into your billing system. This helps finance teams simplify reconciliation workflows and gain clearer visibility into cash flow—without relying on manual spreadsheets or disconnected reports.

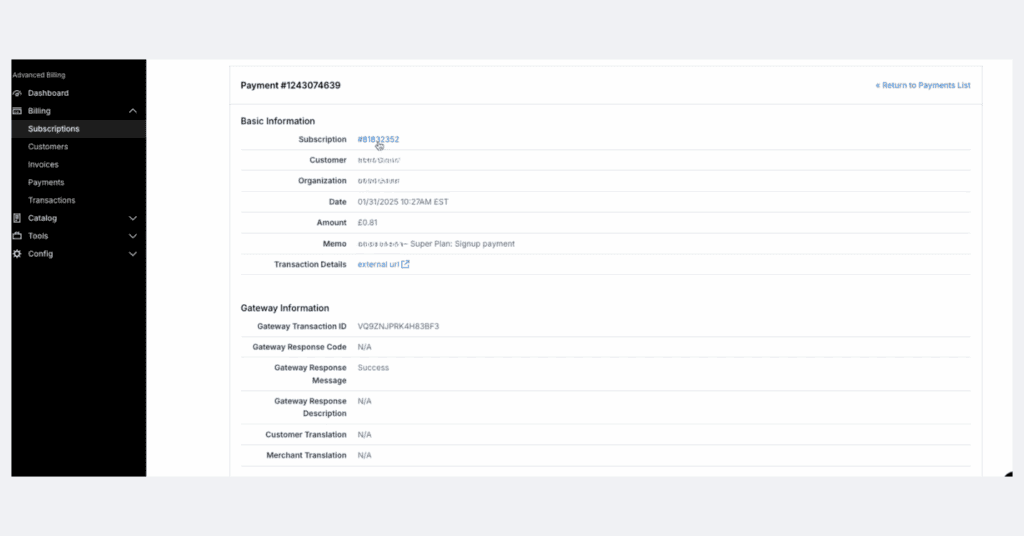

5. Integrate Payment Data with Your General Ledger

Maxio Payments works alongside Maxio Advanced Billing to sync settlement and payment data into your general ledger (GL). This reduces the need for manual data entry and helps your finance team maintain a more accurate, up-to-date view of cash and revenue across the business.

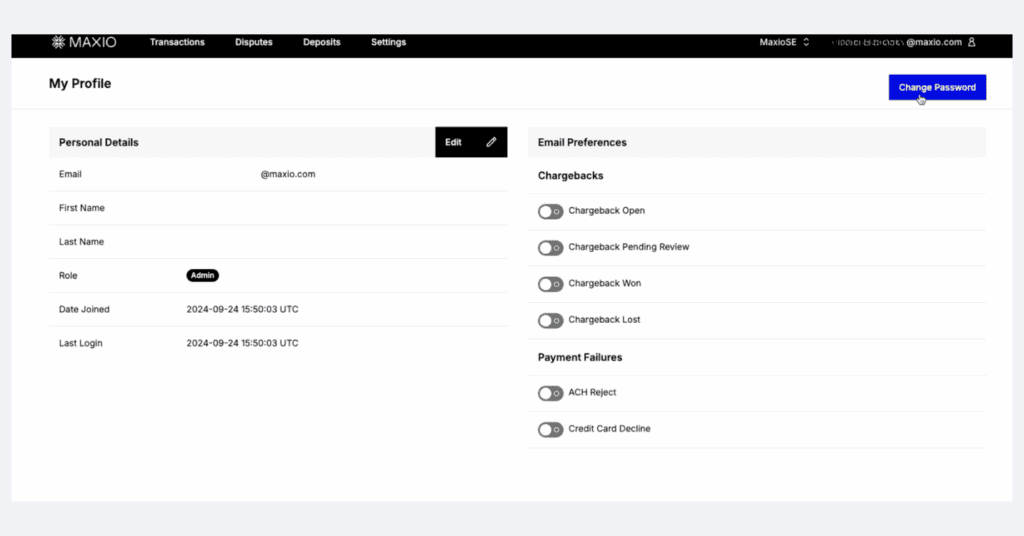

6. Give Teams Visibility & Control

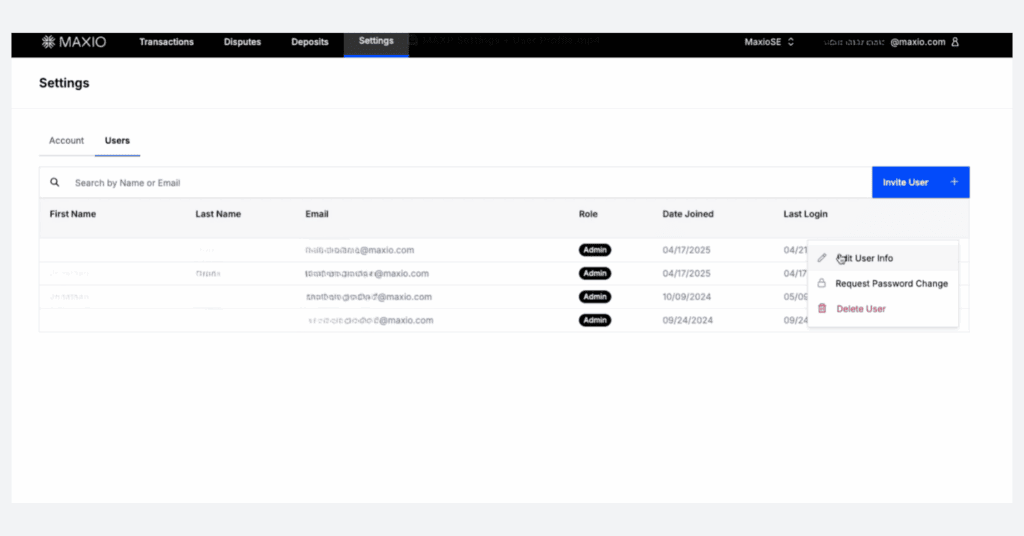

Role-based permissions, customizable alerts, and user-level controls ensure that everyone—whether CFO or analyst—sees only what they need. This level of transparency and control helps teams respond faster and reduce operational noise.

A Smarter Way to Manage SaaS Payments

Maxio Payments is built to handle the real-world complexities SaaS finance teams face every day. From localized payment preferences and currency flexibility to integrated reporting and reconciliation, it’s a platform designed to support growth—not slow it down.

By connecting payments to the rest of your revenue operations, Maxio gives you the tools to scale confidently, reduce risk, and maintain full visibility into cash flow—across every region you serve.

Smarter systems. Fewer workarounds. Global-ready from day one.

Explore what Maxio’s SaaS Payments Solution can do for your finance team.