Stripe Integration

Be More Productive with Stripe + Maxio

Plug your Stripe credentials into Maxio and instantly gain access to features that will streamline your recurring billing and subscription management, increase productivity, and improve customer satisfaction.

Why build it when Chargify has done the work for you?

You can be up and running with Maxio in no time—no costly development required.

Once you configure your products/plans, simply enter your Stripe credentials and start selling.

Maxio is PCI Level 1 certified to ensure that you and your customers are protected.

Our Customer Success team is the best in the business and available 24/7 to help you.

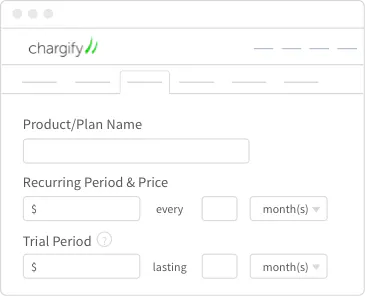

Recurring billing that adapts to your needs

Your billing software shouldn’t dictate your pricing. Maxio supports a variety of popular billing scenarios such as fixed-price, quantity-based, and metered usage.

Fine tune your billing scenario with configuration options that support trial periods, setup fees, billing expirations, taxes, coupons, calendar billing, and much more.

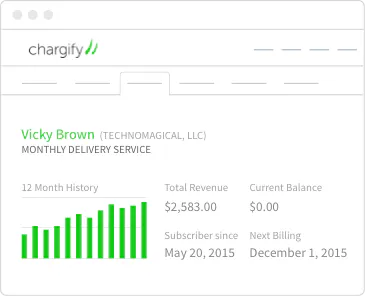

Provide better customer support

With all your subscription data in one place, customer support time is greatly reduced. Your support team can quickly locate plan information and billing history, issue credits, process refunds, and make account changes.

Maxio’s Billing Portal provides your customers with self-service access to view and modify their account information such as update credit card, change plans, or cancel their subscription.

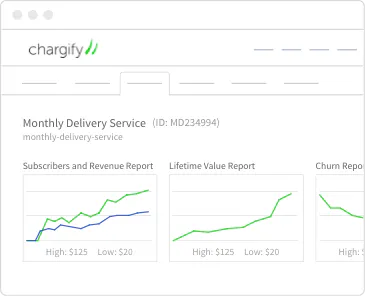

Get clarity into business metrics that matter

Gain clear visibility into the health of your business through a variety of reports that help you understand revenue. Watch signups, upgrades, downgrades, and cancellations as they happen. Access subscription, revenue, churn, and customer lifetime value reports as a whole or broken down by product/plan.

Have more complex needs? Export your subscription and transaction history to CSV files that you can slice and dice any way you please.

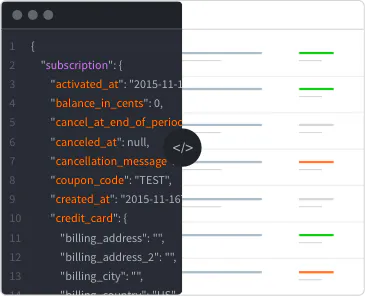

Scale your business

By design, Maxio was built to grow with your business. You can get started quickly with a variety of out of the box features that reduce development resources and implementation costs.

As your business needs grow, Maxio’s API allows for advanced, seamless integrations that can handle even the most complex needs. When you succeed, we succeed, and we’re here to help you along the way!

Stripe + Maxio FAQ

I’m already using Stripe. Can I import my existing subscribers?

Of course! You can import existing subscriptions using one of two methods—our Subscriptions API or our CSV import tool.

Can I switch from another payment gateway to Stripe?

You wouldn’t be the first, and our support team can help assist you. Learn how DNSimple switched from Authorize.Net to Stripe.