Between billing, collections, maintaining GAAP/IFRS compliance, and more, financial operations is only becoming more complex for your average SaaS company. In the past, Finance teams at early-stage companies have relied on spreadsheets and basic accounting systems (e.g. QuickBooks Online or Xero). As these companies mature, they often move to a traditional ERP solution provider (e.g., Netsuite or Intacct). However, we see today that the tech landscape for B2B SaaS finance teams has exploded and there are many ways to build your FinOps Tech Stack.

The recently released SaaS CFO’s 2023 Tech Stack Survey helps make sense of the complexity facing teams as they think about reinventing their tech stack to support more complexity.

Here were our biggest takeaways:

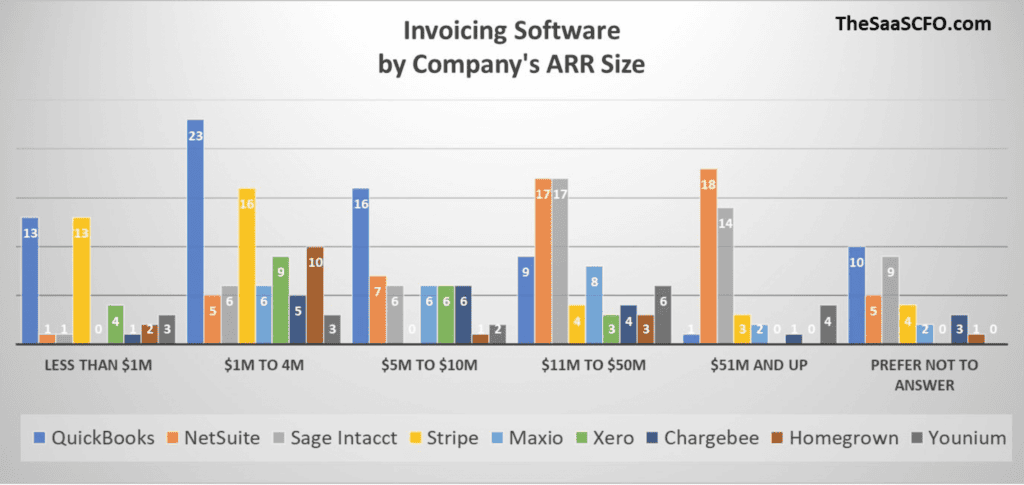

1. Spreadsheets weren’t made to handle billing and invoicing

Most SaaS companies hang on to spreadsheets to handle their billing and collections for as long as possible before eventually switching to an ERP. What’s the problem here? By working out of spreadsheets for too long, SaaS companies aren’t able to test and implement new pricing models at scale. Similarly, by adopting an ERP too quickly, they take on unnecessary tech debt. ERP implementations can last months on end and many of the modules included end up sitting and collecting dust.

It’s a classic goldilocks scenario—you need a point solution that’s “just right” to help you grow from startup to scaleup until you’re finally ready to transition to an ERP solution.

For example, Maxio integrates directly into your product, so you can seamlessly manage your product catalog, bill customers, and collect payments (without having to jump straight to an ERP solution).

2. Homegrown SaaS billing solutions aren’t scalable

Based on survey data, the use of homegrown billing solutions spikes around the $1-4M ARR mark and then quickly drops off.

Why? Once companies start to cross the $5M threshold they realize their homegrown solution can’t keep up with their growth and look for a point solution instead. Homegrown billing solutions take significant developer resources to build and maintain and SaaS companies are typically better off investing in a dedicated billing solution rather than developing one in-house or adopting an ERP too early in their growth journey.

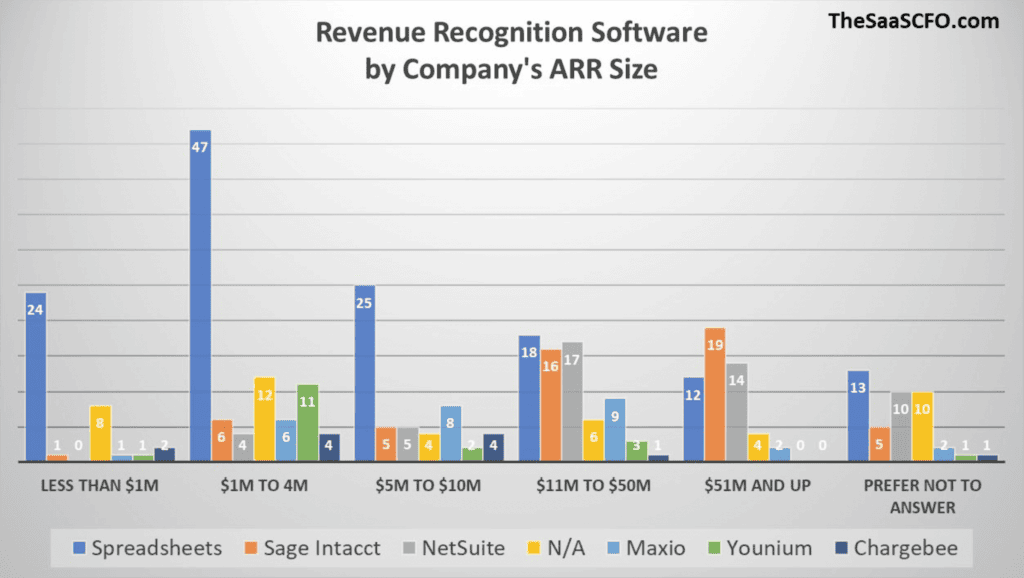

3. Spreadsheet usage for revenue recognition declines as ARR increases

While spreadsheets are still the dominant rev rec solution (36% of participants), spreadsheet usage declines as ARR increases. Around the 11M ARR mark, we see the rise of point solutions and ERPs instead.

That being said, data shows that a smaller amount of SaaS companies stick with spreadsheets for their rev rec past $51M ARR, however, at this stage, they are likely supplementing with an ERP provider such as NetSuite or Sage Intacct.

Why does this happen?

At this stage, companies hire a head of finance (i.e. they move away from outsourcing to CPA firms) and take on professional investors who want more governance and compliance. Whether it’s due to pressure from investors or the need to adopt a tried-and-true, these same companies move to an ERP.

Unfortunately, ERPs are often far too complex for early-stage and mid-market companies that just need to get a basic handle on their billing, collections, and other basic accounting functions. With a platform like Maxio, you can delay the migration to an ERP and start recognizing revenue (without shelling out tons of cash on ERP implementations, consultants, and all the other fees associated with a huge tech investment).

Using Maxio to manage SaaS finance and accounting

In the beginning stages of a SaaS company, the finance infrastructure does not receive much attention. However, as you scale your revenue and headcount, accurate and timely financials and operating metrics become tablestakes.

By using a Financial Operations Platform like Maxio, you can bridge the gap between spreadsheets and ERP solutions, and unlock your next stage of growth. Check out the Maxio Buyer’s Guide to see how other SaaS finance leaders are using Maxio to optimize their financial operations.