The updated ASC 606 & IFRS 15 accounting standards have impacted, and continue to impact, businesses across the globe—especially for those with subscription offerings because of the many billing events that take place throughout the life of any given subscription.

Even if you are not a finance-focused team member, these changes have likely affected you. They have created a shared, cross-functional compliance responsibility that requires sales, product, and client service teams to be cognizant of how revenue from plans and services will be recognized and reported.

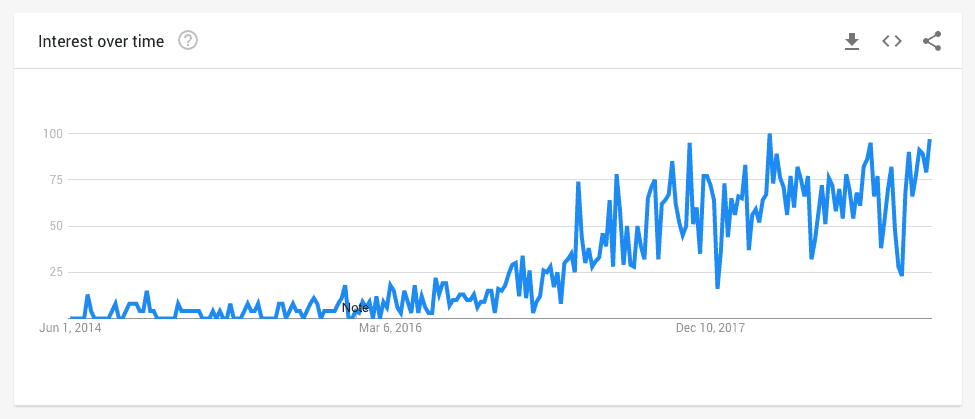

Yet businesses are still scrambling for a compliant solution. Google shows that ‘ASC 606’ search queries continue to trend—even though it was announced in 2014 and started rolling out in 2017. As of 2019, ever public and private business, with very few exceptions, is required to recognize and report revenue under the new standards.

So why is this still such a hot topic? Because revenue recognition rules under the new standards are intimidating, complicated, and time-consuming, which is why we acquired revenue recognition software ProRata and worked around the clock to seamlessly integrate their team and technology into Maxio.

Today we are happy to introduce a major improvement that provides advanced automation through fine-grain control over your revenue deferral workflows.

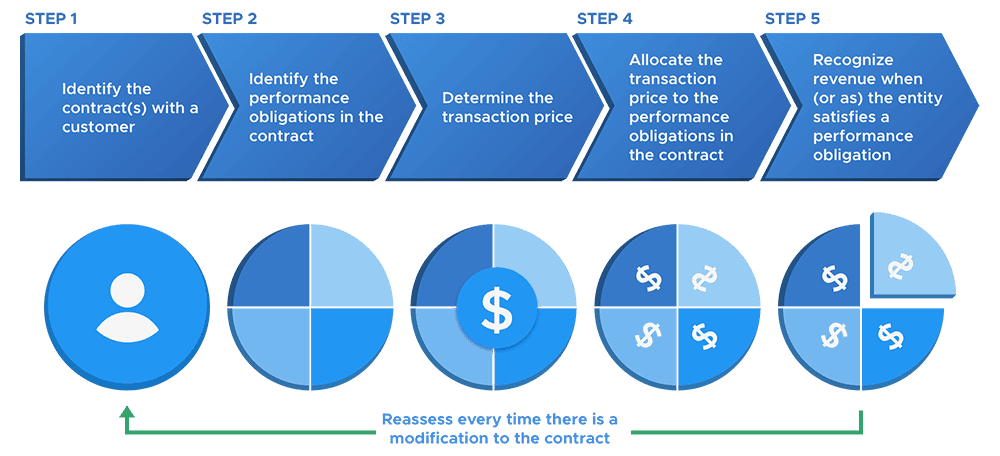

Before diving into the feature, it’s important to understand why subscription businesses need more control over when revenue is recognized immediately vs. deferred over time. Revenue recognition under ASC 606 and IFRS 15 follows the following five-step approach.

When allocating the transaction price to the performance obligations, sometimes revenue from the subscription will need to be recognized differently based on when different performance obligations are satisfied.

For example, if you offer a product with an annual plan that is $10,000/year but requires a $2,000 setup fee, you may need to recognize the $2,000 upfront when the customer converts, but the $10,000 would be deferred and spread out over the annual contract period.

Introducing Deferred Revenue Management

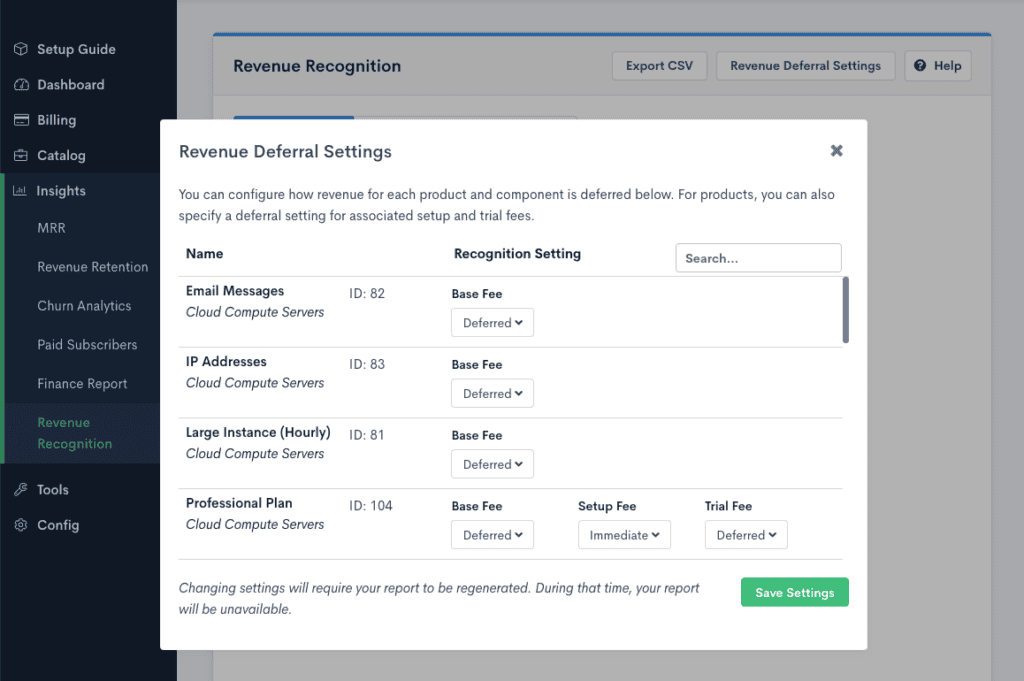

Our Revenue Recognition Reports now offer customizable Revenue Deferral Settings that allow you to control the desired workflow for every Product and Component within your product catalog.

Prior to this update, reports were generated using the transaction price and billing frequency to distribute revenue evenly across the service period with partial months being prorated on a daily basis. But if you have use cases like the one mentioned above, you need more fine-grain control.

What’s really powerful is the ability to define deferred revenue settings for different revenue events within any given Product. So if you have a bi-monthly, quarterly, or annual plan that includes a setup fee and/or paid trial, you can choose to immediately recognize the trail/setup fees but defer the Product fee over the billing period.

Our Revenue Recognition Reports with advanced revenue deferral settings provide a fully automated solution that eliminates, or dramatically reduces, the need for manual data manipulation to comply with ASC 606/IFRS 15 accounting standards.

Getting Started

If you are already using our revenue recognition software reports, the revenue deferral settings are now available to use. You will need to enable this feature by clicking on the ‘Revenue Deferral Settings’ button, which will regenerate your reports to make the feature available.

Note: This is a one-time request that can take anywhere from an hour to a day depending upon the size of your Site and the number of concurrent reports being generated by our system.

Additional Resources:

- Learn more about configuring and using Maxio’s Revenue Recognition Reports in our help documentation.

- If you’re an existing customer, reach out to support@chargify.com if you need any assistance enabling these reports or new settings.

- If you’re looking to learn more about Maxio, feel free to schedule a call with a Billing Expert to get your questions answered.