If your business relies on predictable revenue, then you already know that recurring payments aren’t a nice-to-have: they’re essential.

From streaming platforms and gym memberships to subscription boxes and SaaS tools, recurring billing powers the behind-the-scenes systems that make revenue predictable and user experiences seamless.

For small businesses and startups, the appeal is clear: setting up recurring payments means fewer late payments, stronger customer retention, and more reliable cash flow—all without needing to chase down invoices every month.

In this guide, we’ll walk you through how subscription models work under the hood, how to choose the right payment solution for your business, and how to streamline your payment services so your revenue stream runs on autopilot.

What is recurring payment processing?

Recurring payment processing allows businesses to automatically charge a customer’s account at regular intervals, including weekly, monthly, annually, or anything in between. It’s the engine behind subscription payments, and it’s what allows SaaS companies to collect revenue without manual invoicing.

To make this work, SaaS and subscription businesses rely on a combination of tools, including:

- A payment gateway to securely transmit customer payment information

- A payment processor and merchant account to authorize and move the funds

- An invoicing system that syncs with your accounting software and keeps your billing cycle on track

Together, these tools can streamline how you process payments, reduce the risk of chargebacks, and ensure compliance with PCI standards for data security. It’s also how businesses offer automatic payments while keeping their systems secure and customer-friendly.

Types of businesses that benefit from recurring payment systems

While we primarily focus on software businesses, there are a wide variety of business models that rely on subscription billing to stabilize cash flow and reduce late payments. Here are some of the most common types of businesses using this system effectively:

- SaaS companies use recurring payment processing to bill users for access to cloud-based platforms.

- Fitness memberships charge on a monthly or annual payment schedule to deliver consistent value and build member loyalty.

- Streaming services like Netflix use automated billing to offer seamless access while reducing churn caused by missed payments.

- Subscription boxes rely on predictable billing cycles to manage inventory and forecast growth.

- Utility providers use online payment tools and recurring setups to bill for utility bills like water, gas, or electricity.

For all of these businesses, recurring billing creates predictable revenue, improves the payment system experience, and reduces manual workload for staff. Ultimately, it’s a win for both businesses and their customers.

Advantages of implementing recurring billing

Recurring billing isn’t just about convenience—it’s how smart companies build stable, scalable revenue. For business owners, it means consistent cash flow, reduced late payments, and a smoother workflow. And for customers, it creates a frictionless experience that boosts customer satisfaction and reduces the risk of service interruptions.

By shifting to automatic payments and centralized subscription management, companies can build stronger relationships with customers, improve their operations, and create long-term value through recurring revenue.

Here’s how it plays out:

Increased customer retention

Recurring payments increase customer retention by removing friction from the billing process. Instead of asking customers to manually pay each month, a subscription billing system handles it for them.

Then, when paired with flexible payment methods and well-managed subscription management, businesses can meet customers where they are—offering upgrades, downgrades, or changes in payment details without disrupting service. The result? Fewer cancellations and more loyal users.

Fewer late or missed payments

One of the biggest wins of automation is eliminating late payments. By scheduling automatic payments, businesses reduce the chances of missed invoices, expired cards, or other payment failures that lead to involuntary churn.

This keeps your revenue stream healthy and minimizes the customer service burden of chasing down payments.

Predictable revenue

With a steady stream of recurring charges, business owners can forecast future income with greater confidence. Recurring revenue makes it easier to model growth, plan budgets, and make strategic decisions based on a more stable revenue stream.

Improved cash flow

Recurring billing also smooths out the peaks and valleys in your cash flow. Instead of relying on sporadic sales or manual invoicing, you’ve got a built-in system that feeds your bank account on schedule. For growing businesses and startups that are actively trying to scale, this financial stability fuels smarter hiring, better vendor planning, and less stress during uncertain seasons.

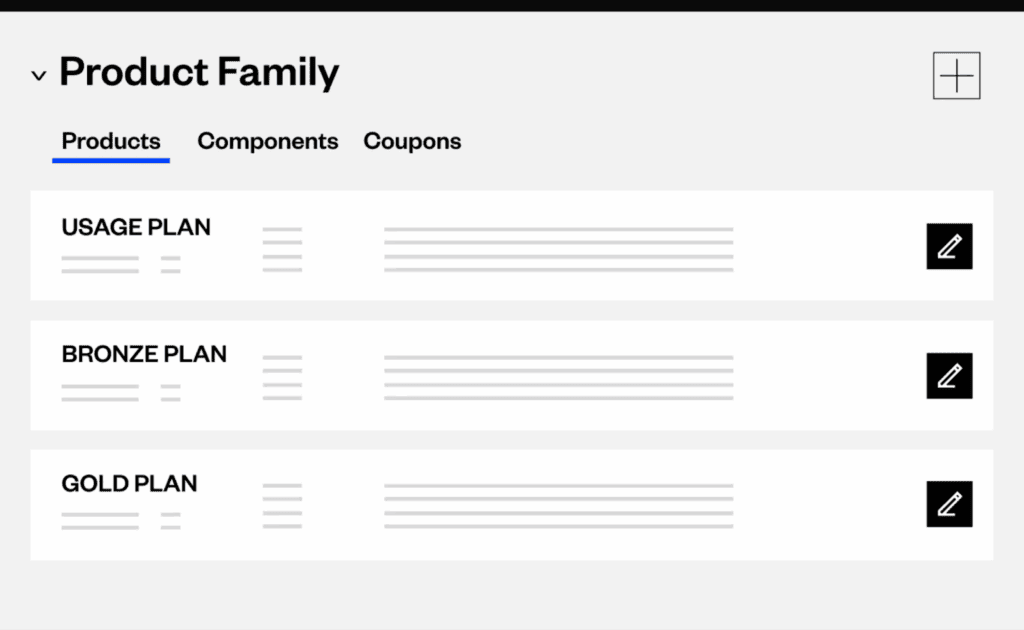

Determining subscription payment frequencies and payment tiers

Your payment model isn’t just about how much you charge: it’s also about when and how often. This means that choosing the right billing schedule is critical to balancing your customers’ expectations with your own revenue stream goals.

For example, some customers prefer bite-sized payment plans (think weekly or monthly), while others are happy to pay annually in exchange for a discount. Your job is to align your subscription billing strategy with the realities of your business model and the buying habits of your audience.

Equally important is offering individual pricing tiers that reflect your customers’ needs. Entry-level users might only want basic access at a flat rate, while power users may prefer usage-based pricing that scales with activity. Offering both fixed and flexible payment options ensures you’re not forcing everyone into the same box.

And if you serve global customers, don’t forget to factor in multiple currencies, as well as tax compliance and localization. Your payment processor should support these variations without adding friction.

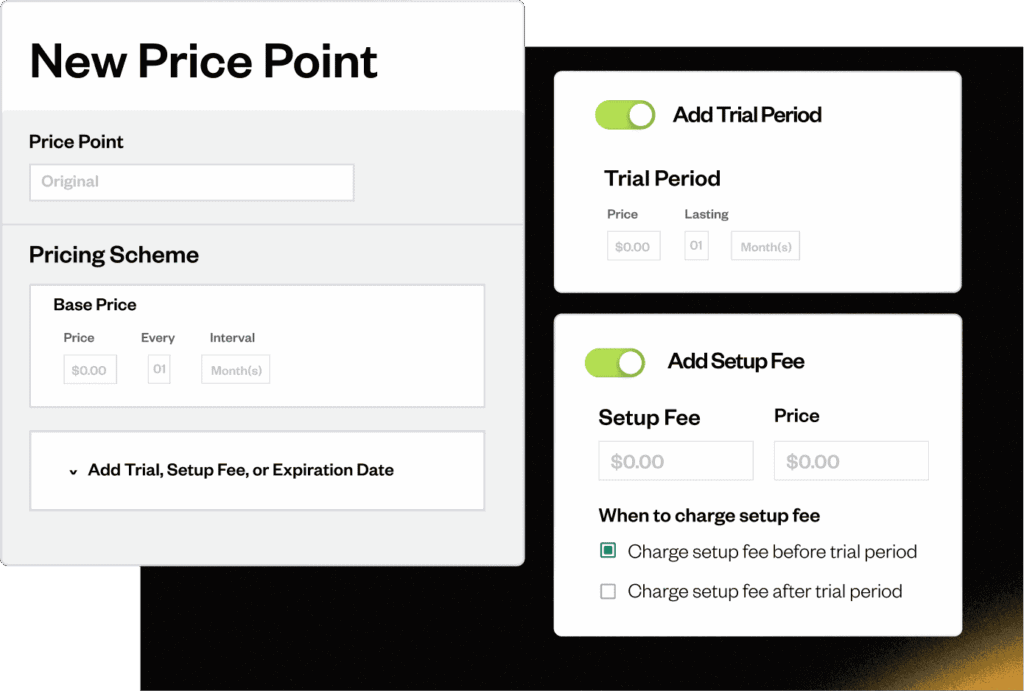

Managing pricing modifications and subscription changes

Pricing changes are inevitable—your product evolves, your costs shift, and your market matures. But changing prices or payment plans doesn’t have to mean losing customers.

The key is to manage these pricing updates in a way that preserves the customer experience. Whether you’re rolling out a price increase, offering new tiers, or allowing subscription upgrades and downgrades, transparency is critical. Customers are far more likely to stay when changes are communicated clearly, well in advance, and with a strong value narrative attached.

Your subscription management system should make this easy by:

- Automatically updating payment details

- Tracking your pricing plan changes

- Processing Recurring Payments

- Triggering alerts for the payment processor when action is required.

(Source)

You’ll also want to ensure there are smooth pathways for cancellations and reactivations, backed by proactive customer support and retry mechanisms to reduce failed payments and unnecessary churn.

For instance, we designed Maxio’s subscription management software to handle all of these use cases in a single platform—allowing you to adapt your pricing strategy without derailing the customer journey.

What to be aware of when accepting different payment types

Choosing the right payment methods is one of the most important decisions a business can make when setting up recurring billing. It impacts everything from the checkout experience and customer satisfaction, to failed payments and operational overhead.

Your payment processor also plays a key role here. The ideal solution should support a wide range of payment options, including credit cards, debit cards, ACH payments, and digital wallets. It also needs to be PCI compliant, protect against chargebacks, and offer the kind of automation that removes manual tasks from your billing team’s plate.

We built Maxio’s automated recurring billing system with this flexibility in mind, helping SaaS businesses manage subscriptions, reduce payment failures, and adapt to changing customer preferences—all while protecting sensitive payment details and supporting secure online payments.

Let’s break down the pros, cons, and considerations of the most common payment types.

Credit card payments

Credit cards remain the go-to for many recurring billing setups—and for good reason. They’re widely used, familiar to customers, and easily integrated into most merchant account and payment processor setups.

For businesses, they offer fast authorization, easy checkout, and strong compatibility with automated billing cycles. Plus, most credit card networks have robust fraud protection, which helps reduce risk.

That said, you’ll want to watch for chargebacks, expired cards, and occasional declines—especially for long-term subscriptions. Smart retry logic and payment details validation can help keep these disruptions to a minimum.

Debit card payments

Debit cards work much like credit cards for recurring billing—they’re easy to set up, widely accepted, and integrate smoothly with most payment processors and merchant accounts. For customers, they offer the convenience of online payment without incurring debt, which can improve customer satisfaction for certain segments.

But there’s one big caveat: insufficient funds.

Because debit cards pull directly from a bank account, failed transactions are more likely—especially if the payment schedule hits before a customer’s payday. This can lead to higher involuntary churn if you don’t have solid retry logic or subscription management practices in place.

Businesses using debit cards at scale should prioritize tools that automate retries, flag failed card payments, and communicate with customers to update their payment details when needed.

ACH payments

ACH payments (Automated Clearing House transfers) are another powerful option for businesses that handle high transaction volumes, long-term contracts, or B2B billing. Instead of charging a card, funds are pulled directly from the customer’s bank account—often with lower fees and fewer chargebacks.

For recurring billing, ACH is especially useful when you need reliable, low-cost payment methods that support large or frequent transfers. It’s ideal for software companies, agencies, and service providers that offer annual or quarterly payment plans.

The tradeoff here is that ACH isn’t instant. Transactions can take a day or two to process, and setup may require additional payment details from the customer. Still, it’s a great way to improve cash flow while minimizing processing costs.

And with the right payment processor, businesses can automate ACH collection just like they would with card payments, without sacrificing PCI compliance or security.

Ultimately, ACH is best suited for businesses with high-value transactions, predictable usage patterns, and customers who prefer direct-from-bank payments over cards.

Digital wallets

Digital wallets like Apple Pay, Google Pay, and PayPal are quickly becoming must-have payment options, especially for mobile-first users who value speed and convenience at checkout.

These tools simplify recurring payments by storing payment details securely and authorizing online payments with just a tap or fingerprint. For businesses, this means fewer abandoned checkouts, improved customer satisfaction, and higher payment success rates—particularly on mobile devices.

Digital wallets also help reduce PCI compliance overhead. And because they tokenize sensitive information, you avoid directly handling customer payment information, which lowers security risks and liability.

As more consumers shift toward mobile and app-based transactions, supporting digital wallets is a smart move to stay competitive and accessible—especially for fast-growing SaaS and ecommerce brands.

Alternative payment methods

As the payments landscape evolves, so do customer expectations. Supporting alternative payment methods—like cryptocurrency or Buy Now, Pay Later (BNPL)—can help you reach new markets, attract younger buyers, and offer more flexible payment options.

While these methods aren’t always the best fit for traditional subscription billing, they can enhance the customer experience in industries like ecommerce, education, or marketplaces where upfront commitment may be a barrier.

Specifically, cryptocurrency appeals to a growing base of privacy-conscious users and global buyers. BNPL options, on the other hand, allow customers to split payments without credit checks—great for boosting conversions on higher-tier payment plans or add-ons.

Whichever you choose, make sure your payment processor and merchant account are equipped to handle these methods securely and compliantly, with tools to prevent chargebacks and streamline payment details collection.

To explore the pros and cons of each method in more detail, check out our guide to selecting the right subscription payment service.

How to collect recurring payments

Once you’ve chosen your subscription billing approach, the next step is execution. A smooth rollout depends on setting up the right systems, ensuring your operations are PCI compliant, and clearly communicating with customers at every stage of the billing process.

Recurring billing should feel automatic—not just for your customers, but for your internal teams. That’s why it’s critical to build or choose a billing stack that’s secure, scalable, and integrated from day one.

Here’s how to set up recurring payments the right way:

1. Select a payment processor

Your payment processor is the backbone of your billing operation. It should support a wide range of currencies, offer real-time automation features, and be fully PCI compliant to protect customer data and minimize risk. The right solution will reduce manual workload, increase payment success rates, and give you clear visibility into every transaction.

Look for a processor that offers:

- Auto-retries for failed payments

- Real-time subscription updates

- Support for multiple payment methods

- Seamless integration with your payment gateway, merchant account, CRM, and billing system

Maxio Payments was built for exactly this. It gives business owners full control over recurring payment workflows, offering global payment support, built-in compliance, and real-time payment orchestration that scales with your business.

2. Establish your pricing model

Before launching your recurring billing system, it’s important to get your pricing right. Your pricing tiers should reflect both your value and your customers’ expectations—something you can only uncover through customer data, market research, and business analysis.

Whether you’re rolling out flat-rate subscriptions, usage-based pricing, or hybrid models, your plan should align with your business model while making it easy for customers to select the right fit.

(Source)

3. Integrate the billing system

A disconnected billing system is a recipe for headaches. Your billing platform should also sync tightly with your payment processor, accounting software, CRM, and customer accounts platform to ensure that every invoice, charge, and payment status flows cleanly across your entire operation.

This level of integration reduces errors, prevents duplicated efforts, and allows for real-time updates across all systems.

Maxio’s Accounts Receivable Software bridges the gap between billing and collections. It automates invoicing, syncs payment data across platforms, and gives finance teams full visibility into their cash inflows, overdue balances, and customer payment history—all without any messy manual reconciliation.

4. Communicate the new option to customers

Finally, once your system is in place, customer communication is critical. Whether you’re introducing new payment options, updating payment plans, or simply switching platforms, clear and proactive messaging builds trust.

Use email, in-app messages, and website updates to walk customers through the benefits of recurring billing—like convenience, uninterrupted access, and simplified payment details management. Let them know what to expect, how they’ll be charged, and who to contact for help.

You may also consider offering proactive customer support during the transition, and make sure all communication reflects your brand’s tone and clarity. Because in the end, a smooth billing transition is about creating a customer experience that earns long-term loyalty.

Using Maxio for processing recurring payments

As we’ve covered, SaaS business owners and leaders need a smart, secure, and flexible payment solution that can handle the full billing process—from invoicing and retries to subscription management and reporting across multiple currencies.

That’s exactly why we built Maxio.

With automated recurring billing, Maxio simplifies your entire payment cycle—reducing friction, minimizing revenue leakage, and eliminating repetitive manual tasks. Our platform includes built-in retry logic, advanced payment services, and customizable invoicing workflows that fit your exact business model.

Pair that with our subscription management software, and you’ve got everything you need to launch, scale, and adapt your billing operations with confidence.

Want to see it in action? Get a demo and discover how Maxio can transform your recurring billing from a burden into a growth engine.