It’s one of the most stressful parts of fundraising: creating and perfecting your SaaS pitch deck. Contrary to popular belief though, the days of the formal pitch deck presentation are largely over.

In a recent webinar, Maxio CEO Tim McCormick, Lessonly CFO Brian Montminy, and OpenView VP of Growth Kyle Poyar discussed what makes a modern pitch deck and how you can differentiate yours by crafting a compelling story supported by metrics.

SaaS Pitch Deck Basics: A CFO’s Perspective

According to Lessonly CFO Brian Montminy, your pitch deck’s focus largely depends on what stage your company is in. The focus of a company raising a Series A is finding and confirming their product/market fit. In contrast, the focus of a company raising a Series B is more so finding a scalable sales and marketing strategy.

As a result, the metrics you focus on in your Series B round will differ from what you presented in your Series A pitch deck.

Fine Tuning Your Pitch

According to Montminy, the things you should focus on in your pitch deck presentation (regardless of stage) are:

- The problem you solve

- The vision and product

- Customer growth

- Market and competitive landscape

- Metrics

- Your financial plan and working business model for ROI

To take it a step further, there are some specific things you’ll want to include in your pitch deck based on your growth stage.

Early Stage / Series A Pitch Deck Metrics

At this stage, you’re still finding your product-market fit. You’ll want to hit on things like:

- Customer success stories and use cases that illustrate the product-market fit

- Upcoming product features that will add value to your customers

- MRR/ARR growth

- Revenue and logo churn

- Net revenue retention

Growth Stage / Series B Pitch Deck Metrics

At this point, you’ve identified your product-market fit and are focused on scaling your repeatable sales and marketing processes. You’ll want to talk about:

- Pipeline growth

- Conversion metrics

- Win-rates

- Average ARR per deal

- Average sales cycle duration

- Net revenue retention

- CAC:CLV

- CAC payback period

SaaS Pitch Deck Basics: A VC’s Perspective

Kyle Poyar is VP of Growth at OpenView, a venture capital firm that focuses on growth-stage companies. In a recent webinar, he largely echoed Lessonly CFO Brian Montminy’s overall sentiments that the pitch deck’s function is to support the company story.

In his view, entrepreneurs should always come to meetings prepared to discuss two things: what makes their business unique and how they are working to mitigate potential risk on the investor’s part.

At OpenView, Poyar’s team invests in Product-Led Growth or PLG companies. These companies rely primarily on their product, not their sales and marketing teams, to acquire and retain customers.

This can be done in multiple ways, but the most common is offering a free trial.

When asked what metrics OpenView tracks for their portfolio companies, Poyar shared that they break their key metrics into four categories:

Size and Growth Metrics

- Employees

- Funding

- ARR

- YoY growth rate

Financial Metrics

- Sales and marketing spend

- R&D spend

- Gross margins

- Monthly burn rate

SaaS Value Drivers

- CAC payback (in months)

- Gross dollar retention

- Net dollar retention

Diversity

- Women in leadership

- Underrepresented minorities in leadership

Whether you’re a CFO or a VC, metrics are vital to understanding a company’s story. Key takeaway: tell an authentic story supported by metrics and don’t over-engineer the deck. The best pitch meetings are conversational and don’t rely too heavily on the deck itself.

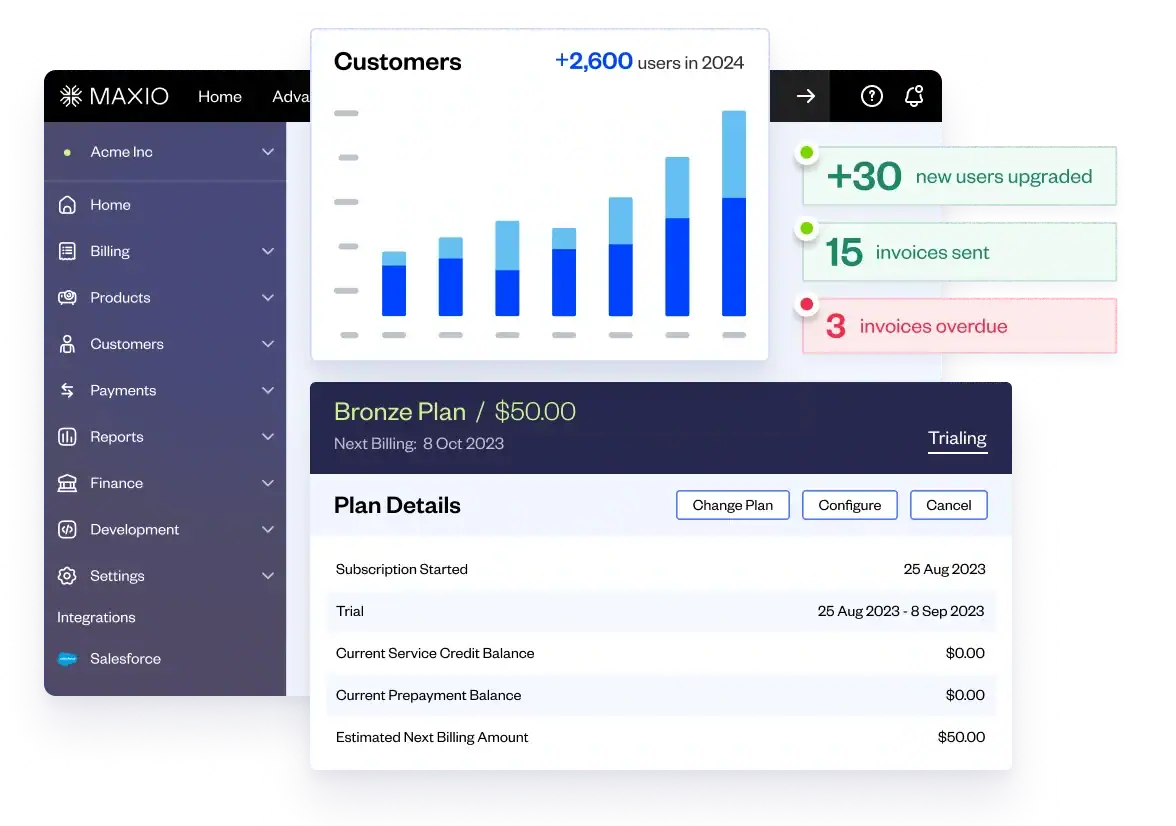

To learn more about how Maxio provides financial data and SaaS metrics to help companies tell their stories to investors, get in touch today.