The Problem:

Sales compensation gets complicated in usage-based models for two reasons. First, the primary method for measuring the value of a sale is unclear — it’s no longer the amount of the first year’s subscription. Second, much of the value of a sale is realized over time through expansion, and this expansion is a shared responsibility between sales and customer success (CS).

Standard solutions to these two issues are hard to come by due to the wide variety of go-to-market motions and hybrid pricing approaches. A good comp plan for a mature enterprise sales company with minimum consumption levels makes little sense for an emerging PLG company with a freemium offer.

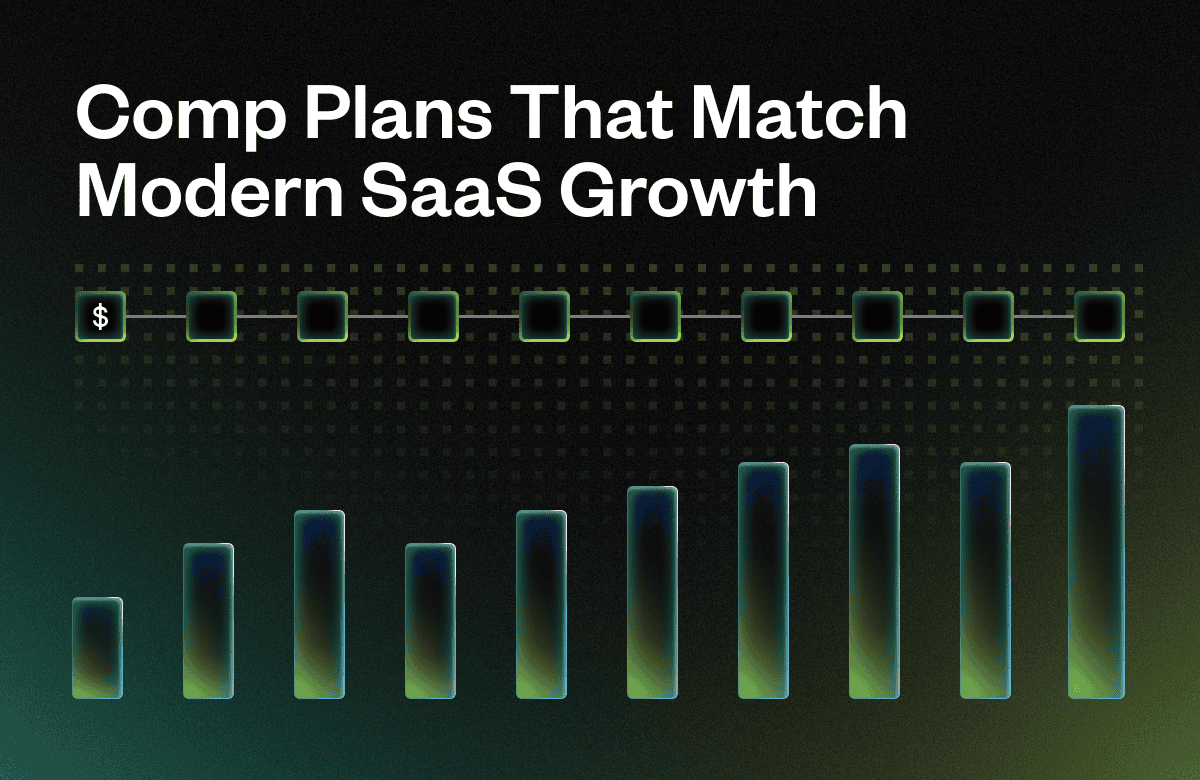

Framing the Issue:

One way to evaluate your compensation plan is to identify your sales priorities in light of your pricing plan. Your sales priorities, along with your pricing structure, will help identify specific sales compensation requirements.

Sales Objectives:

Ultimately, all SaaS companies aim to increase revenue, but there are various ways to achieve this goal. An established company in the midst of a recession may want to invest primarily in revenue expansion opportunities (as new logos are almost impossible to acquire). In contrast, a start-up may wish to focus on developing new logos, regardless of their size. Sales objectives can even vary by territory. Snowflake assigns different compensation weightings to various territories. “Green Field” territories pay more on new logo acquisition, while a “Mature” territory is weighted toward expansion.

Pricing Structure:

The second dimension is the nature of your pricing package. Pricing ranges from pure usage (pay-as-you-go) to multi-year subscriptions. Most companies with usage-based revenue are not pure pay-as-you-go models; therefore, most compensation plans have some form of dual quotas to incentivize both new bookings and usage/expansion.

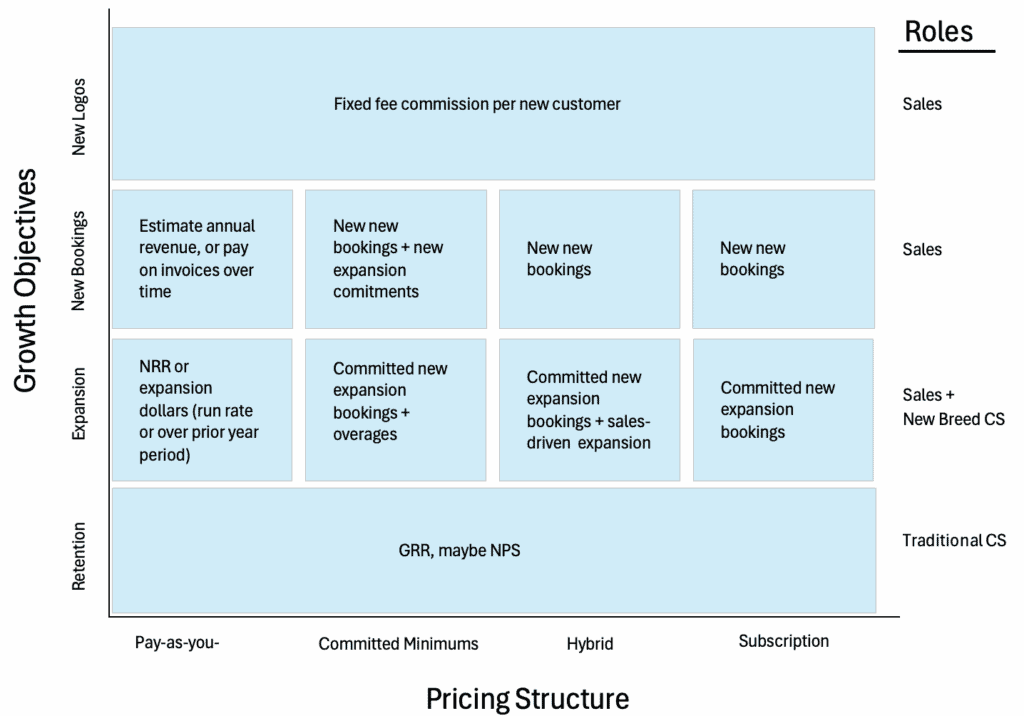

Below is a simple graphic illustrating the two-dimensional framework.

The graphic also includes the employees responsible for the different growth elements. Organizing and aligning sales and customer success resources is one of the most challenging aspects of usage-based compensation planning, and we will discuss roles in detail below.

Since expansion revenue is much more critical in UBP businesses, let’s focus on that first.

The Expanded Role of Customer Success in UBP?

According to a survey by Viola Ventures, 54% of UBP SaaS companies share the responsibility of expansion and renewals between sales and CS, 33% rely upon CS only, and 13% on sales only. That’s much different from subscription businesses, where 40% of those surveyed relied solely on sales for retention and expansion. A few SaaS companies operate at each extreme. At Snowflake, sales handles everything, and at Atlassian, CS handles everything.

What are the best practices? According to Ben Chambers, a sales compensation expert who honed his skills at Databricks, New Relic, Dropbox, and Facebook, there are clear advantages to handing off a customer from sales to CS. “When you hand off a customer, each role has clear and measurable objectives. New business is the job of sales, and retention is the job of CS. The structure allows for less complicated comp plans tied to more focused measures.” Keeping salespeople tied to existing accounts will distract all but the best reps from focusing on closing new business.

Viola Ventures further notes that about half of the companies that hand off accounts from sales to CS do so after six months, and the other half, after one year. Until the handoff, sales get credit for expansion/overage revenue.

An exception to the handoff recommendation is when selling into very large enterprises, where it makes sense to have an AE stay connected to the customer long-term. Some AE’s can spend an entire career selling into one large customer.

What About Expansion?

Explicit expansion goals in CS are somewhat new. Companies that have effectively built CS teams to drive expansion have changed their hiring profile compared to those focused solely on retention. They are recruiting more technically proficient reps with critical thinking and consultative selling skills.

Another approach is to embed an expansion sales team within the CS group. That has been a successful approach in UBP as well as subscription companies with highly modular offerings.

Measuring Expansion:

Organic or Company-led?

Most companies treat all expansion revenue equally, but a few have successfully distinguished between naturally occurring expansion and CS- or sales-led expansion. MongoDB uses a series of relatively simple questions to determine whether expansion was driven by a new use case unearthed by the CS team or if the growth occurred unprompted. They pay commission on the former and not the latter.

That said, most of the time, it’s either impossible or too cumbersome to disaggregate “sold” expansion from “organic” expansion.

Furthermore, some companies have tested expansion revenue in cohorts with and without CS engagement and found similar growth across both groups. Simply put, in some cases, trying to drive expansion is a waste of resources. In these cases, NPS and GRR would be better anchors for CS bonuses.

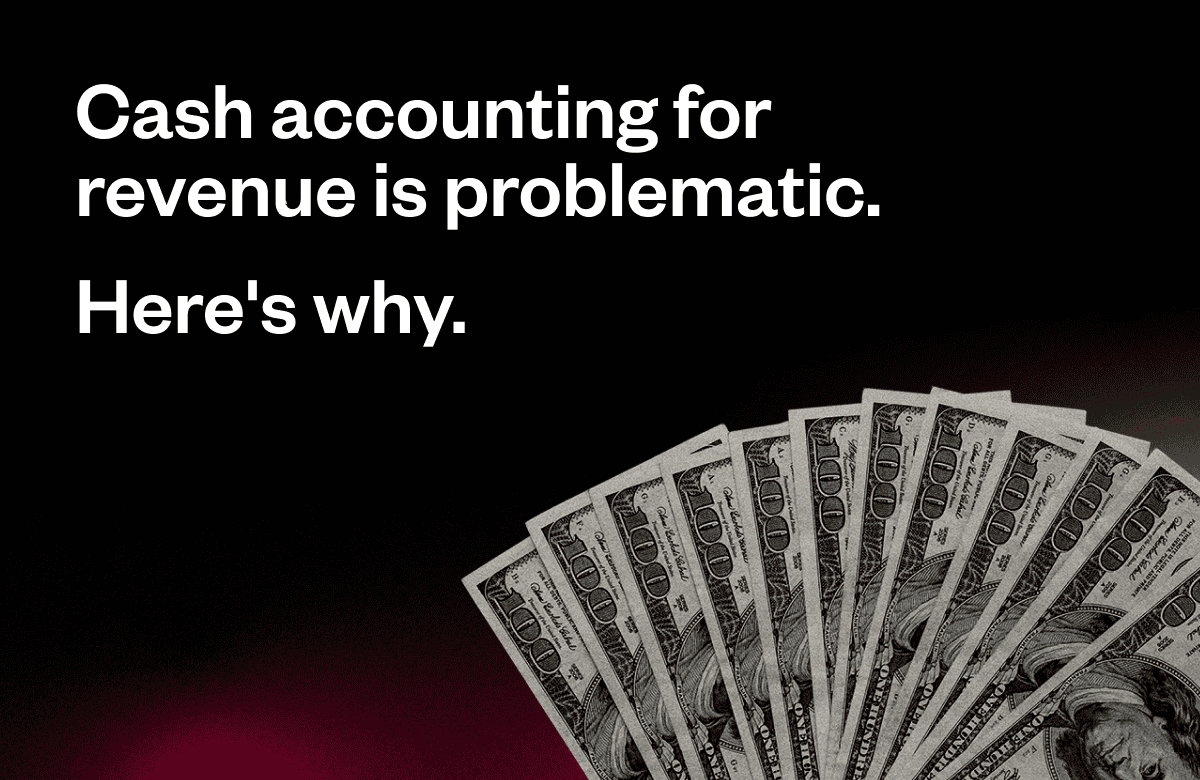

The Year-over-Year Problem:

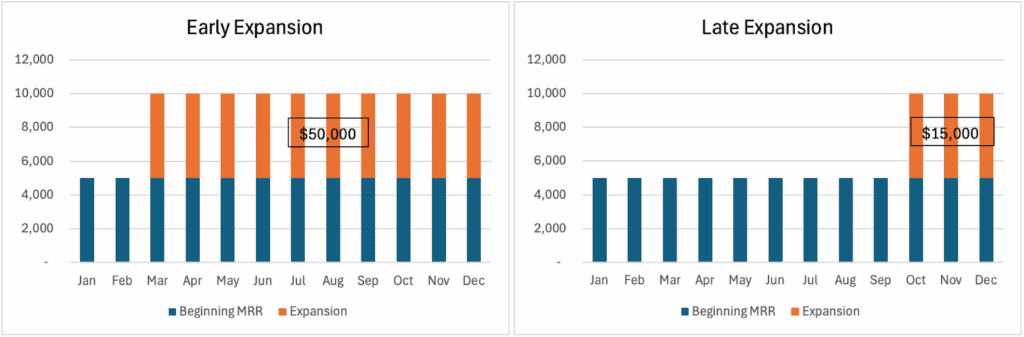

When calculating expansion revenue, comparing a customer’s total revenue for the most recent year to that of the prior year reveals that expansion occurring early in the year has a greater impact than expansion later in the year, even though the ARR growth is the same. Imagine a 25% increase in revenue in the last two weeks of the year. It adds virtually nothing to total revenue for the year and then rolls into the baseline for the following year.

In the example above, an expansion in March would result in commissions three times greater than those from the same expansion in October.

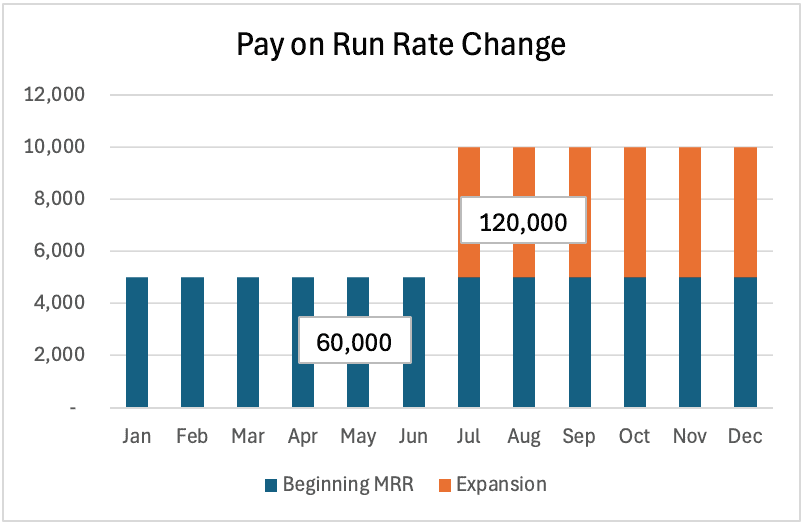

Snowflake addressed this issue by measuring expansion based on run-rate, which can be calculated on a monthly or quarterly basis.

Calculating based on run rate is suitable for customers with relatively stable revenue from month to month, but does not work well if there is volatility or seasonality.

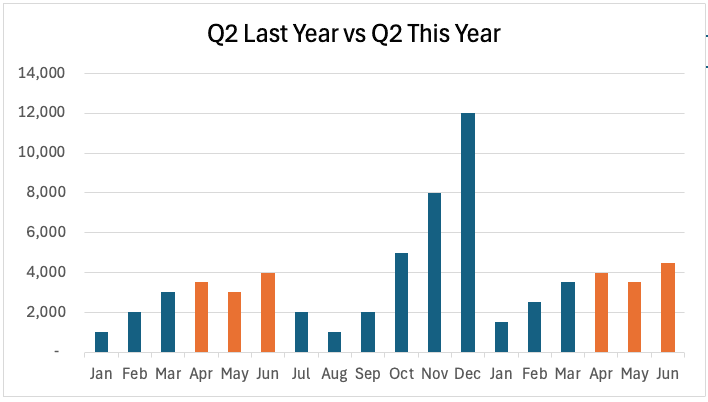

In cases with clear seasonal revenue patterns, measuring expansion is best done quarterly, comparing the current quarter to the same quarter one year ago. e.g. Q4 2025 vs Q4 2024.

Sales Comp:

SaaS cannot live on retention and expansion alone. Companies need new customers, and for most companies, salespeople are responsible for securing them.

Salesforce Structure: Not surprisingly, more than half of UBP companies go to market with an inside sales force—compared to just 40% of subscription-based businesses. They also place greater emphasis on customer success, with 0.6 CS team members per salesperson versus 0.4 in traditional subscription models, according to the previously referenced Viola Ventures survey.

Basic Comp Plan: Like subscription businesses, most UBP plans are 50% salary and 50% commissions at target. One enterprising company allows its representatives to opt into a higher-levered plan at 70% commission and 30% salary (so far, just a few takers.)

Commission rates in UBP companies break down as follows: 33% pay over 9%, 40% pay 7% to 9%, 13% pay 5% or 6%, and 13% pay less than 5%, per that same Viola Ventures survey. Very few companies pay extra for multi-year commitments.

Commitments: For the majority of UBP companies, there remain fixed elements in the pricing structure, whether it be committed minimums or traditional subscriptions. In these cases, commissions on those elements follow a conventional compensation model.

However, some companies saw customer commitments increase when reps were not pushing for them, but rather the customer was asking for them to lock in better pricing. These companies have minimum commitments but do not commission the representatives on them; instead, they pay based on actual usage over time.

Paying on Estimated Usage: Some companies pay commissions on estimated usage. This allows them to operate in a pure pay-as-you-go model, while still paying their reps upfront. They use a scoring system to estimate a new customer’s annual revenue, taking into account factors such as company size, number of users, company revenue, and historical volumes. In some cases, estimating is easy; in others, it is not.

Estimating revenue allows you to pay up-front to align incentives. But don’t pay everything up front, your estimate might be wrong, and attempting to claw back commissions is not a good position to be in.

Pay 60% to 80% of the estimated booking amount at closing, and pay the remainder after one year, based on actual usage.

Paying Based on Actual Consumption: For pure consumption pricing or to incentivize usage within a hybrid model, companies need to select the best usage metric to drive commissions. The two most popular metrics are: 1) actual metered usage (in dollars), and 2) billed invoices. These commissions are paid monthly. Less popular are commission payments based on invoice collection.

Take-Aways:

Sales compensation plans involving variable revenue are highly individualized, based on what the company is trying to achieve with its sales team and the pricing structure in place at the time. Both these things evolve, and so should the compensation plans.

Many companies favor clear handoffs between sales and CS because they provide more clarity to the objectives and metrics for each team.